Let us preface this article by saying that the KIA Sportage, in our very humble opinion, is one ugly car. Of course, the aesthetics of car design is not exactly business or financial analysis, and thus not the forte of Profit, but on a personal level we, the authors of this piece, must profess that it looks very much like an oversized soap dish. It is also trying just a little too hard to look both like a sport utility vehicle (like the Land Cruiser) and your average soccer-mom SUV at the same time.

Why do we say all of these horrendous things about the KIA Sportage? Mostly because we want to get this part out of the way, since the rest of this article will paint a very pretty picture of the position that the Sportage has put KIA in. Manufactured by KIA Lucky Motors, a joint venture between KIA and Pakistan’s cement producing Lucky Group, the new entrant in Pakistan’s automobile sector has managed to sell more than 25,000 KIA Sportages between August 2019 and August 2021. That means on average KIA Lucky Motors has managed to sell more than 1000 Sportages every month since the pandemic.

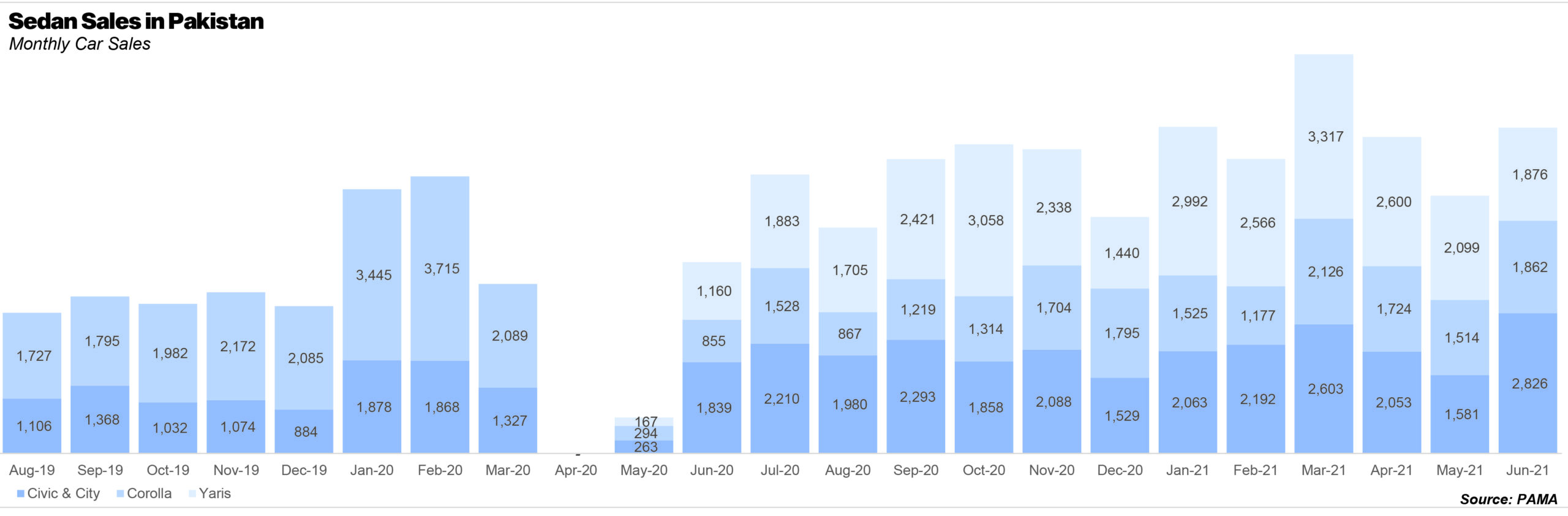

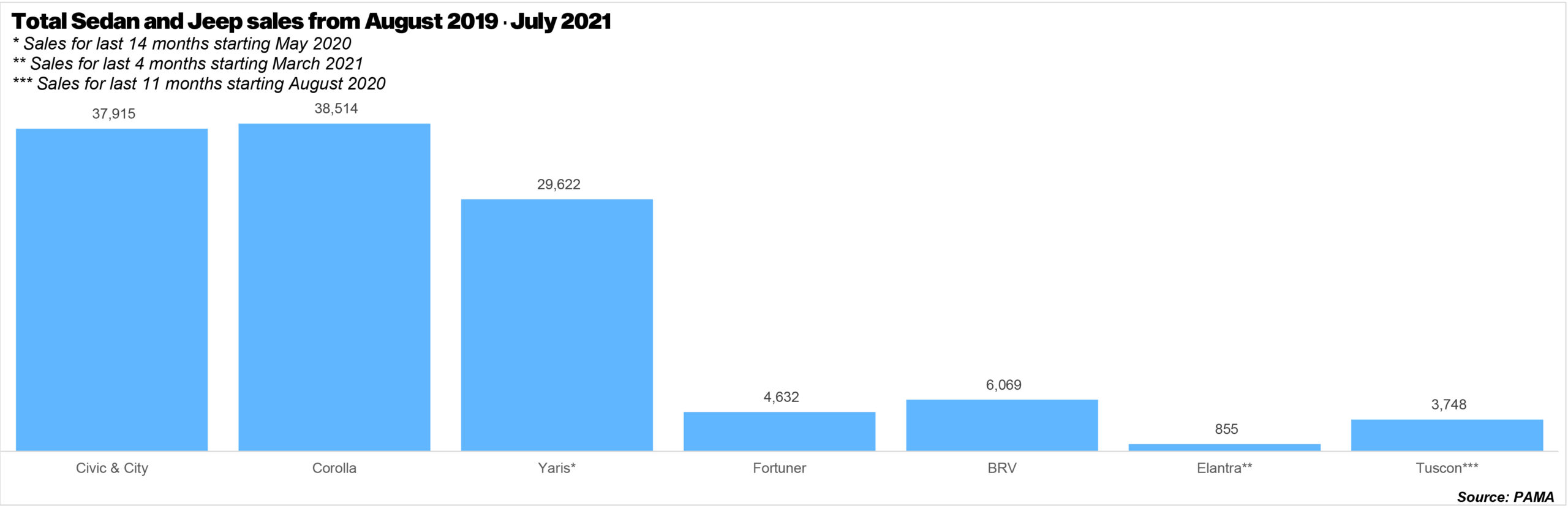

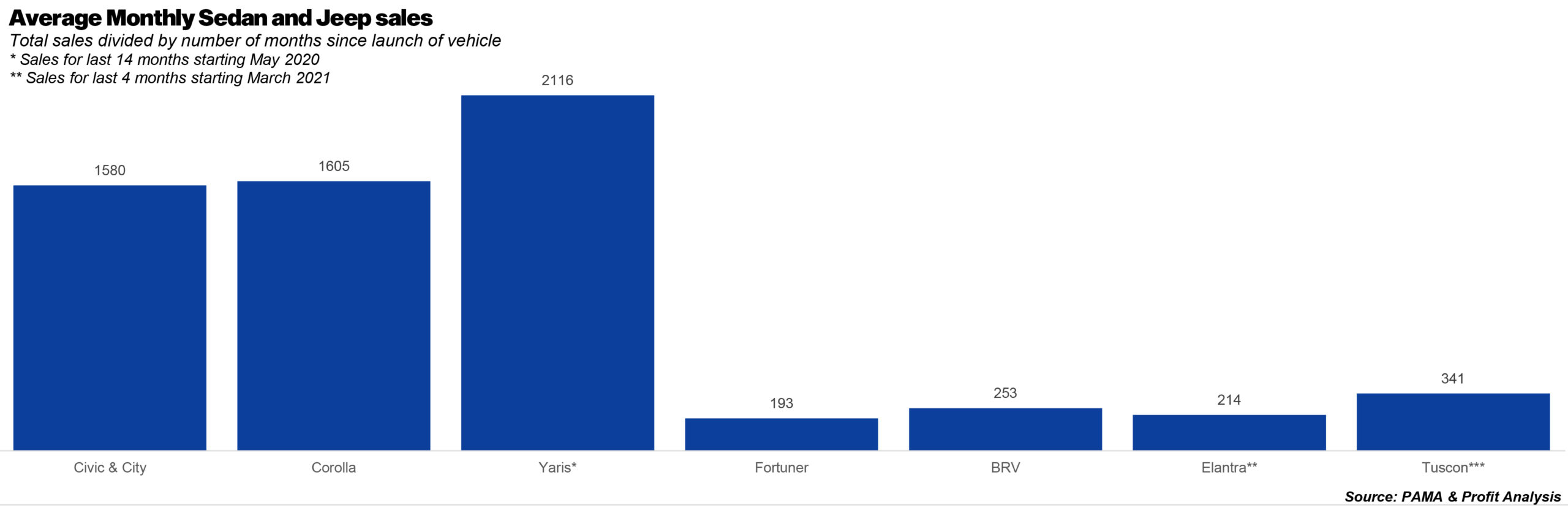

And now, with car sales continuing to skyrocket in Pakistan, it is very much in the realm of possibility that in the financial year 2022, the KIA Sportage will outsell the Toyota Corolla. Now, there are a few reasons for this – most significantly that Toyota has stopped making 1300cc versions of the Toyota Corolla and are instead making the more affordable Toyota Yaris – which is why we must say from the outset that KIA is nowhere close to outselling Toyota overall. Toyota has sold 38,514 Corolla units in around the same time frame. The Toyota Yaris, on the other hand, has only been around