SadaPay and TAG, the two leading lights of Pakistan’s fintech startup revolution, are at war. The ongoing tussle between the rival mobile wallet startups has seen the two young and hungry founders, Brandon Timinsky of SadaPay and Talal Gondal of TAG, engage in a mudslinging match that has left no one unsullied. Now, the rivalry is reaching a new crescendo as the National Accountability Bureau (NAB) has come knocking on the door of SadaPay, much to the delight of TAG.

What makes the matter even more serious is that, according to sources close to the matter, SadaPay is only a few days away from closing another round of funding. While SadaPay has denied that they are about to announce a new round, industry rumours are adamant that the announcement is due any week now and NAB entering the picture has caused SadaPay to go into crisis mode. Embroiled in the middle of the case, either by chance or very much by design, are a former finance secretary that recently resigned as special assistant to the prime minister, a Porsche dealership under investigation for swindling its high-end clients, and the confusing semantics of a State Bank document.

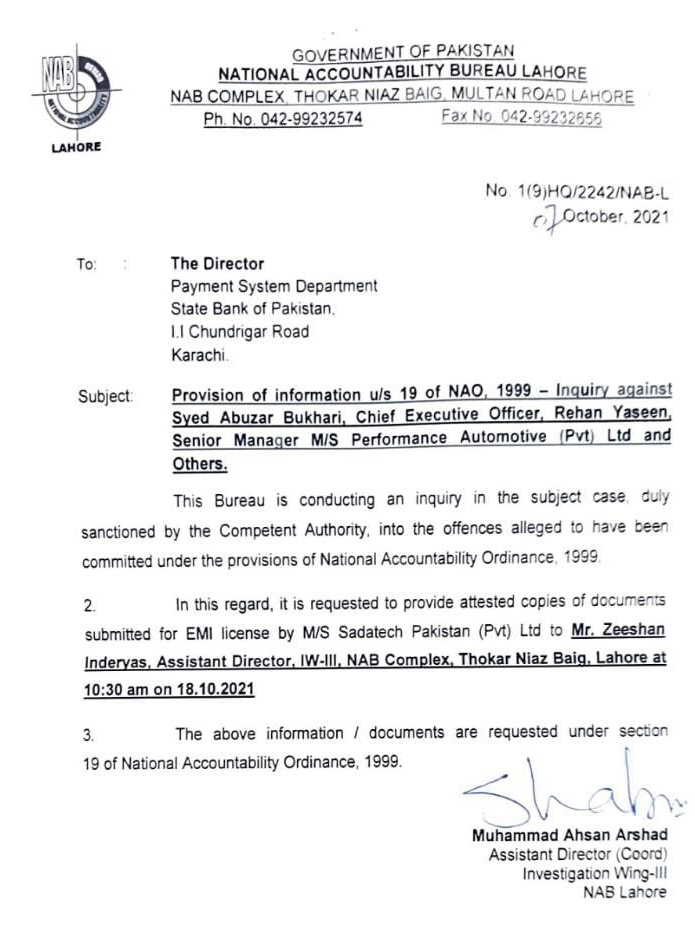

So what in the world is going on? There are two documents at the center of the entire matter, both of which have been made available to Profit. The first is a request made by NAB to the State Bank of Pakistan (SBP) asking for access to the documents that SadaPay submitted when it was trying to gain its Electronic Money Institution (EMI) license, indicating that NAB is interested in SadaPay’s activities. The second is a dossier of unknown origins signed simply and dubiously by “a patriotic Pakistani” which claims Brandon Timinisky fails to meet the SBP’s “fit-and-proper” standards and without proof further claims that SadaPay is being used to “send and receive huge sums of money to and from India.”

And it gets even stranger. The NAB officer who requested that the SBP provide SadaPay’s license documentation asked for the documents in reference to a case against the former CEO of Porsche Pakistan, Abuzar Bokhari, who is accused of embezzling Rs 800 million of customers money. Seemingly, there is no connection between the cases. Timinsky has said SadaPay has nothing to do with Porsche Pakistan, and Abuzar Bokhari has also expressed confusion at the matter. Even the Director General of NAB in Lahore has told Profit he has “no idea” why the documents were requested, and the State Bank director who received the NAB letter was also not sure why SadaPay’s EMI license documents were requested by NAB in Porsche Pakistan inquiry.

