Ashar Nazim is the CEO of Aion Digital one of the fastest growing Fintechs in the region. Aion Digital is a platform that helps banks go digital faster, cheaper and with certainty. It’s “digital bank in a box” approach can help augment digital capabilities of existing banks or create digital banks from scratch. As a Senior Partner at Ernst & Young, Ashar had helped transform and launch over thirty financial services institutions globally. Ashar sat down with Profit to talk about digital transformation in banking.

Q: What is your evaluation of banking digital transformation in Pakistan and where should banks start?

A: Digital transformation is a journey and we’re just getting started in Pakistan. We probably have some of the best bankers in the world but our banking can be more customer-centric. Right now we do not have direct SWIFT integration, outward remittances cannot be done without request, cheque truncation is not happening, you can’t fully open a digital account remotely, and barring a few select premium branches instant issuance of credit card and cheque book is not done. Direct debit is still not happening. However, we have a central switch and central national database for identity so the building blocks for rapid digitalization are in place. The collective will is there and banks are very receptive on the digital dialogue and planning to transform themselves with agility. It’s quite an exciting time.

I feel the first step should be culture. The culture of your organization should be aligned and everyone should be pushing to make digital happen. The buy-in for digital needs to be 3D. This means it must come straight from the board, be owned and driven by the CEO and pushed down, but it must also flow from the edges where frontline staff touch customers and back through middle office and back office. Change is scary and we must recognize people who have been in good positions for 10-15 years cannot become instant cheerleaders. We must constantly communicate and evangelize digital and be mature and empathic enough to get all of them onboard even the ones who are afraid of it. This is doable as the likes DBS and BBVA, and to a lesser degree, Nordea and Deutsche have proven.

Q: In your opinion, how will clients interact with their banks in the future? And what is your role?

A: We will see most activities that require visits to branch go digital, including specific use cases like opening a business bank account. Aion is already offering that to Gulf Cooperation Council (GCC) banks that use our platform. Majority of banking will be done using digital channels that require a smartphone. In Tier 1 cities there will be less branches but more self-service options in branches. AI will transform banking with powerful insights that help banks make better decision faster operationally and related to market and customers. Banks of the future will be built on User Experience and lifestyle banking, giving all customer-centric digital banks a key advantage.

Banks in Pakistan are finding that the right mindset, access to expertise, and ability to personalize products for customer engagement can be challenging. Aion Digital has already delivered accelerated growth in deposits, higher customer profitability and emotionally engaged customers for banks; all of this quickly and at an astonishing ROI. Our role will continue to be to work with banks and understand their growth strategies, so we can help them go digital optimally and raise their key business metrics.

Q: How can banks save cost and time with digital banking? And how can AION help in this regard?

A: Aion digital has demonstrated saving cost and time to market with digital banks already. We do this with our “digital bank in a box” model which is a very cost-effective and fast way for banks to go digital. Our “digital bank in a box” has 5 key components: Digital onboarding customers and businesses in minutes not days without the need to visit a branch. It also allows for borderless banking meaning you can open a bank account in any country in the Gulf Cooperation Council area without leaving your home country. In Pakistan obviously the regulatory environment affects this end result but our technology which incorporates everything from biometrics, OCR, Video analytics for identity to MRZ reading, is ready. Open banking makes your bank customer-centric, offering your customers convenient, feature rich and personalized products. It also allows you to respond to market significantly faster than your competitors. We offer powerful integrated payment solutions that power seamless banking experiences including bill payments and QR codes. Our platform is AI-powered allowing for our customer banks to offer hyper personalize offers with greater conversions. We are also the only banking platform in the region focused on creating a digital ecosystem powered by customized customer campaigns that transform your brand and engages emotionally with Millennials and Generation Z.

Q: When the bank is totally digital, how it will keep the loyalty of the clients?

A: This is a good question. If you simply transfer conventional banking mindset to digital banking, you will be challenged to keep loyalty of clients and win the battle of secondary accounts. The key is to move from a product-centric mindset to a customer-centric mindset and offer products and services that seamlessly embed them into a customer’s lifestyle. For the young, half of the loyalty is convenience. Give it to them by understanding their lives and financial needs and giving them excellent customer service. With Careem, Netflix and several apps providing high levels of convenience and customer service the expectation of customers with banks have become much higher. Banks have to meet these high standards. Data helps greatly. Aion Digital is powered by AI which allows banks to offer hyper-personalized products to customers thus delighting them. Our platform also brings purpose back to banking using our unique loyalty program and inbuilt social nudges which clients have responded to very positively.

