The Securities and Exchange Commission on Tuesday charged Frank founder Charlie Javice with fraud three months after JP Morgan sued her for allegedly fabricating millions of fake customers to lure America’s largest bank into buying her company. The U.S. Attorney’s Office for the Southern District of New York is also conducting a parallel criminal investigation into the case.

The SEC is accusing Javice of “[orchestrating] a scheme to deceive JPMC” about the scale and success of Frank’s business—which in reality had less than 300,000 students signed up—to entice the bank to close the deal, according to a release. The SEC complaint, filed in U.S. District Court for the Southern District of New York, charges Javice with violating antifraud provisions in the Securities Act of 1933 and Securities Exchange Act of 1934.

“Rather than help students, we allege that Ms. Javice engaged in an old school fraud: she lied about Frank’s success in helping millions of students navigate the college financial aid process by making up data to support her claims, and then used that fake information to induce JPMC to enter into a $175 million transaction,” Gurbir Grewal, director of the SEC’s enforcement division, said in a statement. “Even non-public, early-stage companies must be truthful in their representations, and when they fall short we will hold them accountable as in this case.”

Javice was arrested Monday night in New Jersey. The SEC is seeking injunctive relief and civil penalties. Javice’s lawyer, Alex Spiro, declined to comment.

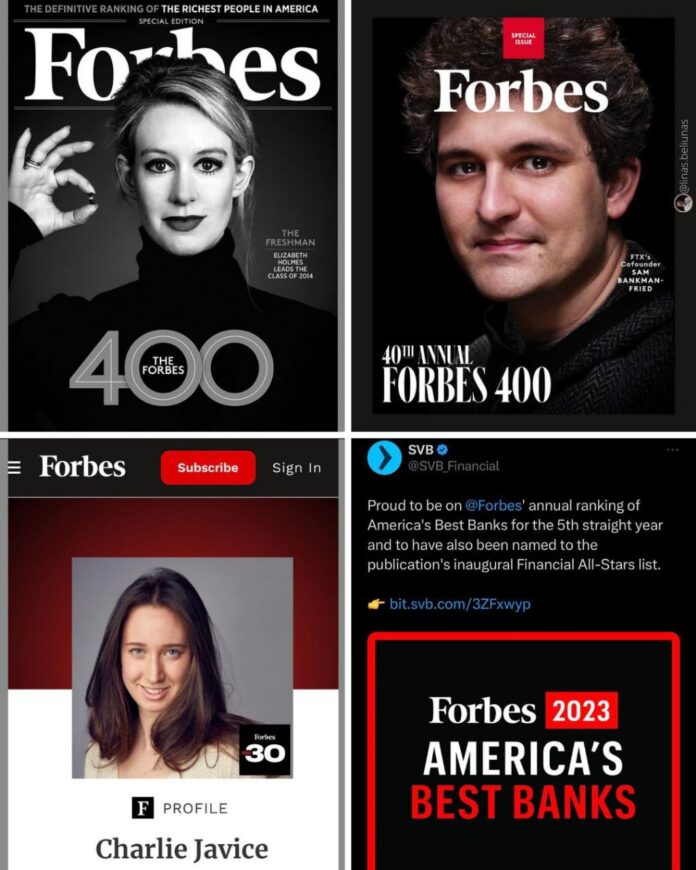

The 31-year-old’s student financial aid startup, which landed her on Forbes’ 30 Under 30 list in 2019, had been acquired to much fanfare by JP Morgan for $175 million in 2021. The bank sued her for compensatory and punitive damages late last year. Javice, who denies JP Morgan’s allegations, at the same time sued the bank, accusing it of spinning up a lawsuit to force her out and deny her millions in compensation. (A JP Morgan spokesperson declined to comment.)

A parallel investigation into Javice is also underway at the Justice Department. The U.S. Attorney’s Office for the Southern District of New York on Tuesday announced the unsealing in Manhattan federal court of a criminal complaint accusing the young entrepreneur of “falsely and dramatically inflating the number of customers of her company” to sway JP Morgan into the purchase. She is being charged with one count of conspiracy to commit bank and wire fraud; one count of wire fraud affecting a financial institution; one count of bank fraud; and one count of securities fraud, according to a release. (Each of the first three counts carries a maximum prison sentence of 30 years, and the final count, 20 years.) The case is being led by the office’s Complex Frauds and Cybercrime Unit.

“Javice engaged in a brazen scheme to defraud JPMC in the course of a $175 million acquisition deal,” U.S. Attorney Damian William said in a statement. “She lied directly to JPMC and fabricated data to support those lies — all in order to make over $45 million from the sale of her company. This arrest should warn entrepreneurs who lie to advance their businesses that their lies will catch up to them, and this Office will hold them accountable for putting their greed above the law.”

Javice will appear today before U.S. Magistrate Judge Barbara Moses.

The suit has become a public mess for JP Morgan, with Chairman and CEO Jamie Dimon in January deriding the deal as “a huge mistake.”

In her response to the initial JP Morgan complaint, Javice said she was clear about the size of Frank’s customer base, and that there was interest from the highest levels of the financial firm—including from Dimon himself—in seeing the deal through. She claims Dimon “personally” set his sights on her business because it had penetrated a student market that JP Morgan had long struggled to break into.

“This lawsuit is the culmination of a massive ‘CYA’ effort by those responsible inside JPMC to shift the blame for a failed and now-regretted acquisition to someone they view as an easy target: its young female founder,” Javice’s response reads. “But JPMC’s core claims in this lawsuit are even more implausible than they are meritless.”