There was a time when Pakistan’s textile manufacturing sector was booming. The country had a steady domestic supply of high grade cotton and plenty of clients not just in the Gulf but also in Europe and the United States that relied on Pakistan’s ability to produce clothes fast and export them.

It is no wonder then that textiles are still the largest export oriented sector in the country. In fact, 2005 marked a milestone year for Pakistan with GMO cotton seeds being introduced in the country with the following years being some of the highest output for Pakistan in terms of both the cotton crop and textiles manufactured.

But in the nearly twenty years since, something has gone wrong. Here is a sobering fact. Two decades ago, Pakistan’s cotton was in demand globally. However over those 20 years, countries such as Bangladesh, Vietnam and Cambodia have all surpassed Pakistan. In 2003, when Pakistan’s textile exports were $8.3 billion, Vietnam’s textile exports were $3.87 billion, Bangladesh’s were at $5.5 billion. Now Vietnam is at $36.68 billion and Bangladesh is at $40.96 billion, while Pakistan is struggling to hit $25.3 billion in 2022.

The reasons for this are manifold. Perhaps most significant in contributing to this was the energy crisis of 2008. Between 2007-8 Pakistan was hit by the global recession. The textile industry faced challenges due to high energy costs, rupee depreciation vis-à-vis the US $ and other currencies, and a high cost of doing business. As a result, there was a reduction in the number of textile mills operating in the country from about 450 units in 2009 to 400 units in 2019.

It was in this vacuum that countries like Bangladesh and Cambodia made their own space. That is until now. The last two years have seen two things happen. The first is that Pakistan’s textile industry has seen a bit of a resurgence. A few good cotton crops along with the falling rate of the rupee have made exports an attractive proposition and textile mills have made big profits. On the other hand, textiles in Bangladesh have seen a downward trend. Could this be just the opening Pakistan’s textile industry needs?

Bangladesh’s troubles

Bangladesh’s textile sector, a cornerstone of its economy valued at $27 billion, stands as a major global player. With its roots dating back to 1976, the garment industry now accounts for 80% of the nation’s exports, featuring over 4,800 factories and employing over three million people, predominantly women. The sector has shown significant growth over the past 35 years, driven by government support, infrastructure investments, and labour-friendly practices.

The key to its success are Bangladesh’s low minimum wages, which attract labour-intensive industries. Coupled with a vast, skilled workforce, the industry efficiently handles large orders, maintains competitive pricing, and meets international demand. The sector’s efficiency is further bolstered by strong transportation networks, ensuring timely deliveries.

The industry has diversified into various segments, including ready-made garments, knitwear, and fashion apparel, aligning with global trends. In response to past disasters, there has been a concerted effort to improve workplace safety and conditions, leading to the closure of unsafe factories and enhancing Bangladesh’s global reputation.

In 2023, Bangladesh’s textile sector achieved a remarkable milestone. The Ready-Made Garment (RMG) exports increased by 10.67% to $42.63 billion in the first 11 months, exceeding the target of $42.308 billion. The sector’s ongoing growth is supported by continued investments in infrastructure and effective marketing strategies, solidifying Bangladesh’s position as a leading textile exporter.

Bangladesh has made substantial investments in textile-related infrastructure, such as textile parks and industrial zones, which have improved the efficiency and productivity of its labour force. The country has also excelled in employing foreign marketing techniques to promote its exports.

The on-going textile workers’ conflict in Bangladesh in 2023, driven by demands for higher wages, has led to significant unrest with far-reaching implications. The Bangladesh Garment Manufacturers and Exporters Association (BGMEA) proposed a 20% increase in the monthly minimum wage to $90, which was significantly lower than the $208 demanded by the workers.

The Bangladeshi authorities, responding to the widespread protests, announced a new salary structure, increasing the monthly minimum wage by 56% to $113. However, this increase was still considered inadequate by workers and their groups due to rising living costs.

The protests, involving thousands of workers in Dhaka and Gazipur, escalated into violence, including the torching of factories and clashes with police, resulting in fatalities and significant property damage. These events underscored the critical issues of low wages and poor living conditions for the estimated four million workers in this sector.

Bangladesh, as the second-largest global garment producer, earns about $55 billion annually from garment exports, contributing nearly 16% to its GDP. The sector is under pressure from reduced pricing by global brands and increased production costs, including higher energy and transportation expenses.

