- ‘There is nothing ambiguous in tax amnesty scheme and neither will it be amended in the finance bill’

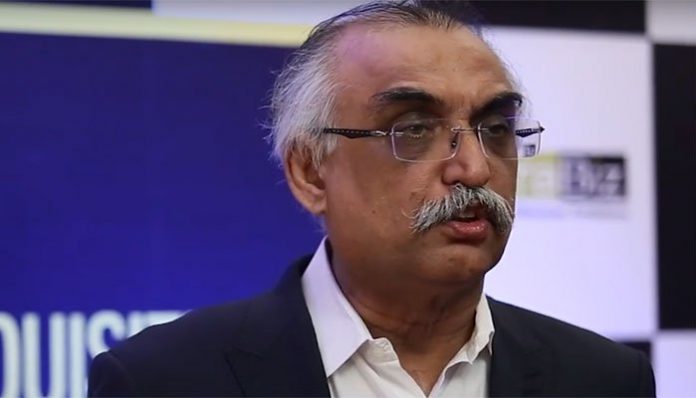

KARACHI: Federal Board of Revenue (FBR) Chairman Syed Shabbar Zaidi has vowed to introduce long-term reforms in the tax system.

Talking to industrialists and businessmen at the Karachi Chamber of Commerce on Saturday, the FBR chief said there was nothing ambiguous in the tax amnesty scheme law and neither will it be amended in the finance bill.

He said the Afghan Transit Trade is not the only path being used for smuggling in Pakistan. “The sale smuggled items in local shops is also against the principles of Sharia,” the FBR chairman asserted.

“Our industry is also being used for fraud,” Zaidi said, vowing to work towards the overhaul of the taxation system.

He promised that the FBR will avoid an unnecessary audit of the taxpayers, adding that the government “could consider relief in duty on some raw materials of industries but not on all items”.

The FBR chairman said that he will present the data about the number of shops and companies in the country. “Around 0.7 million industrial units are functioning in Punjab.”

He said he was unaware about the number of industrial units in Sindh right now and the shops in markets and number of taxpayers among them.

“Only around 1.9 million people are income tax filers in Pakistan,” the FBR chairman concluded.