On steep, jagged, dirt roads in Balochistan, a fleet of beat down Honda motorcycles make a treacherous trek across the unmanned and largely ignored border between Iran and Pakistan. From afar, to people sitting in Lahore or Karachi, these bikers with large blue drums attached on either side of their bikes might look like milkmen going above and beyond in the line of duty.

In reality, they are smuggling gasoline from Iran into Pakistan. Each biker can transport up to 40 liters, which can earn them up to Rs500 for the journey. The trade is hard, accidents are frequent, and the smugglers risk losing not just their cargo, but also their lives.

The bikes are not the only way for the smuggling of fuel and other goods. Fleets of Toyota pickups also make the journey across the rugged land border carrying drums of gasoline, and lone boats on the Makran coast undertake their journey under cover of bad weather to stay hidden from the Coast Guard and Navy. Still they find themselves caught in shootouts.

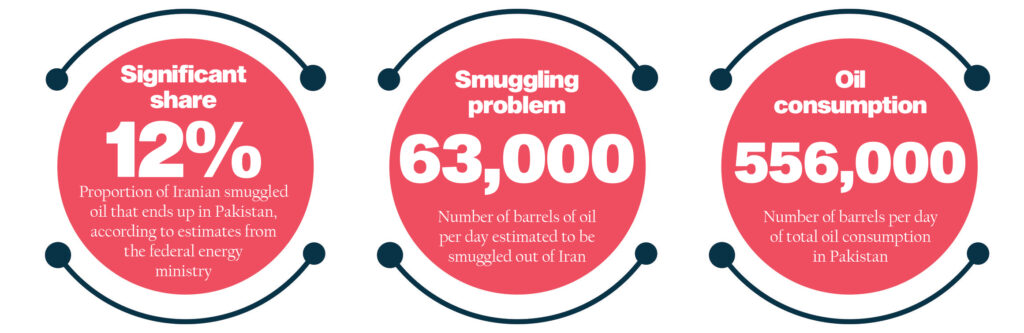

It is no hidden secret that petrol is smuggled out of Iran, even though the country itself faces shortages due to a lack of refining capacity. Estimates suggest an upward of ten million liters of Iranian petrol is smuggled off to countries on a daily basis, which comes out to 3.65 billion liters every year. That is the equivalent of nearly 63,000 barrels of oil per day.

For context, Pakistan’s total oil production comes out to approximately 89,000 barrels per day out of a total consumption of approximately 556,000 barrels per day, as of 2016. Of course, not all smuggled Iranian oil comes to Pakistan, but the amounts that do are quite staggering.

The Iranian smuggling trade is also one of the reasons that the government often cites for erratic fuel prices. While the government only has itself to blame for the pricing of petrol, as discussed in a previous Profit feature, it is worth exploring just how rampant and impactful this smuggling really is, and how it is bad for Pakistan. And more importantly, what are the reasons behind it?

Why the smuggling

Iran, a country that can barely keep up with its own oil needs, has become a center for gasoline smuggling not just to Pakistan, but all across the Gulf states as well. As to why that is the case, the answer is actually quite straightforward: it is all about regulation.

You see, gasoline is incredibly cheap in Iran. Tehran keeps domestic gasoline prices low through government subsidies of nearly 90%. Add a devalued currency, and what do you get? Fuel that is approximately three times cheaper in dollars compared to global benchmark prices, typically set in trading in markets in London and New York. As a result, the circumstances make it seem lucrative to smuggle, since it will fetch a much higher price in neighbouring countries.

This is a good deal for people in the petrol business on both sides, but it is not good for either state. In the case of Iran, every litre of smuggled oil is a litre that cannot be sold at global prices to help cover their massive fiscal deficits. And in the case of Pakistan, every litre of smuggled oil is one on which the heavy import duties, sales taxes and petroleum levies cannot be charged.

Which is why even when there are ups and downs in foreign relations between Iran and Pakistan, the petroleum smuggling racket continues to thrive.

Remember the petroleum shortage in June 2020 this year? Well, one reason outlined by the government – yes the government – about the shortage is the fact that they had managed to curb Iranian petrol in Pakistan, which is why there was such a shortage. That might be at least partially exaggeration, but given just how much fuel gets smuggled out of Iran, and how sizeable it is compared to Pakistan’s total demand, there may still be some truth to that assertion.

Asad Hayauddin, Petroleum Secretary, said that approximately 1.2 million litres of petrol is smuggled into Pakistan on a daily basis. That implies that approximately 12% of all oil smuggled out of Iran ends up in Pakistan. This is mostly done through tankers crossing the borders by bribing officials. However, there are more ways for Iranian petrol to come into Pakistan.

This represents a sizeable revenue loss for the government of Pakistan. On average, the government receives approximately Rs18 in total tax revenue – sales tax, excise duty, customs duty, and petroleum levy – for every litre of legal petroleum sold in Pakistan. Smuggled petroleum, therefore, costs the government Rs7,884 million in lost tax revenue every year – at least.

