The Grand Central Terminal in New York is, by some measures, the largest train station in the world, covering 48 acres in the heart of midtown Manhattan, with 44 platforms serving 56 tracks – more than any other train station on the planet. Its main concourse is one of the most filmed locations in television and movies. Small wonder, then, that nearly 22 million tourists visit it each year.

As you leave the station from its southwest exit, you will find yourself across the street from (by New York standards at least) a nondescript building called One Grand Central Place, a 53-storey structure located on East 42nd Street. It is in this building, on the fifth floor to be precise, where the New York branch of Habib Bank Ltd (HBL), the largest in Pakistan, is located.

It is in this anonymous office, on an unremarkable floor of an unremarkable building in Manhattan, almost 11,671 kilometers from Habib Bank Plaza in Karachi, that is located the branch office the shady financial dealings of which resulted in Habib Bank becoming the first bank in history to be practically ousted from the United States by the New York State Department of Financial Services (DFS).

How did this happen? What did Habib Bank do wrong? What are the consequences of this punitive action on Habib Bank and Pakistani banks in general? And most importantly, will anyone be held accountable for this national embarrassment?

Before we dig into the accountability debate, however, we would like to give a little background to those who missed the most significant business news development of the previous month.

In an order dated August 25, DFS sought to impose a penalty of $630 million on HBL’s New York branch, saying the bank’s American operations failed to comply with its Anti-Money Laundering Laws and Bank Secrecy Act, and booked it in 53 violations of the state’s rules, regulations, orders, and agreements committed to by HBL itself since 2006.

Repeated failure, for over a dozen years

The DFS report states that except 2009, violations of laws occurred in every exam cycle in the last decade. An examination in 2015 demonstrated HBL’s compliance function had deteriorated even further. The bank admitted to deficiencies in its compliance with the ‘written agreement’ and notified this to the Pakistan Stock Exchange. A year later, the DFS conducted another exam determining that the New York branch continued to suffer from severe weaknesses in its risk management and compliance with its laws.

“The head office screening appears to be as weak as that of the Branch itself – if not even more inadequate,” the Department said in its report. For these reasons, DFS’ most recent examination determined that the Branch should receive the lowest possible rating, a score of “5.”

Besides repeated warnings, the Bank was given more than sufficient opportunity to rectify its deficiencies, but it utterly failed to do so, it said. “Indeed, presently the New York Branch is losing key compliance staff due to resignations, including its chief compliance officer.”

The report points towards the bank’s failure to screen and report transactions by a Karachi-based cyber criminal who is on the FBI’s most wanted list, a Chinese arms manufacturer, the leader of a Pakistani terrorist organization, an individual on the Specially Designated Global Terrorist list, and a politically exposed person – all these transactions were cleared by the bank. But HBL’s facilitation of Al Rajhi, the largest private bank in Saudi Arabia, which accounted for 24 percent of the New York branch’s total transactions, emerged as the most serious compliance failure.

The Branch’s deficiencies are all the more alarming given that one of its largest US dollar clearing accounts has been Al Rajhi Bank, the report said, adding, for many years, Al Rajhi has been linked through negative media to Al Qaeda and terrorism financing.

Specifically, Al Rajhi used HBL as essentially its front man to process billions of dollars of transactions through the United States, masking the identities of the Al Rajhi clients on whose behalf those transactions were conducted.

HBL appears to have been unaware of who the ultimate beneficial user of each of those transactions was. But a local television known for its anti-government stance claimed that the ‘politically exposed person‘ the DFS report mentioned is no other than former Prime Minister Nawaz Sharif, who was ousted by the Supreme Court of Pakistan for concealing information during the investigation of the Panama Gate scandal.

The program host showed on his screen details of transactions he claimed were made by Sharif from his account in Al Rajhi bank that routed through New York to the former premier’s account in Standard Chartered Bank, Lahore. The host publicly challenged HBL and the former premier to prove him wrong, but an expert told Profit the details he revealed were transcripts of Society for Worldwide Interbank Financial Telecommunication (SWIFT) cables, which do not prove money laundering. “Firstly, all dollar transactions have to be routed through New York and second, they were made from Sharif’s account and were not anonymous,” the expert said. “That politically exposed person can be former presidents Asif Ali Zardari or General Pervez Musharraf or even Afghanistan’s Hamid Karzai, but we don’t know unless the details are made public,” he added.