Q: A lot of digital banking initiatives in Pakistan seem to not deliver intended benefits. Is there a best practices roadmap or a playbook banks can use to better their odds of success?

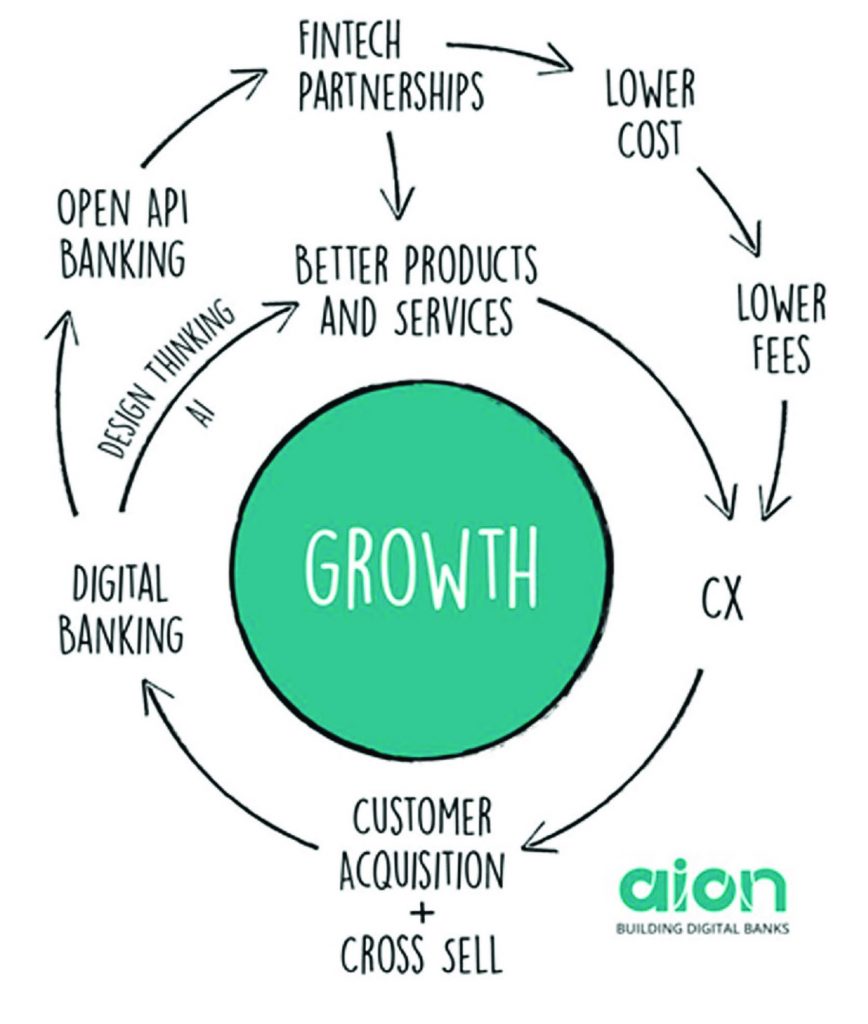

A: Look this is the part of the painful process of digitalization of any category. The central question is how can banks unlock the power of digital banking to realize the opportunities that come from this disruption. You have to be cognizant of the fact that the filters of regulation, economic conditions and domestic conditions of victory affect any global best practice. Having said that the Aion Digital “virtuous digital banking cycle” helps here. Inspired by Jeff Bezos’ flywheel that he used to explain what was powering Amazon, the cycle is a seamless business model which explains how digital banking can augment legacy banking to power the ultimate goal of digital transformation: Customer centricity that results in growth.

Digital banking combines with experience design and AI to result in better products and services which provide a better customer experience. This results in accelerated customer acquisition and cross-sells validating the investment in digital banking which then continues the core cycle. There is a secondary cycle that leads from Digital banking. This uses Open API banking to create FinTech partnerships that result in demonstrated results. You not only get better products and services, but you get to provide financial services at a lower cost allowing you to offer lower fees further powering the customer experience. n

Habibullah Khan is a freelance contributor and a PR professional