“The automobile is an expensive commodity – a consumer durable you don’t forget buying for the rest of your life. You have your house then you have your car. And just like a house, you have a lot of expectation from your car. It is your status symbol. You drive it everyday. It has hundreds and thousands of moving parts all working in tandem such that it can either be a delight or a nightmare” says Danial Malik.

Danial is a man that understands the importance of a car. He knows how integral it is, just how pervasive its presence can be in a person’s life, and just how much people care. He is by no means a raving petrolhead, but he has an appreciation for the more romantic aspects of automobiles. This connection and understanding to cars will help him in what he is setting out to achieve, for Danial is the CEO of Master Motor Limited, a joint venture between Master Motor Corporation and Changan International Corporation with a 70:30 equity partnership. And with this, he wants to bring Chinese cars into Pakistan to compete with the existing, established Japanese brands.

Masters of industry

Master Motor Limited, of course, is part of the Master group, best known for their Molty Foam mattresses which were put into the market by Danial’s grandfather, Riaz Malik, back in 1963. One is naturally taken aback of course, few people know just how extensive the Master group is beyond their mattress business. Master Enterprises, under the banner of which Danial’s grandfather sold Molty Foam mattresses, was a joint venture with Bayer A.G. of Germany to manufacture foam mattresses in Pakistan. The term ‘Molty Foam’ soon enough became the household shorthand for mattress. But the group’s exploits were far from over, and it went to new heights after when Riaz Malik’s three sons Naveed Malik, Najeeb Malik and Danial’s father Nadeem Malik took the company’s reins in their hands. Over time, the group further diversified into textile, chemical, engineering, power, retail and furniture sectors successfully. Now, with the third generation of the family involved in the business, the group has 16 manufacturing facilities all over Pakistan with distribution and supply chain network throughout the country. According to Danial, the Master group directly employs 20,000 people.

But their involvement in the automobile industry is one that can be traced right back to their initial beginnings as a mattress company. The group entered the industry in the most innocent of ways – making car seats. Four years later, they had made inroads into the textile industry and has furnished most of its need for seat covers from there. During a visit to the Master group’s autopart facility, Procon Engineering, one can see seats being made for Toyota’s Fortuner to Suzuki’s Mehran. The same is true for Honda at its Lahore’s facility. Our guide at the Procon Engineering, Amanullah, explained that the group has integrated over decades from making foams to sit and sleep on, and then entered the auto industry. At Procon Engineering, other metal-based auto-parts are also made. Today, the group has two automotive plants located in Karachi with an annual production capacity of 740 buses, 9000 trucks and 30,000 passenger vehicles.

China throws its hat in the ring:

When you think China, you think communism, and dragons and Kung Fu and maybe Pandas. You don’t think cars when you think China. Cars are supposed to be made in Japan or Germany, not China. Or so you’d think. China is in fact the biggest automotive market in the world, producing a whopping 30 million units per annum. Within China, Changan is the largest automotive brand – producing 2.8 million vehicles a year, more than ten times Pakistan’s total car production.

The reason more Japanese and South Korean brands are seen globally is that the market dynamics of these countries are vastly different to China. They have small domestic demand because of population so they had to look outwards in order to grow. China didn’t need a global stage because they had enough of a market at home.

But then why the sudden interest in Pakistan? As Danial explains, the automotive industry has seen a global recession of sorts in the past year or so. “The Chinese automotive market cooled with the rest of the world. And since then, for the past couple of years, Chinese companies have been aggressively looking outwards to grow.”

There is also a deeper, more global reason for China to want to target Pakistan. Chinese cars are all Left Hand Drive, and the Right Hand Drive vehicles designed for Pakistan are being made especially keeping in mind the country is an RHD nation.

By collaborating with Master Motor, the Chinese company is not only looking to tap into the Pakistani market, but also the global right-hand drive market through their Pakistan-based facility.

“You can see all other companies have provided technical licences and support to their partners in Pakistan after the Automotive Development Policy (2016-21) but we are the first joint venture (with a global brand, Changan) to manufacture cars in Pakistan,” said Danial.

The Changan’s right-hand drive (RHD) vehicles produced in Pakistan will be sold to Changan’s distributors in South Africa, Malaysia, Indonesia and other RHD countries. If it happens, this will be the first time in the history of Pakistan that locally made vehicles will be exported out of the country on a large scale.

What’s in it for Master?