After HBL and DFS ended the matter in a settlement, those details may never be public, that is at least what we learn from an article by Robert Kim of Bloomberg BNA, a website that writes about legal, tax, compliance, and government affairs.

“There may be revelations far more interesting than anything publicly released up to now in an enforcement action,” Kim wrote in his article on September 6, before the settlement. He was of the view, if HBL contested the case, the hearing would likely be conducted in a federal court requiring the regulator to reveal all the details relating to those transactions.

“In DFS’s Statement of Charges, the only indication of these remarkable events is the short and formulaic phrase ‘politically exposed person activity’,” he said. “Sharif and others involved in such actions will not like the exposure that they receive at the hearing,” he added.

DFS’s Public Affairs Department, too, denied comment. “We cannot comment on the details of our negotiations and discussions with our regulated entities,” they wrote in an email to Profit.

However, the report reveals that the volume of transactions involved was not small. HBL’s New York branch handled $287 billion in correspondent banking transactions in the calendar year 2015, of which nearly $69 billion was on behalf of Al Rajhi.

The problem, according to analysts who cover the stock (but wished to remain anonymous for the purposes of this article), is that HBL never felt that investing in the technology to automatically detect money laundering and other fraudulent activity was worth it for a branch that only produced total profit of $10 million over the past decade or less than 1% of the bank’s total profits during that period.

According to the analyst, the compliance cost for DFS’s 2015 Order would have been too expensive to have been borne by the relatively small New York operations. So instead of deploying an automated detection system, the bank chose to do it through human analysis. To make screening easier, they reduced the volume of transactions monitored by capping it at $150 billion per year, far lower than the $206 billion the regulator required from them. Though risky, the decision was based on cost benefit analysis, he said.

HBL management made three major mistakes, said the analyst. They preferred human analysis over automation, they turned down DFS when it offered a settlement on a significantly lower amount earlier this year, and they didn’t wind up US operations in 2015 when they received a serious warning.

For these violations of the US law, the state regulator initially announced that it would seek to impose a $630 million penalty. By settling the dispute with DFS, and by agreeing to shut down its New York branch, HBL was able to get that penalty reduced to $225 million (Rs23.5 billion), equal to earnings of last three-quarters.

HBL had been operating its New York branch since 1978, and was one of only three Pakistani banks to have a presence in the United States (the other two being the National Bank of Pakistan and the United Bank Ltd). With the closure of its branch, HBL will now rely on banks like JPMorgan, Deutsche Bank and others for its correspondent banking needs.

By offering to close its New York branch and as a result paying a reduced $225 million penalty, HBL may have done away with a stringent regulator, but that doesn’t solve the main issue: its failure to adequately monitor for money laundering and terrorist financing.

Whether it is the lack of banks’ cyber readiness or monitoring of money laundering, the State Bank of Pakistan seems to be sleeping, said one bank compliance expert. “How come the FBI’s most wanted cyber criminal was able to open and run multiple accounts with HBL in violation of the SBP’s KYC requirements?” he said. “Some Pakistani banks are doing money laundering presently and we are also bringing in Chinese money,” the expert said.

“The cost of management’s failure will now be borne by all shareholders,” an official said adding such mistakes are not expected of a leadership that has a vast work experience in large American financial services firms and are familiar with America’s regulatory environment — the CEO, Dar has spent 18 years in Bank of America and also served Citibank while Manochere Alamgir, Country Manager for NY branch, has worked with JPMorgan Chase Bank for more than 28 years.

The market reaction

Shortly after the damning report had hit the market, HBL’s stock came crashing down.

“Habib Bank’s shares have had their worst two days in nine years dropping by its limit after reports that NY regulator wants to fine them,” Bloomberg correspondent Faseeh Mangi tweeted on August 29. The bank’s shares were sold at about 20 percent below the market price in off market trades, he said.

With analysts yelling ‘sell’ and investors heeding to their shouts, HBL’s stock has witnessed its worst two weeks ever. After hitting its lower cap (5 percent of opening rate) for six consecutive sessions, it lost another 4.6 percent to settle at Rs152.94 per share – its lowest level in three years, at the close of market on Thursday last. This translates to an almost 30 percent decline from Rs218.11 – its price before the DFS’ damning report went public.

