The State Bank of Pakistan (SBP) has released the calendar of Monetary Policy Committee (MPC) meetings for the remaining fiscal year. The schedule indicates that the central bank intends to conduct four meetings in the latter half of the current fiscal year. The first meeting took place on January 29, 2024, with the subsequent meetings scheduled for March 18, 2024, April 29, 2024, and June 10, 2024.

All eyes are set on the central bank as the market is expecting a rate cut that would finally bring the policy rate down from the peak of 22% which has been maintained since July 2023.

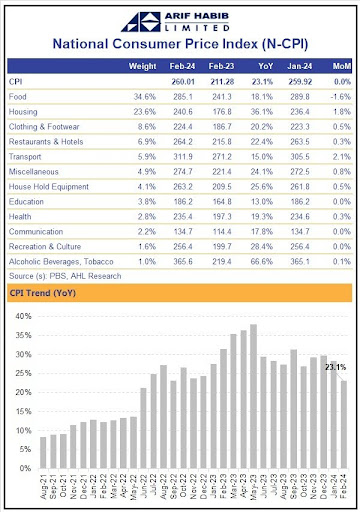

The latest inflation figures released by the Pakistan Bureau of Statistics (PBS) on March 1, 2024 have sparked renewed optimism for a reduction in interest rates. The Consumer Price Index (CPI), a measure of inflation, stood at 23.1% on a year-on-year basis in February. This latest figure marks the lowest inflation rate the country has witnessed in the past 20 months, showing a significant decline from the peak of 37.97% recorded in May 2023.

In its monthly economic update and outlook for February, the Ministry of Finance projected inflation to clock around 24.5-25.5% for February while anticipating further easing to 23.5-24.5% in March 2024. However, the CPI clocked in at much lower levels than expected. The number was also much lower than CPI recorded in January 2024: CPI inflation increased by 28.3% on a year-on-year basis.

The country has been grappling with persistent inflation, prompting the State Bank of Pakistan (SBP) to keep interest rates at historically high levels. One of the IMF’s conditions for its standby agreement was to uphold a stringent monetary policy to curb inflation. This stipulation implies that a rate cut can only be considered if the inflation rate drops below the current interest rate.

Navid Goraya, Chief Investment Officer at Karandaaz Capital, in an earlier conversation with Profit remarked, “The fight against inflation reigns supreme, and any policy adjustments will be scrutinised through this lens.”

The latest inflation figures have already led to the market pricing in an expected rate cut. The Karachi Interbank Offered Rate (Kibor) declined across all tenors on a day-on-day basis reflecting the money market’s reaction to low inflation and anticipation of an interest rate cut in the next monetary policy review.

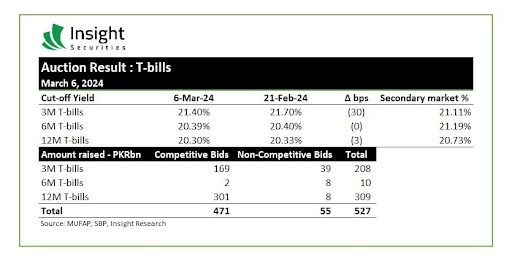

The government securities also followed a similar trend. “In today’s (March 06) T-bill auction, the government has raised Rs 527 billion, with the majority of the amount accepted under the 12-month T-bill. Yields fell by approximately 30bps for the 3-month paper, while the 12-month instrument recorded a decline of 3bps,” read a statement from Insight Securities.

Yields in the secondary markets have already been declining. According to a report by JS Capital, secondary market yields witnessed a sharp decline of around 250bp from mid-September 2023 to January 2024.

So is the rate cut on the horizon?

As mentioned earlier, a rate cut is contingent if the medium term inflation rate falls below the current interest rate. This is when real interest rates will turn positive. The recent CPI figure of 23.1% is building a case for real interest rates to turn positive. “Policy Rate Impact of the higher base effect, becoming more pronounced from here onward, has been building a case for real interest rates to turn positive” read a JS Capital report.

The report anticipated disinflation to continue: “Given the high base effect we expect disinflation to continue where we expect real interest rates to stand at 217bp on March 2024 CPI projections (+100bp MoM), expanding to 413bp on April 2024 expected CPI levels (+100bp MoM), barring negative CPI surprises.”

However, Pakistan is currently at an economic crossroads with the impending final review of the SBA with the Fund set for March 2024. With the new government in power, the primary focus is on engaging in a new extended IMF program, which would entail further fiscal consolidation and phasing out of subsidies specially in the energy sector which can reignite inflationary pressures. “Recent concerns on the expected inflationary impact of prospective reforms under the IMF have however dialled down the quantum of rate cuts at the start of the likely monetary easing cycle,” read the JS Capital report.

Yet, there is a growing consensus among analysts that the trend of monetary easing is likely to commence with the upcoming MPC meeting in March.