ISLAMABAD: Tax authorities warned insurance firms on Monday over their role in underwriting billions of rupees of Afghan transit trade as several of them allegedly went into default after misusing the trade facility.

Federal Board of Revenue (FBR) Chairman Shabbar Zaidi said that some insurance companies were not charging average fee on Afghan transit trade (ATT) cargo as directed by the apex tax authority and therefore they were given warning to immediately comply with the instructions of the revenue board. The FBR chairman said this in a conversation with The News.

“FBR has observed that some insurance companies are not properly complying with the requirements and fee condition with respect to guarantees on Afghan transit goods,” Zaidi said in a tweet. “Such entities are warned to correct their mechanism and immediately correct their system,” he said.

Sources quoted in the report said the insurance guarantee condition was placed to ensure safe transportation of goods up to Afghanistan under the transit treaty. But the FBR found that the issued guarantees worth billions of rupees were not encashed so the FBR issued instructions for insurance companies to avoid such practices and comply with the instructions in order to avoid any punitive actions, the sources said.

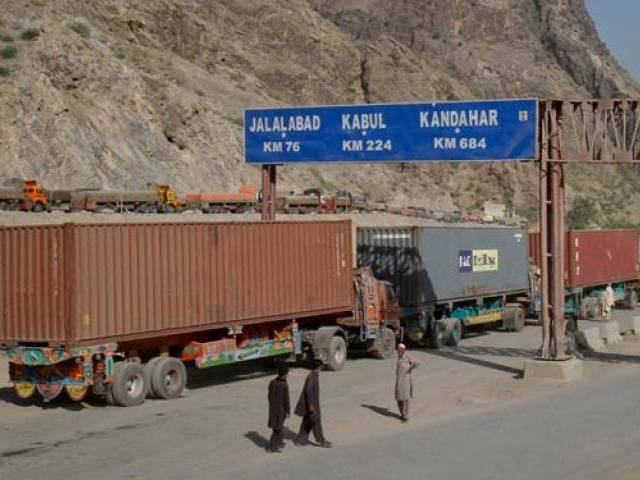

The FBR chairman took this step as Pakistan is ready to open up Torkham border on 24/7 basis. Although Pakistan has placed clearing system on 24-hour basis Afghan side closes border gates in evening and nights. Afghan trade transit was recently resumed.

Officials quoted in the report said the bilateral trade has dropped in recent years,but now it is hoped that the bilateral trade volume would increase gradually in the months and years ahead and could reach $5 billion.

It is not ATT which is hurting the local economy but the porous borders with Afghanistan and Iran which has always created problems for the local industry. Once the borders with Afghanistan and Iran are sealed only than will this issue be closed.