What on earth is going on with TRG Pakistan’s stock price? In April 2020, TRG’s stock stood at around Rs12. It then climbed to Rs51 in August 2020. At the time, several complaints were lodged in the Prime Minister’s portal, alleging ‘insider trading’, which has prompted the Securities and Exchange Commission of Pakistan (SECP) to ask the PSX to submit a report on the issue.

That was then. Now, of course, those complaints seem quaint. Because between December 2020, to February 2021, the stock climbed an absurd amount, the current Rs125. There is an expectation, according to market rumours, that it will certainly cross north of Rs150.

But why? Exactly what happened in the last two months to account for the meteoric rise of the company in the eyes of Paskiatni investors? Even TRG Pakistan seems nonplussed. In a letter to the SECP sent on December 11, the company reiterated “We would like to inform you that we have no formal means of knowing what speculations are circulating in the market and are, hence, unable to directly address these. We would also like to inform you that we do not have knowledge of any material information that may have resulted in the increase in market price of the Company and which has not previously been disclosed to the market.”

To understand the market rally, it helps to have some context. So first: exactly who is TRG Pakistan? TRG, which is short for The Resource Group, is a venture capital company which specialises in making acquisitions and investments in the business process outsourcing (BPO) sector, typically investing in around one or two investments in a year, and typically in technology, IT-enabled services and medicare insurance sectors. The company claims to have an ‘unbroken track record of over a decade’ in generating positive returns on each investment.

The company is the brainchild of Chisti, a Pakistani-American in every sense of that hyphenated label, born to an American father and Pakistani mother, who grew up in Pakistan but studied and worked in the US. After being ousted from his first billion dollar company, he decided to form TRG.

In 2002, TRG Pakistan was created, specifically to act as the global holding company for all of TRG’s investments. It was listed on the then Karachi Stock Exchange in July 2003.

The ownership structure of TRG is somewhat complex: TRG Pakistan is the overall holding company, but it does not own the entirety of TRG International, which in turn does not necessarily own the entirety of the shares in its portfolio companies. Crucially, at each stage, there are minority investors who own significant stakes, which makes it difficult to track exactly how much the overall portfolio is worth, and how much of it is owned by the shareholders of the publicly listed company on the Pakistan Stock Exchange. This is a key point we will return to.

For most of its existence, TRG Pakistan’s subsidiary was TRG International, which is a British Virgin Islands-incorporated holding company, that in turn owns stakes in most of TRG’s portfolio companies. However, in June 2020, TRG Pakistan’s share in TRG International changed from 57.16% to 46.03%. It is no longer a subsidiary, but is instead, technically, an affiliated company.

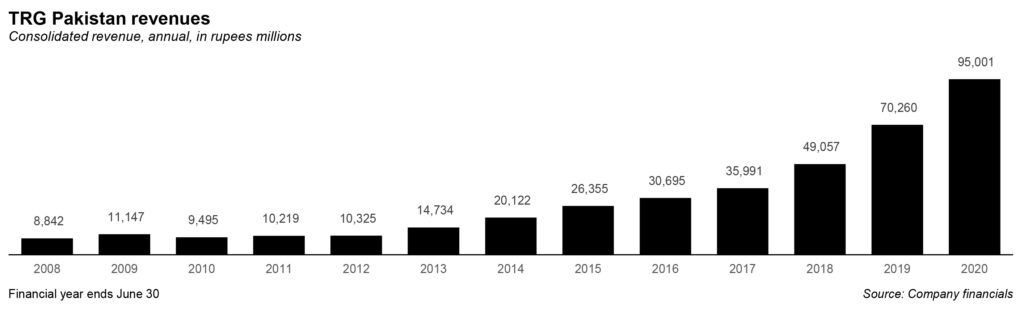

However, that does not diminish TRG International’s importance for TRG Pakistan. According to the latest annual report released to the Pakistan Stock Exchange, TRG International consolidated revenues reached $600 million, or a 15% increase from last year’s $515 million.

Much of this came from the ‘customer experience’ segment, which made up 67% of total revenue (or $405 million). Health insurance marketing contributed 19% of revenue, while enterprise software made up 14% of revenue.