for 14 months, and in that time has sold 29,266 – making it the fastest growing car around. Honda, in the meantime, seems to have taken a bigger hit from the KIA revolution with a total of 37,915 Honda models, both City and Civic, being sold in the same 24 month period from 2019-2021.

Yes, car sales have grown overall in Pakistan as well, but that has been driven not just by the ability to buy cars but the choices available. It also means that the Big Three failed to tap into a massive market – cheap SUVs. Because at the end of the day, that is what the KIA Sportage has brought to the market. You can now buy an SUV for the same price as a sedan.

What is undeniable is that KIA’s successful entry into Pakistan’s auto sector has not just taken away a significant chunk of the market from mainstay players like Toyota, Suzuki and Honda, but it has also caused these three companies (collectively known in Pakistan’s automobile industry as the ‘Big Three’) to change strategies that they have been using for decades to tactfully maintain the triopoly.

Somehow, because of the Big Three, the choices for cars in Pakistan have remained very limited. With a population of nearly 220 million people, and more than 23 million cars out on the roads in the country, surprisingly Pakistan does not manufacture any cars locally and for decades consumers have been restricted from choosing between Honda, Toyota, and Suzuki.

But the success of KIA is challenging this status quo, and their success also means that other car manufacturers making their entry into the Pakistani market are not just being emboldened, but they are also finding it easier to convince customers that there are viable alternatives to the Big Three. Already Hyundai has seen a surge in popularity, the Chinese Changan has made a name for itself with