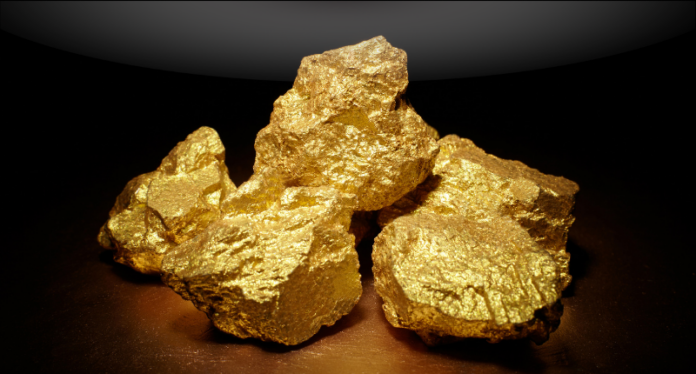

Pakistan’s gold holdings have emerged as a key driver of the country’s strengthening foreign reserves, with their value climbing to nearly $9 billion as global bullion prices surged by more than 50% in 2025, according to data from Topline Securities and the State Bank of Pakistan (SBP).

This increase has lifted Pakistan’s total reserves — including liquid foreign exchange assets — to about $23.4 billion, near historic levels.

“On average, over the last decade, gold made up roughly one-third of Pakistan’s liquid reserves. Now, it is closer to two-thirds — a major shift reflecting how global gold strength is reinforcing Pakistan’s external buffers,” said Topline Securities CEO Mohammed Sohail.

Analysts attribute the surge to global demand for safe-haven assets amid geopolitical tensions, central bank buying, and persistent inflationary pressures. For Pakistan, the revaluation provides an important cushion for its external position and helps stabilise the rupee despite ongoing fiscal and trade challenges.

While the gains are largely valuation-driven rather than a result of new inflows, the rise in gold’s market value has strengthened the SBP’s balance sheet and improved the country’s reserve outlook.

Domestically, gold prices reached an all-time high on Friday, moving contrary to global trends where bullion declined due to a stronger US dollar and easing investor demand.

According to the All Pakistan Sarafa Gems and Jewelers Association, the price of 24-karat gold rose by Rs14,100 per tola to a record Rs456,900, while the 10-gram price increased by Rs12,089 to Rs391,718.

In global markets, spot gold fell 2.6% to $4,212.99 per ounce on Friday after earlier hitting an all-time high of $4,378.69, according to Reuters.

The drop followed comments by US President Donald Trump that a “full-scale tariff” on China would be unsustainable, easing fears of prolonged trade tensions. US gold futures for December delivery slipped 1.8% to $4,225.80 per ounce.