On July 2, 2019, Pakistan’s capital markets passed a little-heralded milestone: the 10th anniversary of the launch of the KSE Meezan Islamic (KMI) 30 index, a stock market index of the 30 largest, most liquid stocks listed on the Pakistan Stock Exchange that meet the criteria for Shariah-compliant investing. For the first time, investors now have an appropriate benchmark to measure the Islamic fund management industry’s performance over a 10-year period.

Profit, in collaboration with Elphinstone, Inc., a US-based financial advisory firm focused on retail consumers in frontier markets, has undertaken an analysis of the performance of all equity mutual funds in Pakistan with a track record longer than two years. This analysis is particularly focused on funds that have a track record of 10 years or more, meaning they have been in business managing money for their clients for at least that long.

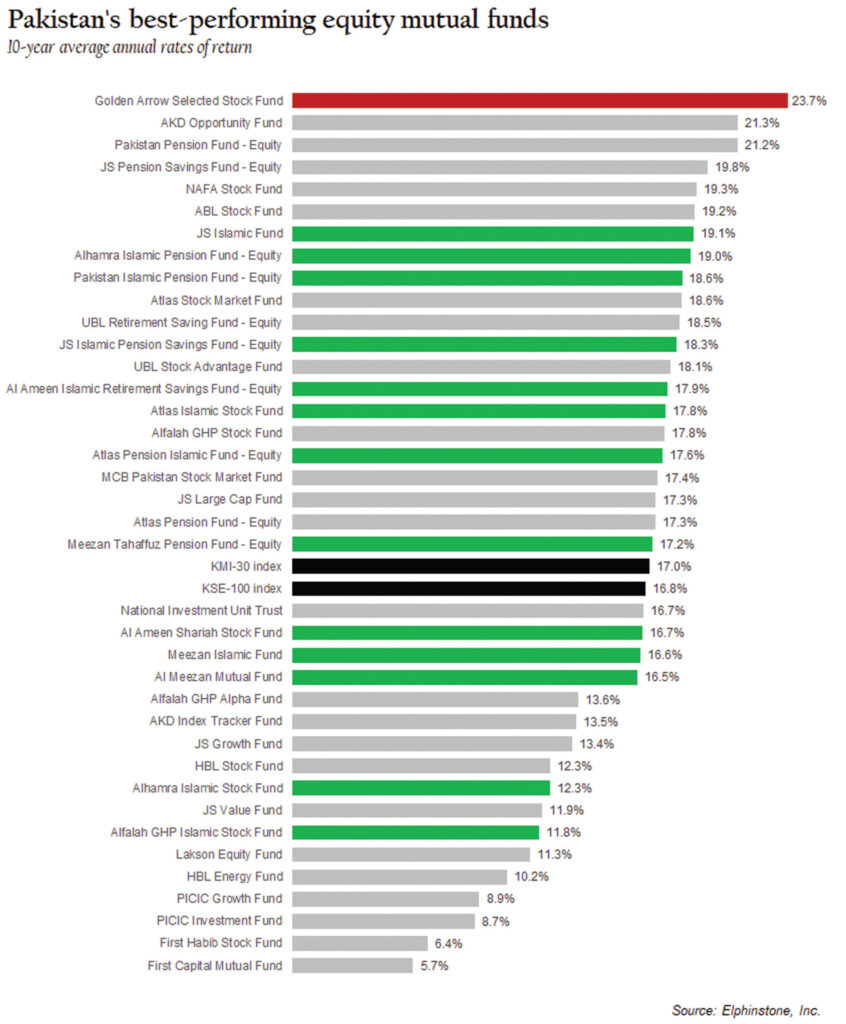

The news for the Islamic fund management industry is both good and bad: the good news is that a greater proportion of Islamic equity funds beat the benchmark KMI-30 index over a 10-year period ending June 30, 2019 than the proportion of conventional equity funds that beat their benchmark KSE-100 index over that same time period. The bad news is that there are still at least six conventional equity mutual funds that beat the best-performing Islamic funds.