The workers argue that the wage increase is inadequate to counter the sharply rising prices of daily commodities and rent, aggravated by a 9.5 percent inflation rate, making their income insufficient even with overtime work.

About 300 garment factories in areas such as Mirpur, Ashulia, Chandra, and Gazipur have closed due to the protests, leading to significant industry disruptions. There are concerns that these protests might not achieve the desired outcomes and could further complicate the situation.

The unrest has attracted international attention, with various entities urging the Bangladeshi government to address workers’ grievances and respect their right to peaceful protest. Concerns among Bangladeshi ready-made garment (RMG) exporters have risen due to potential trade restrictions from Western nations.

Global buyers are including clauses in their orders to avoid responsibility for goods or payments if such restrictions are imposed. Faruque Hassan, BGMEA President, noted the inclusion of such clauses in letters of credit by some buyers, indicating non-receipt of goods or payments if Bangladesh faces sanctions.

The situation has drawn pressure from global rights groups, institutions, and governments, particularly the United States, which has warned of potential trade penalties and visa restrictions against those undermining labour rights in Bangladesh. The European Union and the United Kingdom have also expressed concerns about labour and human rights in the country.

A European brand representative highlighted the potential impact of U.S. sanctions, including the possibility of empty shelves in stores and a ripple effect in the global apparel market. This indicates that while some customers seeking affordable apparel may remain loyal to Bangladeshi products, those with stricter buying practices might shift to alternatives in other countries, a change that could take years to reverse.

The protests highlight the need for fair labour practices and sustainable production methods in the global textile industry. The situation has been exacerbated by inflation and the devaluation of the local currency against the US dollar. The Bangladeshi Taka has devalued by approximately 16% over the past year, increasing the cost of imports, including raw materials for garment production.

This devaluation, coupled with the highest inflation rate in the last decade, has compounded the financial struggles of the workers and the garment manufacturing industry. The economic strain is evident from the bankruptcy of 313 factories, including 80 garment units, from January to mid-August 2023, reflecting challenges beyond a decline in global demand and encompassing banking complexities and the currency’s devaluation.

Pakistan’s opportunity

The textile industry in Pakistan, valued at $16-19 billion, is facing a series of challenges that are hampering its growth and productivity. Key issues include demotivated employees, inadequate pay structures, and reliance on outdated production methods. These are exacerbated by a lack of innovation, insufficient training, and a need for modern manufacturing techniques to compete internationally.

During the COVID-19 pandemic, Pakistan implemented a ‘smart lockdown’ which allowed its textile operations to continue, unlike in countries like Bangladesh. This strategy led to a boost in Pakistan’s GDP in 2021. However, for further improvement in exports, Pakistan needs to streamline export procedures and ensure timely delivery.

As per the figures and details obtained from All Pakistan Textile Mills Association (APTMA) the textile and apparel exports from Pakistan have seen significant shifts recently. Between FY20 and FY22, exports increased from $12.5 billion to $19.3 billion, supported by a $5 billion investment in upgrading and expanding manufacturing facilities. This investment aimed to add another $5 billion in annual exports and create 300,000 to 500,000 new jobs.

A notable shift towards high value-added goods is observed, moving away from traditional exports like yarn and grey cloth. The value addition has increased, with every unit of cotton input now being converted to 3.9 units of value-added exports, compared to 2.5 units a few years ago.

In the year 2023, despite textile manufacturers making big bucks, textile exports in terms of volume actually dipped by 15% to $16.5 billion, influenced by the withdrawal of the RCET amid a broader macroeconomic crisis. High energy costs, constituting 12-18% of total input costs, are a significant burden. An increase in power tariffs from 9 cents/kWh to 14 cents/kWh drastically reduced profitability, impacting major textile exporters.

Despite these efforts, the textile exports in FY 2023 fell by 15% to $16.51 billion, failing to reach the $24 billion target. A major issue is the sector’s focus on exporting raw materials rather than developing own brands and customer-focused strategies, essential for gaining a global market share.

High power tariffs are a critical issue, with any increase beyond 12.5 cents/kWh causing a significant impact on the export sector. This leads to shutting down of existing units, halting investment in expansion, and a decline in production and exports.

