Just how much money is one company willing to pump into a subsidiary before giving up? It is a question the military run-and-owned Fauji Foundation is asking itself.

For now, they have settled on a number everyone is comfortable with: Rs3.5 billion. In a notice sent to the Pakistan Stock Exchange on November 25, Fauji Fertilizer Bin Qasim Ltd (FFBL), said that it was going to “invest, provide, and continue sponsor support to Fauji Foods… for a period not exceeding one year as security”.

This bailout, by the way, is over and above an additional Rs6 billion in collateral that the parent company FFBL is pledging to banks to backstop a long term loan for Fauji Foods. All told, that puts FFBL’s financial liabilities that arise from its ownership of Fauji Foods at Rs9.5 billion.

That is a hefty amount. It represents a little bit of a failure on the part of Fauji Foundation to enter into the fast moving consumer goods (FMCG) space. Their approach, for now, is to soldier on (pardon the pun): but how long can that last?

First, some history. The Fauji Foundation was founded in 1954 as a charitable trust, and was initially designed to help provide welfare for the Pakistan Army’s retired soldiers as well as their dependents. The foundation calls its own beginnings a “humble venture”, which today sounds hilarious, only because the group now runs more than 18 subsidiaries in industries as varied as fertilisers, cement, power, oil, gas, food, grain, and even banking (Askari Bank).

On top of that, it operates 15 medical facilities, 100 schools and colleges, 65 vocational training centers and nine technical training centers across the country. By its own estimates, its welfare programs serve 9 million beneficiaries.

And where is the money for this welfare program coming from? The two most important, and most lucrative, of those companies are Fauji Fertilizer Bin Qasim Ltd, and Fauji Fertilizer Company (FFC). The former is mostly involved in the manufacturing and distribution of chemical fertilisers. It is currently the only manufacturer of diammonium phosphate (DAP) and granular urea in Pakistan. Fauji Fertilizer Company owns 49.88% of the company, while Fauji Foundation owns an 18.29% share in the company.

And now some more numbers: it is Fauji Fertilizer Bin Qasim Ltd which owns a 50.59% share of Fauji Foods, while Fauji Foundation owns 12.75%.

But Fauji Foods was not always so: it began its life in 1966, as part of the Noon Group of companies. Their main arm was the food arm, also known as Nurpur, the beloved and well known dairy brand that produced milk, butter, cheese, desi ghee, honey, and jam.

Despite the brand recognition, Nurpur did abysmally. Between 2012 and 2015, the company posted consecutive losses (loss of Rs128 million in 2013, and loss of Rs142 million in 2014). At the time, company management blamed rising costs, and a lack of financial support. Competitors like Nestle and Engro were also expanding rapidly during this time period and closing in on the space.

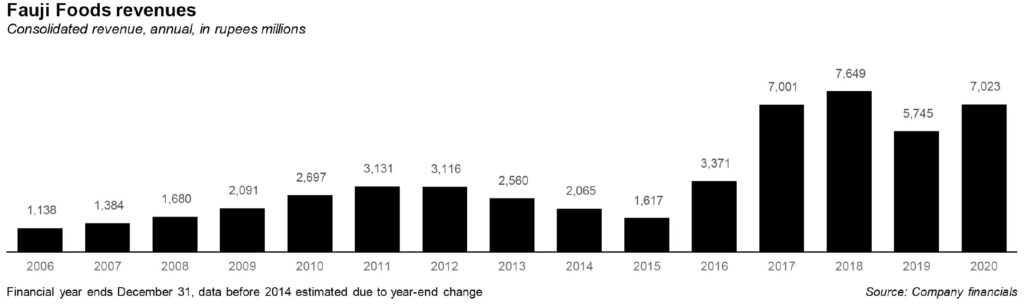

Enter the Fauji Group, who bought the company in 2015, clearly thinking they could do a better job. And, initially, they tried quite hard, throwing money at the problem as a solution. According to the company’s annual report, the management spent Rs7,260 million between 2015 and 2018 modernising the existing infrastructure.

It also raised equity finance of Rs6,896 million during the same time period to support working capital and capital expenditure requirements; arranged long term finances of Rs 4,450 million to finance capital expenditure; arranged fresh working capital lines of Rs 2,000 million in 2019; and provided financial support of Rs 2,630 million in 2019 to meet the company’s contractual obligations.