its budget sedan Alsvin, and even Lucky Motors is now planning to sign a similar joint venture with French automobile manufacturer Peugeot. And while these are all early in-roads, could KIA and the other challengers to the Big Three change Pakistan’s automobile industry forever? Yes. Very much so. And the change has been long, long, overdue.

Cars in Pakistan – a brief history

Our story begins in the early 1990s. Up until then, cars were mostly only for the uber elite, and the auto industry in Pakistan had flip flopped between privatisation and nationalisation. The content in this publication is expensive to produce. But unlike other journalistic outfits, business publications have to cover the very organizations that directly give them advertisements. Hence, this large source of revenue, which is the lifeblood of other media houses, is severely compromised on account of Profit’s no-compromise policy when it comes to our reporting. No wonder, Profit has lost multiple ad deals, worth tens of millions of rupees, due to stories that held big businesses to account. Hence, for our work to continue unfettered, it must be supported by discerning readers who know the value of quality business journalism, not just for the economy but for the society as a whole.To read the full article, subscribe and support independent business journalism in Pakistan

Pak Suzuki Motors was launched as a joint venture between the government of Pakistan and Suzuki Motors Japan, formalizing the arrangement by which Awami Auto Ltd. had produced the Suzuki SS80 from 1982. Suzuki originally owned 25% of the stock, but when the Pakistani automobile market began to deregulate around 1990, Suzuki Japan began an aggressive campaign to gain control of the company and have since increased their holding up to 75% of the company.