Meanwhile TAG, which has long been involved in a subtle, underground mudslinging match with SadaPay, stands to benefit from the letter sent by NAB to the SBP, and sources have alleged that TAG has been less than gracious in the wake of its competitor finding itself in this spot of bother, making sure to play a part in helping spread the documents among those working and investing in the startup ecosystem in Pakistan. And Sadapay has not shied away from taking it a step further than just accusing TAG of spreading rumours about them. In a statement given to Profit Sadapay said that the documents are “a politically motivated agenda by a competitor to disparage our company and the great things we aim to do in Pakistan’s digital financial services ecosystem.”

And why would they put it past this ominously unnamed ‘competitor’? Even the mere possibility of an investigation might affect not just SadaPay’s upcoming fundraising round announcement by scaring off the investors, but also how quickly they will be able to get a permanent EMI license. Either way, the idea is to scare off the investors.

Sources close to persons high up in both startups have said that the entire affair has been caused because of the egos of the two, young, founders of the rival companies – Brandon Timinsky and Talal Gondal. There are peacemakers on both sides that believe the market is large enough to have more than one player, but it seems for now that the two companies have locked their horns even tighter.

What is the truth, and why has NAB inserted itself so strangely into the rivalry? This is a story of ego, malice, and two companies so bent on fighting the other, they do not care what it costs them.

SadaPay vs TAG

There are two parts to this story. The first is the part about SadaPay and TAG and the animosity between the two, and the second part is about Porsche Pakistan and NAB. All of this ties together, but to start off it is important to know that SadaPay and TAG have been at each other’s throats for a while now, and behind the animosity is the race to get an Electronic Money Institution license from the SBP.

An EMI license basically allows you to open up an online bank. Once a company gets an EMI license it can provide services like allowing transactions, paying bills, and even issuing debit cards. Essentially, both of these companies are trying to make money easier, and whoever gets the EMI license first will get a massive head-start. Both companies have had in-principle approval from the SBP since last year. SadaPay got in-principle approval in April 2020 and TAG got it in November 2020. However, in-principle approval does not mean that the SBP is going to guarantee final approval. It is simply a nod of the head from the central bank that allows these prospective EMIs to beta-test their product with a select group of customers.

With the stakes high and the competition clear, both SadaPay and TAG have been subtly trying to undermine each other from the beginning. That is natural, the two are competitors in a new field and there are bound to be some flares in relations. In fact, two different sources close to TAG alleged that when Profit published an article a few weeks ago that said TAG’s $100 million valuation was not accurate, Brandon Timinsky shared the article with TAG’s investors to try and deter them. This would indicate that while TAG seems to have the upper hand right now, this game of cat-and-mouse between the two companies has been ongoing for a while and it has only heated up in the past couple of months.

With this level of antagonism between the two companies, the documents that have been released add fuel to the fire, and even more naturally TAG will be looking to benefit from what could possibly be a setback for SadaPay. Nobody wants to be involved with the accountability bureau. It is a bloated, vain, arrogant, and deeply misguided institution that is hurting Pakistan on countless fronts and giving grief to innocent people. Their attention is something you wouldn’t wish upon your worst enemy.

Except, according to the same source close to TAG, their animosity with SadaPay was bad enough that when the NAB letter was released, TAG along with other players and observers of the startup ecosystem were more than happy to pass along the news and forward copies of the letter. There is a malicious vibe to every single detail that is coming forward about this fight. A lot of these offhanded comments and often petty microaggressions went on in the background and under the books. No one is willing to take responsibility or acknowledge who dealt the first blow, but both sides are at a point where they are poised to pounce at any misstep from the other.

As we mentioned earlier in the story, the fight goes this deep because of the severe dislike that the two CEOs have for each other. “Both of them are young and brilliant, and they are also very stubborn,” explains our source. “The market is big enough not just for two, but even for three or four competitors to work in. If they keep clashing like this, they will end up destroying each other in the process. And do you know what happens next? Nayapay, the third competitor in this race, sweeps away with the entire market because SadaPay and TAG have bled each other dry.”