The market reaction clearly indicated investors were losing confidence in Pakistan’s largest private bank that sits atop Rs2.5 trillion worth of assets (as of December 2016). And just when talks regarding the top management’s accountability started doing the rounds, HBL eked out a settlement with the Department.

Perhaps HBL’s offer to close down its US operations helped The New York State regulator to agree to a reduced fine of $225 million – still the highest ever imposed on a Pakistani bank – late last Thursday. “DFS will not tolerate inadequate risk and compliance functions that open the door to the financing of terrorist activities that pose a grave threat to the people of this State and the financial system as a whole,” it said.

The news of a reduced penalty came as a relief to the shareholders and HBL stock hit its upper cap at Rs160.58 per share minutes after the trade opened last Friday morning. Given it has 5.4 percent weight in the benchmark KSE-100 Index, an upward movement in HBL’s stock quite understandably lifted the pall of gloom from the market in early morning trade. The index heavyweight dragged an already bearish market further down, contributing more than half (947 points) to the index, which shed 1700 points between August 28 and September 7.

A difficult to live down moment

We received a mixed response from analysts over the latest development. Some were pleased, other seem disappointed. Surprisingly for people who get paid to state their opinions about publicly listed companies, none of them was willing to be quoted. It is a moment of shame, not relief, said one analyst adding that even the much-reduced fine is still humongous – especially if one considers that timely action by the management could have averted things coming to such a sorry pass.

Most analysts have estimated that the fine will have an impact of Rs16.3 per share in the ongoing calendar year, or 70 percent of last year’s earnings.

And that’s only the immediate aftermath. In order to maintain its Capital Adequacy Ratio above 11 percent as required by the central bank, HBL will have to reduce its dividend or might not even pay one for a whole year. The bank’s CAR ratio is expected to settle at 13.4 percent at year end, down from 15.4 percent of June.

Besides stripping shareholders of all the capital gains they accumulated on the stock since July 2013, the one-time payment will also result in a 6 percent lower earnings per share on average for the four-year period ending December 2021, if analysts’ estimates turn out to be accurate.

Besides, experts say there is also an intangible cost of this development. HBL had to surrender the New York State license for dollar transactions. Even if one ignores the meagre profit of an average of $1 million a year it earned from its New York operations, losing this legacy business would mean HBL is back in the same league as other banks.

Some senior bankers and experts we spoke to questioned as to why HBL could not avoid a penalty, which was inevitable as evident from the details of the August 25 order and the recent actions of the Department against large global banks who had failed to comply with its laws.

The bank had received repeated warnings about the deficiencies in its New York operations and was under constant scrutiny by the regulator, which was penalizing global banks right left and center.

Since its creation in 2011 by New York Governor Andrew Cuomo, through the merger of the New York State Insurance and Banking departments into a single financial services regulator, the Department of Financial Services (DFS) has extracted more than $8 billion in fines from some of the world’s largest banks, making headlines for its rigorous enforcement of anti-money laundering laws.

Some of those fined are global banking giants, the likes of Standard Chartered Bank, HSBC, BNP Paribas, and Deutsche Bank. “Why didn’t the see it coming and what were they thinking?” said a banker who requested not to be identified.

Profit’s queries to HBL’s management and the board’s Chairman Sultan Ali Allana of Agha Khan Fund for Economic Development – also the single-largest shareholder with 51 percent stakes – remained unanswered. The State Bank of Pakistan did not respond to our email either. We also tried to reach out to some senior bankers but most of them denied comments while those who spoke to us requested their names remain confidential.

So will anyone be held accountable? On that score, there appears to be cause for pessimism.

A culture of impunity

“And on the eighth day, God looked down on his planned paradise and said, ‘I need someone who can flip this for a quick buck.’ So God made a banker,” Marketwatch columnist Brett Arends wrote on February 6, 2013.

