Pakistan has been ranked among the world’s least resilient economies in the Global Investment Risk and Resilience Index released by Henley & Partners, underscoring persistent concerns over economic stability, governance, and investor confidence.

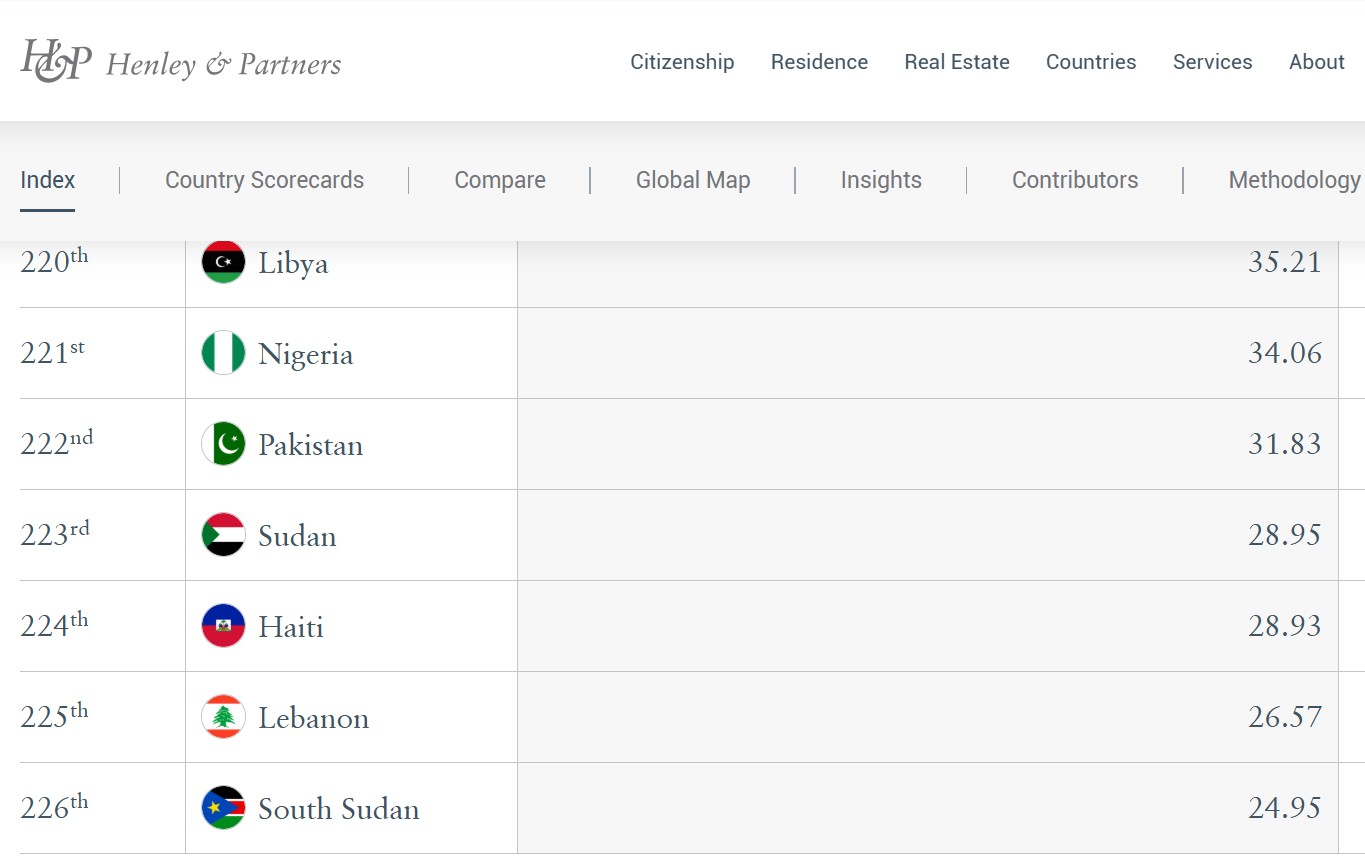

The report, developed by Henley & Partners in collaboration with AI-powered analytics firm AlphaGeo, places Pakistan at 222nd out of 226 countries — ahead of only Sudan, Haiti, Lebanon, and South Sudan. Switzerland topped the ranking, followed by Denmark, Norway, Singapore, and Sweden.

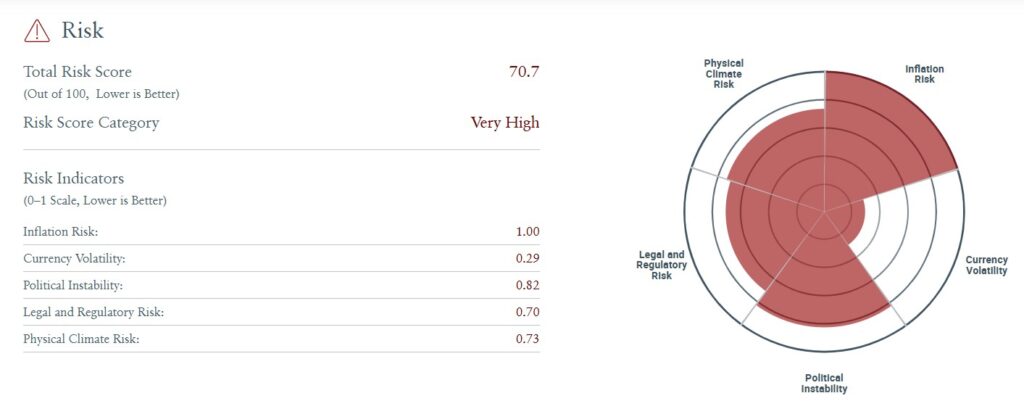

The report cited “significant political instability, weak governance, and limited innovation” as key factors constraining resilience in countries like Pakistan. It noted that these conditions have led to “minimal adaptive capacity and entrenched economic vulnerabilities.”

The publication follows last week’s Henley Passport Index, where Pakistan’s passport retained its position as the fourth weakest globally for the fifth consecutive year.

The index combines risk exposure and resilience capacity to assess countries’ ability to preserve wealth and sustain long-term value.

According to Henley & Partners, it offers “a benchmark for investors, businesses, and families to evaluate sovereign risk and identify safe environments for capital and growth.”

Henley Chairman Dr. Christian H. Kaelin described the new index as “a useful tool for understanding true sovereign risks and resilience.” He said resilience, rather than wealth or political structure, has become “the true driver of future success” amid global volatility.

While Pakistan remains near the bottom of the global ranking, recent fiscal indicators show limited improvement. Supported by a $7 billion International Monetary Fund (IMF) programme and deposits from friendly nations, the State Bank of Pakistan’s foreign exchange reserves rose to $14.44 billion by October 10, 2025 — up from less than $3 billion in early 2023.

Despite gains in reserves and remittances, Pakistan continues to struggle with slow growth and low investment inflows. Economists stress the need for export-led development, import substitution, and foreign direct investment in manufacturing and energy sectors to achieve sustainable expansion.

Although the current account recorded a surplus in September 2025, analysts warn that post-flood reconstruction spending and high inflation — projected to exceed 7% in FY2025-26 — could reignite twin deficits and stall recovery efforts.

The Global Investment Risk and Resilience Index marks the first attempt to measure national resilience by combining geopolitical, economic, and climate factors with institutional strength — a framework that, experts say, exposes how resilience is increasingly concentrated in smaller, adaptive economies.

Not surprising at all. It should have been declared the least resilient, not one of the least resilient. And unfortunately, there is no silver lining for the foreseeable future.