A memorandum of understanding (MoU) has been signed by Pakistan Refinery Limited (PRL) and the United Energy Group of China (UEG). This agreement is set to escalate PRL’s refining capacity from 50,000 barrels per day (bpd) to 100,000 bpd. The MoU was inked at the Third Belt and Road Forum in Beijing.

“Under the MoU, both parties have expressed their mutual desire to establish a strategic cooperation relationship,” states Zahid Mir, Managing Director & CEO of PRL. “This relationship is anchored in a shared interest in Pakistan’s energy sector,” Mir adds.

“In the spirit of good faith, both parties will engage in earnest negotiations to explore potential opportunities for cooperation and collaborations. These opportunities include equity investment in PRL as a strategic investor, with adequate board representation, to upgrade and grow the refinery,” Mir elaborates further.

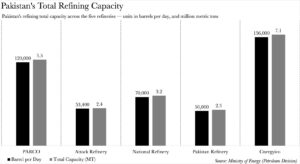

Once the new capacity comes online, PRL will ascend to become the third largest refinery in Pakistan, only surpassed by Cynergico and Parco. At present, PRL holds the position of the smallest refinery in Pakistan, lagging behind National Refinery and Attock with a capacity of 50,000 bpd.

Why does PRL want to increase capacity?

PRL’s refinery upgrade plan — formally known as the refinery expansion and upgrade project — dates back to 2021. The project aims to transform the hydroskimming refinery into a deep conversion facility. The transformation will dramatically curtail the production of high sulphur fuel oil, while simultaneously augmenting the production of commodities such as High-Speed Diesel (HSD) and Motor Spirit (MS/Petrol). The revamped complex will also yield propylene, a feedstock for petrochemicals. The upgrade is scheduled for completion by September 2024.

Why does PRL want to expand their refining capacity?

Every two months, a meeting called the Product Planning and Review Meeting is convened. This gathering brings together the Oil & Gas Regulatory Authority, the Ministry of Petroleum, and all industry stakeholders: refineries, oil marketing companies (OMC), and large state-owned consumers of petroleum products. During this meeting, local consumption for the forthcoming two months is projected and juxtaposed against local production by refineries. Any demand not met by refineries is fulfilled through imports. Essentially, the Government legally ensures that refineries have customers.What do refineries need to do? Merely exist and continue refining.

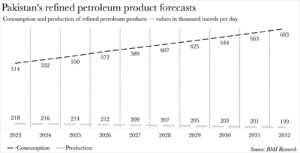

Despite grappling with soaring prices and rampant inflation, Pakistan’s demand for refined petroleum products is projected to escalate at a compounded annualised growth rate of 3%, reaching 682,970 bpd by 2032. A significant portion of Pakistan’s petroleum products — approximately 70% of petrol and 55%-60% of HSD — are imported. Why? Our refineries simply lack the capacity to meet local demand. This scenario provides PRL with a sustained market and customer base to tap into. The only bottleneck to their sales is their refining capacity.

However, there’s more to this than just profit. As the primary shareholder of PRL through their ownership of Pakistan State Oil, the Government of Pakistan has a vested interest in ensuring that as much of the projected 682,970 bpd demand by 2032 is met by local refineries, rather than through direct imports of petroleum products.

“We have ample room for refining locally. More investment is required to bolster local refining capacities to reduce the refined product import bill,” articulates Hassan Tahir, CEO of Hi-Tech Lubricants.

Projections based on the current installed capacity suggest that Pakistan’s domestic capacity will be inadequate to meet local demand from 2023 to 2032. As a result, Pakistan is expected to import petroleum products averaging 389,000 bpd annually over this period.

The forthcoming expansion of PRL is set to dovetail seamlessly with Cynergyico’s strategic pivot from a crude-to-fuel to a crude-to-chemical refinery. This metamorphosis presents a dual opportunity: a commercially enticing proposition for PRL, and a chance for their principal shareholder to stem the tide of imports.

“We need products like base oil for the production of lubricants, and polymer/resin for the local packaging of high-density polyethylene products in Pakistan. There is a substantial market for such raw materials, which are currently being imported,” Tahir clarifies.

“Upgrades are imperative for our oil refineries to manufacture products that align with high-end OEM specifications,” Tahir continues. “Owing to the non-availability of local raw materials, most high-end industrial OEM products are imported. For instance, semi-synthetic and fully synthetic lubricants,” Tahir further elaborates.

WITH THE HELP OF A RECOVERY EXPERT YOU STAND A 90% CHANCE OF RECOVERING BACK YOUR CRYPTOCURRENCY IF YOUVE BEEN A VICTIM OF FAKE INVESTMENT SCHEMES.ILL RECOMNMEND A PROFFESIONAL WHO HELPED ME WITH MINE WITHOUT ANY UPFRONT PAYMENTS THE BEST I COULD DO TO SHOW APPRECIATION IS TO GIVE REVIEWS ABOUT HES GREAT WORK ILL ADVICE YOU CONTACT [COINSRECOVERYWORLDWIDE]

@

G

MAiL

[.]

COM

HES THE BEST IN THE SERVICE

Pakistan better move into furnace oil cracking refinery. Installing more refineries to produce furnace oil wont fix the issue

all these information, Articles, agreements and work in progress between all these things people of pakisatn wish to be a get benifit one day.

This is an exceptional moving article. You have pointed out some fantastic points, thank you Regards

I think it will help a lot. I like your informational views. Such a nice article. This article is very helpful to me. Thanks for wite this article.

Is this part of BRI, there is no mention of BRI in the article.