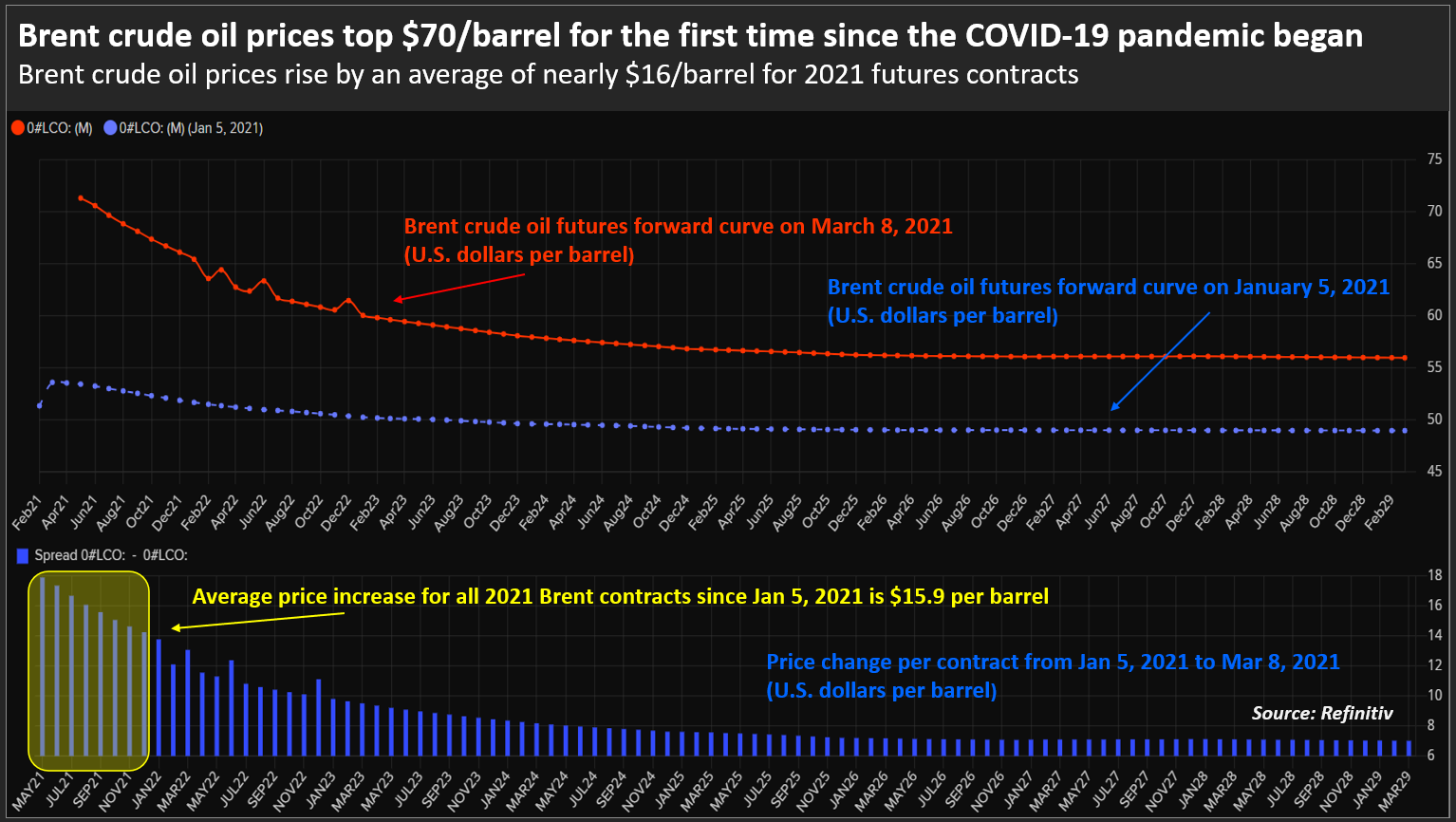

SINGAPORE: Brent crude futures climbed above $70 a barrel on Monday for the first time since the Covid-19 pandemic began, while US crude touched its highest in more than two years, following reports of attacks on Saudi Arabian facilities.

Brent crude futures for May hit $71.38 a barrel in early Asian trade, the highest since Jan. 8, 2020, and were at $70.56 a barrel by 0730 GMT, up $1.20, or 1.7%.

U.S. West Texas Intermediate (WTI) crude for April rose $1.08, or 1.6%, to $67.17. The front-month WTI price touched $67.98 a barrel earlier, the highest since October 2018.

Asian stocks also rose after the US Senate approved a $1.9 trillion stimulus bill while positive economic data from the United States and China bode well for a global economic rebound.

Yemen’s Houthi forces fired drones and missiles at the heart of Saudi Arabia’s oil industry on Sunday, including a Saudi Aramco facility at Ras Tanura vital to petroleum exports, in what Riyadh called a failed assault on global energy security.

“We could see further upside in the market in the near-term, particularly as the market probably now needs to be pricing in some sort of risk premium, with these attacks picking up in frequency,” ING analysts said in a report, noting that this was the second attack this month following an incident in Jeddah on March 4.

RBC Capital’s Helima Croft said the latest incident underscored just how dangerous the security environment remains in the region nearly 18 months after the September 14, 2019 Iranian strikes that temporarily took offline half of the kingdom’s oil output.

Brent and WTI prices are up for the fourth consecutive session after OPEC and its allies decided to keep production cuts largely unchanged in April.

China’s crude shipments in the first two months of 2021 are up 4.1% on year after the world’s top importer expanded its refining capacity and as its fuel demand continued to grow.

Despite fast-rising crude prices, Saudi Arabia’s oil minister has voiced doubts on demand recovery.

“The decision to keep quotas unchanged signals the group’s intent to drawdown inventories further, without concern of overtightening the market,” ANZ analysts said in a note.

“It also suggests they see little threat from rising output elsewhere.”

However, the energy minister in the world’s third-largest crude importer, India, said higher prices could threaten the consumption led-recovery in some countries.

Higher prices have also encouraged U.S. energy firms to add oil and natural gas rigs for a second week in a row, energy services firm Baker Hughes Co said on Friday.