In other words, if one considers equity mutual funds as a whole in Pakistan, the best Islamic fund – the JS Islamic Fund – would be middle of the pack.

This, by the way, is despite the fact that, over the past 10 years, the KMI-30 index has slightly outperformed the KSE-100 index: the former has had an average annual return of 17.0% per year for the past decade, the latter a somewhat lower 16.8% per year during that same period. So, the problem is clearly not a lack of Islamic investing options, at least on the equity side.

Why should any of this matter to you? Because equity mutual funds are the best way ordinary middle-class people can build up wealth over the long term, and knowing which funds are the best ones will go a long way towards helping you make decisions about your financial future.

But first, a primer on personal finance and the fundamentals of investing.

A (very brief) introduction to personal finance

This article will not delve into the fundamentals of personal finance in any detail, but one rule is inescapable and worth mentioning: your financial life is a struggle against inflation. Any amount of money you are saving will have to contend with the fact that money loses value over time in every country and in almost every era. That means that cash, in inflation-adjusted terms, is a money-losing proposition. Saving without investing is effectively the same and destroying your own wealth.

And any investments you make have to beat inflation over the time period that you are making the investment. This means that you need to have a good idea of what inflation is and what it is expected to be in the future. And for that, it helps to know what inflation has been in the past.

Pakistan’s economic history has had periods of both high and low inflation. The average since January 1958 has been about 7.6% per year. However, one can reasonably make the case than the Pakistani economy has fundamentally evolved since 1958, and perhaps not all of those years provide relevant data points. A shorter period that still has a sufficiently long period of data might involve the time since the end of the Zia Administration in 1988. Since that time, inflation has averaged 8.3% per year.

Which number is the more appropriate one to use as one’s personal estimate for expected inflation in the future? It might be simpler and easier to simply use 8% as one’s inflation expectation over the long run. In other words, any investment you make for a period of longer than 10 years has to beat an inflation rate of 8% per year.

Given that fact, and given people’s needs to save over long periods of time, which asset classes perform best when it comes to not just preserving your capital against inflation, but also growing your wealth over time. That question is best answered with some data.

On January 1, 1999, if you had Rs10,000 in your pocket, and you invested that money in a variety of different investment options, here is where it would stand today. To purchase the same amount of goods and services as your could with Rs10,000 in 1999, you would need Rs43,176 today, meaning any investment that you made back then that did not result in you having at least that much money today lost you money.

So here is how the investment options stack up: if you simply bought US dollars with that money, you would have Rs31,827 today. If you bought gold, you would have Rs157,254; if you had bought bonds, you would have Rs75,109. But if you had bought stocks, you would have had Rs355,956. There is, quite simply, no beating the stock market as a venue for investment for ordinary investors.

Of course, this assumes you had the discipline to stay invested and not try to cash out your money in a panic during the stock market crash of 2008 and the many mini-crashes in the middle. Investing of any kind requires self-discipline.

Before we get deeper into what this all means, it is important to address the scepticism that many people feel about the stock market, because they find it difficult to understand. The stock market represents shares in ownership of some of the largest companies in Pakistan. If you buy a stock, you own a part of the company whose stock you have bought.

‘So what?’ you might be tempted to say. Why should I invest in stocks? Because investing in stocks is the only way you can buy an ownership stake in companies that will form the backbone of the future growth of the Pakistani economy. Put another way: investing in stocks is a way to invest in the future of Pakistan.

Why mutual funds matter

The problem with that theoretical exercise is that it is just that: theoretical. You cannot simply invest in the stock market as a whole. If you want to invest in the stock market directly, you would have to open a brokerage account and invest in individual stocks, each of which has different risks and returns than the market as a whole. Your returns could be vastly different from the market average, which is what the benchmark index represents.

The most common way for ordinary investors to put money away every month, then, is a mutual fund. A mutual fund is a pool of investment created by an asset management company to make it easier for investors to invest their money without having to do research for themselves or even having large sums of money. They then take the money from all their investors, conduct their own research, and then invest the money in a variety of different investments.

