Where does the money in your wallet come from? It starts in the cotton-field. All over Pakistan, in the Kapas belt that stretches across southern Punjab and into Sindh, farm workers bend low to pick cotton seeds. They fill the wicker baskets on their backs until they are full before loading them onto carts, cars, and trucks that transport them for processing. The cotton is sent for ginning, turned into bales, and eventually spun into yarn.

Yet somewhere in the middle, when the cotton is being separated from the seeds it grows on, something else happens. Little bits of cotton stay stuck to the seeds. While the rest of the fine, white, fabric gets spun and turned into clothes and other items, these little strands that stay stuck to the seed are called ‘cotton waste’ — and this is where your money comes from.

You see, all bank notes are printed on something called ‘security paper.’ This is a special kind of paper that incorporates features that can be used to identify or authenticate a document as original such as watermarks and magnetic strips. Essentially it is paper with “built-in” identification features. Academic transcripts, degrees, birth certificates, and bank notes are all printed on this cotton paper.

And that is where our story starts. The sole supplier of security papers in Pakistan is the Security Papers Limited (SEPL). Through a myriad of connections, the company is owned and managed indirectly by the State Bank of Pakistan (SBP). For decades, it has been the only company providing these papers and has maintained profitability. Last year, in the wake of Covid-19, the SEPL faced a rare jolt. Dividends went down, some shareholders expressed unhappiness, and the company had to see through low gross margins. Now, the company’s chairman has told Profit that they are looking to de-risk their investments and increase their capacity so they can diversify their customer base. So what happened, and how is SEPL going to fare in the years to come?

Origin story

The SEPL was incorporated in 1965 as a Private Limited Company. Up until this point, money in Pakistan was either produced at the Pakistan Mint in the shape of coins or it was printed on imported security paper. The same was true for things like bonds and college degrees. In 1967, however, things changed. The SEPL became a joint venture between Pakistan, Iran, and Turkey with the latter two holding 10% ownership each while Pakistan controlled a majority 40% share.

The company began commercial production in 1969 and immediately became the main source in Pakistan for security papers. As a national strategic industrial organization, it produced the paper that was used to print prize bonds, defense savings certificates, non-judicial stamp papers, passport papers, cheque Books, and even ballot papers.

As the population grew, the demand for such paper increased as well. A new state-of-the-art Paper Machine (PM-2) was commissioned in 2003 which gave SEPL the capability to produce high-quality specialized banknotes and other security paper of international standards. Over the years, the company continued to expand and improve its facilities and plants. It installed a Reverse Osmosis Plant, commissioned new power plants, and upgraded its existing manufacturing facilities. In 2019, capacity enhancement of the existing PM-2 was done through in-house development which resulted in the highest ever production in 2020. Currently, the company can supply over 5,000 tons of security paper per annum — which is expected to be tested when the company is given the orders to produce ballot papers for this year’s general elections.

The company’s main client, however, was and has always been the Pakistan Security Printing Corporation Limited (PSPC). The PSPC is responsible for printing banknotes and prize bonds. Interestingly enough, the PSPC is not just a customer of the SEPL but also has a 40% shareholding in the company. The PSPC was controlled by the finance ministry until 2017, when it was acquired by the SBP for Rs 100.49 billion.

After the acquisition, PSPC now only prints banknotes and prize bonds while the remaining printing of official documents, passports, certificates are done by NSPC, Nadra and other government departments. Since then, the SBP has controlled the PSPC with its governor serving as chairman of the corporation, and indirectly also controlling the SEPL. This gives the central bank complete control not just over the printing of money but also the management of the paper it is printed on.

And because PSPC holds 40% shares in SEPL, the chairman of SEPL is also a nominee of PSPC, Mr. Mohammad Aftab Manzoor. The previous chairman of SEPL, Mr. Muhammad Haroon Rasheed, became the managing director of PSPC. Recently, a new CEO was appointed at SEPL, Mr. Imran Qureshi on 15th September, 2022, in place of Mr. Mohammad Arshad Butt, who was also a nominee of PSPC. PSPC withdrew the nomination of Mr. Butt after which he had to leave the company.

The financials

“Our role has simply been to provide security papers to the State Bank of Pakistan. There is a long history behind this, but at the end of the day this is what the SEPL has been doing”, says Aftab Manzoor, chairman of the company. A seasoned banker, he does not run the company which is the job of the CEO. However, he knows the ins and outs of the business of security papers in the country. “This is a very profitable company providing an essential service”.