“Tariffs are not the only contributing factor, the Bangladesh government provides cheaper utilities, subsidies in finance just for an overview lending rates in Bangladesh rates 7.15% as opposed to Pakistan’s 25% which discourages investors to upgrade plant and machinery. Pakistan textile industry has in the last decade grown leaps and bounds as the scope of adding value to products has grown where investors using their own resources have invested as the government policies have been discouraging of late.

The textiles and apparel sector, contributing 60% to Pakistan’s export earnings and employing 40% of the labour force, plays a crucial economic role. The exit of firms from this sector could reduce export earnings, increase the need for external borrowing, and potentially trigger a recession. It could also lead to increased government borrowing and debt servicing, loss of employment affecting millions of households, and spillover effects on other sectors like cotton, retail, and power, further impacting output, investment, and employment. Additionally, the collapse of publicly listed firms in this sector could affect the stock market, impacting public savings and reducing both foreign and domestic investments.

Pakistan’s textile industry, though heavily subsidised, faces challenges such as demotivated employees due to employment instability, inadequate pay, and outdated production methods. The industry requires more trained personnel, innovation, and modern production capabilities.

What is the path forward?

Pakistan’s Federal Caretaker Minister for Commerce, Gohar Ejaz, recently announced a vision to significantly boost the country’s textile export to a hundred billion dollars over the next five years. To achieve this ambitious target, Ejaz formed a sixteen-member Export Advisory Council, which includes influential figures from both the government and the textile sector.

The council is composed of ten owners of leading Pakistani textile companies, including Musadaq Zulqarnain from Interloop Holdings, Fawad Anwar of Alkaram Textile, Shahid Soorty of Soorty Textile, Aamir Fayyaz Sheikh of Kohinoor Mills, Shahid Abdullah of Sapphire Textile Mills, Ahmad Kamal of Kamal Textile Mills, Ashraf Salim Makda of Liberty Textile Mills, Yaqub Ahmed of Artistic Milliners, and Mian Muhammad Ahsan of US Group. Additionally, the council includes high-ranking government officials such as the Secretary of Finance Division, the Governor of the State Bank of Pakistan (SBP), the Chairman of the Federal Board of Revenue (FBR), and the Chief Secretaries of the provinces. Gohar Ejaz, a prominent figure in the textile industry, serves as the chairman of the council.

According to documents obtained by Profit, the council believes that while various export growth policies have been developed over the years, their implementation has been consistently inadequate. They pointed out that the Textiles and Apparel Policy 2020-25, despite offering a comprehensive framework for export growth, was not effectively implemented. The council members suggest revising and implementing the existing Textiles and Apparel Policy 2020-25 in line with the current economic conditions, rather than creating a new policy. They stress the importance of a unified policy framework for the export sector, encompassing all government sectors, to ensure full implementation and continuity for sustainable growth.

As per the council’s perspective, the textiles and apparel sector in Pakistan faces a critical challenge due to its limited variety of exportable products. Dominated by cotton, the sector’s product range is restricted to items like denim, knitwear, and home textiles. This narrow focus impacts the industry’s ability to compete globally, as many international buyers only turn to Pakistan when items are unavailable in larger markets like Bangladesh and Vietnam. To counter this, a significant diversification of the export basket is necessary.

A promising area for expansion is the man-made fibres (MMF) sub-sector. However, this segment is hindered by a lack of industry expertise and production capacity. Additionally, the sector suffers from price distortions due to a protected monopoly held by three major PSF manufacturers in Pakistan, who impose high import duties on foreign PSF. These practices keep domestic PSF prices high, making MMF production financially challenging.

There is also a growing need to incorporate recycled materials in manufacturing, aligning with the increasing global emphasis on sustainability and the circular economy.

From the council’s perspective, Pakistan’s textiles and apparel manufacturing capacity is severely limited and requires substantial investment. This includes the development of industrial export processing zones equipped with comprehensive facilities like plug & play setups, infrastructure for power and water, effluent treatment plants, and various other support services.

To boost apparel exports by an estimated $20 billion, the establishment of 1000 new garment factories is essential. The implementation of plug & play and shared facilities in these industrial zones can significantly reduce the costs associated with setting up new factories, as infrastructure expenses constitute a major part of the initial investment.

The council suggests starting with a pilot project to develop 25 factory sites with comprehensive facilities near major cities and textile hubs. To attract investment in these new capacities, the government must offer competitive tax incentives, matching those provided by other regional textile and apparel exporting economies.

