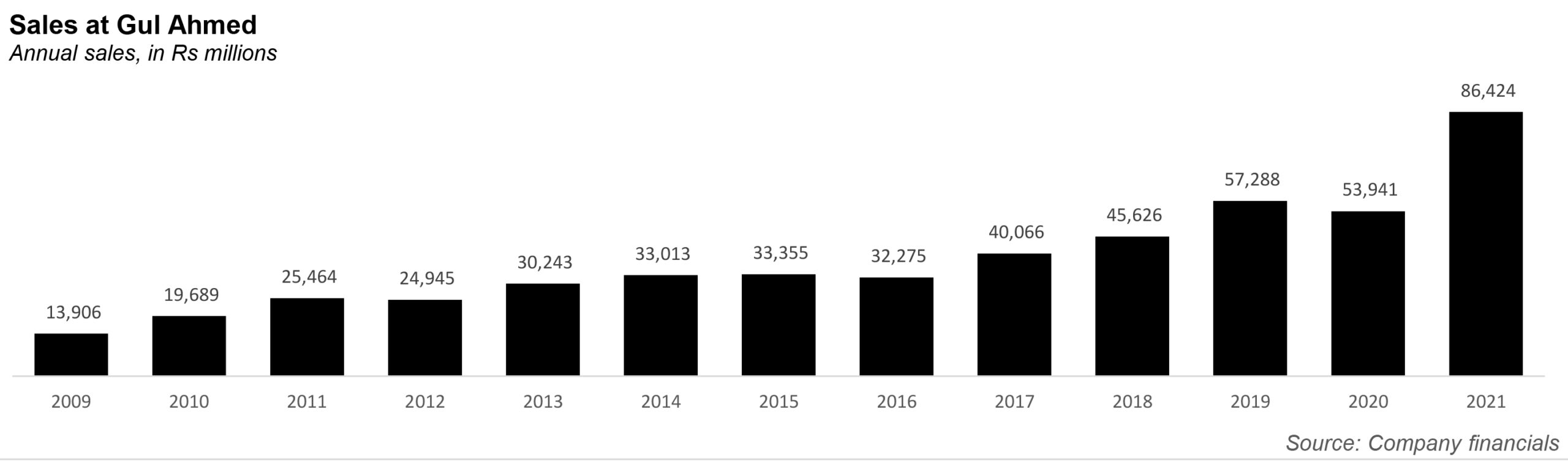

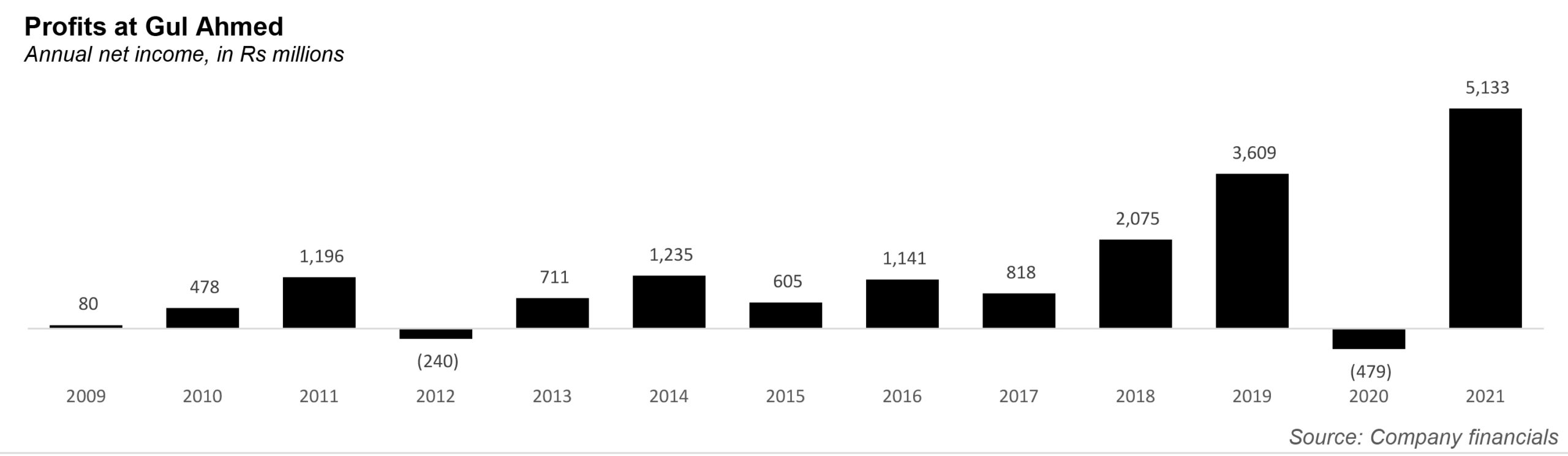

If you had read the pages of this magazine just a few years ago, you would have noted a somewhat skeptical approach to Gul Ahmed. The textile mill with the local retail footprint was struggling to find ground, having a patchy year in 2012, and stagnant growth between 2013 and 2017. Then, in 2020, the year of Covdi-19, it experienced a drop in sales, and its first loss in net income since 2012.

Which makes the financial results for the year 2021 all the more surprising. The companies’ sales jumped 60% to Rs53 billion to Rs86 billion, while the company’s loss of Rs479 million went straight to a profit of Rs5 billion – the highest net income the company has ever recorded. Even Gul Ahmed itself seems surprised. As its annual report notes, all of this change happened despite a record year of, “unpredictable and strange movements in rupee versus dollar parity, continued increase in raw material prices, increase in utility prices, challenges in logistic front, enhanced supply chain cost, and a continuously growing inflation.” You know, just the usual problems when it comes to doing business in Pakistan.

But actually that very bit – that the textile mill has switched its focus somewhat just from pure exports to local retail in Pakistan – is what has helped Gul Ahmed, and paid off in the long run.

To understand how, first, some history. Gul Ahmed as a group started in the early 1900s trading in textiles. It was in 1953 that the company entered manufacturing with Gul Ahmed Textile Mills. It was listed on the Karachi Stock Exchange in 1955. Today, the plant has more than 130,000 spindles, with 300 weaving machines and yarn dyeing, processing