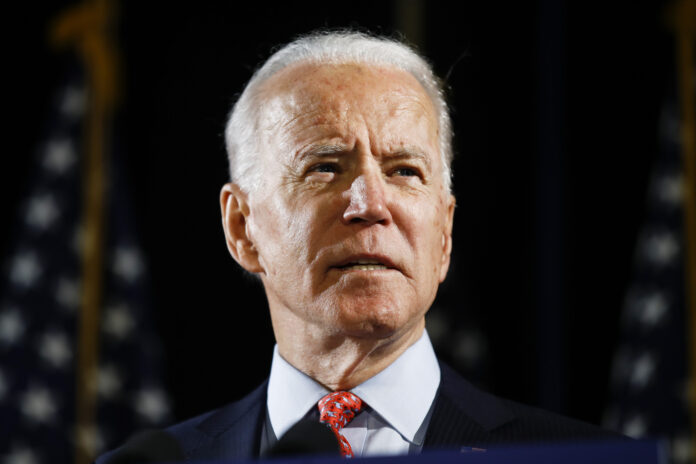

LONDON: Global shares steadied on Monday, after President Joe Biden’s decision to bow out of the election race at the weekend injected a degree of optimism into the markets, while a surprise rate cut by China’s central bank failed to give Asian markets any pep.

Biden announced on Sunday he would drop out of the election race and endorsed Vice President Kamala Harris for the democratic ticket.

Online betting site PredictIT showed pricing for a victory by Donald Trump had fallen 4 cents to 60 cents, while Harris climbed 12 cents to 39 cents.

Markets took the news in their stride, with S&P 500 stock futures up 0.5%, while Nasdaq futures rose 0.8%.

The MSCI All-World index, which fell 2.1% last week in its worst weekly performance since April, edged into positive territory, up 0.04%.

The dollar held steady against a basket of currencies, while crypto – which has tended to be a beneficiary of the growing chances of a return of Trump to the White House – steadied after having fallen on Sunday following Biden’s announcement.

“There’s been a bit of an unwinding of that ‘Trump trade’, those fears we saw last week that lifted the dollar and pressurised European stocks at least and an overall, a bit of an upbeat mood on the news,” Fiona Cincotta, senior market analyst at City Index, said.

“What has been interesting has been crypto. It’s like the Trump barometer and that is off slightly.

So that does suggest that, potentially, there is a little bit more of a challenge presented from Kamala Harris,” she said.

Bitcoin, which hit six-week highs last week in its strongest weekly rally since February, traded on a more even keel on Monday, up 0.5% at $67,356.

US Treasuries strengthened, pushing yields on the benchmark 10-year note down 1.6 basis points to 4.221%.

Yields rose last week as investors priced in the prospect that a Trump administration would likely favour big increases in spending that would further undermine the United States’ already stretched fiscal position.