Clearly Changan has a reason to be interested in Pakistan, but why is the Master group joining hand with them to bring Chinese cars to Pakistan? It is a risky venture, Pakistan is a naturally suspicious market, and people have not yet completely warmed to Japanese import cars, even as their end is being spelled by the government, let alone be comfortable with buying Chinese cars. The impression is that “made in China” means made cheap, and the fixation with Japanese cars is will not be easy to shatter. But Danial has no qualms about the quality of his product, claiming the “made in China” label is little more than perception.

“Chinese companies like Tencent, Alibaba and WeChat are leading the world. They are bigger than their American counterparts, even though they only operate in China while the Americans operate all over the world,” he says in the defence of China.

“The final frontier for Chinese brands really is the automotive sector. And this is the most exciting and challenging frontier because the automobile is a special kind of commodity – a consumer durable that one purchases as a long term investment.”

The idea is to bring Changan passenger cars to Pakistan. According to Changan’s Director Marketing and Sales, Shabbiruddin, Changan’s goal is to bring Chinese SUVs to Pakistan that will be available in the price of a high end sedan. While the company has been hush hush with exactly what models they are going to launch, or even what they are trying to compete with, Profit’s impression was that the group is trying to bring SUVs to compete with the Honda Civic and the Toyota Corolla Grande – cars that float around in the Rs 3.2 – 3.8 million mark. A risky proposition, to say the least, especially if it is entering the market with a virtually unknown, Chinese sounding name.

For now, the company is still just working on its load carrying vehicles. It launched three 1000 cc vehicle, the carriers M-8 and M-9 as well as the seven-seater van ‘Karvaan’ in April this year. Danial said that the company has built a plant in Karachi with a production capacity of 30,000 vehicles per annum within 13 months’ record time.

“There is a textile part, there is a plastic part, it has got an engine, it has got metal, glass, paint – it has something or the other from so many different industries. That is why automotive is called the mother of all industries. It’s complicated, and changing the myth about Chinese products through this industry is going to be a very exciting challenge for China” says Danial.

Smoke and mirrors:

In Pakistan, that challenge is for the Master group alone. While Danial may have no worries about the product he is putting out in the market, perception does matter. And it is going to take a lot to change it.

Changan has an uphill task ahead of it. All other cars have a past in Pakistan. Either the companies have operated here or their cars were imported. Even now, one can sometimes still see passenger cars like the Nissan Day, Nissan Juke, Kia Sportage, or the Hyundai Santro out on the road, but Changan passenger cars have never made it to Pakistani roads. Which is why they will have to do something extra to stay in the game.

To tout their fated success, Changan likes to point out how well Chinese buses have done in Pakistan. Danial says that Master Motor, which has in the past produced Chinese vehicles such as Forland trucks – which they brought to the country in 2002 – quickly understood that it has to bring the best product from China. In the three-ton segment, Master Motor are market leader in Pakistan. It has also been selling Yutong buses in the country. “Yutong are the most sold buses in the country and it happens to be Chinese. We have partnered with Yutong to bring inter-city buses to Pakistan. We are doing its CKD production for the last four years,” he said.

For the past few decades, Korean company Daewoo and Japanese company Hino had dominated the inter-city bus market in Pakistan. Master Motor is now dominating the market with 70% market share and selling its buses at roughly 30% higher price. “So, if you ask me whether it will be difficult for us to bring out a Chinese vehicle to compete with Japanese brands, then I can only show you that we’ve done it already in the bus segment thanks to our superior quality and bus service. We have been producing at our full capacity for two years and yet we are unable to meet demand,” Danial said.

Still, one wonders whether Master would not be better off expanding their bus business rather than trying to get into the household vehicle market. After all, buses are not family cars, and family’s don’t really want rough, bulky, Chinese, practicality.

The car market has generally not looked fondly upon Chinese cars. Syed Anjum, a car dealer at a showroom at Khalid bin Walid Road, says that people were not happy with Chinese car performance.

Anjum had facilitated the sale of a FAW pickup, not even a passenger car such as the FAW V2, to a close acquaintance and had received negative feedback. While Changan is not FAW, there is a generally low opinion of Chinese products, and people aren’t quite ready to risk it with a purchase as major as a car. “Even as a dealer with a commission to make, I would not want to risk my reputation over this car. It just isn’t trustworthy.”

