Let us begin this with a question – twenty years ago, when young professionals starting their first job or small business owner went to open their first bank account, how would they know what bank to give their business to? The very basic factors they might have looked at back then is which banks would charge lower fees and interest rates, which bank has better-trained staff, and which bank might offer better security, discounts and services. Realistically speaking, in Pakistan, another concern might have been which bank was close to the person’s house or place of work — considering the fact that at that time the concept was “kaam sirf original branch sai ho ga.”

Much has changed since then. For most people signing up for financial services today, the most important factor determining what bank to choose is how easy and reliable a bank’s mobile application is. That is because as the ‘banked’ population of the country grows, the demographic of people that need financial services is also changing. This means that there are new priorities. For most people, quick and simple transactions on a reliable mobile phone application are key.

Changing landscape

In today’s fast-paced world, digital banking has emerged as a cornerstone of the financial services industry. Pakistan is a growing consumer market of smartphone technology and mobile data internet connections. With digitalization at its early stages, the 3G/4G penetration rate in the country stands at 35.21%, which means more than 74 million subscribers are connected – numbers that are supposed to continue to swell. Over the past few years, this permeability has meant that banking through phone applications has become more common too.

Collectively, banks and EMIs processed 844 million retail payments amounting to PKR 128,470 billion during the quarter. Perhaps most noticeably, 47% of these transactions were funds transfers while 6% were bill payments and mobile top-ups, indicating the importance of digital banking services.

It is clear that as technology continues to evolve, the relevance and importance of digital banking cannot be overstated. Digital banking has become indispensable in contemporary society offering multiple advantages. Conversations with customers reveal a pattern in which the most important factors include:

- Accessibility and Convenience

- Enhanced User Experience

- Cost Efficiency

- Security and Fraud Prevention

- Financial Inclusion

The rise of digital banking aligns with the changing behaviors of consumers, particularly younger generations who are accustomed to technology. Millennials and Gen Z prioritize convenience, speed, and digital solutions, making them more inclined to use digital banking services. As consumer expectations evolve, banks must adapt to remain competitive, prompting a broader industry shift toward digital-first strategies.

UBL’s digital revolution

In an age where technology is reshaping the financial landscape, United Bank Limited (UBL) stands out as a pioneering force in the digital banking sector. With a robust strategy focusing on innovative digital solutions, UBL has quickly emerged as one of the fastest-growing digital banks, catering to a tech-savvy clientele that demands convenience and efficiency.

Click here to follow a link to UBL Digital’s website

UBL’s digital drive focuses on introducing unique products while maintaining high quality in general services every bank might offer. One needs to look no further than the new groundbreaking feature offered by UBL whereby customers can deposit cheques digitally through the UBL Digital App. A cornerstone of UBL’s vast and diverse digital landscape, UBL has transformed the cumbersome task of handling physical cheques by introducing this convenient facility.

This offering streamlines transactions and reduces the risks associated with physical cheques, such as loss or fraud. This innovation is particularly advantageous for businesses that rely on quick, secure payment methods to maintain their cash flow.

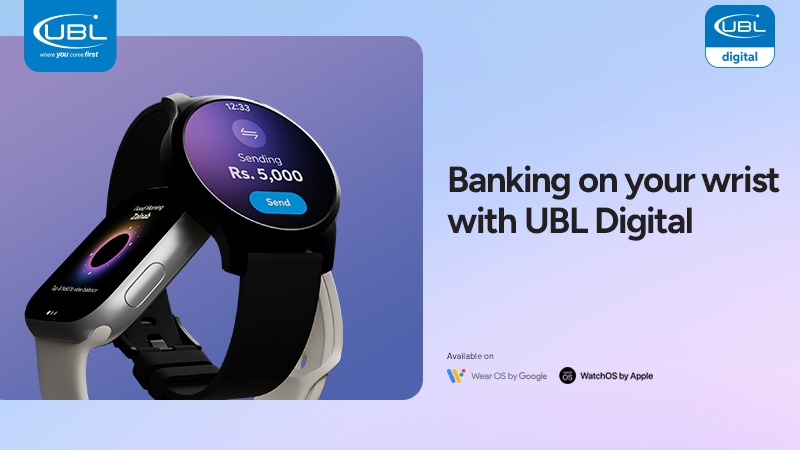

Embracing Digital Wearables

Another of UBL’s standout offerings is its integration with digital wearables. Remember how we mentioned in the beginning the number of retail transactions that are digital has risen to 83% in Pakistan? The UBL wearable is the next leap in Pakistan’s digital banking. It is a device that allows customers to easily access their accounts, check balances, and even make direct payments.

UBL’s commitment to integrating banking services with wearable technology ensures that customers remain connected to their finances at all times. This level of accessibility not only enhances user experience but also aligns with the fast-paced lifestyles of modern consumers.