Nayapay, a third company trying to break into the mobile wallets category that also has an in-principle license, has been very quiet and passive this entire time. Our source claims that their CEO and founder, Danish Lakhani, is more experienced and mature than Timinsky and Gondal and has thus wisely stayed out of the confrontation. There is a general perception about startup founders that while they are brilliant, their relative youth and inexperience makes them brash and at times not the most tactful operators. “They will destroy each other, meanwhile Nayapay will quietly keep doing its work and get the most from this entire mess,” says our source.

According to another source, sane voices do prevail in both companies that want to see an end to the one-upping and showmanship that has dominated the competition, but these voices seem to be drowned out in the fury of the CEOS. As things stand, the documents relative to SadaPay, both the NAB letter and the dossier, undeniably exist and could deter investors as well. However, that still leaves many questions unanswered as to their origins.

The first problem – NAB and Porsche

In February 2021, the world of Pakistani luxury car lovers was rocked. Syed Abuzar Bokhari, the CEO of Porsche Pakistan, was accused of taking orders for cars worth Rs 800 million, and running away with it without a trace. Naturally, people were outraged. The outraged parties being rich and influential, very quickly NAB launched an inquiry against him.

Fast forward to six months later, and an officer of NAB Lahore asked the SBP to provide them with attested copies of the documents that SadaPay submitted to the central bank to get their EMI license. The problem? The request was made with the title “Provision of information u/s of NAO, 1999-Inquiry against Syed Abuzar Bukhari, Chief Executive Officer, Rehan Yaseen, Senior Manager M/s Performance Automotive (Pvt) Ltd and others.”

