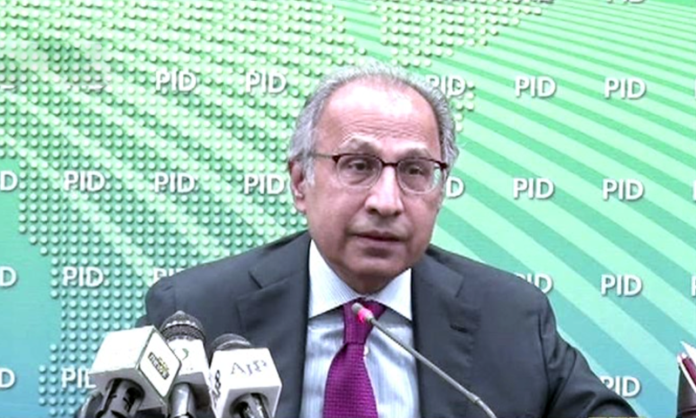

ISLAMABAD: Adviser to Prime Minister on Finance and Revenue Dr Abdul Hafeez Shaikh on Thursday emphasised upon the need for better coordination among stakeholders to arrive at a consensus on macroeconomic targets and to chalk out required policy actions in achieving them.

The adviser was chairing a meeting of the Monetary and Fiscal Policies Coordination Board, according to a press statement issued by the finance ministry.

The adviser said that all organs of the state should play their role in these difficult times and fully utilise their potential to achieve the set macroeconomic targets as per their mandate.

Other members of the board present on the occasion were Adviser to PM on Commerce and Investment Abdul Razak Dawood, Planning Commission Deputy Chairman Jehanzeb Khan, Finance Secretary Naveed Kamran Baloch, State Bank of Pakistan (SBP) Governor Dr Reza Baqir and Economist Dr Asad Zaman, while Federal Board of Revenue (FBR) Chairperson Nausheen Javaid attended the meeting on a special invitation.

The adviser stated this high powered board facilitates the policymakers to review and coordinate in an effective manner so that comprehensive set of policy actions could be adopted to overcome economic challenges that the country had been facing at internal and external fronts.

Speaking on occasion, the finance secretary informed the board that the government had embarked on a journey towards stability and sustainable inclusive growth through various structural and policy adjustments that have paid off in the form of decline in current account deficit, fiscal deficit, build-up of foreign reserves, stable exchange rate etc.

He said for the first time, the country’s primary balance posted surplus of Rs104 billion during July-March FY20 (0.2pc of GDP) as compared to the deficit of Rs474 billion (1.2pc of GDP) during the same period last year.

He also presented the pre-COVID-19 and post-COVID-19 overview of the economy and stated that the pandemic had brought multiple challenges for the country’s economy.

Prior to coronavirus, the GDP growth was estimated at 3.24pc for 2019-20, but after the pandemic outbreak, it may decline significantly, he added.

The government had timely initiated a ‘Fiscal Stimulus Package’ worth Rs1.24 trillion which encompasses emergency response, support to businesses and relief to citizens, he said, adding that couple of other schemes approved by Economic Coordination Committee and the cabinet were also in place to minimise the adverse impact of COVID-19.

The SBP governor appreciated the efforts of the Ministry of Finance for curtailing fiscal deficit and achieving positive primary balance in first three quarters of current fiscal year.

From monetary perspective, he briefed that SBP had given the stimulus to economy through cut in policy rate (425 bps) and increasing quantity of money by injecting additional liquidity.

“SBP has introduced a number of measures and some concessional refinance schemes to address both the demand and supply side conditions for businesses,” he said.

The measures, he said, include Temporary Economic Refinance Facility (TERF), Refinance Facility for Combating COVID-19 (RFCC) and Refinance Scheme for Payment of Wages and Salaries to the Workers and Employees of Business Concerns.

“These measures are aimed at facilitating the businesses to remain afloat during the crisis times. On the demand side, a cumulative reduction of 425 bps in the policy rate is expected to address the high cost of borrowing issue.”

Meanwhile, The Planning Commission deputy chairman apprised the meeting that coronavirus had declined the confidence of both consumer and investors. Thus, both aggregate demand and supply had been disrupted and the society was following risk aversion behaviour.

He said the government should provide further support in terms of simplification of processes, lower administrative burden on businesses and help SMEs find some ways to cope with emerging situation.

However, he added, accommodative fiscal and monetary policies adopted by the government would be helpful in stimulating economic activities.

Moreover, the commerce adviser was of the view that under prevailing circumstances, exports would be around $21 to $22 billion, while imports would fall to $42 billion mainly due to decline in international commodity and oil prices.

“There is a risk of decline in remittances. However, due to decline in imports, current account deficit may not be adversely affected,” he stated. “Even in these testing times, Pakistan’s exports to Africa and Middle East have remained positive and are growing, which has been a direct outcome of the government efforts to explore new avenues in export markets.”

Dr Asad Zaman emphasised upon the need to enhance the capacity of institutions like Federal Bureau of Statistics for timely dissemination of authentic data, as that would be helpful to reset policy direction in the post COVID-19 changing environment.