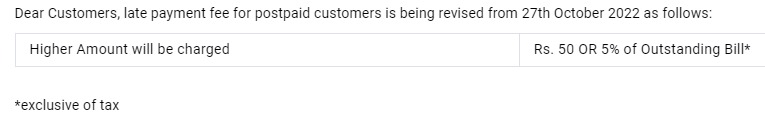

ISLAMABAD: Jazz, the country’s largest cellular mobile operator, has recently imposed a late payment fee (LPF) equivalent to 5 per cent of the total bill of postpaid customers or Rs50, whichever is higher.

Interestingly, the likes of Telenor and Ufone have no such fee as part of their schedule of charges.

Source: Jazz’s official website

Official sources at Jazz, while talking to Profit, rationalised the move as an attempt to encourage subscribers to pay their postpaid bills on time. Profit reached out to official sources at Ufone and Telenor which confirmed that both companies, currently, have no plan on introducing any such additional fee. The official source at Zong did not respond to the query.

As per Jazz’s LPF terms, a customer paying an average monthly bill of Rs3,000 would be paying Rs150 for late payment. Similarly for those paying Rs2,000 postpaid bill would be charged Rs100 LPF for making payment after the due date. For Customer paying the monthly bill of Rs1,500 would be paying Rs75 extra for late payment. Rs50 would be charged for late payment on customers having a monthly bill of Rs1,000 and below.

It is pertinent to note that the cellular companies have already been suspending outgoing calls for delayed payment or exceeding the limit of postpaid customers. Further it is a customary practice in the industry to warn the subscribers before penalising them for late payment.

Apparently, the local cellular mobile industry was the only sector not charging late payment fees on services as all utilities including gas, electricity, landline, and banks etc. have historically been charging 10pc LPF.

Pakistan Telecommunication Authority (PTA), the only telecommunication regulator of Pakistan, is yet to take notice of the development.

However, LPF is a practice observed by cellular mobile operators globally e.g. Verizon, Jio, Vodafone Idea, T-mobile etc. Usually, other CMOs follow suit when such initiatives are introduced by one operator.

The step taken by the telecom company, according to sources, may be an initiative to meet the cost or losses. It may be mentioned here that the cellular mobile operators have been complaining about unprecedented rise in the cost of their operations. Jazz’s reported decrease in revenue by 12.1pc in dollar terms during the second quarter of 2022 mainly due to devaluation of local currency. Company’s margins were also hampered by an exponential increase in operational cost including fuel, electricity, interest and forex rates, says the company.

Telenor Pakistan on the other hand posted an operating loss of Rs42 billion in 1HCY22, compared to an operating profit of Rs12 billion in the same period last year. The Pakistan Telecommunications Company Limited (PTCL) also went into deep net loss of over Rs3 billion in 1HCY22, compared to roughly Rs3 billion in net profits in the same half-yearly period last year.

Thanks for sharing an informative article.

Thumbs Up!!

Thanks for sharing an informative article just like you always do.

Thumbs Up!!

Great article. Can’t wait for your insight on the recent development happening in the town..

just found, being payment late payment charges even I’ve credit lint of 6000+ Rupees and my bill is well below my credit limit…

what a benefit of Good enough credit limit though…

I’m n leaving mobilink after 18 years