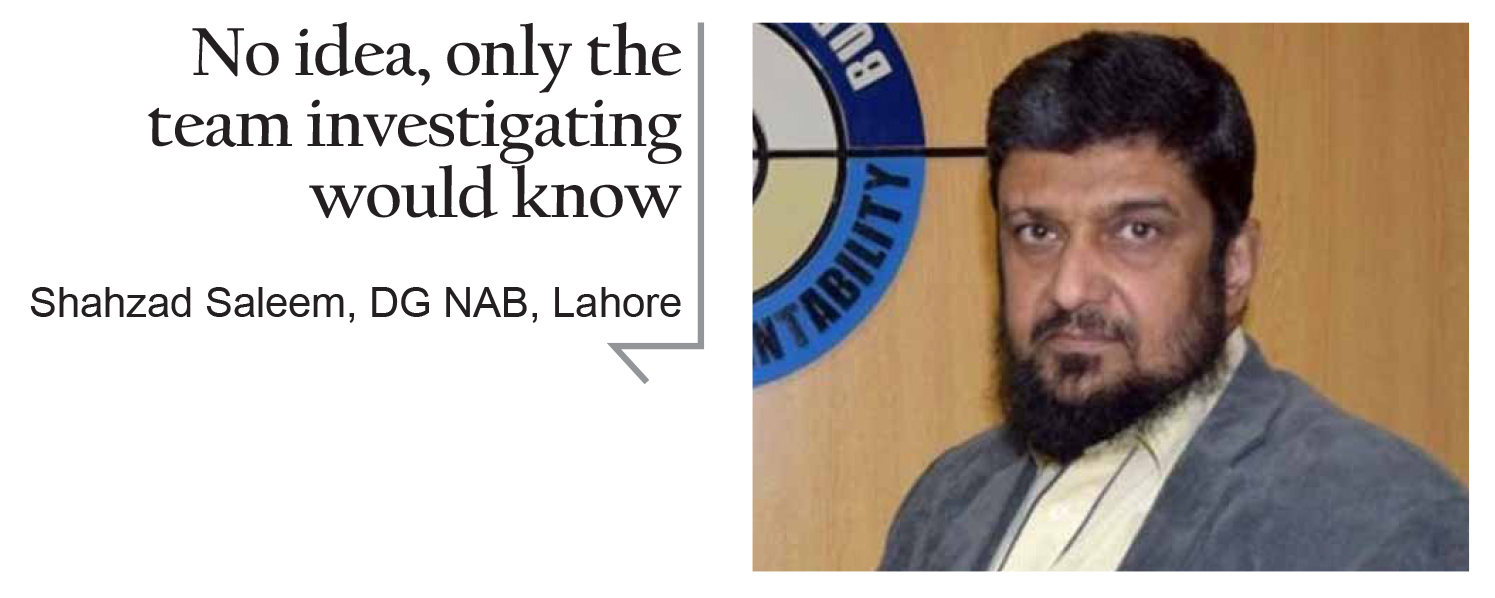

That’s right, with a very straight face NAB asked the SBP to provide them details of the EMI license documentation of SadaPay in a case that involves a Porsche dealership in Lahore. What is the connection between the two? Nothing so far as can be told. Profit contacted a host of senior NAB officials including their spokesperson and their Director General in Lahore, all of whom either had no idea what was going on or were dumbfounded by the request. The spokesperson refused to comment, while the DG Lahore said that he was unaware of the situation and that the relevant team investigating the case would know the details. “No idea,” said the DG in a Whatsapp message in response to the notification. “Only the team investigating would know.” Brandon Timinsky pleaded much the same. “I’m not sure who these people are,” he told Profit. “Why would Porsche be related to SadaPay? It’s funny to me and this is the first that I am hearing of it.”

An official statement from Sadapay said that “We’d like to categorically affirm that our company has no affiliation or relation to Porsche Pakistan.” The statement then went on to claim that the entire involvement of NAB has been concocted by a “competitor” who they have not named, but which can only be TAG. “It is saddening that the valuable resources of State Institutions can be distracted by what appears to be a politically motivated agenda by a competitor to disparage our company and the great things we aim to do in Pakistan’s digital financial services ecosystem,” read the statement.

