Buckle up, this one is complicated, and we’re going to get right to it. On the 3rd of December this year, Shahid Habib of Arif Habib Limited announced that the Globe Residency REIT (GRR) was being listed on the Pakistan Stock Exchange (PSX).

In the world of Pakistani real estate, this is historic. It is the first development REIT to be listed on the PSX. But what does any of this mean? The GRR is a real estate project launched in November 2021 which is building nine apartment complexes within the bounds of the Naya Nazimabad housing project — an ambitious undertaking by the Javedan corporation to build a “city within a city” in Karachi.

To anyone not keyed in to the specifics of and terminology being used, the above information is French. Essentially, a very brief summary of the entire matter is that Arif Habib Limited have launched this nine tower project by establishing a ‘Real Estate Investment Trust (REIT)’, which is a special category of real estate project that brings public money into real estate projects through the stock market. The reason for establishing this REIT could be the tax-breaks that are offered by the government, but largely it seems that with dwindling trust in real estate the Arif Habib group may be going this route to boost investor confidence.

And that, more than anything, points towards our thesis: a major shift is happening in Pakistan’s real estate market where property is no longer considered the hedge against inflation it once was. With investors also wary of the many scams and the lawless landscape of real estate in the country, developers are now looking for better ways to make real estate more liquid and transparent.

There is still a lot to unpack here. To get to the bottom of the entire matter, there are a few critical questions that need to be answered:

- What is a REIT, and why has Arif Habib decided to operate this one project building nine towers under this category of real estate development?

- How exactly is public money involved in this project, and what are the benefits that it provides to the owners of the project?

- How are the Javedan Corporation, Arif Habib, and GRR all tied together — essentially what is the ownership structure of this entire project?

- What does this mean for the larger Naya Nazimabad project?

Profit spoke to a number of industry experts, analysed the project prospectuses of both GRR and the Javedan Corporation, and spoke to Muhammad Ejaz, CEO, Arif Habib Dolmen REIT to try and get to the bottom of why the Arif Habib group has gone for the REIT structure for this project, and what this means for the future. But we will start, of course, at the very beginning and answer the four major questions that are necessary to understand how this whole thing works.

The basics (Do not skip)

REIT and GRR: Real Estate Investment Trust. REITs are not a concept unique to Pakistan, but they are an underutilised one. Essentially, a REIT is an ownership structure under which public or private ‘shareholders’ split ownership of a real estate project. The ‘REIT’ is a legal entity that either acquires land to develop real estate or acquires already developed real estate . The developed real estate is then either sold or rented out, and the money from this is then distributed among the unit holders or ‘shareholders’ in the REIT. In Pakistan, going for a REIT offers many benefits in the form of tax breaks. For REIT projects, there is no tax on capital gains on transfer of immovable property. No tax on income.

How is public money involved: REITs are collective investment schemes that take money from investors and deploy it in real estate projects. Because REITs are listed on the PSX, they offer a degree of protection and transparency that regular real estate projects just do not have. And with trust in real estate at an all-time low, a REIT project brings with it a certain level of legitimacy.

Ownership structure: Take the case at hand, for example. The Global Residency REIT (GRR) as we’ve mentioned earlier is a project constructing nine apartment towers inside Karachi’s Naya Nazaimabad. Now, the Naya Nazimabad project was launched back in 2011 by the Javedan Corporation, which is owned in large part by the Arif Habib Group. Originally a cement manufacturer operating since the 1960s, after the Arif Habib Group took over its attention was diverted from cement production towards real estate development.

Its biggest undertaking and still greatest purpose was Naya Nazimabad. Spread over 1,366 acres and located just 2km from Sakhi Hasan, North Nazimabad, Naya Nazimabad was envisioned as a big chunk in the middle of Karachi that would be free of all of Karachi’s problems — a gated utopia.

Within Naya Nazimabad, of course, there are a number of different projects going on. The 1,366 acres of land are not being developed single-file Soviet style. Different areas within Naya Nazimabad offer the options of houses, apartment buildings with different styles of construction, different levels of amenities, and even different management all fall under the umbrella of Naya Nazimabad. Of this, nine apartment towers are not that big, so what is the big fuss with converting this one project into a REIT?

