ISLAMABAD: The Federal Minister for Finance and Revenue, Shaukat Tarin, while presiding over the Steering Committee meeting of Kamyab Pakistan Programme (KPP) directed relevant departments to expand the programme all over the country.

The meeting was held at the Finance Division on Thursday.

During the meeting, a detailed presentation was given to the finance minister on the progress of the programme.

Tarin was informed that the first phase of the programme was going successful and applications for the award of loan were being received through SMS from all over the country.

Tarin appreciated all the stakeholders for their contributions in the success of the Kamyab Pakistan Programme and further directed to expand the programme all over the country.

Akhuwat Foundation Founder Dr. Amjad Saqib, who was also present during the meeting delivered a presentation on the disbursement of loans and highlighted important issues pertaining to access to information regarding the programme among the target population living in rural areas.

Subsequently, the finance minister directed the concerned authorities to resolve the issues of information accessibility and further underscored that Kamyab Pakistan Programme will prove to be a milestone in uplifting the lower strata of the society.

The participants of the meeting including NPHDA chairman, Bank of Punjab president, SECP chairman and other senior officers assured Tarin of their full cooperation and participation in making the programme successful.

What is the Kamyab Pakistan Programme?

The Kamyab Pakistan Programme is an initiative of the Government of Pakistan aimed at elevating the financially marginalized segments of the population through the provision of micro credit.

The programme has five components; namely, (i) Kamyab Kissan (ii) Kamyab Karobar (iii) Naya Pakistan low-cost housing (iv) Kamyab Hunarmand and (v) Sehatmand Pakistan.

Under this programme, over the next three years, the government aims to disburse loans worth over Rs1.6 trillion to around 3 millions families.

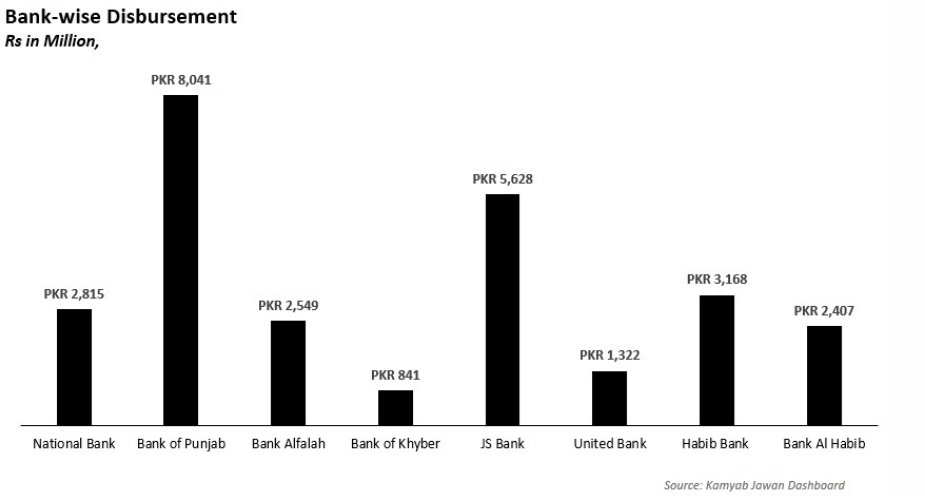

As per the government statistics, up till now, more than 20,000 loans worth Rs31.3 billion have been disbursed under the Kamyab Jawan Programme. The following graph shows the leading banks by disbursement amounts.

The Bank of Punjab received the highest number of applications under the programme (456,873) and also had the highest value of disbursements, around Rs8 billion. JS Bank with Rs5.6 billion disbursements and National Bank with Rs2.8 billion stood at second and third place respectively.

Under the Naya Pakistan Housing Scheme, loans worth Rs33.4 billion have been issued until now against 9,964 applications.

The programme, when announced, was appreciated by the masses as a step forward towards poverty alleviation. However, experts have doubts over the government’s ability to fully deliver on its promise under the programme, especially after the programme had to be scaled back in September amid objections raised by the IMF on the limit of guarantees provided by the government.

Under the umbrella of the Kamyab Jawan initiative, the government aims to achieve three goals, namely, youth entrepreneurship, youth skill upliftment and youth engagement.

Who can benefit from the programme?

As per the official criteria, all Pakistani residents, aged between 21 and 45 years with entrepreneurial potential are eligible to apply for the loan (for IT/ e-commerce related businesses, the lower age limit is 18 years).

The Youth Entrepreneurship Scheme is for both startups and expansion of existing businesses across Pakistan. Loan applications have to be submitted online through the Kamyab Jawan website.

The loans provided under the Kamyab Jawan Programme are segregated into three tiers.

The first tier comprises loans ranging from Rs100,000 upto Rs1 million with a 3 per cent markup. No security is required for loans in this tier.

The second tier includes loans ranging from Rs1 million upto Rs10 million with a 4 per cent markup, while the third tier includes loans above Rs10 million upto Rs25 million with a 5 per cent markup. Tier-2 & 3 do require security.

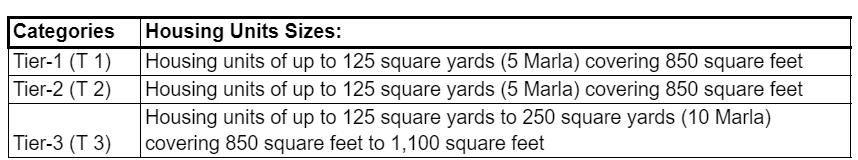

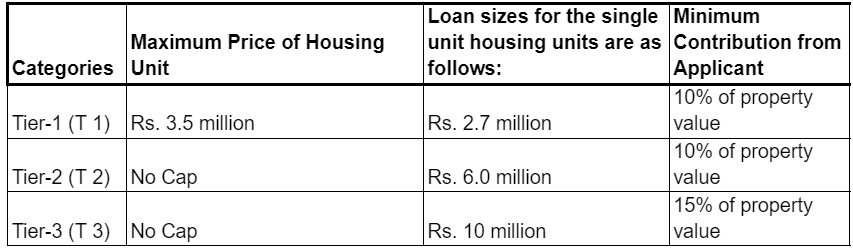

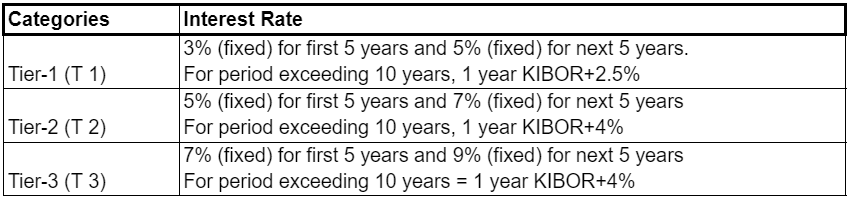

The loans under Naya Pakistan Housing Scheme are available at a markup subsidy for buying and constructing housing units. All CNIC holding citizens that are first-time house owners can avail this facility once from designated banks.

The details of financing available under the scheme and corresponding rates are as follows:

Good Information

Watch the most exclusive short interview of Col Farrukh who is the author of Jo Bicharh Gya

Click on the given link to watch most awaited documentary

https://www.youtube.com/watch?v=cSk3aEyn5tY