The news media in Pakistan has been suffering for at least two decades now, and the past few years have perhaps been some of the hardest. Well established newspapers and television channels have had to undertake mass layoffs, and despite such measures have still regularly failed to meet payroll.

Amongst those affected was also Media Times, the publicly listed Taseer family’s media conglomerate that had at one point under its umbrella the English daily newspaper Daily Times, the Urdu daily, Aaj Kal, a cooking channel called Zaiqa, a kids channel called Wikkid and Pakistan’s first business and economics oriented news channel called Business Plus.

The media group’s misfortunes are made worse by the fact that things were not always so, in fact, Daily Times, and its parent group ‘Media Times,’ started off strong.

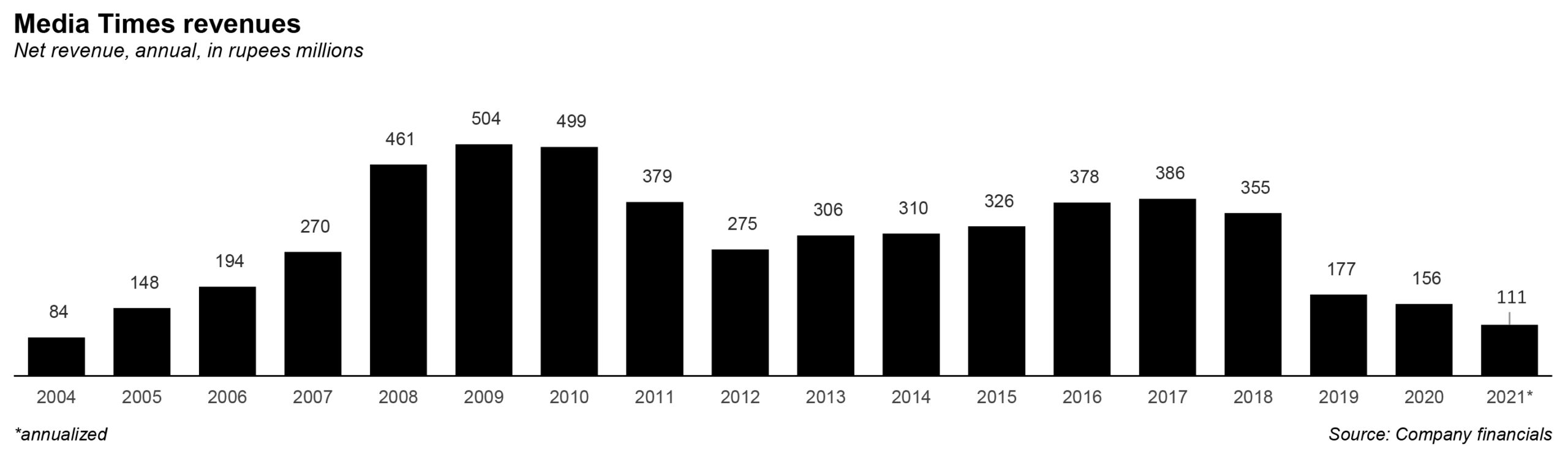

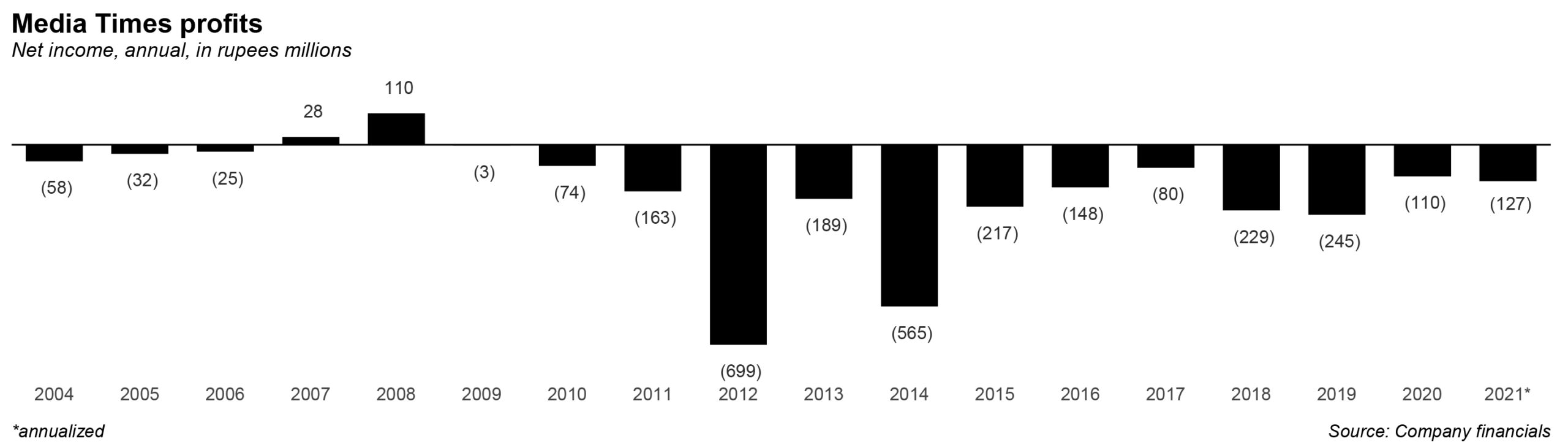

Since those early days the fortunes of Media Times and its associated organizations have been largely downhill. The media conglomerate has made a loss every single year since 2009 – and is on track to make another loss in 2021 (the company’s financial year ends in June). On April 26, the company released its latest financial results for the nine month period ending on March 31. The company’s net revenue stands at Rs81 million, significantly lower than the Rs126 million from the same period the year before. And the loss after taxation is also greater, at Rs73 million, compared to Rs56 million for the period the year before.

If one analyzes that data, the results are not pretty: for the year 2021, the net revenue stands at Rs111 million. That would be the lowest recorded revenue since 2004. And the net loss stands at Rs127 million, which is greater in value than last year’s loss of Rs110 million. Perhaps the kindest thing one can say is that the annualized loss for 2021 is still not as bad as the years 2018 and 2019, where losses stood at around Rs220-250 million range; or as bad as the loss in 2014 (Rs565 million), or 2012 (Rs699 million).

What is going on? It is a two-pronged problem: first, is that the Taseers have invested in a traditional media group, in an era where media is struggling, both globally, and most certainly in Pakistan. Second, is the peculiarities of the family itself – the group has not benefited from being attached to the Taseer family name.

Beginnings