The council pinpointed a significant shortfall in Pakistan’s transport and logistics infrastructure, stressing the need for major enhancements in inland transportation, including freight rails and inland waterways. This improvement is essential to reduce transport costs. A particular issue is the long outbound shipping times from Pakistan, as major shipping lines (mother ships) do not frequent Pakistani ports, relying instead on time-consuming feeder vessels.

Moreover, the council highlighted the growing dominance of India in the international textiles and apparel markets, attributed to strong government relations and effective lobbying in key Western countries. In response, the council suggested exploring high-potential markets like Japan and Southeast Asia. Industry leaders and the Minister for Commerce are encouraged to conduct an international “roadshow” in Europe and the United States, including networking sessions at industry events and meetings with top executives of leading apparel firms, to attract them to set up sourcing offices in Pakistan.

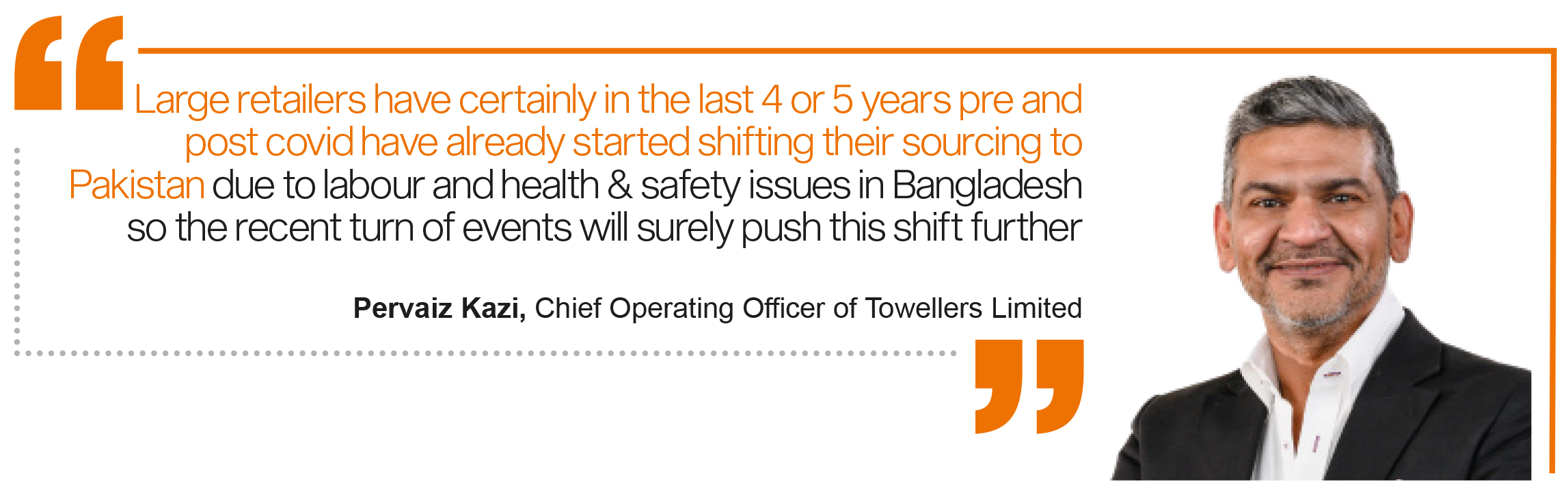

However, the COO of Towellers pointed out the effective approach of India’s government and trade bodies in promoting the ‘MADE IN INDIA’ slogan and label. He noted that the Indian government not only incentivizes its export industries but also actively champions the ‘Made in India’ brand at every international platform. He suggested that it would be wise for the Pakistani government and its Ministry of Textiles to adopt a similar approach to globally promote Pakistani brands.

The Secretary for Commerce addressed the Council, highlighting the role of the Export Development Fund (EDF), now under the Ministry of Commerce, in promoting exports. He stressed the need for a framework allowing export-oriented firms and trade organisations to access and utilise EDF funds for export promotion activities.

Dear Shahab Omer,

Congratulations on crafting a well-researched and insightful article shedding light on the challenges and opportunities faced by Pakistan’s textile industry. Your comprehensive analysis, from historical perspectives to current trends, provides valuable context for readers to understand the intricate dynamics of the global textile market.

