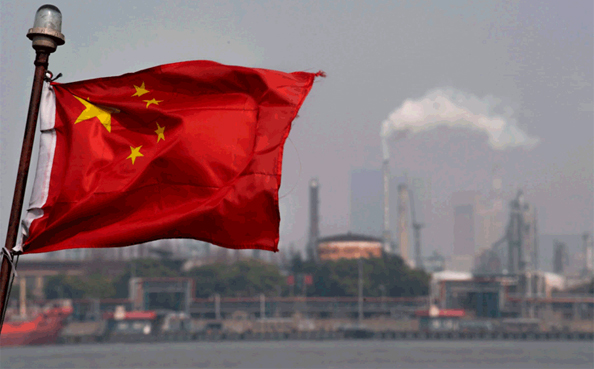

Foreign investors are increasingly hesitant to invest in China’s commercial real estate market, with remaining investors focusing on niche strategies such as environmentally friendly developments.

From January to June 2024, cross-border deals into China’s commercial properties totaled $3.3 billion, a 13% decrease from the previous year, according to MSCI.

Japan led the Asia Pacific market despite a 35% decline in deals, reaching $3.7 billion. Singapore investors, less affected by geopolitical issues, remained the top overseas buyers in China’s commercial estates, with investments amounting to about 6.9 billion yuan ($1 billion) in the first half of 2024. U.S. investments were significantly lower at 600 million yuan.

Singaporean capital saw an 80% increase in the first half of 2024 compared to the previous year, but this was still far below its peak in the second half of 2019. The Chinese property market has struggled since the government introduced policies in 2020 to curb developers’ borrowing. Major developers like Evergrande are now in liquidation, affecting investor confidence.

GIC, Singapore’s sovereign wealth fund, warned that China’s growth model, reliant on real estate, has reached its limit. Jeffrey Jaensubhakij, GIC’s Chief Investment Officer, stated that the perception of China’s long-term property investment potential has been significantly reduced.

Some investors are shifting their focus within China. Keppel Corp., backed by Temasek Holdings, has been reducing its portfolio in China. Keppel CEO Loh Chin Hua announced the sale of land worth about SG$3 billion ($2.2 billion) and other assets totaling SG$280 million, noting that opportunities in China are challenging compared to markets like Singapore and Vietnam. Keppel is now focusing on real estate services, such as renovating buildings for sustainability.

Despite the challenging conditions, some see opportunities. Principal Financial Group, which formed a joint venture with China Construction Bank, is acquiring logistics centers in China’s Yangtze River Delta and Pearl River Delta. Thomas Cheong, Asia president of Principal, highlighted the appeal of good quality assets and realistic seller expectations in the current market.

CapitaLand China Trust on July 30 reported net property income of 631.3 million yuan for the first six months, down 4.9% from a year ago, due to lower revenue from its logistics operation that saw lower occupancy and rental rates. The Singapore-listed REIT’s share price is down 26% so far this year, underperforming the 4.4% gain in the benchmark Straits Times Index.

Weak demand for offices is likely to persist in Beijing, and recovery there depends on the macroeconomic environment, the trust said in its quarterly report on July 30. While new supply in Japan is resulting in lower rental costs, the country’s consumption is likely to see a boost as real wages grow.