It has gone something like this. The nine towers were of course owned by the Javedan corporation. Javedan in its prospectus claims that “the REIT is established with the objective of upliftment and construction of the acquired real estate including construction of residential units under the project named “Globe Residency Apartments” (the “Project”) for generating income for the Unit-holders.”

Further details reveal that the project was acquired by the newly minted GRR from the Javedan Corporation, and the SECP has approved the transfer which came into effect on the 1st of April this year. The REIT has a limited life of 48 months spread over 5 fiscal years. That is, of course, because a REIT’s scope is limited.

For example, if this current project has nine towers, the land will be acquired for them, development work will begin, grey structures will be built and the ‘files’ for the under-construction apartments will already start to be sold. Separately, the law requires that the REIT be listed on the stock exchange and that at least 10% of the units (REITs are sold in units not shares) be offered to the general public. The rest of the 90% is split between the consultants working on the project (5%) while 85% is being offered to the existing shareholders of the Javedan Corporation. Essentially, the nine under-construction buildings were a project of Javedan and owned by them. The project was then shifted to the ownership of GRR in exchange for which Javedan got the ‘units’ for GRR, as well as more than Rs 2 billion.

From here on out, once the project is completed and all the earnings from it are distributed amongst the unit owners, the REIT will finish since the ownership of the apartments will then be with the actual buyers who will either live in or rent out these apartments.

So what is in it for the Arif Habib group? How will they make money off of this? For starters, a vast majority (85%) of the units on offer for GRR are being offered to the existing shareholders of the Javedan Corporation at a set rate of Rs10 per unit. The offer to the general public is only for Rs 140 million, and the only reason for the IPO seems to be that as per REIT regulations, a REIT is required to be listed within three years of financial close to acquire the tax benefits. GRR does not require any funding from the IPO for the project. In fact, the proceeds from the IPO are being used to pay the GRR sponsor — Javedan. Including the 14,000 units up for sale to the public in the IPO, the overall value of the units being sold is Rs 1.4 billion. Since the project has been acquired for Rs 3.24 billion, the remainder of the liquid cash has to be paid to Javedan.

Then, of course, there is another small twist in this intricate web of ownership. The GRR project needs to be managed. The Global Residency REIT is not a company, it is just a structure for ownership. The day to day management of the project will be managed by the Arif Habib Dolmen REIT Management Limited (AHDRML) — which will of course charge a management fee.

During the four years, the REIT management company will charge a fee of Rs 126 million to the REIT. This amount is slightly less than the funds raised by the REIT from the general public in the IPO. If the life of the REIT extends beyond 48 months, the RMC fee will be higher.