Mutual funds are classified by which types of securities they invest in. A stock mutual fund, for example, is not allowed to invest in anything but stocks. A fixed income fund is not allowed to invest in stocks. A balanced fund is allowed to invest in both stocks and bonds, but cannot be invested in just one category of investment.

For the overwhelming majority of investors, mutual funds are the most logical choice of investment. There are dozens of asset management companies in Pakistan and they offer a wide variety of mutual funds.

For any savings needs (retirement, children’s education, etc.) for which you need to save for a period longer than 10 years, stock mutual funds are the best way to invest. For periods between five and 10 years, balanced funds are a better option. And for periods shorter than five years, fixed income funds or National Savings bonds are likely the best option.

The best equity mutual funds in Pakistan

Having laid out the context of why equity mutual funds matter, and why you should care about which ones are the best, we can now examine the data as to which funds have outperformed the market, which is also laid out in the chart in this story.

The good news is that the Pakistani fund management industry as a whole has a very good track record of managing investors’ money, even after taking into account the fact that they generally tend to have substantial management fees (fees of upwards of 2% are the norm).

Of the 38 equity mutual funds in Pakistan with a track record of longer than 10 years, 21 (the majority) beat the benchmark indices, and only 17 do not. Of these, 8 of the 13 Islamic funds beat the benchmark KMI-30 index, and 13 of the 25 conventional funds beat the benchmark KSE-100 index even after taking into account their management fees.

The data makes AKD Investment Management Ltd look really good compared to its rivals: both the number one and number two funds by rates of return are managed by AKD, the capital markets firm owned and run by Aqeel Karim Dedhi, the bold, brash Karachi-based stock-broker.

Maheen Rahman, CEO of Alhfalah GHP Asset Management and long regarded as one of the best minds in Pakistan’s investing business, unfortunately has had a few bad years that have knocked down her performance. Her flagship Alfalah GHP Stock Fund still beats the market, but is lagging behind some of its competitors, ranking 16th overall among equity funds.

And in what is likely to be seen as a disappointment for Meezan Bank’s brand as the best name in Islamic finance, the bank’s asset management subsidiary Al-Meezan Investment Management Ltd has a middling performance in the equity fund management business. Both its flagship funds – the Meezan Islamic Fund and the Al Meezan Mutual Fund – narrowly underperformed the benchmark KMI-30 index.

The best Islamic fund turns out to be one managed by a company that is not even a dedicated Islamic finance company: JS Investments, an asset manager that operates both conventional and Islamic funds. JS Investments is owned by the financial conglomerate founded by veteran investment banker Jahangir Siddiqui.

But what is likely to be an uncomfortable truth for the Islamic asset management industry as a whole is the fact that no Islamic fund made the top five funds in the rankings, and only three made the top 10. And this is despite the fact that the KMI-30 index slightly outperformed the KSE-100 index and has consistently done so for most of the past 10 years.

It is not as though Islamic investment avenues do not exist, it just appears that the Islamic fund management industry is less well-equipped to capitalise on them. For investors in Pakistan who value Shariah-compliance as an attribute in their money managers, that will no doubt come as a disappointment.

