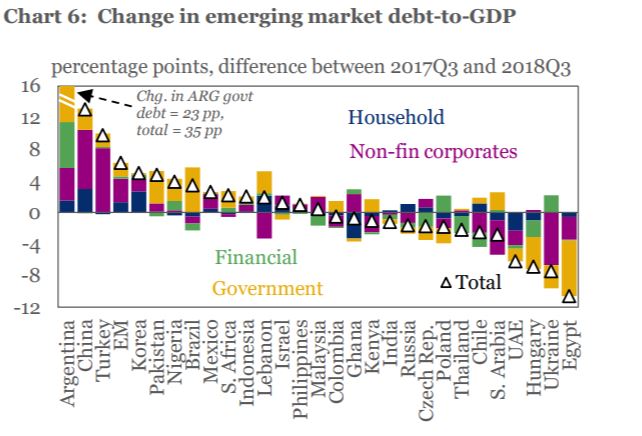

LAHORE: A report released by the International Institute for Finance (IIF) on Tuesday said Pakistan’s government debt rose to 71.2% of gross domestic product (GDP) or 3.9 percentage points in the third quarter of 2018 from 67.1% in the same quarter of 2017.

According to IIF, Pakistan’s household debt as percentage of GDP saw a meagre increase of 0.1% from 2.7% in quarter 3 of 2017 to 2.8% in the third quarter of 2018.

Also, the non-financial corporate debt as a percentage of GDP increased to 16.4% in the third quarter of 2018 compared to 15.4 in the same quarter of 2017.

And financial sector debt as a percentage of GDP contracted to 0.9% in the third quarter of 2018 compared to 1.3% in same quarter of 2017.

In a comment to Profit Sonja Gibbs, Managing Director of the Global Policy Initiatives department said, “A significant share of maturing debt in 2019 is in the rupee.

We estimate that around $96 billion of bonds and syndicated loans will mature in 2019. The US dollar accounts for only around $4 billion of that.”

“Given that Treasury bills are the main vehicle for financing the government budget, a potential rise in short-term rates (as a response to pressure on rupee and FX reserves) would make debt service more challenging,” said Ms Gibbs.

“More broadly, while the debate about specific options for Pakistan continues, IMF advice regarding fiscal consolidation, monetary tightening, greater exchange rate flexibility is certainly applicable as countries seek ways to reduce debt-related vulnerabilities and build external buffers,” she added.

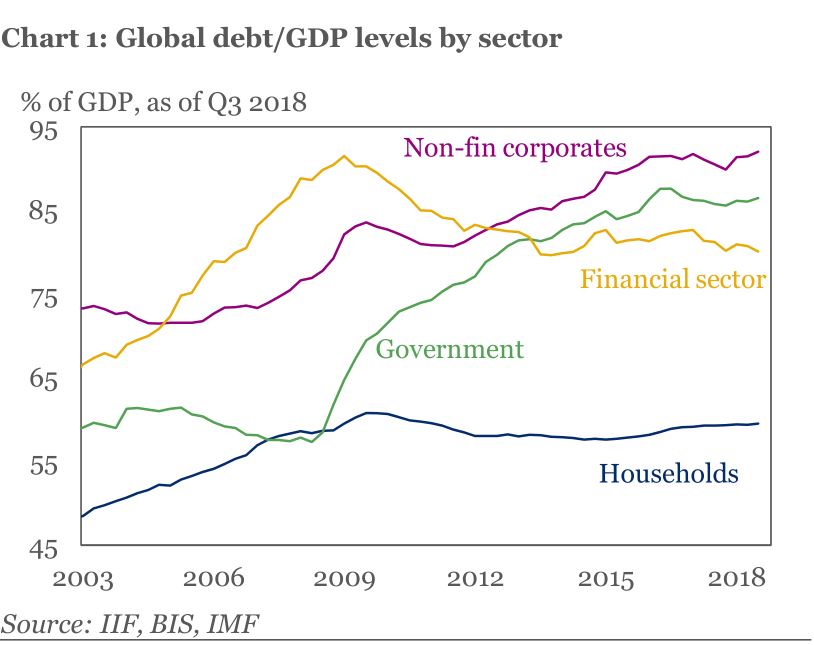

The IIF’s “Global Debt Monitor” report highlighted that global debt had risen by over 12% since 2016, touching $244 trillion or 318% of GDP in Q3 2018.