“…I need someone who doesn’t grow anything or make anything but who will borrow money from the public at 0 percent interest and then lend it back to the public at 2 percent or 5 percent or 10 percent and pay himself a bonus for doing so …

“…I need someone who will take money from the people who work and save, and use that money to create a dotcom bubble and a housing bubble and a stock bubble and an oil bubble and a commodities bubble and a bond bubble and another stock bubble, and then sell it to people in Poughkeepsie and Spokane and Bakersfield, and pay himself another bonus …

‘So God made a banker’

“So God made a banker…” Arends’s dripping-with-sarcasm post was actually a Wall Street parody of popular radio broadcaster Paul Harvey’s 1978 speech, ‘So God made a farmer’.

Harvey’s speech was a heartfelt tribute to America’s hardworking farmers whom he considered ‘caretaker’ of God’s planned heaven. By contrast, the Marketwatch columnist took a jibe at bankers implying the latter make quick money by doing nothing.

Arends was criticized for his article, which many commentators said was based on mere assumptions as opposed to facts – apparently with some reason. Banking is the engine of economic growth after all, and an economy like the United States’ can collapse if big banks fail. Or why else would Federal Reserve bail them out in times of crisis?

His post also earned many endorsements and sparked a fresh debate on what remains a topic of much discussion globally: are top bankers – who receive insanely inflated pay cheques along with a host of other executive benefits – accountable vis a vis their performance?

The question is even more relevant in the Pakistani context, where banks have long been making risk-free spreads through investment in government securities instead of lending to private sector (An issue Profit has already featured in a separate report). Given they sit on a huge pile of deposits, making money from government securities is a no-brainer, still bank presidents remain the highest-paid, some say overpaid, executives in corporate Pakistan.

“Bank CEOs are at the helm of for-profit organizations, with assets running into hundreds of millions of rupees. I don’t find it surprising at all that their remuneration is relatively higher than that of their counterparts in other sectors of the economy,” a bank president said speaking to Kazim Alam for a 2012 article in Express Tribune.

The banker went on to say shareholders hold executives accountable and can fire them for bad performance – and we couldn’t agree more.

However, that claim sounds hollow when it is belied in the case of HBL’s reaction thus far to the DFS fine and its departure from the US market.

A singular lack of accountability

Market analysts argue HBL is one of the best-run banks in the country and one would have to agree as long as one ignores customer service issues at the branch level operations.

HBL offered 18 percent return on equity, highest among the big five banks in 2016. Foreign investors are in love with this stock, owning 29 percent, as of December 2016. Based on financials for the last five years, HBL is Pakistan’s best-performing bank according to an independent study by Profit. In fact, it is the only large bank of its size in the country where management faces no intervention from the board other than legal requirements – a strategy it is widely praised for.

One would argue that rewarding the top management for a good financial performance is justified, but that is only one side of the story.

“Is maximizing profits the only job of a CEO,” a senior banker who wished to remain anonymous asked. The CEO is also responsible for compliance, he said in the same breath. “This was an absolute management failure,” he said. And equity analysts, including those bullish on the stock, agreed, saying there were no two opinions about it.

HBL is a publicly-listed company and has a responsibility towards public (depositors), shareholders, the regulator and the market, a senior banker said. “When you are not able to perform well, you step down and let someone else do the job, which helps gain investors’ confidence,” he added.

Far from being laid off, the top management was not only able to retain their positions but also walked away with increments, bonuses and stock options in the years the bank was being investigated for money laundering and other compliance issues.

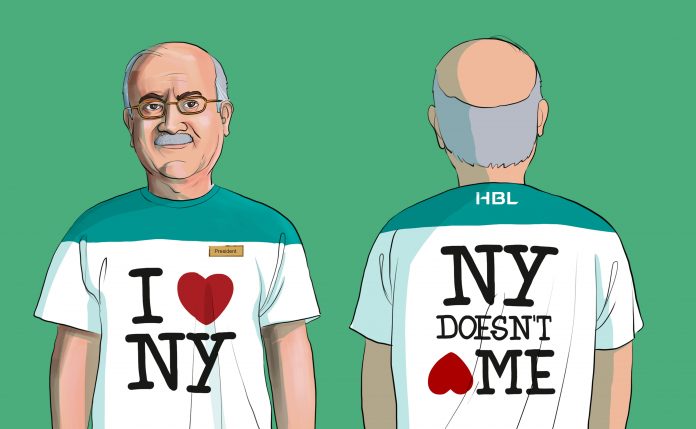

HBL’s President and CEO Nauman Karamat Dar, who is one individual with the ultimate responsibility for operational risk and compliance, received notable increments during the period the bank was under scrutiny. This was in addition to other benefits and stock options offered to him during the period.