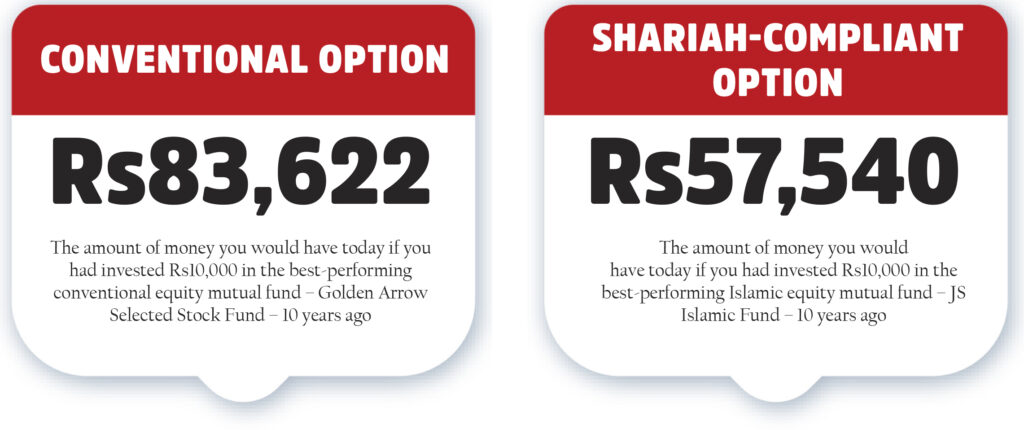

And lest anyone think that the numbers do not seem so far apart, let us consider the best Shariah-compliant fund’s performance versus the best conventional fund’s performance.

If you had invested Rs10,000 in the JS Islamic Fund 10 years ago, you would have Rs57,540 today. Had you instead invested in the Golden Arrow Selected Stock Fund, you would have had Rs83,622 today. Yet if you look simply at the average annual rate of return, the numbers do not seem that far apart: Golden Arrow’s returns averaged 23.7% and JS Islamic Fund had a respectable 19.1% per year.

That is the power of compounding: small differences can become hugely magnified over a long period of time.

It is possible the Islamic fund management industry is doing what the Islamic banking industry does: realise that its client base does not view conventional financial solutions as a viable option and thus restrict themselves to Islamic funds and Islamic banking products alone.

And that strategy has certainly worked out for the Islamic finance industry, which has historically grown at between twice and three times as fast as the conventional industry. But at some point, the conventional industry is going to begin pressing the advantage it appears to have in talent and institutional infrastructure and go after customers who value Shariah-compliance.

That is evident in the fact that, of the 13 Islamic mutual funds with 10-year track records, all of the top seven are managed by a company that has both conventional and Islamic investment options. And only one of the eight that beat the benchmark KMI index is managed by a purely Shariah-compliant asset management company.

The conventional erosion of the Islamic finance industry’s dominance in its business has already begun in the banking sector, with MCB Bank launching its dedicated Islamic banking subsidiary and Bank Alfalah continuing to invest in its already robust Islamic banking branch network. The second largest bank in the Islamic banking space is not a pure-play Islamic bank, but Bank Alfalah’s Islamic banking division.

As for consumers who value Shariah-compliance in their financial products, they would be better off sticking with financial institutions that value not just faith, but also technical competence and expertise, and invest in the infrastructure to offer the best possible solution to their clients. For now, at least, that is the conventional firms’ Islamic finance windows, not the dedicate Islamic financial institutions.

A note on index funds

Before concluding, we would like to address some of the so-called wisdom you might get from returning expats: that somehow index funds are the better option for investing over the long run. It is true that index funds have been a tremendously useful investing tool for investors in the United States that have consistently outperformed most actively managed mutual funds.

(Index funds are those funds that simply buy and sell stock according to the constituent list of the index they track, rather than making decisions about which individual stocks to buy and sell. That latter kind of fund is called an actively managed fund.)

The problem with that supposed conventional wisdom is that works only in the United States and almost nowhere else. That point, we think, will likely be proven by the fact that, of the 38 equity mutual funds in Pakistan with a track record of longer than 10 years, 21 (the majority) beat the benchmark indices, and only 17 do not. In the United States, only about one quarter of the actively managed funds beat the benchmark indices.

It is important to test the data in the local context before blindly applying principles that may work well in other markets, but may not be attuned to local conditions.

Sorry Sir mutual funds in pakistan are bullshitting investors money their only concern is generating profits for themselves through management fee or front end loads which does not benefit investors but do give safer side to AMC,s

We have Islamic UCITS funds in Luxembourg called Saaf. Is there a bank in Pakistan that would help us to distribute?

Comments are closed.