The significant company within the ‘customer experience’ segment is Ibex, which TRG International has a 64.2% stake in. The company provides contact centre services and other BPO facilities to enterprise customers. Today, it has around 90 clients, is found in seven countries, and has more than 22,000 employees worldwide.

In August 2020, this company completed its initial public offering on Nasdaq. At the time, its post money valuation was approximately $350 million, with the total amount raised in the IPO, prior to expenses, of approximately $90 million. Ibex has done generally well: its revenues increased to $405 million in 2020, or a 10% growth from the same period in fiscal 2019. The company’s EBITDA (or net income, with interest, taxes, depreciation, and amortization added) increased from $36 million to $54 million.

Now, the second segment. TRG International’s health insurance marketing company, E-Telequote, saw its revenue shoot up from $35 million in 2018, to $65 million in 2019, to $113 million in 2020. According to TRG, this increase was a result of the continued investment in business and expansion of service delivery locations. In part due to the larger scale, the company’s profitability has also increased with EBITDA rising from $28 million to $43 million.

As mentioned in previous reports and announcements to the PSX, TRG has been actively seeking to monetize this company, though it is unclear when this will happen. In a recent letter sent to the PSX on February 12, the company noted that “no decision has been made as of this date relating to the listing of Etelequote Limited on NASDAQ or any other exchange.”

It further added: “As stated in our previous disclosures, we continue to evaluate various monetization alternatives for our portfolio companies, including assessing the US public markets and private transactions. We would also like to reiterate, as we did in our earlier disclosures, that due to the volatility in the financial markets there is no certainty as to the timing, valuation and potential success of any such transaction.”

The crown jewel in TRG’s portfolio, however, is Afiniti, a company that develops artificial intelligence software that is designed to help companies improve the efficiency of their business processes, specifically their call center operations. TRG’s investment in Afiniti started in 2005 as a seed investment into a company that was developing a solution that TRG felt its portfolio companies would be able to use. Over time, it morphed into a business in its own right.

And it is not hard to see why Afiniti gets the bulk of the attention: it is a rapidly growing business in an area of technology that can truly be described as cutting edge. In 2016, the company achieved Rs1.6 billion in revenues, a number that had skyrocketed to Rs11.2 billion by 2019, the latest year for which TRG clearly broke out Afiniti’s revenues on its consolidated financial statements. Afiniti was last valued at $1.6 billion in its Series D fundraising, which was in October 2018, according to sources familiar with the matter. It is unclear if the company’s valuation has risen by much since then. Rumours of Afiniti being listed on the NASDAQ have been doing the rounds since at least 2016. In total, Afiniti has raised close to $200 million in funding across several venture capital rounds, as well as its most recent debt financing.

Much of what has been disclosed above is publicly available information from the company’s annual reports. Indeed, Profit has done a feature story on Zia Chisti, and two follow up articles, in the last three years, explaining some of the intricacies of the company.

In speaking to sources, one thing that clearly sticks out is that not enough people were simply aware of TRG Pakistan’s investments, and therefore the stock was criminally underpriced. According to one, many in Pakistan were not even aware it was essentially a venture capital vehicle.

According to one analyst, at the macro level, the IT sector and pharma sector are two verticals that everyone is really talking about. This renewed interest in the sector means that more people are honing in on companies like TRG, which fit the bill.

But when it comes to TRG in particular, there are other forces at play. A document with no author has been making the rounds on Whatsapp, which puts the valuation of TRG Pakistan at roughly Rs400. It does so by comparing the various subsidiaries – Afiniti, E-telequote – to their listed peers on American stock exchanges, and arrives at a projected total valuation of TRG Pakistan.

First, let us reiterate: because there are minority investors who own significant stakes in TRG Pakistan, it is difficult to track exactly how much the overall portfolio is worth, and how much of it is owned by the shareholders of the publicly listed company on the Pakistan Stock Exchange.

But leave aside whether or not the stock is worth Rs400; it is the fact that people certainly believe it so. All sources interviewed either alluded to the document, or simply quoted the document verbatim as analysis. Some even went so far as to call TRG Pakistan as a non-traditional company trying out something new, that it was revolutionary. They also pointed to the fact that Zia Chisti was ‘charismatic’, that both the JS Group and AKD – traditional rivals- were bullish about TRG.

