KARACHI: The Pakistan Stock Exchange (PSX) started the first trading session of the week on a dull note, as indices kept following the downward trajectory.

Investors preferred to stay on sidelines owing to a lack of positive triggers, resulting in low volumes. Foreign investors ended as net buyers in the previous week with a net inflow of $3.48 million.

The KSE 100 index benchmark depleted by 465.48 points to touch an intraday low of 39,550.65. It closed lower by 409.34 points at 39,606.79. The KMI 30 index declined by 602.53 points or -0.90pc to settle at 66,957.34, while the KSE All Share index fell short by 224.54 points, ending at 28,792.24. Out of the total traded scripts, 100 advanced, 211 declined while the value of 21 remained unchanged.

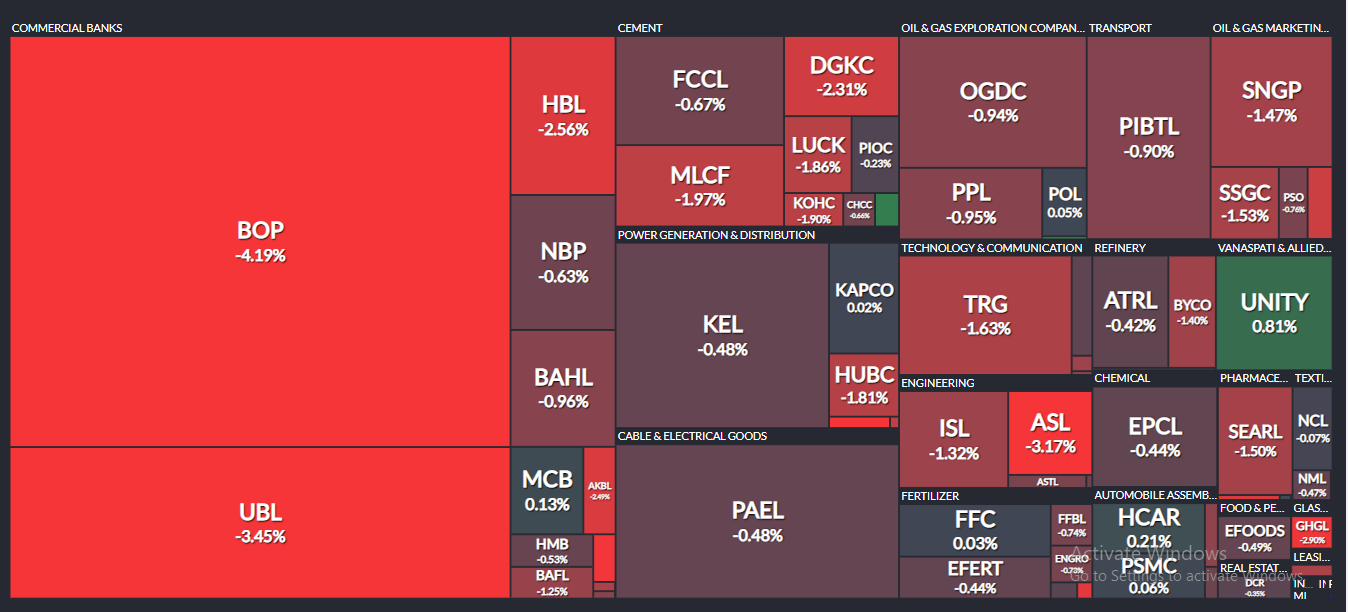

The market volumes remained low and were recorded at 68.07 million. The Bank of Punjab (BOP -4.19pc), Siddiqsons Tin Plate Limited (STPL -2.48pc) and United Bank Limited (UBL -3.45pc) led the volume chart. The scripts had exchanged 12.23 million shares, 5.20 million shares and 4.51 million shares respectively.

The tobacco sector (-4.10pc), miscellaneous sector (-2.36pc), glass and ceramics sector (-2.10pc), food and personal care products sector (-1.96pc) and jute sector (-1.70pc) all ended the day as losers.

Indus Motor Company Limited (INDU -0.59pc) announced its financial performance for the second quarter of financial year 2018-19 (FY19). An interim cash dividend of Rs25 was declared by the company. Sales went up by 30pc YoY, while earnings per share declined from Rs47.53 in the same period last year to Rs43.31 in the current year.

At-Tahur Limited (PREMA +1.23pc) also declared its financial results for the second quarter of FY19. The company’s revenue increased by 30pc YoY, while earnings per share also surged from Rs0.24 in the same period last year to Rs0.59 in the current year.

In its financial performance for the second quarter of FY19, Murree Brewery Company Limited (MUREB 0.00pc) declared an interim dividend of Rs10. Sales inched up by 8.60pc YoY, while earnings per share also increased by 3.9pc YoY (2QFY18 Rs10.27, 2QFY19 Rs10.67).

Moreover, Byco Petroleum Pakistan Limited (BYCO -1.40pc) declared its accounts for 2QFY19. The company’s revenue appreciated by 49pc YoY, whereas earnings per share declined from Rs0.21 in the same period last year to Rs-0.06 in the current year.