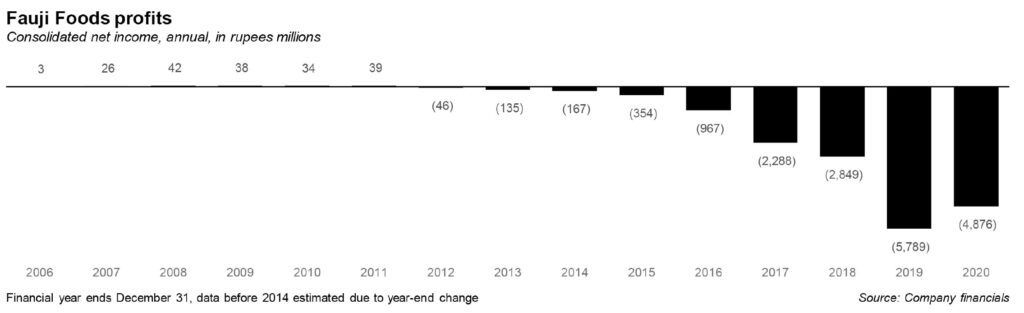

This made absolutely no dent. The company has made a loss every single year since 2015 (an astonishing loss of Rs2,849 million in 2018, and shocking loss of Rs5,789 million in 2019). Its current liabilities exceeded its current assets by Rs8,789 million in 2019, while its total debt amounted to Rs13,638 million.

So Fauji went for option B: selling the company to a strategic foreign investor. In 2018, the Chinese company, Inner Mongolia Yili Industrial Group, wanted to buy a 51% stake in Fauji Foods. Yet, by 2019, the company had withdrawn its offer. Fauji Foods itself was quite mournful of the deal not working out. “It could have helped the company to overcome some of its challenges, apart from boosting Fauji Foods business and image,” the director of the company said in its annual report.

So, what happened? As Profit already pointed out in 2017, is that Fauji always had an uphill battle when it came to its foray into fast-moving consumer goods (FMCGs). Fauji Foods would require the fertiliser experts – more attuned to the industrial engineering challenges of manufacturing fertilisers – to suddenly learn an entirely new type of business – one focused on consumer preferences – essentially from scratch.

The food business requires the additional skills of knowing – and caring – about how consumers perceive your brand, something one suspects is not a task the manufacturers of fertilisers generally have to deal with.

It is a view echoed by analysts, who pointed out that simply trying to copy Engro Foods, for example, will not work. FMCGs are predicated on the quick decision making, and relatively quick marketing strategies to accommodate changing trends and stay ahead of the competition.And yet the Fauji Foundation has a culture of, well, faujis, which meant that decisions took time to be approved and went through levels of bureaucracy. Despite recent aggressive hiring from the private sector, that mindset is hard to change. And it explains why once again, the solution is just to bail out the problem subsidiary.

The problem, however, is that the bailouts are now starting to get to a scale where they may begin to threaten the financial stability of the parent companies. While the Fauji Foundation has several subsidiaries, its biggest cash generators are FFBL and FFC, both of which have mature businesses that are able to pay out a steady – and large – stream of dividends each year.

If, however, the loan guarantees and bailouts to Fauji Foods start eating into the cash flows of FFBL, that would reduce the cash flow available to the Fauji Foundation, which in turn could cause a financial constraint on its welfare operations.

Of course, this is a fact that the Fauji Foundation management is well aware of, which is why they tried to sell their shares to the Chinese company in 2018. The collapse of that transaction has been a strategic blow to the group because it signalled two things: one, that the Fauji Group is no longer interested in being a long-term owner of Fauji Foods, and secondly, that the company has so many problems that even a well-capitalised state-owned company from China did not want to take it on.

That means that the only way out for the Fauji Group is to actually turn the company around, which means sinking in yet more money and taking on yet more financial risk. But that strategy, in turn, risks becoming a case of throwing good money after bad, meaning that it may not solve the problem, but actually just make it bigger.

In other words, there are no good options here, and no easy way out. The Fauji Group finds itself in a bind, and will face a long and difficult road ahead.

Hi

Do you see a commercial recovery plan

Thanks

most of the employe hired in Fauji food are on nepotism base

i seen so many employe in fauji food whose education, skill and experience is below requirement of the job but they are on heavy wages becuase they are relatives

Difficult to understand that food buisness in a loss.They are marketing milk products mainly from a running plant in sargodha.All such plants are doing a roaring buisness here but them???????Looks that something else…..