LAHORE: The Pakistan Stock Exchange (PSX) opened the session with a positive outlook as investors found this to be an opportunity to buy big stocks and small prices. The indices traded higher but volumes remained thin.

The week which saw the conclusion of the earnings season saw indices drop and lift up again to end at the same level where it initiated trading this week. Foreign investors were net sellers for the first four days as the political noise continued to create turbulence. Majority scripts posted a fresh 52-week low opening a door of opportunity for value hunters.

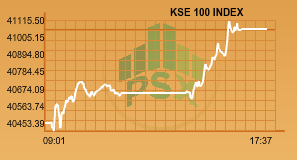

The KSE 100 index surged to intraday high of 41,115.50 with a 616.63 points increase. It settled the week at 41,064.00 up 565.13 points. The KMI 30 index jumped 1080.07 points with a strong cement sector while the KSE All Share Index inflated by 305.78 points. The advancers to decliners ratio stood at 245 to 89.

The market volumes inched lower from 116.56 million of the previous session to 115.44 million. Worldcall Telecom Limited (WTL +2.77 per cent) was the top pick of investors and 14.54 million shares were exchanged in the script. Pakistan Elektron Limited (PAEL +4.99 per cent) after hitting its 52-week low yesterday bounced to upper circuit breaker price. It recorded second top volume of 10.13 million. TRG Pakistan Limited (TRG +4.56 per cent) saw 7.35 million shares traded.

After a few tough days, cable and electrical goods sector topped up its market capitalisation by 3.14 per cent. The refinery sector appreciated by 3.14 per cent. Attock Refinery Limited (ATRL +4.93 per cent) touched the day’s maximum possible price, Byco Petroleum Pakistan Limited (BYCO) was up 2.63 per cent and National Refinery Limited (NRL) gained 2.75 per cent.

Azgard Nine Limited (ANL +3.10 per cent) posted a contraction of 3 per cent in sales for the year 2017 but managed to reduce losses and record a loss per share of Rs 0.29 against Rs 1.79 of last year.

Pakistan’s domestic urea sales for the month of October 2017 are expected to reach around 375k tons, up by 4 per cent YoY/ 110 per cent MoM, market analysts speculate, due to the onset of Rabi season demand.

Meanwhile, international Urea prices stabilised in October; the Middle East & Chinese prices ranged $ 270-280/ton, while US prices were between $ 240-255/ton. The recent strengthening in prices was driven by a host of factors; lower Chinese exports, higher coal price, US dollar weakness, and the resurgence of global demand (India imported 1.4mn tons in 3Q). Experts speculate going forward prices may remain volatile as new capacities come online and seasonal demand adjusts due to climate changes.

SEARL announced consolidated earnings of Rs5.2 (diluted Rs4.3) up 4 per cent YoY in 1QFY18, better than estimates owing to higher than estimated sales, up 18 per cent YoY. It is expected that the company keep this sales trend throughout the year with new products in the pipeline and hence warrant an upward revision in earnings.

Overall the outgoing week managed to restore loses. Oil sector was the major driver whereas Cement sector lagged behind.