and stitching units. Its four main business segments are spinning, weaving, retail, and distribution & processing for home textile and apparel. Subsidiary companies of Gul Ahmed include GTM USA Corporation, Gul Ahmed International Limited, and GTM Europe Ltd. The company reaches more than 44 countries around the world. Its greatest revenue contributor, after Pakistan, is Germany, followed by the US, France, Netherlands, UK and Italy.

On one front, Gul AHmed is quite unusual: unlike many of Pakistan’s textile exporters, it has had a domestic retail brand presence in the Pakistani market for decades. The retail segment is more recognizable as Ideas by Gul Ahmed, which has over 100 stores all across Pakistan.

Ideas has been pushed strongly by the CEO Zaki Bashir, son of founder Bashir Ali Mohammad. Zaki, a graduate of Babson College in the United States, joined Gul Ahmed in 2005 where he learned the ropes from his father before transitioning towards becoming the CEO of the company in 2014, around the time that he decided that the retail business could become the core of the company.

There are two reasons for this. First, the year 2014 was a time when Pakistan’s textile manufacturers were suffering from a chronic shortage of reliable supplies of natural gas to run their manufacturing units, making it difficult to meet tight export order deadlines. Second, the early 2000s and 2010’s had seen a boom in the number of women working, leading to a demand for cheap and easily available clothes such as ‘lawn’. Retailers such as Khaadi and Junaid Jamshed were beginning to make serious money off of serving the domestic market – Gul Ahmed, the original manufacturers of lawn could not afford to be left behind the trend.

