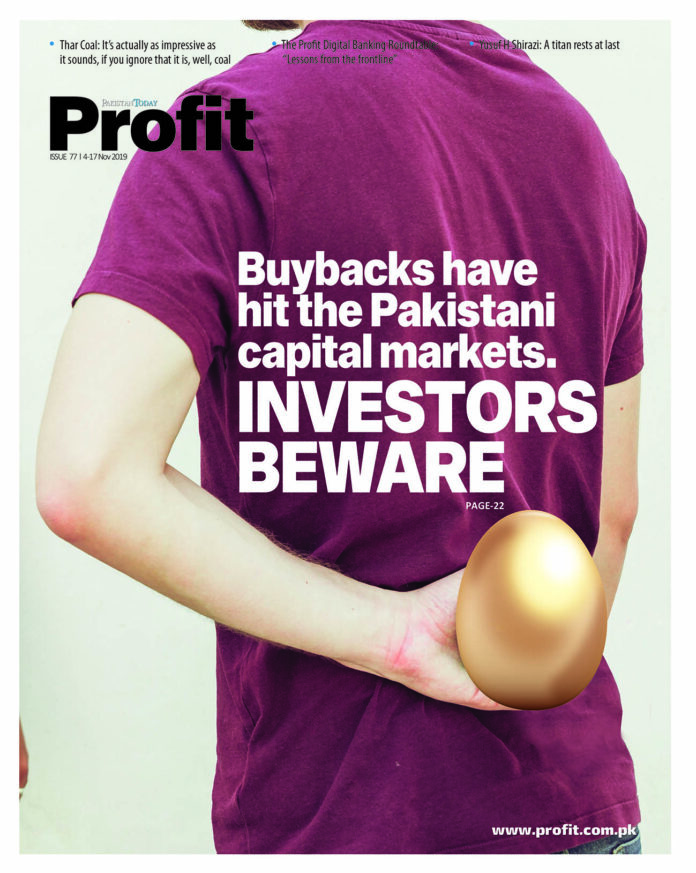

In this week’s cover story, we explore the advent of share buybacks in Pakistan’s capital markets, with major companies listed on the Pakistan Stock Exchange (PSX) engaging in such buybacks over the past few months. While we are certainly sympathetic to the argument in favour of allowing companies to return capital to shareholders, we find ourselves inclined against the practice, and implore the Securities and Exchanges Commission of Pakistan (SECP) to consider tightening the rules that govern such buybacks, or at least not relax them any further than the new regulations issued earlier this year.

The argument against buybacks is simple, in our view: it is not the job of the company itself to determine its own stock price. That is the sole prerogative of investors. By intervening in the market for its own stock, and using shareholder money to do so, companies are effectively manipulating the market for their own shares.

In our view, the logic behind restricting this practice is the same as the logic behind the prohibition on insider trading: entities with access to material nonpublic information must not be allowed to take advantage of those informational asymmetries. For the markets to deepen as a source of capital, investors must perceive the markets to be fair, and not the rigged playground of a few privileged insiders.

Beyond that argument, however, there is the broader concern: allowing share buybacks is a way of allowing CEOs and top management to shirk their responsibility to create value for their shareholders and the wider economy. Put simply: by allowing CEOs to use company money to bid up the value of the shares of their own companies, regulators are effectively delinking growth in the stock price from the financial performance of those companies.

For example, if a company failed to grow its net income, by buying back shares, it can still grow its earnings per share (EPS). EPS is defined as net income divided by total number of shares outstanding. A company’s management should be paid to increase net income, which is representative of increasing the value of the company to the economy as a whole. However, by allowing companies to short-circuit that, and grow EPS by simply reducing the number of shares outstanding – and using company money to do that to boot! – CEOs will naturally have the incentive to take the easy way out.

This, in turn, means that shareholders will continue to get richer at the expense of all other stakeholders of the company, an outcome already widely prevalent in the United States, the birthplace of the share buyback.

This is a sclerosis Corporate Pakistan can do without. We urge the SECP to prevent it from taking hold while it can still be nipped in the bud.

This is a nonsense article. It’s a capital allocation decison. If the best use of the company’s cash flows is to return it to shareholders through a tax effecient structure then it is the boards decision to do so.. Not sure how its creating a bad incentive for the CEO of the company…

I’m surprised at the ignorance of the editor of this newspaper. He has demonstrated little knowledge of finance. Shares Buy back (also called treasury stocks) is a globally recognized practice that allows companies to buy back their own stocks if they think that the market has undervalued its price. A company will only invest in their own stocks (that is buy back) if it thinks that the value of the company is higher and they will get better return if they sell that same stock later at higher prices.

How is it a disease? No one is stopping you to buy that company stocks which the company itself thinks is undervalued and will appreciate in future. It’s walking the talk. It was company decision itself to list the company shares for public and it is their own decision to de-list some of the shares. Do you realize that by selling the stock to public (i.e. by listing) the value of shareholders were already diluted as the public will now share the dividends that were previously enjoyed by shareholders? Now if that listing is curtailed through buy back, the private shareholders and owners of the company will naturally be happier as they will get higher share of profits in their own and company’s pockets. There is no EPS manipulation whatsoever.

It is a capital allocation decision. If a company cannot invest retained income to create additional shareholder value then it should either payout more or buy back shares. This increases the ownership of existing equity holders and give them a greater piece of the firms earnings and it is done in a very tax efficient manner for the investors without them having to make any investment outlay. This is global best practice and I can’t see any logic in the author’s article.

Zzz It is a capital allocation decision. If a company cannot invest retained income to create additional shareholder value then it should either payout more or buy back shares. This increases the ownership of existing equity holders and give them a greater piece of the firms earnings and it is done in a very tax efficient manner for the investors without them having to make any investment outlay. This is global best practice and I can’t see any logic in the author’s article.

Sir,

With respect You are wrong in this. If you are worried about company EPS performance push for regulations that buy back will require AGM approval so at least 75 percent shareholders agree with the decision. If the super majority of owners agree that the company should do it and theRefore board decision on this matter is acceptable no outsider (writer) should challenge it. It is the opinion of the owners and the managers and the oversight of the board it is a good decision.

Comments are closed.