And why would they not want to do that? Pakistan was an open market with no major player already there and Suzuki saw the opportunity to thrive. In 1989, they launched the now iconic (and now discontinued) Suzuki Mehran. Other models like the Suzuki FX followed and even their vans like the Suzuki Bolan became wildly popular.

Suzuki was the first real car manufacturer that Pakistanis got an opportunity to buy from, and they were offering small, affordable, hatchback models that were reliable and provided comfort and safety according to the standards of that era. Sensing this success, other Japanese companies knew that Pakistan was an open market and decided to step in. These companies were Toyota (which also sells under the brand name Daihatsu) and Honda. Now, Suzuki had already taken first-mover advantage and would fight tooth and nail to keep their monopoly, which is why Honda and Toyota decided to target a completely different market – sedans.

In a joint venture with Toyota Japan, Indus Motors Pakistan rebranded itself as Toyota Indus in 1990 and started to assemble. The Toyota Corolla started being manufactured in Pakistan in 1993. Honda Atlas was based in Lahore, and under the auspices of Yusuf Sherazi and the Atlas Group, launched in 1992. By 1994, they were giving Toyota Indus a run for their money with the production of the Honda Civic and Honda City in direct competition with the Toyota Corolla.

Suddenly, the Pakistani market had three new entrants and what seemed to be a world of choice. Initially, Suzuki did try to fight back by trying to produce their own sedans from the Suzuki Khyber to the Margalla and the very modern looking Baleno. However, all of their attempts to make sedans work, even up until recent years with the Suzuki Liana and Ciaz, have failed.

The Big Three from this point on maintained a tactful and unspoken agreement. Suzuki kept its monopoly on the hatchback category and Honda and Toyota slugged it out for the sedans. If any new entrants came onto the market (and many tried), they were quickly sullied and sent packing. In this way, for nearly three decades there were essentially only six options for locally assembled ‘family cars’ in Pakistan. Suzuki at any given time was assembling three to four hatchbacks, with mainstays including the Mehran, the Alto, and the Cultus. Meanwhile Honda produced its cheaper sedan the Honda City, and it’s more expensive competitor to the Toyota Corolla the Honda Civic. Toyota focused on making just the one car, albeit in different variants with different engine sizes.

The state of the market – why it was KIA’s time to shine

This is how it continued. A number of companies tried to launch in Pakistan. The Chinese company FAW brought in its hatchbacks along with heavy loaders around 2014. All of the attempts failed. Why? One simple reason – resale value.

Successively bad car policies and the unwillingness of these three companies to manufacture completely in Pakistan meant that car prices remained high. Even though the cars were being assembled in Pakistan, they were being imported here part by part. This meant that no matter what car prices would also rise with the price of the dollar. So very quickly, cars in Pakistan were no longer just a mode of transport, they also became an investment and a crutch against the devaluation of the rupee since most parts of the cars were imported. So, for example, if a person bought a Suzuki Alto in 2007 for Rs 500,000, a likely price they would sell the car for in 2012 would be somewhere between 600,000 – 700,000. Because of this phenomenon, one of the major factors when buying a car became resale value. And because the Big Three had become mainstays, anytime a new manufacturer came around, consumers would be worried that if they failed and packed up, then the resale value of their cars would plummet.

When you only have five or six cars out on the roads of an entire country (minus the imported Mercs and BMWs of the uber rich) then any new entrant is bound to be treated with mistrust. As a result, a lot of the new manufacturers coming in would see the less than lukewarm response towards their cars and go running in the other direction and investors would pull out their money.

This is where KIA comes in. “This is the third time Kia is being introduced to Pakistan. What’s different is who the people behind the project are. The Lucky Group is Pakistan’s largest and fastest growing group. It has a positive track record with success stories like ICI,” says Muhammad Faisal, the Chief Operating Officer of KIA Lucky Motors and himself a former Toyota Indus executive.