This is however slightly lower than the all-time high of 320% in Q3 2016, helped by the cyclical pickup in global growth in 2017/18.

It added corporate sector accounted for over a third of the rise, putting debt to GDP ratio at an all-time high of 92% of GDP.

IIF said the corporate sector (ex-financials) and governments across the globe accounted for over 75% of the global debt levels since 2008.

The total government surpassed $65 trillion in 2018 compared to $37 trillion a decade ago. In the past decade, non-financial corporate debt grew by $27 trillion to over $72 trillion last year, standing a near high of 92% of GDP.

IIF observed whilst the increase in corporate debt was centred in emerging markets, government debt exhibited a faster rise in mature markets.

Furthermore, the increase in borrowing in other sectors has been relatively slow since household credit rose over 30% to $46 trillion and financial sector debt grew 10% to around $60 trillion.

According to IIF, emerging market household debt experienced rapid growth since 2016 debt has been increasing fastest in the household sector, up by 30% to over $30 trillion.

The lion’s share of the increase in the emerging household debt is held by China, which grew by 45% to $6.8 trillion in nominal terms.

As per IIF, countries like India, Mexico, Malaysia, Chile and the Czech Republic have recorded a growth of over 20% in household debt since 2016.

In the same period, mature markets like France, Finland and Belgium have seen significant growth in household debt, said the report.

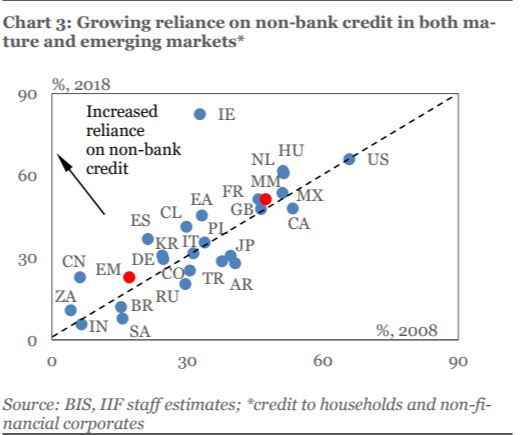

The dependence on banking financing saw a shift as corporations (ex-financials) and households around the globe have made a major switch towards non-banking financing i.e. bond markets, mortgage lenders, specialized finance companies over the last decade or so.

Especially, emerging markets have exhibited rapid growth in non-bank financing, with nearly 25% of total credit to non-financial private sector now originating from non-banks compared to 17% in 2008.

IIF pinpointed the share of non-bank financial intermediation in emerging markets exhibited the fastest rise in Chile, Korea and China whilst Argentina, Russia and Turkey witnessed a major decline.

In comparison, non-bank credit now constitutes for over 50% of credit creation vs 47% in 2008, with a wide disparity across markets like 15% in New Zealand to over 82% in Ireland.

In the U.S., big corporates (ex-financials) now get only about a third of their funding from banks, down from nearly 50% in 2007 (see our latest note on U.S. corporate debt).

In the Euro Area, bank financing has declined to about 65% of total private sector debt (ex-financials), from over 75% in 2008, partly reflecting bank derisking over the past decade.

In contrast, reliance on non-bank financial intermediation has declined in Japan (down from almost 40% in 2008 to 30%in 2018).