How the smuggling occurs

One of the reasons for this ease in smuggling is a lack of oversight about suppliers. Pakistan has famously stringent ‘Know Your Customer’ (KYC) regulations. KYC guidelines in financial services require that professionals make an effort to verify the identity, suitability, and risks involved with maintaining a business relationship. And with Pakistan’s obsession with money laundering, it is no surprise that its KYC guidelines are strict.

What is surprising, however, is that while financial institutions keep a vigilant eye on their customers, they do not do the same for suppliers, especially in the case of international suppliers. This means that while a private petroleum company will have tabs kept on it, no one will ask questions about where their petrol is coming from. This way, they can easily acquire smuggled petrol at low rates, mix it with their own petrol to hide any possible chance of detection, and sell it at much higher prices.

In Pakistan’s petroleum industry, although suppliers are chosen through a bidding process by Pakistan State Oil (PSO), there is still room for irregularities. PSO goes through the process of posting tenders for suppliers, accepts bids, and chooses the bids for Pakistan’s supply of petrol.

PSO procures High Speed Diesel on a long term agreement with Kuwait Petroleum Corporation (which is a Government entity of the state of Kuwait). This Agreement has been in place since the last forty years and initially it was handled by the Government of Pakistan and in the year 2000 it was handed over to PSO.

One would assume that PSO follows similar if not stricter requirements that a bank follows while opening up an account while choosing suppliers. It is not like PSO does not ask for detailed information from their suppliers – they do, in the form of a 46-page document.

The PSO spokesperson says, “Banking Industry is governed and regulated by the State Bank of Pakistan (SBP). Being banks regulator, banking industry follows all the requirements and conditions which are laid down by SBP. Similarly, for all its procurements, PSO follows the regulations as laid down by PPRA.”

First and foremost, the document outlines the tender process, quality, quantity, schedule of deliveries, and how to quote prices. It later goes on to explain various other terms and conditions. The initial pages also include templates for the bidding document, cover letter, and form regarding technical details.

The next form explains how the bid bond is to be paid which is an unconditional bank guarantee in favor of PSO. Lately, a bid bond is worth $300,000. Moreover, the process also requires one to outright mention any conflict of interest there may be while bidding such as relations to any employee.

PSO has a single stage two envelope procedure for bidding which is being followed for import tenders as per PPRA Rules Clause 36(b). The technical bids are opened and technically evaluated as per the evaluation criteria laid down in the tender documents. The Commercial bids of only the technically qualified bidders are opened in the presence of bidders. The Commercial bids of those bidders are returned unopened who do not qualify in the technical evaluation.

However, as an anonymous source explained to Profit, while PSO is going forward with its due diligence, the scale at which it is done is simply not enough. The source alleges that “punters” have entered into the supply chain and are putting Pakistan’s supply at risk. And considering that a petroleum shortage in Pakistan is a sneeze or a thunderstorm away at all times, the thought is a terrifying one.

To start off, a concern posed by the source is that in order to be a bidder, all you need is a company letter. This letter could even be based out of the UAE.

The PSO spokesperson explained, “As of now, PSO does not register any company as we follow an open competitive bidding procedure. Submission of company letter, necessary documents and tender fee is a requirement just to obtain tender documents. PSO tender documents have technical criteria that enable only technically sound, reputed and financially capable international suppliers to participate in the bidding procedure.”

What this means is that even if the PSO catches on to a company sourcing their petrol illegally and blacklists them, all that company needs to do is make another company letter and produce the other documents required. Ofcourse, it is not as easy as just printing a company letter, but this implies that the scrutiny stops at the company and the fulfillment of the documents required rather than who is behind it.

Moreover, some of these punters are not related to refineries and are merely traders. This, however, does not seem like a large issue. Except this is exactly what put the supply at risk, considering how refineries are more reliable with regards to supply and fluctuations in demand. Moreover, it is easier for a refinery to provide a detailed explanation of components in their product.

“It is not necessary for a bidder to own a refinery. Globally, the oil industry operates through traders which may or may not be backed by a refining business,” explains the PSO Spokesperson.

“Generally, these traders/suppliers operate independently and almost every refinery has their trading arm or marketing business units. PSO does not restrict or put any condition as it follows an open competitive bidding procedure as per PPRA rules in order to encourage healthy competition.”

However, in attempts to encourage healthy competition, PSO is forgetting on thing and that is: petroleum is fundamentally a blended product. This means when you are buying from a trader that is not backed by a refinery, you do not know what is blended and from where unless a refinery or company provides documents. Traders have it easy. They can use Iranian products or have it mixed prior to it reaching the port from where it is dispatched. Once at the port that is dispatching to Pakistan, one can through means change documents for the vessel and leave little to no trace of routes over which the vessel has traveled on.