First, some context: Media Times was founded in 2001 by Salmaan Taseer, who had become very wealthy from his accounting firm Taseer Hadi, and his real estate business Pace Corporation. The core businesses were print and electronic, and Taseers were constantly trying to make sure that their media organizations were innovative.

In its heyday in the early 2000s, Edited by Najam Sethi and owned by the Taseer family, Daily Times was the first new entrant in the English language newspaper space that looked like it had the journalistic standards and financial backing to challenge the old guards of the English press that were still around, which back then included Dawn, The News, and The Nation. Similarly, Business Plus was the first time a business and economics channel was introduced in Pakistan, and Zaiqa targeted middle class women working as homemakers, both of which were acquired by Media Times in 2008.

Initially, when it was just a print media organization, Daily Times like many others in the print industry was not doing too well in terms of roping in advertisers. At this point, the surprising saviour of the group was Sunday Times, the fashion and lifestyle magazine that came out with the Sunday edition of Daily Times and kept the company stable. At a time when facebook was still very new and there was no Instagram, the lives of the rich were largely hard to get a peek into. Through Sunday Times, people suddenly had an inside man and celebrities had people to photograph and publish their parties and weekend activities. Driven by the surprising amount of ad revenue from Sunday Times, the company’s revenue between 2004 and 2010 grew by 34.6% per year on average, reaching a peak of Rs504 million in 2009.

The only problem was that thing got to a point where Sunday TImes was carrying the entire operation. For a long time, it had very successfully carried Daily Times, which could easily focus on news reporting and journalism while Sunday Times brought home the bacon. But when the news channels joined the mix in 2008, suddenly there was a lot more weight to carry, and the first serious signs became apparent. It still has to be said that for the first two years that Media Times had its television channels, they still managed to increase revenue, but this involved glossing over a lot of cracks. By now, meeting payroll and delayed salaries had started becoming an issue for the organization. It would be made worse in the coming years.

