Is there any silver lining for the automobile sector in the pretty awful year that has been 2020? Yes, and that is to just brace for whatever is happening this year, and instead focus on the years 2021 and 2022. Plus, it helps if you are Indus Motors, the Pakistani subsidiary of Toyota.

This is what Hassan Arshad, analyst at Foundation Securities, a securities brokerage firm, argued in a note issued to clients on June 3: that despite the Covid-19 pandemic wreaking havoc on the global and domestic economy, the firm’s outlook remains neutral on the sector, and even positive towards Indus Motors.

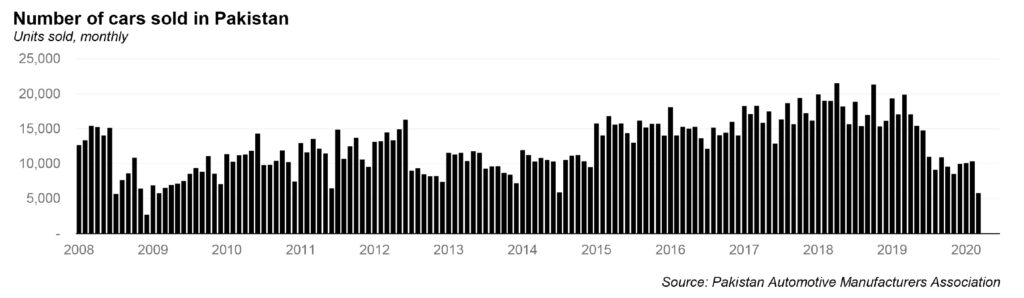

Arshad expects demand for cars to fall 51% year-on-year (YoY) in fiscal year 2020, but rise 17% YoY in fiscal year 2021, and rise 24% YoY in fiscal year 2022.

And while the three major players in the industry have somewhat low predicted earnings per shares for this year (and in the case of Pak Suzuki Motors, even negative), the predicted earnings pick up in 2021, and flourish by 2022.

To be clear, the year ahead is still going to be a bumpy ride (pun intended). Poor economic conditions have stunted growth in demand. “Low volumes have forced local players to stage multiple price hikes to keep their margins and earnings afloat,” noted Arshad.

Companies have taken drastic steps, motivated by fears of rupee depreciation. For instance, Honda Atlas Cars had to increase its prices on average by Rs90,000, while Indus Motors had to increase its prices on average by an astonishing Rs200,000. Pak Suzuki Motors has not increased its prices yet, but is expected to soon.

The high prices are likely to have a spillover effect: there might be a larger market share of 1,000 and 1,300-cubic centimeter (cc) engine cars. (Car sizes are typically measured not by physical size, but by engine size, measured in cubic centimetres of displacement.) This is likely to impact Pak Suzuki Motors, which is already expected to suffer somewhat should it choose to increase its prices as well.

Still – and this is important – these may be overly cautious moves. As Arshad points out, there has been relatively stable dollar and rupee parity.

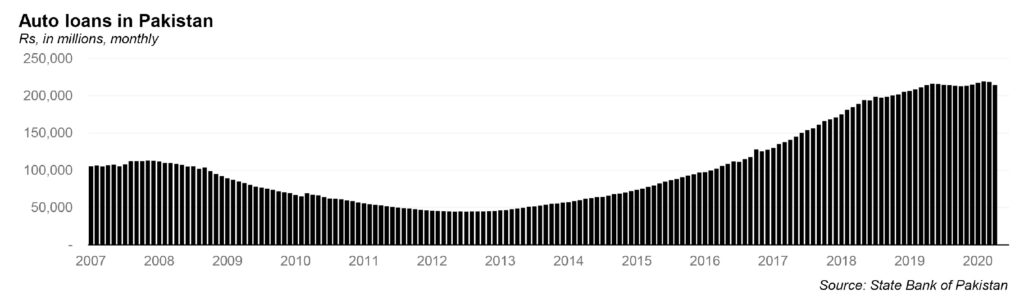

Additionally, the State Bank of Pakistan cut interest rates rapidly between March 17 and May 15, by a whopping 525 basis points, with the benchmark discount rate falling from the relatively high 13.25% to 8%. This cut in the policy rate is expected to reduce financing costs, and hopefully trigger consumer financing and an increase in sales.

The international oil crash also means that Pakistan is currently experiencing extremely low fuel prices (In fact, as the current government recently tweeted, Pakistan has the cheapest fuel costs in South Asia).

These combined factors are why Arshad expects growth to pick up in the next two fiscal years, at 17% and 24% respectively.

Indus Motors – the Toyota subsidiary in Pakistan – is particularly well positioned, thanks to its new product. At the end of March, Indus Motors launched its new sedan, the Yaris. The average price of the Yaris is Rs2.7 million, which is significantly cheaper than the Corolla (at Rs3.7 million), and only Rs0.1 million more expensive than its competitor, the Honda City. Importantly, it has better features than the City.

“We expect Yaris to absorb some of City’s market share due to Toyota’s high brand equity and the novelty factor of a new product,” says Arshad.

Indus Motors is also protected from the drastic cut in the policy rate due to its strong cash position. As of the third quarter of the current fiscal year 2020, it stood at Rs35.2 billion.

Consequently, Arshad estimates an earnings per share of Rs70.6 for fiscal year 2020, Rs94.5 for fiscal year 2021, and Rs147.1 for fiscal year 2022.

The future is not so bright for Honda Atlas, however. Unlike Indus, it has no shiny new product in the pipeline, and the company is not looking forward to competition from the Yaris.

That means the overall lack of demand is expected to hit Honda Atlas a little harder. “The next two quarters are likely to be debilitating for the company due to sluggish demand pick-up following lifting of lockdown restrictions,” says Arshad.

On top of this, Honda Atlas made the mistake of borrowing significantly in the short-term, which as of the third quarter of March year, stood at Rs8.4 billion.

Still, the company may just make it through. That cut in the policy rate could support the company’s earnings, and according to Arshad, improve its interest coverage ratio (or the ability of a company to pay interest on its debt) from the expected 3.1 in March year 2020 to 6.6 in March year 2021. Therefore, the earnings per share for Honda Atlas are estimated at Rs4.8 in 2020, Rs5.1 in 2021, and a jump to Rs22.4 in 2022.

And, at least Honda Atlas still fares a lot better than Pak Suzuki Motors, which this report dubs ‘the major loser’. This year the company will face yet another loss, with the double whammy of increased financial costs and low volumetric demand.

What happened? Well, the higher than usual finance cost is due to the company’s significant short-term borrowing, at Rs31.2 billion in the first quarter of this calendar year. This is much higher than Honda Atlas’ short term . The impact is also going to be felt for much longer, because Pak Suzuki’s inventory buildup and liquidity issues has made repayment of debts very difficult.

It does not help that Pak Suzuki’s products have high demand elasticity – or more simply, that the demand for Pak Suzuki’s cars is very vulnerable to changes in price. There is a reason why Pak Suzuki has resisted increasing its prices so far: it simply cannot afford to do so, not with the intense foriegn and domestic competition, like KIA, United and Prince.

The end result: an estimated earnings per share of -34.2 in 2020, -0.7 in 2021, and Rs20.5 in 2022.