The nitty gritties

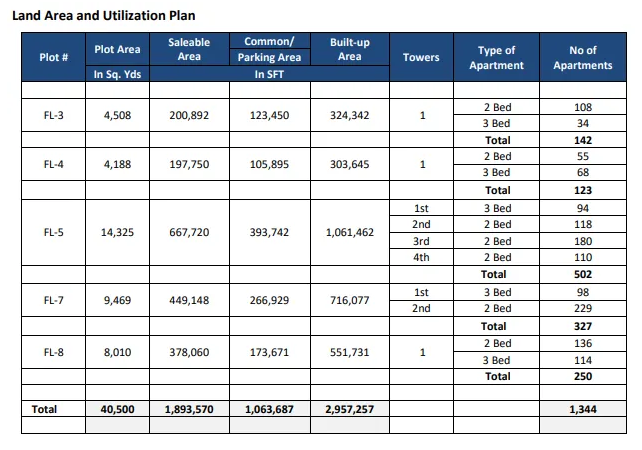

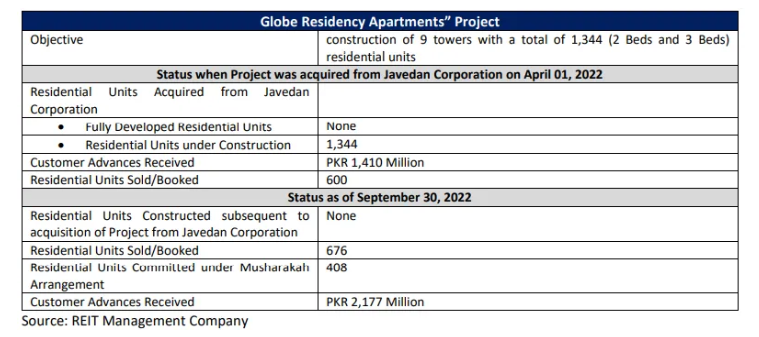

All of that, of course, was just the tip of the iceberg. A more thorough look at the nine buildings under question that are now the ownership of the GRR shows just how many players are involved in this one project. The objective of the REIT Scheme includes construction of 9 towers with a total of 1,344 (2 Beds and 3 Beds) residential units under the project named ‘Globe Residency Apartments’. The goal is to build and afterwards sell these apartments and generate profit for the ‘unit holders’.

However, other than the ownership structure, things are pretty much standard in terms of how the project is being financed. “It needs to be clearly understood that this is an “Offer for Sale” by the existing unitholder. This offering is not related to project financing”, says Muhammad Ejaz, CEO of Arif Habib Dolmen REIT — the management company that is overseeing the GRR. He says that they did not go the REIT route to collect money, and that the financing for this project was still mostly coming the typical way — buyers of apartment files making advance booking payments before the development stage, and instalment payments during the development stage.

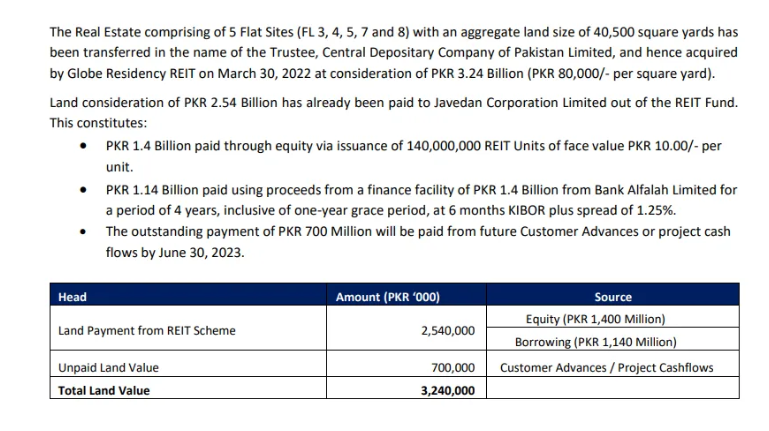

Like most real estate projects, the entire construction will be financed by customer advances. The total project cost when completed is estimated at Rs.20.6 billion. The project in its current form was acquired by GRR at a consideration of Rs3.24 billion, out of which it made a partial payment by borrowing Rs 1.14 billion from bank Alfalah. For the remaining balance, Javedan was paid in kind with 140,000,000 REIT units of face value PKR 10.00/- per unit. But that still leaves Rs 700 million that needs to be paid to Javedan Corporation from future customer advances.

Thus, since the IPO proceeds will not be used towards the project, the IPO is a liquidity event for Javedan Corporation who will be able to realise the profit from the tax-free sale of land to GRR. Since Javedan provided the land on an as-is basis to GRR for Rs.3.24 billion, the IPO proceeds are only being used to provide exit liquidity to Javedan Corporation. None of the IPO proceeds will be used toward the project.

Globe Residency REIT and Meezan Bank Limited agreed to launch three towers (Tower 2, Tower 3 & Tower 4) on FL-05 for sale to the public after completion of the grey structure. And preference will be given to buyers intending to obtain long term mortgage financing from Meezan Bank Limited for the purchase of subject apartments. As of September 30, 2022, 1,084 units have been booked, comprising 676 units booked directly by customers, and 408 apartments have been booked by Meezan Musharaka. While Meezan Bank has booked the three towers but as per the prospectus, the units in these three towers will only be released for sale once the grey structure of these towers is complete.

With the exception of the three Meezan bank towers where Meezan will finance the grey structure through a Musharakah arrangement, no additional cash is being provided by the banks or the sponsors.