Others that Profit contacted were also unwilling to let go off their Sedans for a Chinese brand SUV. A major reason for such harsh opinions, again, is the comparatively low performance of FAW vehicles compared established brands like Honda and Toyota. One car enthusiast, Shakaeb Khan, said that the Changan CX70T – the car Changan is likely to try and launch in Pakistan – looks like a crossover, with its front inspired by range rover models, an overdone interior, and loaded with unnecessary minute technological trinkets that have no bang for the buck.

“Both have a 1.5 turbo charged engine with 6speed auto and manual gearboxes. None of them is a four wheel drive. Hence no offroad, which the Pakistan market expects from an SUV,” said Shakaeb, who had the chance to check out Changan vehicles during the Pakistan Auto Show held here at Karachi Expo Center in April.

He thinks that the Changan SUV, simply on its merits, might be able to compete with the Honda BRV, front wheel drive. What it can’t compete with is the much lower cost of the BRV, which is a Rs2.5 million machine for a new car with and established and well respected brand name. The Cx70T is the premium among Changan models. And while it might have better fuel economy given its 1.5 turbo engine, if it is indeed in the Rs 3.2- 3.8 million range, it will be blown away in the market by the BRV for those that want to upgrade to a cheaper SUV from their sedans.

Master and Changan are no oblivious. Changan’s Director Marketing and Sales Shabbiruddin also confessed that established brand names have been embossed on the minds of people aged roughly 50 years plus and minus five years.

“But the new generation is not like that” he argued. “They see what they are paying for and analyse whether or not they are getting value for money, and with our product, they definitely are.”

At the same time, Changan is only so flexible. They know that the demand is Pakistan is directed more towards affordable hatchbacks and Kei cars, but they will not be launching such models any time soon.

Meanwhile, Danial also admitted that there may be demand for hatchbacks or kei cars in the country, but they were helpless in the face of their parent company Changan to launch models as per Pakistan’s market requirements since the demand here was only a small fraction of what they produce in China. So in effect, the Changan-Master alliance is less about providing cars to a Pakistani audience, and more a side venture for the Gargantuan Changan.

The state of the industry:

What will become of Changan in Pakistan is yet to be seen. The Master group is confident in their investment and Changan sees enough potential in the market to take the gamble and throw some SUVs Pakistan’s way. But what kind of industry is Changan and master entering into? For Changan, Pakistan is new territory, and even for the Master group, trying to sell household cars is going to be uncharted waters.

The immediate concern is of course the original concern. Japanese companies such as Toyota, Suzuki and Honda have been in the Pakistani market for a long time. But that doesn’t mean Changan is swooping in to break the big three. Other companies including Japanese Nissan and Korean brands Kia and Hyundai have previously been to Pakistan as well, and Nissan and Hyundai will be making their second entry while Kia will be doing it for the third time, fighting for scraps and a seat at the table.

Danial is not worried though, and his easy candour is almost infectious. He certainly knows the importance of a car, and his belief cultivates confidence in the venture. “We have a clean slate and we can be whoever we want to be. And with our beautifully designed cars with the latest technology at an accessible price, why in the world would it not work?” he asks.

The joint venture between Master Motors Changan is worth $100 million at a ratio of 70:30. The top brass prides itself of managing to form a joint venture for the first time in the country’s auto sector. In all other collaborations, the foreign partner has always been there just for Technical License Agreement.

It has been alleged in the industry that under Technical License Agreements, the foreign partners generally limit the domestic partner to the task of procuring parts from them – so that they can achieve their own export growth goals, creating a clear conflict of interest. Considerable localization by such collaborations is difficult to achieve and thus not very beneficial to the host country.

And as Danial pointed out, the drastic devaluation of the rupee and high import duties has made it very important for companies to localize to remain profitable. “They (Changan) have invested in the venture so if the joint venture remains profitable, so will they. So it is also in their interest for us to localise as soon as possible.”

This would also be good for the economy at large, because more localisation would mean fewer dollars moving out of the country, giving Pakistan the precious foreign exchange that it so badly needs right now. With all this in mind, the Master-Changan alliance has vowed to achieve localisation upto 50% by 2021. For sure a bold claim, but that seems to be the flavour of the entire venture.