Foreign currency debt at multi-year highs

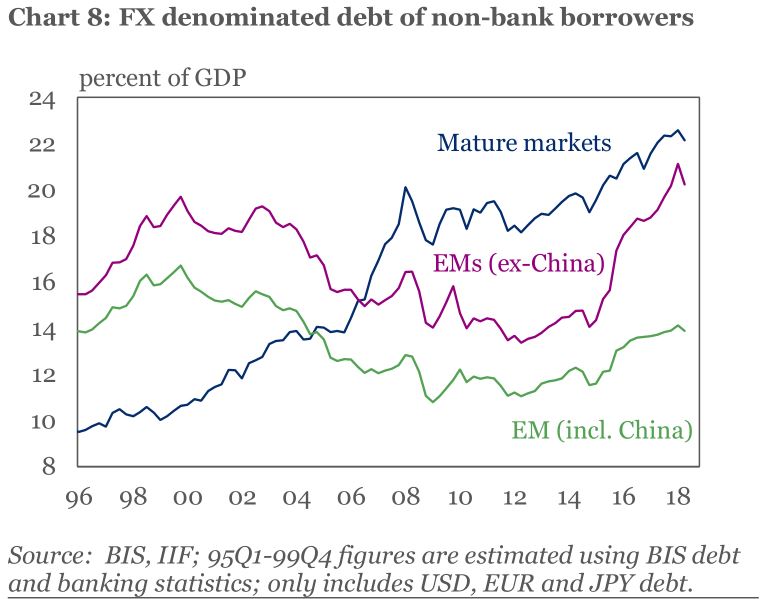

IIF observed that dependence on foreign currency debt outside the banking sector has been growing since 2014.

At over 18% of GDP, non-bank foreign currency debt/GDP is about 3 percentage points higher than it was at the beginning of the 2007/8 global financial crisis, mainly driven by mature markets.

It observed the increase has been relatively modest in emerging markets, rising to 14% in 2018 from 12% in 2014.

However, IIF stated the pace of foreign currency debt accumulation since 2004 has been a concern in some emerging market regions notably in the Middle East and Africa region.

Emerging markets to face heavy forthcoming financing needs

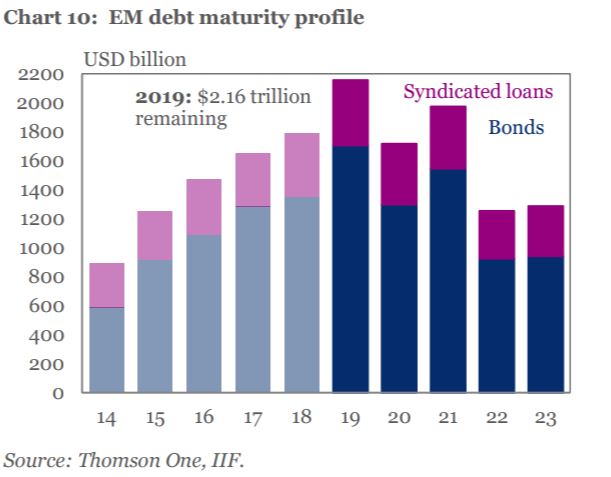

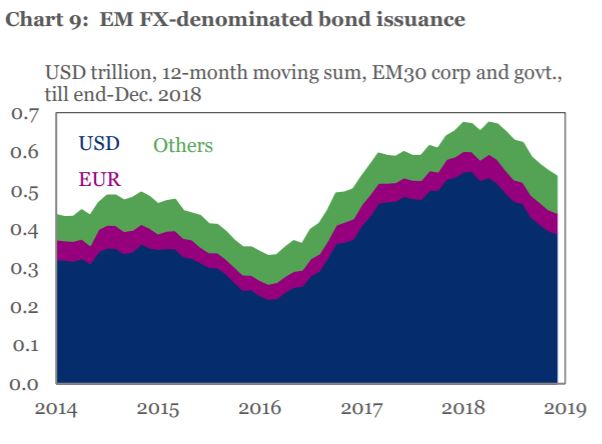

IIF highlighted around $3.9 trillion of emerging market bonds and syndicated loans are set to mature by the end of 2020, which will be $0.8 trillion for general government and $1.9 trillion for non-financial businesses.

“FX redemptions are estimated to be some $1.3 trillion. Refinancing needs in USD are relatively high for Egypt, Nigeria, and Colombia (nearly 80% of redemptions), followed by Lebanon (77%), Chile (72%), and Argentina (73%),” said the report.