It is difficult to calculate the exact compensation of the CEO but based on publicly available data, Dar’s annual remuneration increased by 120 percent to 81.3 million compared to Rs36.84 million of 2013. This does not include another Rs60 million the board showered on him in long-term benefits during 2015 and 2016. Moreover, the CEO was given stock-options for purchasing 373,800 shares in 2014 and another 107,054 shares in 2015.

The bank had a huge team, the senior banker said, adding the entire top management including directors is responsible for this negligence and failure. “The DFS gives you a warning long before knocking at your door. But when they come to you, they have done their work already,” he said questioning why the management did not act in time to avoid the penalty. “They [top-tier executives] earned bonuses while the inquiry was going on,” he added.

In the year ending December 2016, the directors’ remuneration increased to Rs37.2 million, up 18.4 percent from Rs31.4 million in 2015. In the same period, another Rs1.13 billion was paid to the key management personnel in short–term benefits.

Whether a group of top executives deserves to be rewarded as richly as those of HBL’s for their failure to comply with risk management shall best be answered by the board’s chairman. But the display of such largesse, say experts, can send negative signals to shareholders and investors who worry about corporate governance and senior management’s accountability when they fail.

No heads roll

“It’s perfectly reasonable for people to ask for accountability from the current leadership. However, one important aspect that seems to be missing from the debate is the accountability of the former leadership that is responsible for all the suspicious transactions processed at their time,” said Barrister Zahid Jamil, an expert on banks’ anti-money laundering laws. “It should be transparent, bringing out in the open who those people are, because they may currently be providing consultancy or advisory services to other banks or even the government,” he said.

In September 2012, Dar had replaced Zakir Mahmood who had joined HBL as president and chief executive officer in 2005. After leaving the bank’s presidency, Mahmood continued to serve on the bank’s board of directors until March 2015, according to the bank’s financial reports.

“The company’s board should fire the president and file damages suit against all other officials responsible for this penalty,” said one senior banker. The New York branch compliance officer, the country head, the legal head should all be questioned by the board, he said. By doing so, the board can demonstrate to shareholders that there is accountability, which will help restore investors’ confidence in the bank, he said, adding it will also show the regulator that the bank is taking it seriously.

Shareholders may wish for the accountability, but no one from the top management had resigned, nor did HBL’s board of directors fire any executive, as of the filing of this report. In fact, the bank’s handling of the matter implies it is not even thinking along those lines.

“The bank was not charged with any criminal wrongdoing,” said HBL CEO Nauman Dar at a press conference and at analyst briefings. “The penalty was a consequence of the bank’s outdated clearing system as a result of which its soundness and safety were compromised, and the DFS’ decision to impose such a big fine [the unrevised $630 million] came as a surprise.”

Dar admitted that the bank’s system was still using human analysis as opposed to an automated system to analyse transactions. He acknowledged the bank made mistakes but objected to the size of the fine, saying it was disproportionate. Though he hinted the bank would pay the fine if it was reasonable, Dar told the media that the bank would vigorously contest the penalty in American courts.

The hearing of HBL’s case was scheduled for September 27, but HBL signed the Consent Order for a settlement at $225 million on September 7.

The management has not fired anyone so far. Meanwhile, some of the market analysts who invest in HBL’s stock seem to throw their weight behind Dar.

“The US is a high-risk market and such fines are imposed on big banks every now and then. It is business as usual,” said one analyst. “It is a good bank and it will continue to perform well in future.”

Edited by Farooq Tirmizi in New York

While giving an analytical comment would require expending precious resources, it essentially displays poor governance at the bank. The Board of Directors is devoid of risk management parameters with apparently weak Operations oriented research at the which may enable the management to timely draw appropriate strategies to counter lapses of the magnitude that have surfaced. In-house legal counsels and those on their active panel also do not seem to be adequately involved to avert such lapses.

The repercussions of such lapses is widespread and not limited to the shareholders – a single penny lost is a loss of the whole nation….