Faisal claims that the success of the KIA Sportage has come because of Lucky Motors. However, the real difference this time around has been two-fold. The first difference, which is a more technical difference but still a more important one, is that the Lucky Group put some skin in the game themselves. KIA Lucky Motors opened up three dealerships in Pakistan themselves – an unprecedented move. Normally, manufacturers simply assemble and provide the cars to dealership franchises. “We took on no debt on our balance sheet when we conceived this project. We made an investment of $175 million. All equity. We put our skin in the game. People trusted us,” explains Faisal.

The other reason is the KIA Sportage in particular. You see, KIA does not just have one car on offer. There is the KIA Carnival in the Multi Purpose Vehicle (MPV) category, as well as the KIA Picanto in the 1000cc hatchback category as competition to the cars offered by Suzuki. However, while the Picanto has good reviews and has done well, it has been the Sportage that has mainstreamed KIA and given them a head start. And that is because it is a very reasonably priced SUV in the price of a top of the line sedan, that does not cut corners to achieve this cost.

The SUV factor

Let us try to understand what your options are if you want to buy a car in Pakistan. If you’re rich, and we mean rich rich then you don’t need to worry yourself about Toyota showrooms or which version of the Corolla to get and whether it is better than the Civic or not. You simply go to the Porsche dealership or import a brand new Mercedes and you’re done. If you want an SUV instead of a luxury sedan, you can go to Audi or even go to the Toyota dealership and get a fortuner or the Hyundai dealership for a Tucson. Now, these are cars that range anywhere between Rs 7 – 40 million.

