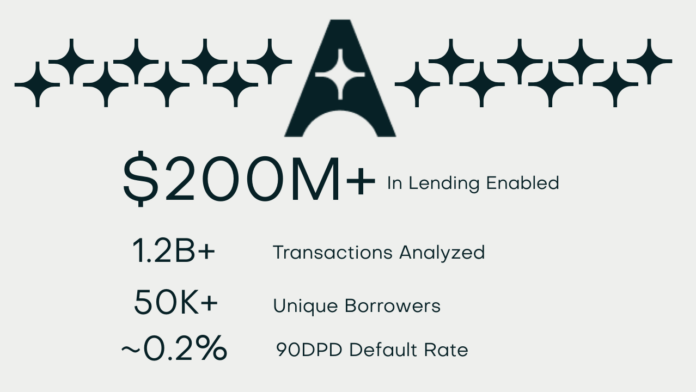

Profit readers expect a sober view of growth and risk. AdalFi’s updated figures anchor both. The company has enabled more than $200M in partner lending with defaults at 0.2%. Its AI model spans 1.2B+ processed transactions and 30M+ borrowers evaluated. The model’s learning rate is driven by more than 50K repayments each month, which tightens selection and pricing.

The platform’s core mechanic is a closed-loop system. AdalFi calls it Assess → Activate → Disburse → Optimize. It is the operating model, not a slide. The Assess layer, built on the AdalFi Analytical Architecture, consolidates core, open banking and bureau data to output explainable, policy-aligned decisions. Continuous rescoring of the deposit base also enables banks to revive dormant demand without mass marketing.

Activation is where unit economics improve. A built-in engagement layer runs personalized, event-driven campaigns across SMS, push, email, in-app and agent-assisted flows. Because it is tied to the scoring engine, the system can adjust eligibility windows and offers dynamically.

Disbursement is measured in seconds. For prequalified customers the end-to-end journey is designed to finish in under a minute, embedded through SDKs and APIs across digital channels. Pre-integrations with core systems like Oracle FLEXCUBE, Temenos and Symbols reduce delivery risk and keep programs within quarterly timelines.

Optimization reframes portfolio management as a real-time discipline. Signals on balances, cash-flows and repayment events feed back into the scoring layer to refine cutoffs, limits and pricing. Early warnings can activate targeted outreach before delinquency accelerates.

Learning is both local and networked. Banks get an on-prem inner loop where models learn from their own data, and a federated outer loop where anonymized performance patterns roll up across partners. That outer loop is fueled by 50K+ repayment events monthly and strengthens the model without exposing raw customer data.

On delivery, the company outlines a 12-week blueprint with milestones for model testing, policy setup, journey design, integrations and campaign activation. With pre-integrations and drop-in UIs, teams can move to production in weeks, which matters when cost of capital and board expectations are high.

Recent leadership moves — Ian Read leading Credit Excellence and Emre Unlusoy leading MEA sales — reflect a scale plan that balances governance with commercial momentum. If Pakistan’s banks want faster approvals without losing control, this mix of loop-based learning and enterprise delivery is worth a close look.

Company details and contact are available at AdalFi.