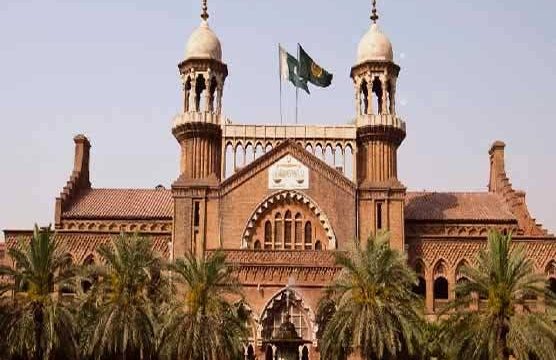

LAHORE: The Lahore High Court (LHC) has ruled that criminal proceedings cannot be initiated against a taxpayer for the recovery of tax arrears unless the tax liability has been conclusively determined by a competent authority.

The judgment came in response to a petition filed by a tobacco company and other stakeholders challenging the registration of criminal complaints by revenue authorities over alleged tax evasion. The court declared the complaints unconstitutional, stating they were filed without any prior assessment, audit report, or show-cause notice against the petitioners.

In a significant clarification, the court observed that under Section 48 of the Sales Tax Act, the recovery mechanism, including fines and penalties, can only be activated once the taxpayer’s liability is officially assessed and remains unpaid. Until then, no special judge may impose fines, which are directly tied to the quantified amount of tax owed.

The court noted that while authorities are empowered to investigate cases of alleged tax fraud, such investigations must follow due process. It emphasized that taxpayers have the right to contest revenue officials’ decisions through departmental appeals, the appellate tribunal of Inland Revenue, and eventually the High Court via tax reference.

Further, the court highlighted a core principle of law: while civil and criminal proceedings may run concurrently, when criminal liability hinges on unresolved civil adjudication, it is in the interest of justice to pause the criminal case until the civil matter is resolved.

The bench also underscored the statutory privilege of taxpayers to compound offences—subject to payment of assessed dues. However, it warned that launching criminal action without prior assessment effectively shuts the door to compounding, as the tax amount must be quantified for the option to be exercised.

Reinforcing its stance, the court found that the petitioners had consistently submitted sales tax returns and that the impugned complaints were filed without any legal prerequisites in place.

Accordingly, the court annulled the criminal complaints, terming them ultra vires to the Sales Tax Act and in violation of the petitioners’ fundamental rights.