In that he is correct. The SEPL has generally been a financially healthy institution. But it is worth looking at some of its recent financials. During the financial year 2021-22, the SEPL had sales of Rs 5,147 million against volumes of 4,176 tonnes, registering a minor growth of 2.91%. It’s EPS declined to Rs 16.47 against Rs 24.61 the previous year. The company has a paid-up capital of Rs 592 million, free float of 40%, and a market capitalization of almost Rs 6 billion.

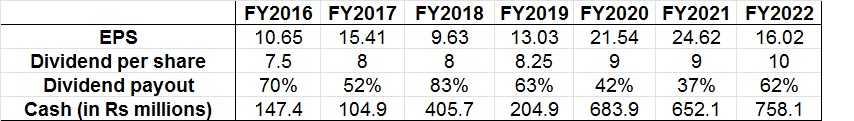

It also announced a 100% dividend (Rs. 10 per share) against 90% the previous year. However, when considered as dividend payout, this only forms 62%. Over the past few years, the company has not increased its dividend payouts as its EPS has increased. Consider the following table.

We see that for the past 7 years, the company has given dividends around Rs 8-10 per share even when the company registered EPS of over Rs 20. When these are compared with the cash flow of the year at the end of every subsequent year, it raises the question why is the company not giving out higher dividends in the past few years and instead keeping hold of liquid cash. The company has said that much of this has not been payable as dividends and it has also faced the crunch because of the Covid-19 pandemic.

“One also needs to understand the circumstances of last year. Other than the bank notes, the requirement for our security paper for passports and educational certificates etc was low due to Covid and travel restrictions”, the company secretary said in a response to Profit.

That said, things may also be looking up. In the current year FY23, the company has also managed to secure a big order from the Election Commission of Pakistan for the supply of secure Watermark Ballot Paper, which is an effort towards diversification of their products and customer base. Our sources tell us this order will have a sales volume of over 2000 tons which can result in higher profitability for the company this year.

The Company has Rs 6,545 million as reserves as at June 30, 2022 depicting a positive and healthy financial status. The Company has Rs 1,785 million of fixed assets as at June 30, 2022, constituting 20% of total assets of the Company. Total inventory of Rs 561 million was reported.

A closer inspection of the company’s investments and standing is also worth taking a look at.

Investments and land holdings

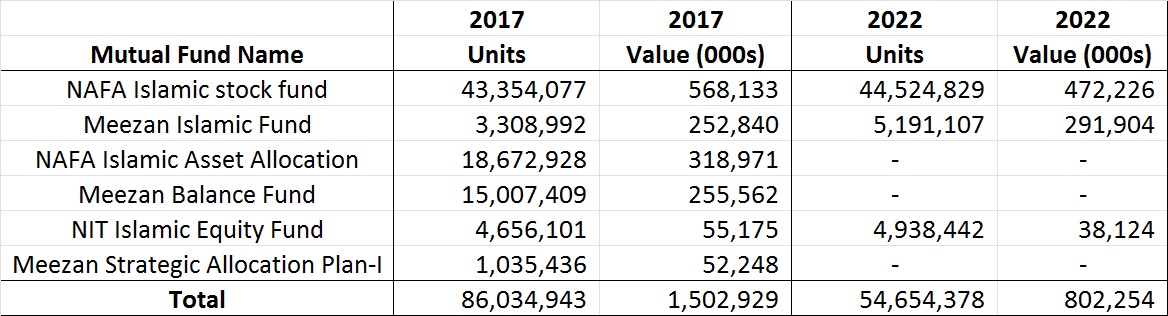

The first thing worth exploring is the company’s investment trends. In 2017, SEPL increased its investments in mutual funds to Rs 1,502 millions from Rs 904 millions, an increase of almost Rs 600 million. Today, five years down the line, the total value of the investment in these mutual funds have declined to Rs 802 million, a staggering loss of almost Rs 700 million, not accounting for the potential profits that are lost.

A closer look at the annual reports show that in 2017, almost Rs 600 million was poured into six different mutual funds. The units invested in 2017 and their value in 2022 can be seen from the table.

From the table, we see that by 2022, investments from three mutual funds were completely pulled out (although they pulled out very late) and partially put into the three remaining funds. A closer look at the particulars of the three mutual funds shows that SEPL increased its units of investment into these funds even though all of them showed a decline in their absolute value.