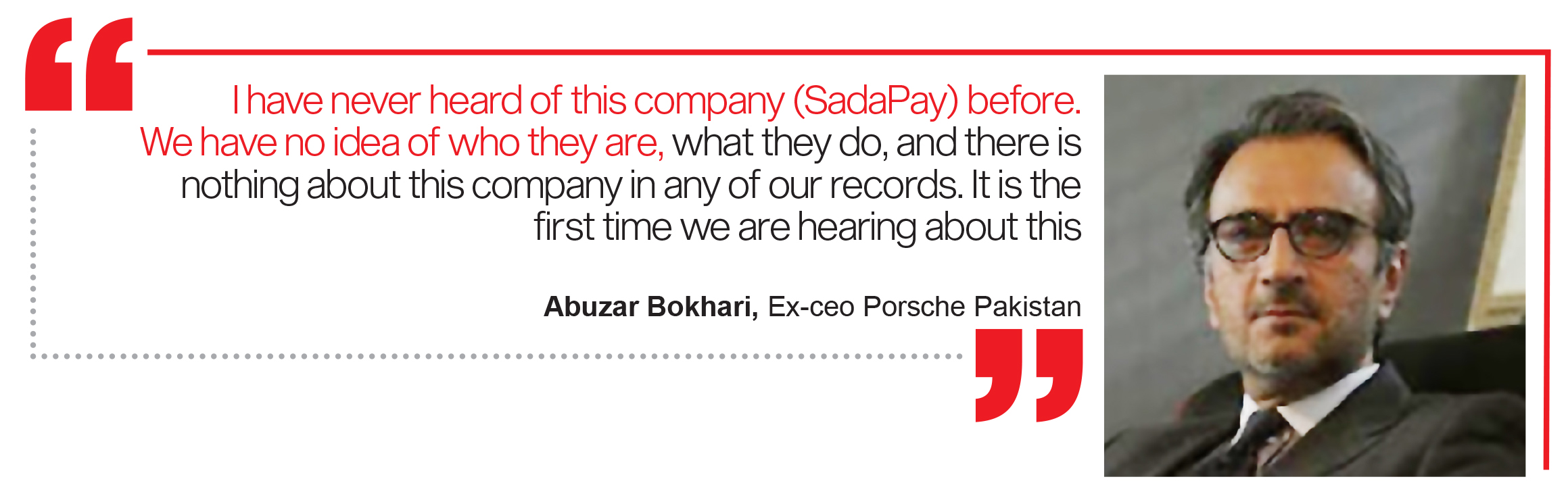

Meanwhile Abuzar Bokhari, the under investigation CEO of Porsche Pakistan, said much the same. “I have never heard of this company (SadaPay) before. We have no idea of who they are, what they do, and there is nothing about this company in any of our records. It is the first time we are hearing about this,” said Bokhari. He said that perhaps Brandon Timinsky or one of the directors of the company were customers of the Porsche dealership that is under accusation of fraud, but after a thorough check, Bokhari confirmed that none of them were customers. Even if that were the case, it makes no sense for NAB to need SadaPay’s EMI documents to investigate a car dealership.

It is still entirely possible that there is an angle to this that is being missed and only NAB is privy to. However, Profit has reached out to everyone involved that could possibly know what is going on. While the NAB leadership and SadaPay are clueless. According to one source close to the company, even TAG, which has been trying to benefit from the news of the NAB letter, does not know why the documents have been requested in reference to the case against Porsche Pakistan.

What is undoubted is that all of this commotion has caused some serious ruffled feathers. According to one source close to the matter, “Foreign investors are worried about the fate of their investments due to spread of different speculations against M/s Sadatech Pakistan (Pvt) Ltd in the market following NAB’s letter.”

“The final round of funds collection from investors is in its zenith right now, and SadaPay has been working hard to get it done. In fact, they are ready to announce it within a few days. However, their rivals have been striving hard to discourage the investors to invest with SadaPay,” said the source.

The second problem – the dossier

Around the same time that the NAB letter began to circulate, two other documents also surfaced and started making the rounds on Whatsapp. The first one was the earlier mentioned dossier about Brandon Timinsky or sketchy origins, which made some ridiculous claims and other more relevant allegations. Then there are the tax returns of Dr Waqas Masood, which are also being used as proof that something shady is up at SadaPay. Let us look at both documents one by one, starting with the dossier.

The dossier looks suspicious as soon as you open it. It is titled in aggressive all caps type with the subject line “PAKISTAN AT STAKE; BRANDON T.TIMINSKY AND M/S SADATECH PAKISTAN PVT LIMITED FACILITATING PAYMENTS TO INDIAN COMPANIES AND PERSONS THROUGH ITS PAYMENTS SERVICES.” Any time a random dossier appears peddling theories of any person or organization colluding with India, it is wise to ignore it. What makes the document even stranger is that it does not have an author or any attribution – it is simply signed as “Sincerely, A Patriotic Pakistani.”