Competition enters the race

In 2010, the television channels were not getting the kind of ratings that advertisers salivate over, and the print side of the business was also suffering as a result. Then, in 2010, the last thing that Daily Times wanted happened – they got competition. Express Tribune was launched in 2010, and late in the same year, this paper’s parent publication, Pakistan Today, was also launched.

The English newspaper space in Pakistan has always been small. There was a small period in the late 80s and early 90s when it was a thriving and vibrant space with older papers like Dawn and Pakistan Times being established giants, and new entrants like The Nation, The News, Frontier Post, and The Muslim around. Byt the late 90s, it was only Dawn, The Nation, and The News that remained before Daily Times figured it had some space to grow. But with two new entrants on the scene in 2010, dire straits had arrived for Media Times.

Then, in 2011, the organization suffered the blow of its founder, Governor of Punjab Salman Taseer, being assassinated by one of his own bodyguards. Rudderless and at a difficult turn in its history, Media Times plummeted. Between 2011 and 2018, revenue figures declined by 3.8% per year. The year 2019’s revenue figure of Rs177 million and 2020’s Rs157 million are the lowest figures since 2005 (Rs148 million). And as mentioned before, the year 2021’s revenue of Rs111 million is the lowest revenue since 2004 (Rs84 million).

According to the company’s latest half-yearly report, the company has incurred a net loss of Rs 57 million during the period ended December 31 2020 and, as of date, the company’s current liabilities exceed its total assets by Rs561 million. Worse, the company’s equity has eroded and the accumulated losses exceed the share capital and share premium by Rs902 million

The company had also defaulted in payments of its loan and lease liabilities, and was negotiating with Faysal Bank Limited for settlement of short term borrowings from their own sources. “There is a material uncertainty related to these events which may cast significant doubt on the Company’s ability to continue as a going concern and, therefore, the Company may be unable to realize its assets and discharge its liabilities in the normal course of business,” the report read.

So much for being a media business: both Zaiqa and Business Plus remained non-operational all of 2020. According to one company report, it was “due to shifting of up-linking stations from Karachi to Lahore region.” Revenue from advertisements also decreased by 12% compared to 2019, because of the economic crisis caused by Covid-19.

In fact, in October 2020, Media Times said it would restructure its company: the electronic and print media divisions would be broken apart, while the electronic media would be divided into two wholly owned subsidiaries for Business Plus and Zaiqa.

According to the company, “The ultimate purpose of this corporate structuring includes to operate the Electronic Media at own, or to be sold or to be liquidated as a divestiture… the above restructuring of Electronic Media into two different entities may be used ultimately to raise capital or selling off two different segments,” said the company in its public announcement.

Unfortunately, that has not happened yet. But at least it shows one thing: the group has realized that satellite TV is not the way to go. Perhaps even without the Taseer name, the group would have made losses: increasingly, people get their news, information, and entertainment from their smartphones. And that is why Media Times has decided to pivot, with a new planned Web TV under the brand name Daily Times.

But is this a realistic strategy? Will people turn towards watching their WebTv? And even if they do, would they be able to make enough money from it? As per Profit’s own research, Youtube channels in Pakistan typically make close to USD 0.5 per thousand video views from Youtube advertising. So even with as high as 10 million video views in a month (which is saying something), Media Times will make a paltry USD 5,000 a month. There are obviously other ways to monetise the web, each with their own set of challenges.

The good news for the shareholders is that there is more to the plan, well at least on paper, than just a WebTv. “The Management is also planning to purchase and install its offset printing machines so that the Company can offer offset printing services to outside customers as well.” the company said in its latest annual report. The plan to diversify outside of media also includes exploring the real-estate business.

One thing is obvious: The company knows it is in trouble and that it needs to liquidate its legacy businesses to fund new projects. But it is unclear what is causing the delay in selling of the satellite Tv licenses which should sell for much more than the Rs 4 million mentioned against these in the company books. The intent is there but as the saying goes, the road to hell is paved with good intentions. The management must act, before it is too late.