The juxtaposition of Pakistan’s textile industry against its counterparts like Bangladesh and Vietnam offers a clear narrative, and your exploration of the recent developments in Bangladesh adds a timely and relevant dimension to the discussion.

Your detailed examination of the textile sector’s challenges, such as the energy crisis, high power tariffs, and the need for innovation and modernization, underscores the complexities that the industry grapples with. Furthermore, your coverage of the ongoing textile workers’ conflict in Bangladesh adds a human perspective, highlighting the crucial need for fair labor practices in the global textile industry.

The proposed path forward, as outlined by Pakistan’s Federal Caretaker Minister for Commerce, Gohar Ejaz, and the Export Advisory Council, presents a compelling vision for the future. The emphasis on revising existing policies, diversifying export products, and exploring new markets demonstrates a strategic approach to revitalizing the textile industry.

In conclusion, your article serves as a commendable resource for anyone seeking a comprehensive understanding of the challenges and opportunities facing Pakistan’s textile sector. Keep up the excellent work in contributing to informed discussions on economic matters.

Best regards,

asif

I want to job here I feel it’s Good industry..I m Merchandiser In industry can I join it?

I feel we cannot neglect the cotton crop. Our production stagnated at levels achieved three decades ago, and at times it was even lower.

High energy cost has been identified with loss of competitiveness. We also need to consider how the availability of high quality, domestically sourced raw cotton would strengthen comparative advantage in textile exports. There is a need for developing better cotton varieties that are more climate resilient, more resistant to disease, and have high yields.

Also, there is a need to analyze how the government incentives differentially benefit the various sub-sectors within the textile sector. The energy costs, impact different subsector differently depending on energy intensity.

I haven’t seen analyses along those lines. The reason this is important is that policy effectiveness will be compromised if a large share of government incentives, including any subsidies, is captured by low value added sub-sectors that exhibit high degree of producer concentration.

Looking at the textile sector within the context of the larger macroeconomy, several things stand out. First we need to fix the energy sector mess both in terms of its ability to absorb energy price shocks originating in the international markets. This requires greater indigenization of energy sources, including both coal and renewables). Second, we need to make the energy sector more efficient (theft, losses etc) and find a way around the lock-in some energy producers producers have to unrealistic returns (backed by souverign guarantees). A major overhaul of the sector is called for.

a very well written article.

Thanks for sharing the information with us, it was very informative

a very interesting reading encompassing almost all the issues facing our textile industry. However there’s a need for critically evaluating our labor market especially when it comes to female workers. a focus on skills development, safe and secured workplace, transportation and housing facilities can attract suitable workforce for our industry and can be a trend setter.

Political instability & corruption are the causes for both countries,if work on these two parameters then they can overcome

No amount of enlightenment on the subject would help unless true, sincere leaderships in all the institutions of Pakistan overtakes present corrupt individuals. Perhaps, still a long struggle is ahead for this godforsaken country.

good some money want jobs

very good.thanks for sharing

I am a production senior manager

Pakistan has huge potential to grow this industry but for this need honest leadership for this country not these jokers who demolished all industries and make people un-employee, our people are also corrupt so as our leadership we need to change ourselves first Bangladeshi government didn’t teach people to beg they give them skills and tech to be independent and this is the main key of their successes and they left the Pakistan behind in every aspect

Pakistani textile industry has more efficient and talented workers, just explore Faisalabad for party wear and you mind will blow they need little support to stand up and government should provide them more easy and relaxed policies to grow Pakistani party wear dress are high in demand not only in India but in USA, UK and Arab we are missing train with our own will jokers and fools are appointed in such industries and they have no interest in development and that’s why we are facing crisis

Highly Recommended!

Very insightful, i will also say this here. Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto at some point not until saw a recommendation on Elon musk successfully success story and I got a proficient trader/broker Mr Bernie Doran , he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony; I have made total returns of $10,500.00 from an investment of just $1000.00 within 1 week. Thanks to Mr Bernie I’m really grateful,I have been able to make a great returns trading with his signals and strategies .I urge anyone interested in INVESTMENT to take bold step in investing in the Cryptocurrency Market, you can reach him on WhatsApp : +1(424) 285-0682 or his Gmail : BERNIEDORANSIGNALS@ GMAIL. COM bitcoin is taking over the world, tell him I referred you

very nice blog website

Information

VIP knowledge

all article is good