It’s a gamble

This is the major risk of the project. If the customer advances are delayed and usually they are due to circumstances beyond the customer’s control, the project will be delayed. The REIT doesn’t generate any cash flows. All the construction and expenses of the REIT are to be financed from the cash advances received from the customers. Thus the GRR unit investors are taking a punt on not only all the units selling but the buyers of these units making payments as per forecast.

Considering that the sponsors are only putting in the land, and barring the three towers for which Meezan bank will be providing partial financing for the grey structure, the financing of the rest of the project is solely reliant on payments of instalments from customers. On top of this, inflation has taken a turn for the worse in Pakistan. This can result in an increase in the construction cost of the project in excess of what is budgeted (including contingencies) in the cash flows.

There are other complications. The towers being financed by Meezan bank cannot be sold till the grey structure is complete. How will the funding shortfall over and above the amount Meezan bank has pledged, for these three towers then be managed? Would customer advances received against other towers be used here?

There is also a risk if the grey structure isn’t complete by September 2023, the fixed tax regime of construction amnesty becomes unavailable. If that happens, it exposes the project to cost inflation risk if FBR refuses the amnesty.

“You have correctly identified the risks, but these are dangers that are inherent in such projects. The capital structure (combination of Equity, Debt and Customer Advances) of such projects defines the present competitive landscape. For this project, fortunately, the majority of the risks have been addressed as the bulk of the available inventory is already sold with a healthy track record for collection. Participation by Meezan further strengthens the project finances,” explains Muhammad Ejaz.

“It may be noted that instalments received by customers have three in-built components: 1) cost of land, 2) cost of construction and 3) profit for the developer. Hence there is enough liquidity with the REIT fund to contribute its share in the construction of structures of three towers jointly with Meezan Bank after setting aside construction of the remaining towers”.

Be careful what you invest in

With inflationary pressure making even developers sweat, there is a very serious problem of this entire project being financed by customer advances. In that way, just because it is a REIT project does not make it safer than most real estate projects. Just look at the issue of payment plans.