Commitment to Security and User Experience

As UBL ventures into these digital innovations, security remains a top priority. The bank employs cutting-edge encryption and multi-factor authentication protocols to ensure that customers’ financial information is safeguarded against cyber threats. By prioritizing security, UBL builds trust with its users, reassuring them that their digital banking experience is not only convenient but also secure.

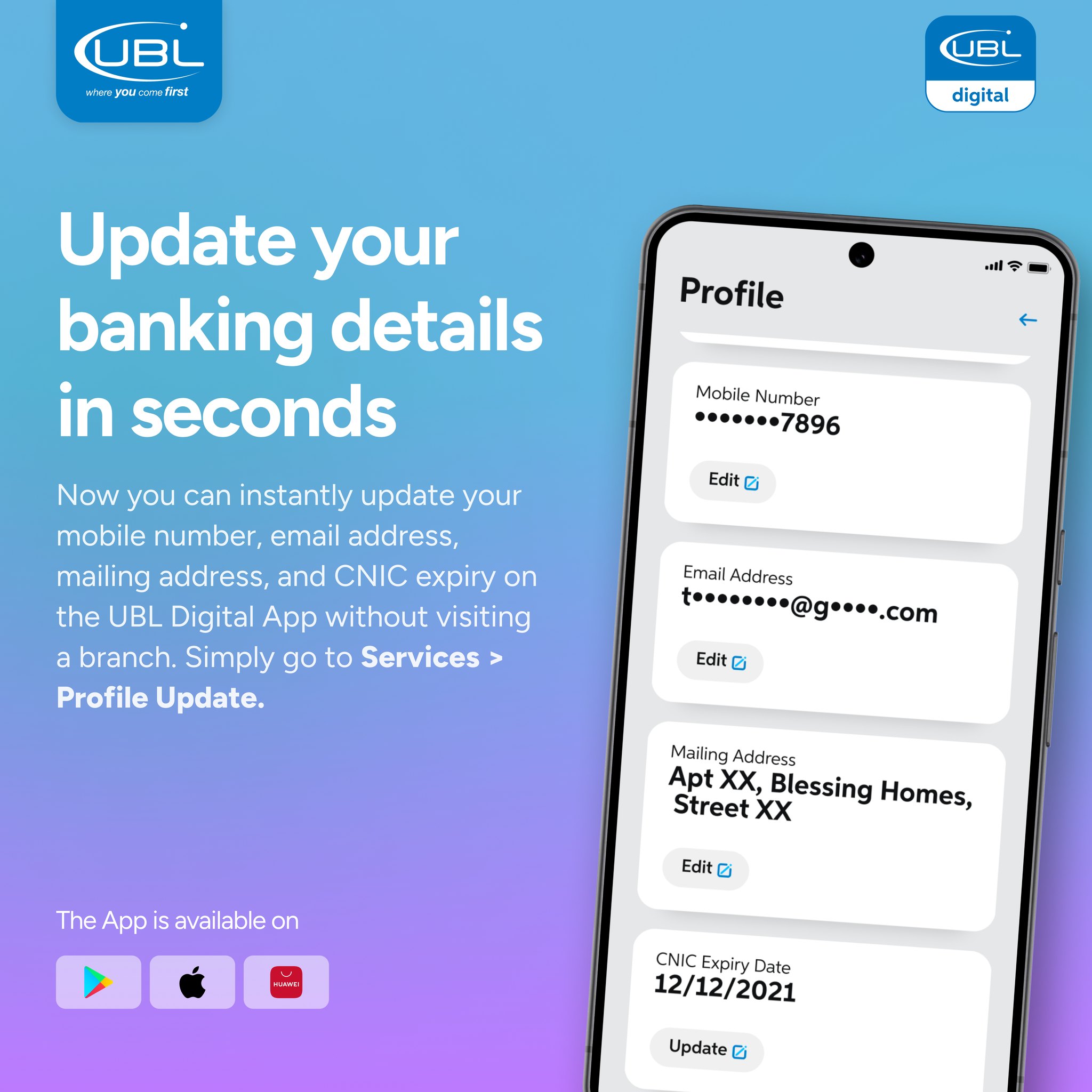

Moreover, UBL’s user-friendly mobile app is designed to enhance the customer experience. The app’s intuitive interface allows users to navigate various banking services effortlessly, from fund transfers to bill payments. These multiple security features further streamline access, making it easier for users to manage their finances on the go.

UBL is at the forefront of the digital banking revolution, offering innovative solutions that resonate with the needs of contemporary consumers. As the financial world continues to evolve, UBL’s commitment to embracing technology while prioritizing security and user experience positions it as a leader in the digital banking sector. For those seeking a modern banking experience that combines speed, convenience, and cutting-edge technology, UBL is undoubtedly the best and fastest emerging digital bank, redefining what banking can be in the digital age.