As of Nov 2022, the three mutual funds in which over Rs 800 m of cash is invested by SEPL have given the following absolute returns since mid of 2017: NBP Islamic Stock Fund (-12.89%), Meezan Islamic Fund (-20.01%), and NIT Islamic Equity Fund (-33.19%). These figures should raise enough doubts in shareholders about SEPL’s ability to manage its investments.

The mutual funds loss is alarming. If the SEPL, instead of investing in mutual funds, had invested the Rs 1.5 billion in a fixed income instrument with a stable interest rate of 11-12%, in five years, that investment would have easily given over Rs 1 billion in returns, bringing the original investment to over Rs 2.5 billion — money that could have gone towards dividends.

“The investments in Shariah Compliant Mutual Funds had generated attractive returns during 2017. However, in the subsequent period the returns on these funds were affected by the performance of the equity market. Furthermore, we had redeemed units in NBP Islamic Sarmaya Izafa Funds, Meezan Balanced Fund and Meezan Strategic Allocation Plan-1 in the Financial year 2021 and 2022 by more than Rs 500 million approx. and also substantially trimmed the ratio of investments in fixed income securities Vs. Mutual Funds from 53:47 in FY 2020 to 73:27 at present. Kindly note that these investments are in top rated mutual funds which are expected to generate attractive returns in the long run” explains the company secretary in a response to Profit.

Essentially, the company invested in these funds at a time when they were hot on the market, but the subsequent years saw a dip. “If you know the history, everyone made a lot of money off these funds a few years ago. Our investment portfolio was a well-thought out decision looking at the climate of the time, but in the subsequent years we lost money,” explains the company’s chairman. “That said, our investment committee is looking to invest the surplus we have in safer avenues. A decision has been made to de-risk”.

This was further explained by the company secretary who said a board level investment committee closely monitors the performance of these investments. “Earlier, the Committee had decided to hold on to these investments because things were getting better, so hopefully, we would be able to recover losses, if any, in due course of time. Furthermore, this matter also came under discussion at the recently held Annual General Meeting of the Company wherein it was suggested that the Company should also consult industry experts in this matter. Accordingly, we have established contacts with some investment advisors who will present various options to our Investment Committee to manage these investments”, reads the response.

Then there is the question of land holdings. The SEPL has two parcels of land in Karachi: one in Malir halt and the other in DHA. The first consists of freehold land of 20 acres and 60 square yards at Jinnah Avenue, Malir Halt. On this parcel of land is the registered office and factory of SEPL. It also includes the offices and factories of SICPA Pakistan (sole producer of security ink) and PSPC (sole printer of banknotes). A 20 acre piece of land is huge, but according to SEPL’s annual report of 2022, it has the remarkable value of just Rs 231,000. That is clearly a misrepresentation, and some shareholders have apparently complained that the land should be revalued.

“We have three units in Malir, PSPC, one which makes ink, and the FPL. The government gave a special grant for this zone and this land can only be used for those purposes. We have seen this in the world of banking before, where some defaulting clients had properties in the middle of town but they had a specific purpose. It is the same case with our land. Frankly, revaluation is only done when a company is having issues like bank loans, and we have ample facilities. These properties cannot be used to pay dividends either, so revaluation makes no sense for us” says Aftab Manzoor.

He is not wrong. Security Papers is categorized as a Key Point Installation Category 1-A by the government of Pakistan. As a Key Point Installation 1-A, no structure can be raised at least within 200 yards of the company without the prior clearance of the KeyPoint Intelligence Division (Inter Services Intelligence). Also, the Category 1-A is a key point whose structure or services are of the highest importance to the war potential and whose total loss or severe damage might have disastrous effects on the both national war efforts (owing to the lack of any alternative source).

The question then is, does the accounting standard IAS 16 apply to this key installation point? According to International Accounting Standards 16 (IAS 16), which deals with Property, Plant, and Equipment, companies are required to account for their properties either at a cost or revaluation model .The revaluation done every few years gives a fair market value to the fixed assets. According to the note in the Annual Reports of SEPL, the company is using a cost model in this regard.

The second parcel of land is a leasehold area of 1,193 square yards with a building at Plot No: 25-B, Central Avenue, Phase II, DHA Karachi. According to sources, this house is used for the residence of ex-CEOs of Security Papers. This has also been a point of contention for shareholders. The book value of this land as of recent reports is only Rs 417,000, which also means that the cost model used by the company gives a 1,193 square yards house in DHA Karachi a higher book value than 20 acres of land in prime commercial area of Malir Halt.