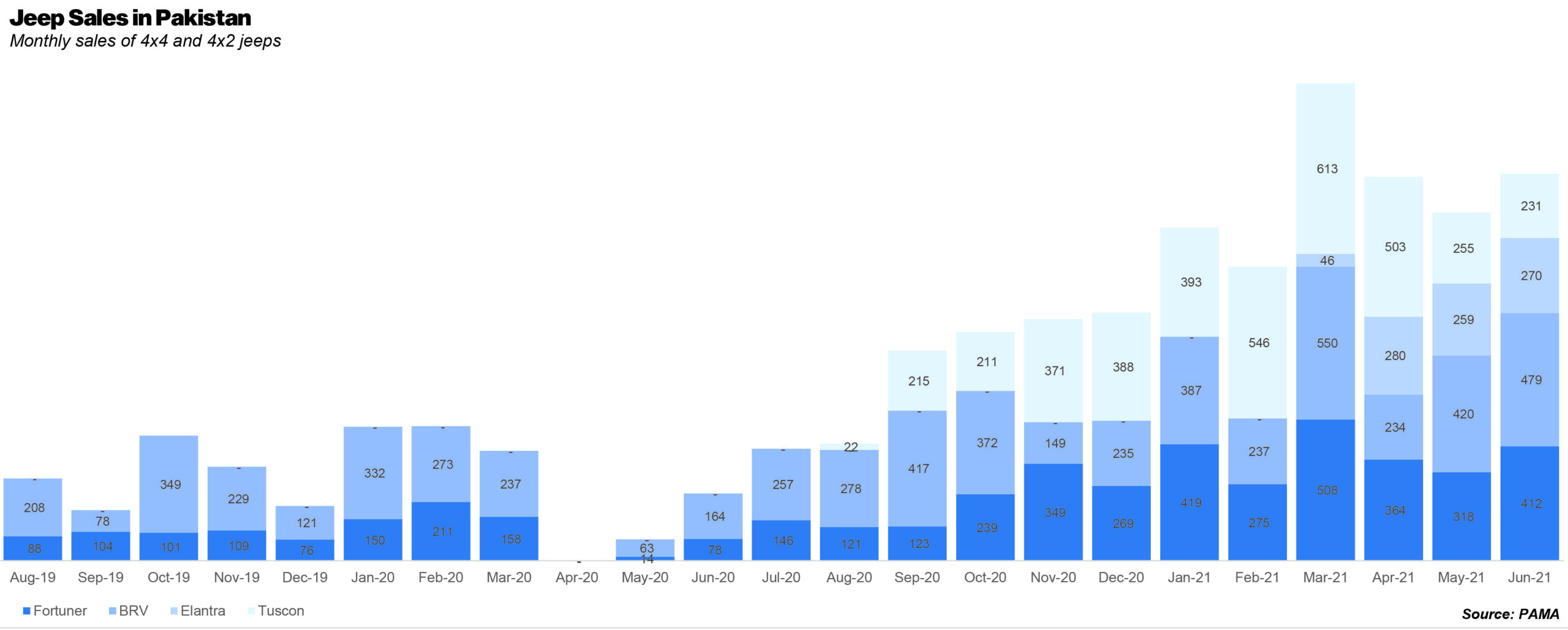

For most people, the range that they can buy a car in is Rs 1 – 5 million. Because of this, up until around 2018, cars within this range were divided into four different categories. There were the hatchbacks that Suzuki offers, with the Alto pricing at around Rs 1.2 million, the WagonR at around Rs 1.5-1.7 million, and the Cultus at around Rs 2 million. In the price segment above this, you could find Japanese refurbished hatchbacks, a completely different industry. The imported Toyota Vitz and Toyota Passo could be found in the Rs 2.2 – Rs 3 million range depending on the condition of the car. After this point there are the sedans. A basic model of the Toyota Corolla with a 1300cc engine used to cost around Rs 2.7 million, and a fully loaded Toyota Corolla Grande with an 1800cc engine went for around Rs 3.6 million. Similarly, the Honda City in its top most variant was priced around Rs 2.4 million at this time and the Honda Civic with its top most variant cost around Rs 4 million. If you wanted to buy an SUV, you either had to get a Toyota Fortuner for around Rs 7 million or a Hyundai Tucson for around the same price.

These were the prices around 2018-19, and around this time, the import of Japanese refurbished cars was down. The reconditioned car market shrunk. Pakistan used to import around 70,000 cars. The number has gone down to less than 15000. This meant options were tighter than ever and the prices of the Big Three were rising, with a Civic going beyond the Rs 4 million mark and the Toyota Corolla’s top most variant not far behind. And that is exactly the moment when KIA struck.

Initially, Honda tried to introduce the BRV, a seven seater SUV within the Rs 3 million range, however, the car had an underpowered engine of 1300cc and the seven seater nature made it seem more like a wagon than an SUV and it did not sell very well. In 2019, KIA Lucky Motors launched the KIA Sportage for around Rs 4.5 million. Most people loved the design and KIA provided a quality SUV in Rs 4.5 million. Before the KIA Sportage, SUVs were being sold in the Rs 7-8 million range even by new entrants like Hyundai. The KIA Sportage suddenly meant that people buying the top most variant of the Toyota Corolla or the Honda Civic could now simply add another Rs 500,000 and enjoy the comforts and the sex-appeal of an SUV. And if a person can come up with Rs 4 million to buy a car, it is more than likely that they will be able to muster up another Rs 500,000 from somewhere or the other. Especially in a country like Pakistan, where SUVs and Land Cruisers are considered the height of wealth. The KIA Sportage could give you that feeling of being a Chaudhry Sahab without the extra Rs 3 million that it cost to upgrade from a Corolla or a Civic to a Fortuner or a Tucson. “As for the Sportage, there was no such product that gave such value for money. We were also the first to introduce a 4 year or 100,000 km warranty,” explains Faisal. He is clearly proud of the move KIA pulled here, because it was undoubtedly brilliant.

Toyota claps back

The KIA Sportage suddenly broke the market for the Honda Civic and the Toyota Corolla. As a result, Corolla had the idea to launch the Toyota Yaris. Essentially, they discontinued the cheaper variants of the Toyota Corolla with 1300cc engines, and launched a new car from scratch that was cheaper. Now, people could either buy a Toyota Corolla in the Rs 3.5 – 4 million range, or a Toyota Yaris in the Rs 2.5 – 3 million range.