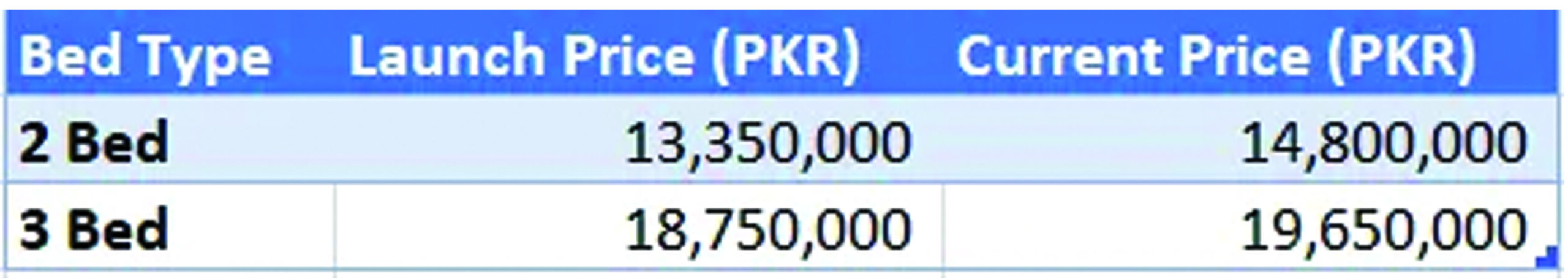

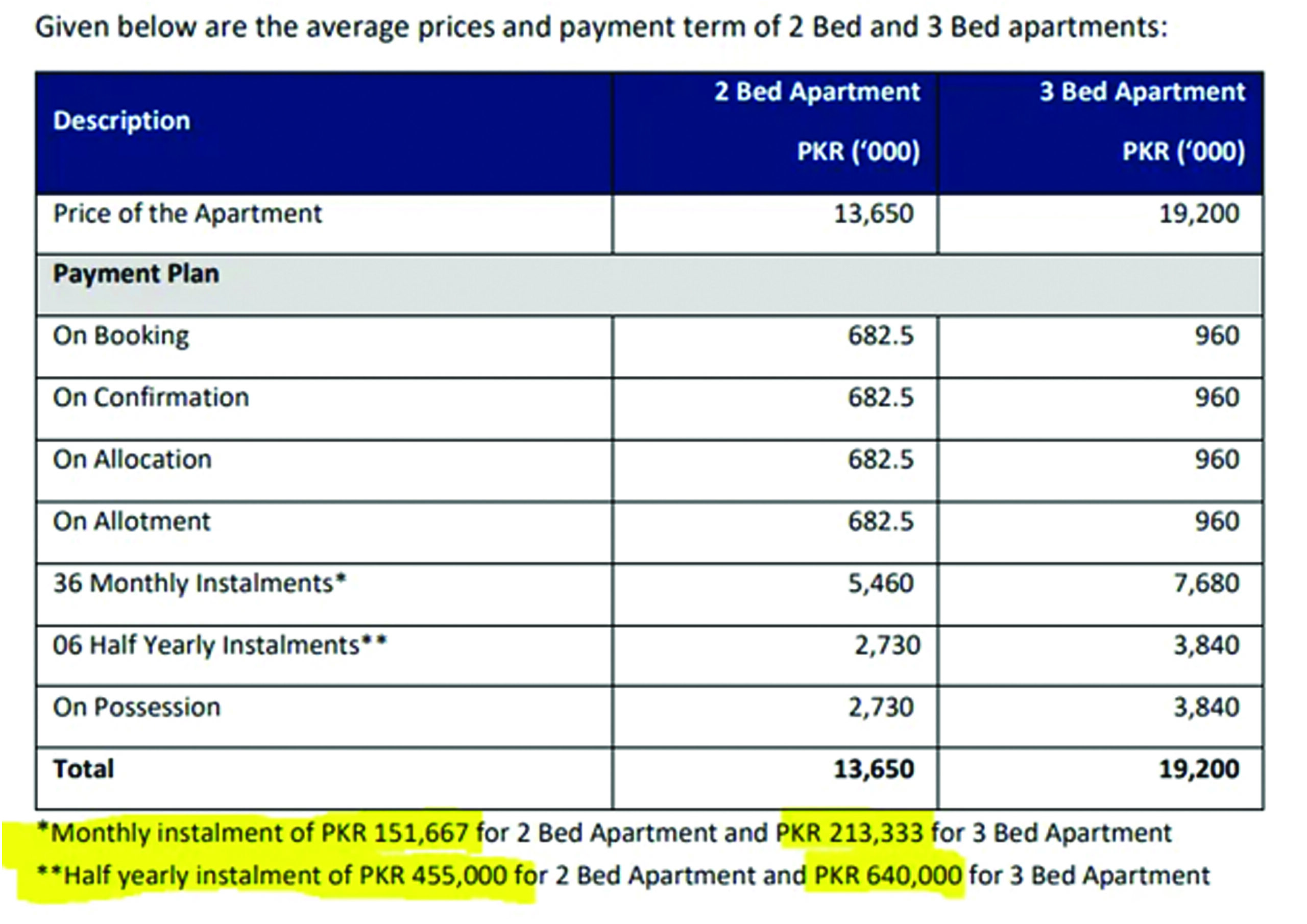

The payment plans for this project may be unrealistic. As per the prospectus, the target market of the project is people with a monthly household income between Rs.120,000 to Rs.150,000. How can buyers with a household income of Rs.120,000 to Rs.150,000 afford these instalments when the size of the monthly instalment is more than their monthly income and half yearly instalment is three-times their monthly income?

This is the price of the units as per the prospectus:

The below table gives the 48-month payment plan as per the prospectus:

We have already seen that a 4-year payment plan is unrealistic for the target market. We also know from the prospectus that out of the total 1344 units in 9 towers, only 50% of the units are sold

- Sold units: 676 units (50%)

- Meezan* units: 408 units (30%)

- Unsold units: 250 units (20%)

*Meezan has booked the three towers but as per the prospectus, the units in these three towers will only be released for sale once the grey structure of these towers is complete.

However, as the REIT is expected to last only 48 months, and the repayment of unit holders can only be from sales collection from customers, the prospectus shows this unrealistic collection schedule where the purchase price from year 2 sales is expected to be collected in a little over two years and purchase price from Year 3 sales are expected to be collected in a little over 1 year.

