LAHORE

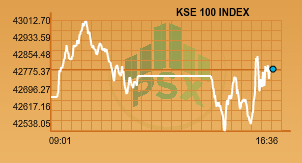

The Pakistan Stock Exchange (PSX) after a relatively smooth first session looked shaky in the second session. With noise in the political scene, investors remained cautious. But a positive close shall be a relief for them.

The benchmark KSE 100 bulged above 43,000 mark intraday after 330.85 points gain. The index failed to hold up to these and dropped down to 42,538.05 after 145.52 points loss during the session. It ended the week at 42,787.19 with 103.62 points in the green.

The KMI 30 index appreciated by 118.65 points while the KSE All Share Index lapsed 47.64 points. The advancers to decliners ratio stood at 125 to 210.

The market volumes fell 8 per cent on a day-to-day basis to 200.09 million. Dost Steels Limited (DSL +9.00 per cent) led the volume chart with 16.26 million shares exchanged. TRG Pakistan Limited (TRG +1.05 per cent), volume 10.34 million, and Bank Alfalah Limited (BAFL -1.66 per cent), volume 9.66 million, followed.

Oil and Gas Development Company Limited (OGDC -1.10 per cent)

Index Giant declared financials for the year ended June 30, 2017. Sales grew by 6 per cent to Rs 171.83 billion pulling up gross profit margins slightly from 54 per cent to 55 per cent. Operating profit margins improved from 52 per cent to 54 per cent. Profit after Taxation of Rs 63.80 billion was reported against previous years Rs 59.97 billion. This converted into earnings per share of Rs 14.83 and brought along total cash payout of Rs 6 per share.

The company has been affected adversely by the slump in international crude oil prices which is evident when compared with its financial standing 5-years ago. The current sales are 23 per cent lower than those in FY13 bringing down profits by 30 per cent. The share price has also depreciated by almost 40 per cent.

Pak Petroleum Limited (PPL -0.40 per cent)

The company expanded sales by 46 per cent during the year but gross profit margins remained flat. Operating profit margins were better from 34 per cent to 42 per cent. Net profit was reported at Rs 35.68 billion against Rs 17.24 billion in the last year. Earnings per share clocked at Rs 18.10 with a final cash dividend of Rs 6 per share.

The company sales have grown 14 per cent since 2013 but earnings per share have come down from Rs 25.53 to Rs 18.10. Share Price has also declined 30 per cent in the same period.