IGI Holdings Limited has announced that its wholly owned subsidiary, IGI Investments (Private) Limited, has received in-principle approval from its board to evaluate and conduct due diligence for the purchase of up to 98.3% shareholding from ICI Omicron B.V. and up to 1.7% shareholding from minority shareholders of Akzo Nobel Pakistan Limited.

IGI Holdings shared this development through a notice to the Pakistan Stock Exchange (PSX) on Wednesday in accordance with Sections 96 and 131 of the Securities Act, 2015, and Clause 5.6.1 of the Rule Book issued by the PSX.

“We have been informed by IGI Investments that its Board of Directors accorded its in-principle approval, in its meeting held on October 21, 2025 to evaluate and conduct a due diligence for the purchase of upto 98.3% shareholding from ICI Omicron B.V. (a wholly-owned subsidiary of Akzo Nobel NV) (“Substantial Shareholder”) and upto 1.7% shareholding from minority shareholders of Akzo Nobel Pakistan Limited,” read the notice.

Context of Akzo Nobel’s delisting

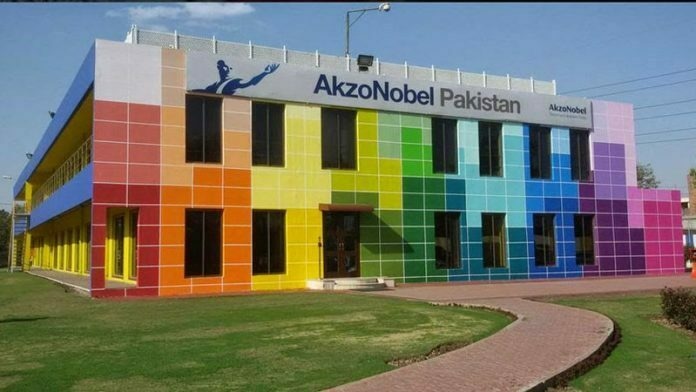

As previously reported by Profit, AkzoNobel Pakistan had been undergoing a significant internal restructuring since the parent company fended off a takeover bid from the world’s largest paints company, PPG Industries, in 2017. Following the failed merger, AkzoNobel’s global board was under pressure to prove it could create value independently, leading to a strategy focused on creating “focused, high-performing” business units.

This global strategy trickled down to Pakistan, where the local entity was integrated into global verticals, reducing the autonomy of the local CEO and streamlining operations to improve efficiency. This restructuring, while painful, eventually bore fruit, with the company reporting a 41.8% surge in net profit for 2019 despite a slight dip in revenue, showcasing significantly improved operational margins.

The backdrop for this current potential transaction is hence defined by the formal valuation of Akzo Nobel Pakistan. According to the company’s Q1 2020 financial report, a majority shareholder buy-back and subsequent delisting were approved at a price of PKR 270 per share. The majority shareholder, ICI Omicron B.V., subsequently held almost all the stake in the country. With 46.44 million shares outstanding, this pegs the entire company’s market capitalisation at approximately PKR 12.54 billion, at the time of delisting on June 18, 2020.

In dollar terms, using an exchange rate of PKR 163/USD, this values the iconic Pakistani entity at roughly $76.93 million, a figure that can be described as a steep entry point for a strategic domestic player like IGI. This marks one of the most significant private acquisitions in Pakistan’s recent history.

Company backgrounds

The IGI Holdings is owned by Syed Babar Ali family. With roots in the textile and manufacturing industries dating back to pre-Partition British India, the group has evolved under his leadership to become a dominant force in the insurance sector, where its flagship companies, IGI General Insurance and IGI Life Insurance, are market leaders and has strategically expanded into life sciences through its pharmaceutical arms, IGI Pharma and a joint venture with China’s Tianjin Fuso.

The move indicates that IGI’s interest is in a strategic acquisition of key operational assets, potentially including inventory and intellectual property. For IGI, a diversified conglomerate, the appeal of Akzo Nobel lies in its deep-rooted brand equity and extensive supply chain. AkzoNobel Pakistan’s portfolio includes iconic brands like Dulux, which carry immense brand equity built over decades.

The talks are logically framed by the PKR 12.54 billion enterprise valuation from 2020. Any potential offer for a major asset portfolio would need to be sized appropriately against this benchmark, providing a credible floor for negotiations.

Another consideration of this potential acquisition is that Akzo Nobel’s global parent, Akzo Nobel N.V., moves to consolidate its holdings and exit the Pakistani bourse, adding to the long list of international companies that have exited Pakistan in the recent past.

If successful, IGI’s move would signal a significant transfer of a classic multinational asset into the hands of a powerful Pakistani conglomerate, reflecting a broader trend of domestic consolidation in the current economic climate. The proposed transaction will be carried out subject to the results of satisfactory due diligence, finalisation of transaction structure, negotiation of purchase price with the Substantial Shareholder, execution of a definitive agreement and compliance with applicable laws and upon fulfilment of applicable corporate and regulatory approvals.