Ask any millennial Pakistani and they will have a refrigerator story. Nothing interesting like getting stuck inside one or tipping one over, but a story about their ever reliable, ever present refrigerator that has been around in their home since before they were born. Sometimes, this refrigerator is a wedding gift, and one that stands the test of time and stands witness to the lives families build. At other times, they are hard fought items bought after months of waiting patiently for money from a committee.

On average, the lifespan of a refrigerator is around 5 years across the world. For people in Pakistan, that lifespan is much longer, usually even more than ten years. Because of this, Pakistanis are generally very sentimental about their home appliances. So when a refrigerator does finally bite the dust, it is a moment of sorrow.

Despite all of this importance and attachment to home appliances and refrigerators, people in Pakistan are surprisingly limited in the kinds of fridges they buy, who they buy them from, and how many of them we buy as a nation, and how often. Profit looks at the refrigerator industry in Pakistan.

Market realities

If you walk into an electrical appliances store, whether that store is in Saddar in Karachi or in Lahore’s Abid market, and ask to see their selection of refrigerators, the shopkeeper will automatically assume that you want a direct cool refrigerator. Direct cool refrigerators are common in Asian countries and in Africa. These refrigerators start collecting ice on the inside in their freezers, which will be a familiar sight for most people in this country.

“Considering the climate in Pakistan, people mostly sell direct cool refrigerators. In fact, these refrigerators are so common that they account for around 99% of all fridges sold. Most people don’t even know about other options,” says Murad Saigol of Pel. “With load shedding being a problem, and the average family size being around 6 people, consumers want a fridge that keeps perishables cool despite the power being out or the refrigerator being opened repeatedly.”

This, of course, makes all the sense in the world. Unless you have a constant supply of electricity and mini-fridges in your rooms, you need a direct cool refrigerator. But there is a small minority of refrigerators sold that are not of the direct cool variety. This 1% of the refrigerator world are no frost refrigerators. All of these are imported. “The primary reason why no frost refrigerators are imported is because there is a lack of demand for them. The technology is not what is preventing local manufactures from producing no frost refrigerators, it’s the fact that only a very small amount of people are out to buy them,” Saigol explains.

While no frost refrigeration is how things are done in most parts of the world, and Pakistan is capable of producing them, the focus remains on direct cool refrigerators. Currently, the market leader in Pakistan is Haier, which is a recognised international brand and has been prominent in the international arena for at least the last five years. “There is one simple reason for Haier’s success, and that is their low prices, which are approximately 10 to 15 % cheaper than others in the market,” says Saigol.

A Chinese brand that also operates in Pakistan, Haier has also had the foresight to have effective marketing. One of the avenues they have used is cricket, sponsoring a number of different players. Their CEO, Javed Afridi, is most popularly known as the owner of Peshawar Zalmi. Their major competitor is Dawlance, another major player in Pakistan, is a Turkish brand that is owned by Arcelik. They are roughly tied at second place with Pel, the only major local player in the refrigerator market in Pakistan. While there are other smaller players in the market, both local and international, their share is far too small compared to the cumulative share of Haier, Pel, and Dawlance.

“Despite the competition in price, I would say that Pel refrigerators are far more successful in Pakistan considering they are produced keeping in mind local conditions such as the tropicalized environment and large family size in Pakistan,” says Saigol.

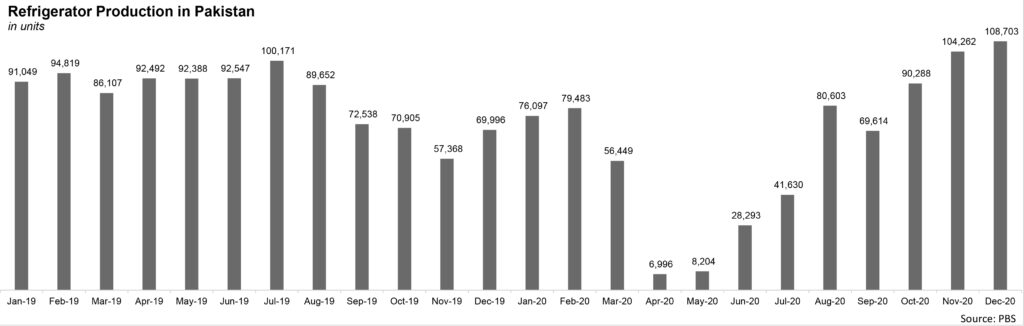

”As for Covid-19, the second quarter of the calendar years is always an important time for us. Air conditioners and refrigerators are often sold during this time. However, this also coincided with the lockdowns. Nearly 40 to 50% sales of refrigerators take place in the hot months of the second quarter. It is also important to note that refrigerators and air conditioner sales are of greater value than washing machine and television sales that often occur in winter months. In order to deal with the pandemic, the industry in general ordered less and revised down their sales plans.”