While one can assume that for the 30% of units booked by Meezan, the purchase price will be paid by Meezan in a lump sum for providing a mortgage to buyers, however, it still leaves 20% of the units. If the 48-month payment plan was unrealistic for the target market, this assumption about future sales to be collected within one to two years is bordering on ridiculousness. Unless all the units are to be sold to rich investors (see next section) and the talk about a target market with a household income of Rs.120,000 to Rs.150,000 is an iffy claim.

Why go for a REIT?

This is the Rs3.24 billion question. We have talked about what the REIT is, how it is structured specifically in the case of GRR, what the pay-off is going to be to the unit holders, how the shareholders of the Javedan Corporation are going to benefit off the back of this. But one important question is left: why go for the REIT in the first place?

The most logical answer would be the tax breaks that going the REIT route offers. The problem with this is that while it is true, this current project involving GRR there are very few tax benefits. The original land owner, Javedan Corporation Limited, has owned the land since 1961. Hence there is no implication of capital gains. The project is also registered with FBR under the fixed tax regime, which was an amnesty scheme introduced in 2021 under which a lot of tax breaks were given. Hence no additional tax benefit to the REIT scheme.

Why then jump through hoops to first establish a REIT knowing that 10% of the units would have to be offered to the public in the form of an IPO. One of the more obvious explanations is that this offered liquidity to the shareholders of the Javedan Corporation — top in that list of shareholders is the Arif Habib Group itself. However, there is also the possibility that this is the Arif Habib Group also trying to think ahead of the curve.

“The perception that the mere purpose of establishing GRR is to take full advantage of the tax benefits available under the amnesty scheme and generally available to REITs is not correct. The project is being developed in the REIT mode as REIT regulations subject the project to a stringent regulatory regime that demands transparency, discipline, and accountability by all the participants,” Muhammad Ejaz explains.

“We have a plan here. The offering is made at a stage when most risks related to such projects, such as: acquisition of land with clear title and possession, planning, designing, approvals and sales have already been addressed. Hence, it’s a low risk opportunity for retail investors for projects of this nature. Meanwhile, as far as the financing of the project through customer advances is concerned, assets like these are acquired through years of savings by the household. The instalment plan merely tries to facilitate buyers and tries to match their outflow with the construction plan. The target market is defined for indicative purposes and is based on our understanding of a particular economic strata.”

“Holding a certain percentage of inventory and gradually off-loading it as the construction progresses is a sure way to hedge against inflation and to benefit from higher values. There is a certain market segment which needs assets closer to completion at a higher cost as completion risk gets gradually addressed.”

Apparently, there is no additional tax benefit to the REIT scheme. The entire benefit of the REIT structure is that it allows one to bypass the corporate tax if 90% profits are distributed and here Ejaz is saying that we are not going to benefit from it. Then why go through with it at all?

The only thing that makes sense is that they are trying to establish a track record for future REITs they are planning where they will need financing. If you go through the financial statements of Javedan Corporation, there are a few more development REITs in the pipeline. But it is true that REITs have been getting a lot of attention in the past couple of years since a changeup in regulation. What happens next is anybody’s guess.

This article is discussing the recent announcement that the Globe Residency REIT (GRR) is being listed on the Pakistan Stock Exchange (PSX). This is significant because it is the first development REIT to be listed on the PSX, which is an important milestone in the Pakistani real estate market. The GRR is a real estate project that is currently being built in the Naya Nazimabad housing project in Karachi, which is an ambitious undertaking by the Javedan corporation to create a new city within the city. Overall, this listing on the PSX is a significant development in the Pakistani real estate market and could have significant implications for the future of the industry.

TPL Properties is also coming up with REIT, please have a comparison as well for readers.

I was looking for another article by chance and found your article related to the one I am writing on this topic, so I think it will help a lot. I leave my blog address below. Please visit once.

온라인 카지노

j9korea.com

Dolmen REIT management company formed in 2015 was the first, kindly check.

I think it will help a lot. I like your informational views. Such a nice article. This article is very helpful to me. Thanks for wite this article.