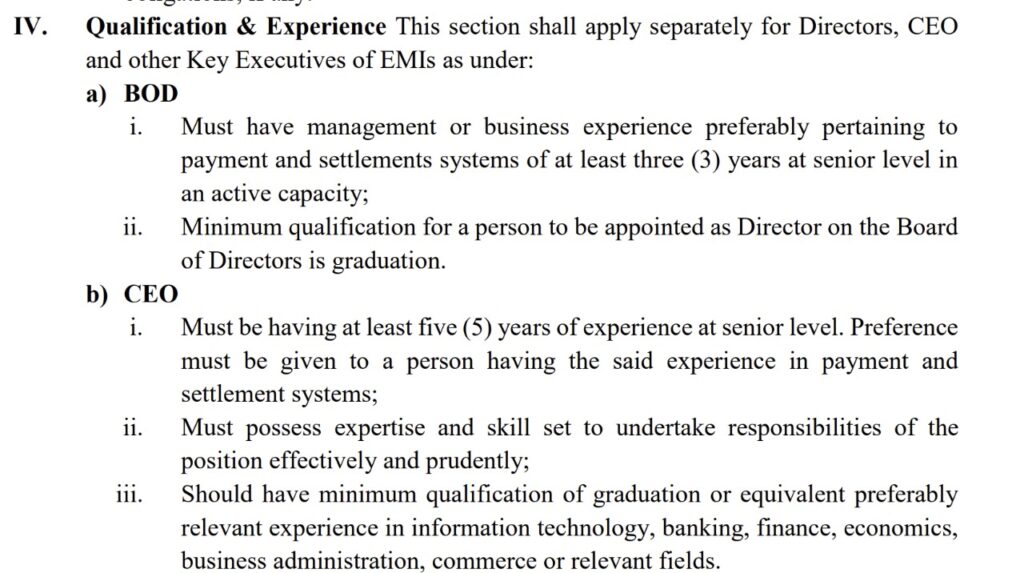

The document makes some wild assertions, the most significant of which is the very random claim that SadaPay is somehow involved in laundering money between India and Pakistan. But there are some other claims that are not as vague. For starters, there is the issue of Timinsky being “fit and proper” to be the CEO of an EMI. The SBP’s rules hold that the head of such an organization must be a qualified professional possessing relevant experience and a degree relating to the job. They must also not be associated with any business that has had solvency issues or debts. On surface, Timinsky fails both tests, since he is a college dropout and had filed for bankruptcy case (chapter 11) in the United States.

Apparently, the issue of Brandon’s degree had actually been brought up during the granting of the in-principle EMI license, but since the language of the SBP’s rules was vague enough to make it seem like a degree or relevant experience would be enough, rather than both thing, Timinsky was given the go-ahead on the basis of this loophole.

EMI Regulations require “graduation or equivalent preferably relevant experience in [information technology, business administration commerce].” According to team at Sadapay, Brandon’s experience as an accomplished entrepreneur and business owner over the last 15 years covers this requirement. On the issue of being involved in a business that went bad, they say that “the claims of insolvency are being interpreted out of context.”

“Brandon Timinsky was part of a real estate investment in 2013 where a Chapter 11 Bankruptcy was filed to restructure corporate debts from the prior property owner. The prior owners stopped taking care of the property (a trailer park rental community), abandoned it, and left the property in disrepair. Brandon and a group of investors took control of the dilapidated property, worked with the creditors, and the property was ultimately sold to new owners,” read the statement.

However, despite this the objections are still logical, and their relevance very real. However, even with the explanation, Brandon barely met the requirements, and getting EMI licenses has been notoriously difficult for local competitors trying to break into the market. So how did Timinsky manage to practically saunter over these obstacles and get a license from the SBP. According to a lot of Sadapay’s competitors and observors, it had to do with Dr Waqar Masood – who special assistant to the prime minister at the same time that he was a director on Sadapay’s board. They accuse him of using his contacts and influence to act as an in-house lobbyist for Sadapay, and now with his name in the Pandora Papers, Sadapay is possibly trying to put as much distance between itself and Dr Waqar Masood as possible.

The third problem – Dr Waqar Masood

A scholarly man by nature, Dr Masood has been finance secretary to multiple governments at multiple times and until recently was also serving as SAPM on revenue. His involvement with SadaPay is interesting, and it begins with Khan and Ali Law Associated, a law firm run by Masood and a man called Asim Imdad.

The firm specialises in engaging in dialogue with opposing parties and believes in arbitration, and knows how to get things done outside of court. After working with them for a while, and seeing Dr Masood’ vast experience in finance and his understanding of the government’s financial machinery, hired Dr Masood as the company’s chairman as well. For this job, Dr Masood had both the right expertise and the right connections – which SadaPay made full use of. He was also given shares in SadaPay and a seat on the board of directors – a position he declared in his tax returns.

However, things started to change when the Pandora Papers were released and it turned out that Dr Masood’s son, Abdullah Masood Khan, was found to co-own a company Linkquest Ltd in the BVI jurisdiction. Dr Masood said he knew nothing about his son’s company, which is why he had not declared it in his list of assets which he submitted upon assuming the position of SAPM. This bit of information was taken by SadaPay’s opponents and used as proof that something shady was up in SadaPay’s leadership. They also pointed towards the fact that Dr Masood was still special assistant to the prime minister when SadaPay was given its in-principle EMI license.