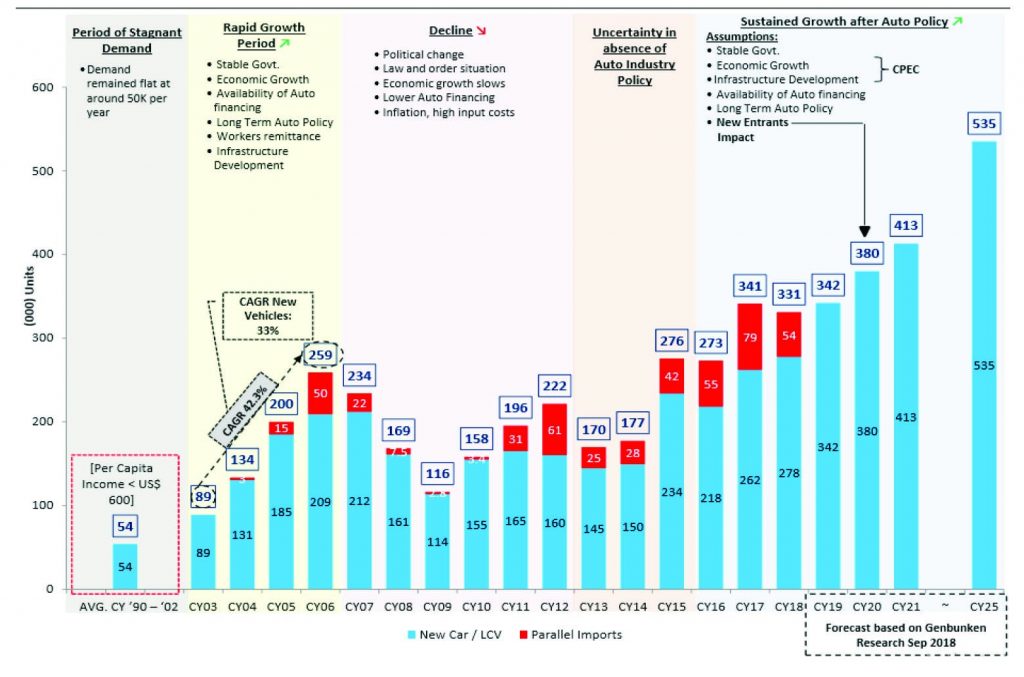

According to one study, production capacity of the auto industry may double to 600,000 units with new entrants entering the auto fray and further investment by existing assemblers. Approximately $1.3 billion will be invested by new and existing players.

The auto industry in Pakistan has huge potential due to low motorization, which is only 18 vehicles per thousand people. The government has already removed auto sector anomalies by restricting used car imports, removing regulatory duties and allowing non-filers to purchase vehicles. The next challenge is ensuring GDP growth and a stable policy environment leading to increase in vehicle demand.

However, the recent rounds of rupee devaluation, and subsequent price increase has reduced sales of established players Honda, Toyota and Suzuki.

“Apart from Toyota’s Corolla car, sales decline of the whole industry has been quite evident. Suzuki has been incurring losses in the last two consecutive quarters,” JS Global Capital Senior Analyst Ahmed Lakhani told Profit.

He said that the existing players should prepare to receive another blow from the new entrants onto the market. One thing that has been made abundantly clear by macro-economic indicators is that demand will not be increasing until at least next year.

“The worst years are yet to come for the auto industry.”

The good news for the auto car manufacturers, however, is the government’s restrictions on imported cars. The import of used cars has declined by 60%, according to reports. Commercial imports of used cars has never been legal, but it has been imported under different pretence – through manipulation of gift, baggage and transfer of residence (TR) schemes, which was supposed to facilitate overseas Pakistanis. This means that there is now a new market for local car manufacturers to target.

During the calendar year 2018, 278,000 passenger cars and LCVs were sold while another 54,000 used cars were imported – giving Pakistan a market size of 331,000 cars. Since January 15 this year, there has been a complete halt in imports of used cars due to government restrictions. Not only will the new entrants be looking to scoop up major chunks of this 54,000 car pie, they will at the same time be making an effort to cut into those that would buy from the big three otherwise. This would make sense because even though they may not be as recognisable brands, especially Changan, many of the apprehensions involved with imported cars such as them being refurbished will not exist.

Sir i m Zeeshan .

plz Recognize me

03116815000

03442301799

Just bring in CHEAP Sedans and Hatch Backs and you will see them sell like HOT CAKES !

Plz offer me one i will be your client.

In view of too narrow roads /streets network both in the urban and rural Pakistan along with population explosion, majority middle and lower middle class, there should be small and inexpensive cars to cater to the needs of majority of population.

Comments are closed.