LAHORE: Power Cement Limited (PCL) is obtaining foreign financing worth 30 million Euros from Deutsche Investitions for its ongoing expansion project of 7700 TPD clinker production.

This amount of 30,000,000 Euro’s being obtained by Power Cement would cover loan principal amount of Euro 15 million including borrowing cost and all other charges to be accrued during the tenor of the loan.

In a stock market notification sent by Power Cement Limited on Monday, the company said “Resolved that PCL being the ultimate borrower and beneficiary of all of the foreign financings to be obtained for its ongoing Expansion Project of 7700 TPD Clinker Production, may irrevocably and unconditionally provide a guarantee (the “Guarantee”) to DEG — DEUTSCHE INVESTITIONS- UND ENTWICKLUNGSGESELLSCHAFT MBH, a financial institution incorporated and existing as a limited liability company under the laws of the Federal Republic of Germany (Reg. No. HRB 1005, AG Cologne), having its registered office at Kämmergasse 22, 50676, Cologne, Federal Republic of Germany (“DEG”) on behalf of its associated company, Arif Habib Equity (Private) Limited (“AHEPL”), subject to the following terms and conditions:

Amount: EUR 30,000,000/- (To cover loan principal amount of Euro 15 million plus borrowing cost and all other charges to be accrued during the tenor of the loan).”

One of Pakistan’s leading cement producers, Power Cement Ltd has completed the financing arrangements of Rs24.9 billion ($205 million) for the 2.5Mta expansion of its cement plant in the Nooriabad Industrial Area, Kalo Kohar District, Jamshoroo, Sindh.

On completion of this expansion, Power Cement will be the second-largest producer in the Southern Region by May 2019, with a total capacity of 3.4Mta, said Power Cement’s CFO, Tahir Iqbal.

The breakdown of financing includes equity of Rs1.3 billion by foreign investors such as The Investment Fund for Developing Countries (IFU), IFU Investment Partner K/S and FLSmidth. Equity of Rs7.4 billion has been retained by local shareholders for subscribing to right shares.

Other than equity, local investment includes Rs12.1 billion, financed by the National Bank of Pakistan (NBP), Habib Bank Ltd (HBL), Faisal Bank Limited (FBL), The Bank of Punjab (BoP), Al Baraka Pakistan Ltd, Bank Alfalah, Dubai Islamic Bank (DIB), Askari Bank, First Oman Investment Co, and the First Credit and Investment Pakistan Ltd.

Investment worth Rs4.1 billion is being financed by overseas organisations, including the Islamic Corporation for the Development of the Private Sector (Saudi Arabia), OFID, OPEC Fund for International Development (Austria) and DEG – Deutsche Investitions- und Entwicklungsgesellschaft mbh (Germany).

Equipment is being supplied by FLSmidth Europe while TEPC China is working as the construction contractor.

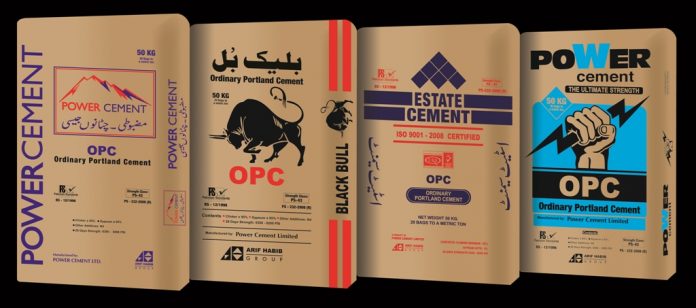

Power Cement Limited manufactures, markets, and sells cement under the Power Cement, Black Bull Cement, Blue Star Cement, and Estate Cement brand names in Pakistan.

Its product portfolio includes ordinary portland cement, sulphate resistant cement, Portland blast furnace slag cement, and grounded granulated blast furnace slag. Power Cement Limited also exports its products.

The company was formerly known as Al-Abbas Cement Industries Limited. Power Cement Limited was founded in 1981 and is headquartered in Karachi, Pakistan. Power Cement Limited is a subsidiary of Arif Habib Corporation Limited.

Power Cement shares were trading at Rs8.57, up Rs0.08 (+0.94 percent) and KSE-100 index opened on Monday, up 51.96 points at 41,689.34 points at time of filing this report.

Dear Writer,

I believe you have mistakenly put “Pioneer Cement” instead of “Power Cement”.

Thanks.

Thanks for the correction.

Comments are closed.