All of this was made worse when it was also discovered that Dr Masood was a director of SadaPay’s parent company, which is registered in a special economic zone in Dubai. This directorship Dr Masood had not declared in the papers he submitted when he became SAPM. Now, there is a case to be made here for conflict of interest. He was in a ministerial position and also held a directorship in Dubai that he did not tell the government about. However, he did not in fact own shares in the parent company in Dubai and thus it was not an asset – the shares that he did own in SadaPay in Pakistan he declared in his assets. Dr Waqas Masood has declined to comment on the matter, but the discrepancy is still being spread around as rumours about SadaPay run rampant.

According to his law partner, Asim Imdad, the directorship ended after the two years term expired and only the shares remain, which Dr Masood declared as part of his assets. As for the undisclosed directorship in Dubai, that ended on the 10th of October, just this week. Whether that is a coincidence and his two year tenure just ended, or SadaPay is distancing itself from him is for anyone to guess. What is for sure is that Dr Waqar Masood’s footmark on SadaPay is still causing an after effect.

Analysis – War, what is it good for?

All of this has been very speculative. That can happen when two competitors in the same field are going off against each other not just within industry circles but to the media as well.

The question, however, is why NAB made the request in the first place. Again, there might be something to it, but it is also possible that the documents have been requested maliciously. There seems to be no link between the two cases, and no one from NAB itself to TAG and SadaPay and even Abuzar Bokhari understand the connection. Despite this, people close to TAG are consistently trying to point towards the fact that SadaPay might be under investigation and the truth about NAB’s letter will soon come out in the open, while SadaPay is saying it makes no sense for their EMI application documents to be requested in a case about Porsche Pakistan and that their competitors (read TAG) are trying to brand them with the NAB name.

There is no evidence that the letter has been planted by a competitor or that NAB has been nudged into this direction. However, the possibility can also not be discounted.

Normally, competition between such startups is over cutting edge UX design, customer experience streamlining, or innovative business models and creative marketing. Since this is a highly regulated industry in Pakistan, however, right now the competition is to see who can get the full license first. To this end, both companies have on board influential men that know the ins and outs of government institutions and are helping them make their case.

TAG is founded by Talal Gondal, the scion of a Punjabi political family, and has on his team a recently retired, very senior, and very influential Lieutenant General of the Pakistan Army, as well as a former finance secretary, Tariq Bajwa, who served as the 19th governor of the State Bank of Pakistan between 2017 and 2019. Meanwhile SadaPay’s trump card is Waqar Masood, the earlier mentioned former federal finance secretary and special assistant to the prime minister, who is on the company’s board of directors. While these are people that know the ins and outs of governments and are thus useful to these companies, they can also act as sources of information against the competition. How long could it really take for these heavyweights in such an environment to stop using their connections for their own companies, and instead to attack their competitors?

The hostile environment created between TAG and SadaPay is good for neither company. The simple fact is that TAG is trying to gain momentum using SadaPay’s NAB misfortune, and if the shoe were on the other foot, SadaPay would most likely not shy away from it. And while sane voices from both sides are saying that the feud is simply allowing their third competitor, Nayapay, to quietly chip away at the lead that these two companies have, it seems for now that the Mexican standoff between SadaPay and TAG might be on the brink of turning into a full blown shoot out.

Both companies must be cautious, because the National Accountability Bureau, if anything becomes of the request letter, will not rest at just SadaPay. Once they have their teeth in an industry, it is a free for all and in NAB’s world there is no room for logic or reason. Doing the tango with the accountability bureau is like playing with fire – there is a high risk of getting burnt. Pakistan’s startup ecosystem has remained relatively away and thus unscathed from the unnecessary fury of the National Accountability Bureau. Whatever becomes of the tussle between SadaPay and TAG, it is our sincere hope that this does not open the door for NAB to come knocking at every startup’s door.

With additional reporting by Ariba Shahid and Taimoor Hassan

Awesome article! The author has the potential of being the Tom Clancy of Pakistan’s Financial world.

Find live NFL scores, pro football player & team news, NFL videos, rumors, stats, standings, team schedules & fantasy football games on this website.

Nice article about sadapay