With this new strategy, an improvement in the textile sector, and general investments in manufacturing and retail, the years 2018 and 2019 proved fruitful, with net income reaching unprecedented levels of Rs2 and Rs3 billion.

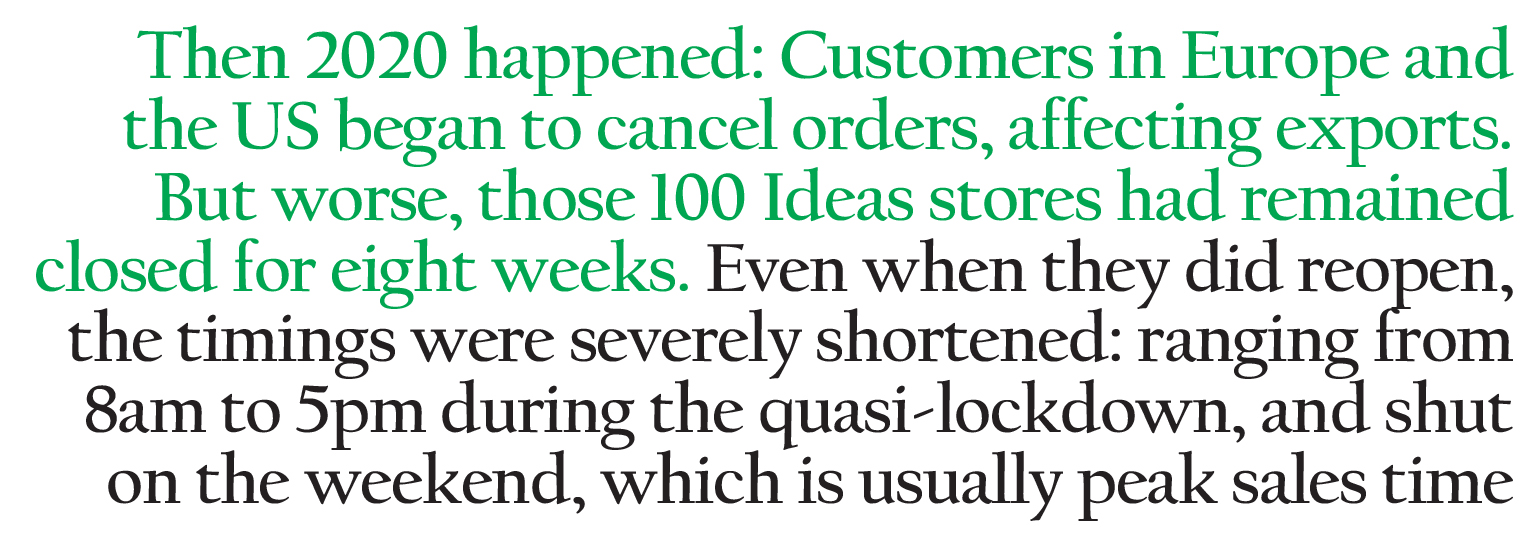

Then 2020 happened: Customers in Europe and the US began to cancel orders, affecting exports. But worse, those 100 Ideas stores had remained closed for eight weeks. Even when they did reopen, the timings were severely shortened: ranging from 8am to 5pm during the quasi-lockdown, and shut on the weekend, which is usually peak sales time.

Yet in 2021, the company bounced back, with the company noting this year had become a ‘yardstick’ for the company. “Our results reflected the yield from investments made in machinery, inventories, marketing channels, human capital, and choosing the right options available in the financial sector,” noted the annual report.

Like the year 2020, the local retail sector still had to operate within restricted timings; but unlike the year 2020, Gul Ahmed got the required volume of export orders, which allowed full utilization of available capacities. The home textile segment, which is mostly exports, reported three-folds profit compared to last year.

And almost every other segment did well as well. New investments in the spinning segment resulted in sales increasing by 89% to Rs26 billion. Even when retail sales constricted, the segment bounced back with a 12% increase in sales and 160% increase in operating profit, compared to last year.