Many banks have been fined by American regulators but why US not ask KSA to colse AlRajhi bank of Saudia which is said to be maintaining accounts of Al Qaeeda a terriorist organisation.

@Imran Zaheer: Whether they cloase AlRajhi or not, the question is what was going through the minds of Directors of HBL? I can only think that they were either compelled to ignore the warnings to please someone. Who? I think is any body’s guess.

The CIA first involves the Poor Pakistani banks in terror related transactions, then when their work is no longer needed, the banks are penalized and closed. This is what had happened to BCCI in 1990s post-Soviet Afghan war period (http://www.historycommons.org/timeline.jsp?before_9/11=sovietAfghanWar&timeline=complete_911_timeline). Also please see the documentary Fahrenheit 911 to understand how terrorism is financed. That is the reason why Alrajhi will never be touched.

This is United States of America. Number One terrorist country in the world. Number One Facilitator of world wide terrorists including Israel, and Saudi Arabia. Number One Arms supplier to the world, encouraging countries to fight each other and earn billions and billions and trillions of dollars by selling Arms. Giving them forced Long Term Loans to pressurize the countries. Permanently established a very specialized department in Pentagon Washington D.C. planning and executing conspiracies against Muslim World, specially creating differences by threatening them. Weakening them economically by targeting and damaging their Financial Institutions on the grounds which every single American bank practices in the U.S.

For Pakistan the first target was BCCI – Bank of Credit and Commerce International and now HABIB BANK.

This is a very brief introduction of the United States of America.

What about the shareholders’ loss? Can they not sue the bank, because it was the fault of the management and repeated warnings were given? If a cashier losses money by mistake, he /she is made to pay from their salary! What does the law say on the rights of shareholders?

There is no loss to share holders. Shares market goes up and down for different reasons every single day. It is a high risk game. You can not claim any compensation at all. You should know about it. Don’t be selfish. If this is happening with HABIB BANK it means it is happening with Pakistan. Get ready for further losses for Pakistan. You have to stand strong. Our enemies (one of them USA) despite their criminal efforts to damage Pakistan will never succeed.

It’s is another bad reputation on the Pakistani bank. The harsh words used by DSF USA is another thrash on Pakistani Nation. All responsable including Chairman and the President should also be penalized. HBL has to face it due to the “Aahh” mean unfair with their staff and snatching / dacoity on the payable dues which were reduced by two third if anybody calculate it sensibly.

Habib Bank has always been a rotten egg and this is not new. Since last many years, they have tormented me by committing fraud, forgery, tampering of loan documents, illicit financial deals, harassment, threats, blackmail, slander, defamation and perjury. I have finally managed to Sue HBL for USD 3 million in a local Court in Sindh. I cannot write a great deal as the matter is Sub judice, but several links can be followed to the facts of the matter @ https://www.scribd.com/document/359491664/Habib-Bank-Limited-Sued-by-Khalid-Memon-for-USD-3-Million#

I worked in the tiny,dingy branch of Habib Bank Ltd. in the Lincoln Building on E.42-nd Street in New York City for three years from 2007 to 2010 as a consultant on their AML-Compliance project.The office was a joke ! A tiny one room operation in a drafty,old and run-down office. Most of the full-time employees were Pakistani and all the officers were. The few American employees were the temporary consultants on the mandated compliance project that the gov’t also was overseeing by the Federal Reserve Bank. This office was implicated in money laundering and terrorist financing. They had links to banks in Pakistan and the Middle-East,where they funneled funds through the U.S.via U.S.Dollar correspondent bank accounts on their books. Terrorist organizations like AL-Qaeda, Al-Shabab and ISIS were all implicated.They also ran a clearing through that office of foreign checks,bank drafts and traveler’s cheques. Deposited there from Pakistan and then disbursed into correspondent bank accounts in the names of many private citizens and companies held on their books here in U.S.Dollars. There was never any information regarding the true originators or ultimate beneficiaries of these funds either. Often only “special codes” for the beneficiary banks to use to reconcile the transfers. No KYC was ever done in Pakistan as to the legitimacy or source of funds for these proceeds. Absolutely no transparency and fraud was evident ! Millions upon millions of dollars were funneled through the bank this way weekly.All this and more was going on undetected for years,until 9/11 occurred in 2001.