However the PSO spokesperson explains, “PSO tender documents restrict Supplier from loading a cargo from any of the UN sanctioned countries and Suppliers are bound to conform to the Policy and Regulations of the Government of Pakistan regarding origin of products, flag of vessel and other trade restrictions. Suppliers are also bound to provide certificate of origin of the product issued by the relevant chamber of commerce at the Load Port / relevant port authorities / relevant terminal operator mentioning origin of the goods. As per the terms of the contract, PSO is fully indemnified in case of any violation from Government of Pakistan / UN related restrictions by the Supplier.”

As a result, traders are better able to sell lower grade products which can push out (international) refineries from the bidding process. This is exactly why refineries are not able to compete with lower grade products provided at cheaper prices, yet are the most reliable of the lot when it comes to importing petrol.

These refineries are usually state owned and thus have a somewhat informal sovereign guarantee to the fact that supplies will be met on time and they cannot sell lower grade while claiming something else.

However, while speaking on the issue of components and low grade products, the PSO explains that it only imports refined petroleum products such as Motor Gasoline, High Speed Diesel, Jet Fuel and Fuel oil which is as per the Specifications notified by the Ministry of Energy (Petroleum Division). In case of each product there are a number of parameters notified by the Ministry, against which the imported product is tested by the Government nominated laboratory – Hydro Carbo Development Institute (HDIP).

“As per PSO’s contracts and the OGRA Rules and Regulations, if there is a negative deviation from the specifications, then the import cargo is not allowed to discharge its product in the country and is returned to the Supplier with heavy penalties and no obligation on PSO. PSO in line with PPRA Rules encourages maximum competition and endeavor to procure products on value for money basis.”

In addition to lower grade fuel, these traders are also known to be flaky with deliveries. They are often late with their supplies, which is a critical problem for Pakistan considering 80% of fuel is imported. Sources allege that PSO then asks other accepted suppliers to pick up the brunt and supply earlier than decided to make up delays by the punters despite successful bidders having to submit a Performance guarantee in accordance with the PPRA Rules.

Over time this will not only damage the relationship between PSO and the reliable vendors but will also result in shortages throughout the nation if supplies do not fall through considering the nation usually has stocks that can last for 15 days.

So what should PSO and the government do?

Profit has a few suggestions for the government and its petroleum corporation.

For starters, PSO needs to inquire about certificates regarding blended products and should be traceable. One should know where the fuel is from and of what quality. Why is this important? Because the FATF and other regulatory organizations have made it clear that Pakistan must stop importing fuel from sanctioned countries like Iran. With Pakistan in a flimsy position regarding the grey list, the fact remains that PSO cannot just get away by shrugging their shoulders and saying there is no way to trace where the fuel is from.

However, PSO says they are in the safe if they are caught off guard. The Spokesperson states, “If any violation of UN trade restrictions / sanctions is done by the Supplier, then the Supplier / issuing authority of Certificate of Origin at the Load Port shall be fully responsible for such act and PSO by virtue of its contract is fully indemnified against such illegal act by the Supplier.”

However, when asked if it is true if only the documents of the last port are checked and if PSO checks the routes over which vessels have travelled on prior to dispatching to Pakistan, the representive in other words said the responsibility lies on the supplier.

The spokesperson answered, “The Supplier is responsible for ensuring the Certificate of Origin and other contractually required documents of the product from where the cargo for Pakistan is loaded. The Supplier nominates the vessel which is cleared by the Port Authorities in Pakistan prior to loading of the cargo.”

As far as the government is concerned, following a decline in Covid-19 cases, the Pak-Iran border has eased up security and movement. As a result, more fuel is being smuggled into Pakistan than it was before. These products are ending up in Karachi. As a result of this smuggling of fuel, a number of dealers and oil companies are able to take advantage of these illegal imports.

In order to deal with the dilemma at hand, Pakistan needs to ensure that in addition to the detailed form and documentation PSO requires during tender bidding processes, they also go through thorough background checks of private sector companies, especially traders.

This is essentially important considering the FATF aspect of where the money is going. Moreover, the State Bank of Pakistan should also adopt a similar practice while providing LCs for these traders. The spokesperson at PSO adds, “all banks in Pakistan as per their statutory requirement have to check a Supplier for credit worthiness and background prior to opening of Letter of Credit for the import cargo, and accordingly as per PSO’s contracts in case any Supplier does not qualify in LC opening banks scrutiny, PSO is indemnified against the repercussions and Suppliers contract will be terminated in such situation.”

Stringent checks like the one a regular individual faces while opening a mere bank account should be scaled to match the importance of a secure and consistent petroleum supply. If not done, it is inevitable that Pakistan is setting the stage to face another petroleum shortage.

V. Good information

wow really detailed article. good job