“The Company had acquired this house for the residence of the Chief Executive Officer in 1979. The Company has provided this facility to its CEO in line with the best practices whereby a number of good companies have extended similar facilities to their CEOs. This property is a good real estate investment by the company (investing in real estate is a normal practice by corporates) and will be revalued if and when required by the company for any strategic reason”, the company secretary told Profit. While this one may raise more eyebrows than the land in Malir because of its use, there is nothing really inappropriate about it — although it makes sense why shareholders would be peeved.

It should be noted that rental accommodation can also be provided to the CEOs without the need to buy a whole house in a prime location, which also gives no rent or returns until and if it is sold. No doubt the property is a good real estate investment, but it would help to give a more fair value to the shareholders and public, whether or not the company intends to sell it anytime soon.

Low gross margins for two quarters?

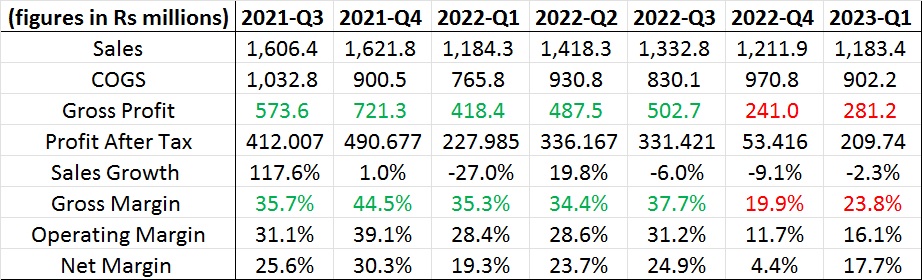

If we consider the past 25 quarters of the company, a time period of around 6 years, we see that the average gross margins of SEPL have been stable at around 36%. This stability in margins is because SEPL is the sole supplier of security papers with a stable clientele and demand. But if we look at the past two quarters of the company, 1QFY23 and 4QFY22, we see that these margins have declined to 23.8% and 19.9% respectively. It raises the question: how is it that a manufacturing company which enjoys a sole monopoly and stable demand for its products suddenly experiences a sharp decline in gross margins?

“We have gross margins in an excess of 20%. Dips and rises are all a part of business, but even at this point we clearly have a situation where we aren’t just floating,” says Manzoor. “There have been some challenges in the recent past. I’ve already mentioned that the demand for passports went down and that is also something that needs to be understood. While we are the sole providers of security papers in Pakistan, this is not a commodity product. We are totally dependent on the orders that the SBP places with us”.

If we consider the sales and cost of sales of these two quarters, we see a Rs 140 millions increase in cost of sales in 4QFY22 followed by a Rs 70 million decrease in the next period, whereas the sales revenue has declined in both of the last subsequent quarters. Why has the cost of sales increased while sales revenue has relatively declined? A possible explanation is that since security papers operates at a cost-plus-margins pricing strategy, it didn’t raise its margins as its costs increased.

Surely, when Profit reached out to the company for a comment about the low margins in the last two quarters, they said that this decrease in margins happened because of a price review discussion going on currently for their main products with their major customer. They also said that they expect the margins to improve after the discussion concludes towards the end of this year.

This comment by the company suggests that the second quarter of FY23 will also report poor margins and only in the 3rd quarter the shareholders may get to see higher margins. This will also affect the overall financial performance of the company for FY23. Pricing discussions are normally done before the period starts so that the company enjoys stable revenues in the near future, but for some reason it has been over 2 quarters (half a year) and there has been no agreement on pricing by the company with its main customer.

Conclusion

The SEPL regularly posts profits, and gives its shareholders dividends. However, it is clear that there is more that could be done with the company. While there have genuinely been some conditions out of the hands of the management, more controls of margins and better investments could make a company that has been profitable for a long time even more profitable. The company is in a sweet position where it is the sole proprietor of security papers in Pakistan. While it is doing well, with the advantages it has, it should aim to do better.

Very good article and there should cotton paper for currency note nut i think this will durable than paper note

Very good article and there should cotton paper for currency note nut i think this will durable than paper note.

Such an interested article keep sharing such stuff to read I think we should move towards the digital currency after all its a next future

Such an interested article keep sharing such stuff to read I think we should move towards the digital currency after all its a next future

I have read so many content about the blogger lovers however this article is truly a nice paragraph, keep it up.

온라인 카지노

j9korea.com/

The article is written in a detail about Paper palace – the business behind banknotes

Detailed article about the business behind banknotes