In reality, Chisti is often known to make decisions that are behind schedule – this is true for both Afiniti, and TRG Pakistan itself. Far from growing the business, as early as 2017, Chishti had confirmed that TRG is in the process of seeking to sell its stakes in all of its portfolio companies so that it can convert its initial investors’ holdings to cash to return to them. There isn’t growth at all – yet the people putting their bets on TRG seem convinced otherwise.

Ibex went public! Be careful another GameStop.

Who’s the analyst quoted here ?

Excuse me

Very insightful! Great perspective.

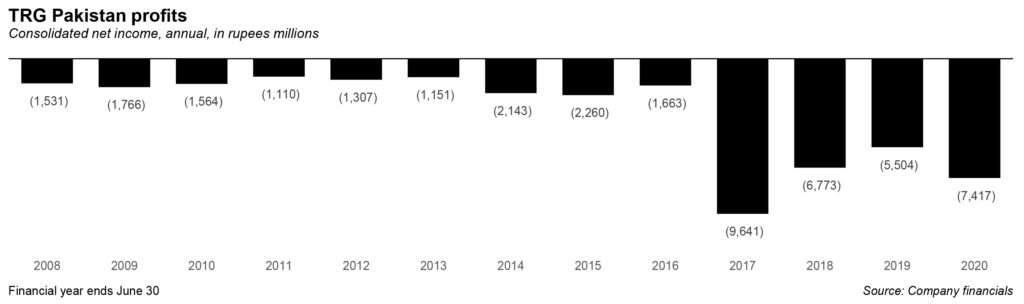

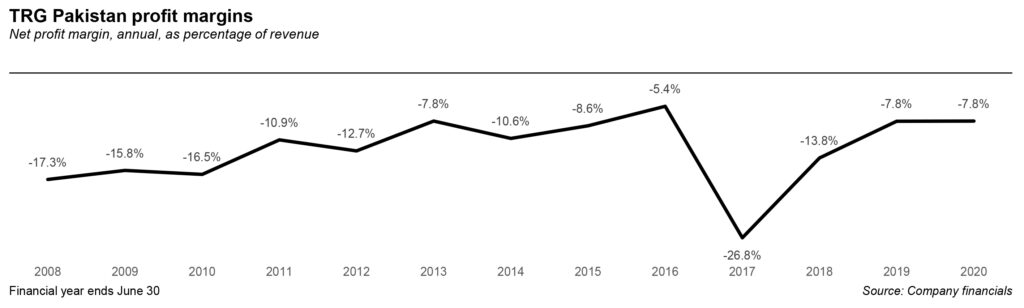

keep in mind from 2008 to uptil now company is in loss. There is a saying if any company starts getting too much media attention and higher price targets, so stay away with it. I will never invest my hard earned money on this share when half of the market is tading on 5 PE.

People in Pakistan are skeptical about TRG because it is the only listed company in Pakistan which is an investment vehicle involved in Private equity . Due to structure of the company it used to consolidate its accounts and was in a loss as expected because it has invested in startups . If Vision fund ( SoftBank ) start to consolidate its accounts with its invested subsidiaries it will probably had lost 50% of its 100 $ Billion investment . This is not the case as most high growth startups incur huge losses but command billions $ valuations. This concept was alien to Pakistani investors and hence the reason for its low share price. Now One of its company is listed and others are in process which include its AI investment , a company with a valuation of anything north of $ 5 Billion . It’s not rocket science , do your maths and you will realise TRG is still cheap at current price .

I’m afraid Soft Bank is not the best example to quote here as for TRG investment decisions only one thing common Zia Chishti like Mr. Son of Soft Bank we know how that turned out!

Folks we need to distinguish between the west and us with the kind of helicopter funds available private equity is not the best route for founders to take.

TRG BV is 34 whereas it’s trading at 4 times that and with nearly 160 million shares held by Zia and JS out of 500 million being skeptical should be least of our worries!

AKD group and affiliates also own more then 50 million shares too .

Shady people have shady ways, they are a highly immoral bunch