Essentially, Toyota did to the sedan exactly what KIA did with the SUV. KIA offered an SUV at a comparable price to a sedan and people went crazy for it. Toyota offered a sedan at just a little over the price of a hatchback. Think of it this way. If you were going to buy a Suzuki Cultus hatchback with a 1000cc engine in 2019, you would be spending around Rs 2 million. Now, you could simply add in Rs 400,000 and get a Toyota Yaris, which is a sedan with a 1300cc engine. The Yaris was also priced just a little lower than the Honda City, which ranges from Rs 2.7 – Rs 3.1 million. And since the Yaris is a newer design, people naturally gravitate towards it. Similarly, if you were buying a Honda Civic for Rs 4 million in 2019, now you can add Rs 500,000 and get a KIA Sportage SUV.

So what was the result of this massive change? For starters, Suzuki had to fall back on their smaller car the Suzuki Alto, which is a 660cc car that ranges from Rs 1.2-1.5 million and is the cheapest car available in the Pakistani market other than the United Bravo, which has not seen great success and has continued to achieve the same brand value as Suzuki or the other new entrants. This was because the segment that the Suzuki Cultus in the Rs 2 million and above range catered to was cut by the Toyota Yaris in particular, as well as the KIA Picanto – which is KIA’s hatchback car that has done well but not as well as the Sportage has done.

The real damage was done to Honda, since KIA cut into their sale of the Honda Civic, and the Toyota Yaris meant another budget sedan was available causing the sales of Honda City to be affected. That is why Honda Civics and Honda Citys combined sold a total of 37,195 units in the past two years. In comparison, the Toyota Corolla alone, despite being challenged by the KIA Sportage, sold 38,514 units in the same two year period. Toyota had an incredible run with the Yaris, with 29,622 units sold in 14 months. If we take an average of the number of Yaris sold in 14 months, we get 2115 cars. If we then multiply it with 24 months, that makes it 50,780 cars in total. Meaning, had Yaris been produced and sold all 24 months, it would be the most sold car. At this rate, the number of Toyota Yaris sold are double the number of KIA Sportages – something that is to be expected since the Yaris is Rs 2 million cheaper and cutting into both the Suzuki Cultus market and the Honda City market.

Meanwhile the KIA Sportage sold just over 25,000 units – which would otherwise have been split between the Toyota Corolla and the Toyota Civic. Honda will be hoping to regain some momentum with the launch of the new generation of the Honda City which might help them capture some of the market from Toyota Corolla and also Suzuki Cultus. However, whatever happens, in only a couple of years it has become very clear that the KIA Sportage has changed the landscape of what Pakistan’s automobile industry looks like.

The other challengers

Let us give some credit where credit is due. Other manufacturers had already entered Pakistan before KIA Lucky Motors began operations and were taking a gamble on Pakistan. However, there was always going to be hesitation within the consumers over buying outside of the Big Three. The Big Three fail to provide airbags and other basic services, but they are a familiar evil that has good resale value. That is why KIA did what they did – they offered the deal of a lifetime and it just couldn’t be ignored. A quality SUV in the price of a sedan with a 100,00KM warranty.

People went for it, and as a result became more comfortable with not just the idea of shopping KIA, but of buying cars outside of the Big Three as well. That is why the rest of the new entrants owe a debt to the KIA Sportage as well. Take, for example, the Chinese-English company MG, which has launched its own MG HS and ZS, including all electric variants in the price range of Rs 5 – 6 million. They are also preparing to launch a sedan called the MG 5 which will also reportedly be priced less than the Toyota Corolla and the Honda Civic. Similarly, Chinese company Changan has launched its budget sedan called the Alsvin, which is within the Rs 2 – 2.3 million range and could make a significant impact. While Hyundai has kept its SUV Tucson in the Rs 6.5 – 7 million range, it has now brought in its Hyundai Elantra, which in the Rs 3.8 million price category is a little cheaper than the Civic and the Corolla and has a bigger 2000cc engine and more features.

Most importantly, now that Pakistani consumers are more comfortable with buying outside the Big Three and it has become clear that resale value exists for these other cars as well and that these new entrants are going nowhere, people are excited to try out these new cars. The Toyotas and Hondas are old news, and fresh designs and features have excited people. While Toyota, Honda, and Suzuki are going to remain the ‘Big Three’ for a while with the most sales, they are no longer a triopoly. They have serious competition and that is a good thing. Not just because it makes the market more interesting and diverse, but because now they will have to improve their standards and quality as well.