Consumer behaviour is one of the issues in the industry that different companies have had to face. As with anything, people like to wait until the last possible moment for necessary purchases. So just like you are delaying paying your bills, or how the reporters at Profit wait until the last possible moment to file stories and how their editors wait until the last possible moment to edit them – people wait until it is unbearably hot to buy refrigerators and air conditioners. That is why April, May, and June are the moneymaking months for this industry.

Our per capita refrigerator stats are far from cool

Even in some pakki abadis in Karachi, refrigerators are seen as a luxury only for the rich. In such neighborhoods, if one such household has a refrigerator, all the other residents share it as much as they can. Access to a refrigerator is scarce because they are expensive one time investments.

“The per capita consumption of refrigerators is quite low in Pakistan. The number of households with a refrigerator is around 30-40 million. You could multiply that with the average family size and the number would still not be very large. The market is under penetrated.”

A number of people still rely on purchasing ice from ice depots for storing perishables and for having cool drinking water. Saigol, however, claims that as per an analysis conducted by his team at Haier, it would be cheaper to pay a monthly installment for a fridge than to buy ice for a month. For this very purpose, refrigerator producers sell to dealers who then sell to customers on either cash or installment basis.

“What is very interesting is that platforms like Daraz can now pick up what smartphone you are using, and determine your creditworthiness by it. This means they could give you 3 times the credit and low markup rates, making it easier to buy an appliance online on installments. This is good for producers because this allows for better cash flows.”

“However, the online home appliance space needs to improve. In India, approximately 15% of their home appliance sales are carried out online, In Pakistan that statistic stands at 1%.”

Despite all this, basic access to a refrigerator remains weak in Pakistan because of the fact that industry has not been able to grow to the extent where it achieves mass economies of scale and eventually exports whilst coming up with low cost solutions for those that need it most.

Production process and export potential

The refrigerator making industry is not new to Pakistan. It has existed for over forty years. However, what is important is the fact that a large number of raw materials used to produce refrigerators is imported. For instance, Saigol points out that approximately 25% of the cost of a fridge is attributed to the compressor. However, they aren’t produced here because Pakistan does not manage to achieve economies of scale with regards to them. For this, he illustrates that approximately 1.6 million units of refrigerators are sold in a year, whereas the smallest of international compressor makers make on average 14 million units. According to him, economies of scale is what can help the local industry flourish.

“Raw materials make up around 60 – 70% of a refrigerator. 25% of that is the cost of a compressor. However, we have local value addition. We are now able to buy some steel used in our refrigerators from Pakistani manufacturers like ISL (International Steels Limited). However, we still have to import cold rolled steel, VCN, glass and plastic granules, in addition to other materials.”

“Refrigerators are consumer necessities, and all refrigerator manufacturers produce for the masses. However, we have three types of categories, good refrigerators, better refrigerators, and the best refrigerators. The market share for the highest grade is just 10 – 15%” explains Saigol. “Side by side, French design refrigerators are either completely imported from abroad, or their parts are imported and the fridge is assembled locally. These refrigerators are not as popular because they are expensive.”

Now, if we look at the trends globally, direct cool refrigerators are preferred in hot developing countries that also face power struggles. That is an opportunity for Pakistan. The home appliance industry, including refrigerators, began in the United States and Europe. However, as the US moved to higher tech, mass market production began in Japan, and South Korea followed suit and picked up on the Japanese model so that they could export too.

China later entered the arena successfully using its cheap labour. While it began producing unbranded units that could be whitelabel, it later started selling under the brand name Haier as a means to ensure quality and standards. However, what Japan, South Korea, and China have in common is the fact that the local industry was protected in order for the producers to become big enough to attain economies of scale efficiently. Meanwhile they also worked on producing the raw materials for the industry locally.

For Pakistan, exporting refrigerators is currently a pipedream, especially considering the ups and downs in the value of the rupee. With moves in the rupee, the cost of assembling or making a fridge drastically change. For that very purpose, if Pakistan is able to produce special high quality glass, steel, and plastic initially and at later stages the electrical components; then exporting refrigerators does not seem far fetched.