Poor South Africa. The world should be lauding that country’s scientists,for its advanced genomic sequencing that helped identify the new variant of coronavirus known as Omicron. Instead the world panicked, and banned all flights to South Africa (Pakistan did so as well). Never mind that in today’s world, the virus had probably already been present in Europe and Asia well before it was detected in South Africa.

Does this mean anything for us? In fact, yes it does. In a report sent to clients by senior analyst at AKD Securities Hamza Kamal, this new scare would cause a commodities spiral – which ultimately, may benefit Pakistan in a roundabout way.

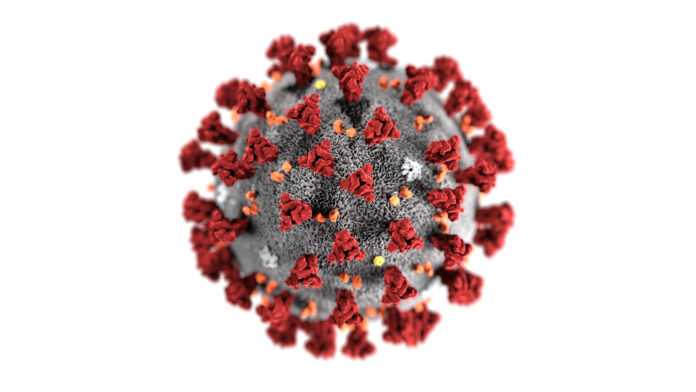

But first, the virus. As Kamal puts it, since Covid-19 struck a year and a half ago causing widespread disruptions and bringing global economies to a screeching halt, many variants have come to lightThe latest inclusion in this group is the ‘Omicron’ designated by WHO. This poses a risk of carrying materially different properties than the original Covid-19 virus. Though data remains inconclusive, and South African authorities are still trying to gauge risk, the world is already frenzied. Europe in particular is bracing for a bleak winter, and western Europe wants to initiate lockdown. Already, Austria, Slovenia and the Netherlands have declared a lockdown.

The spike in COVID cases in Europe manifests into risks of lower than expected economic growth in the region. This has in turn spooked commodity prices with oil spiraling down 9.4% to $74.5 per barrel, which is the lowest it has been since August 2021. “While the breather could be short-term, however, possible continuation of measures to clip growth across the globe could put fetters on longer-term price trends in our view,” says Kamal.

But what about Pakistan? Here it is a different story. The government has been fretting about its over reliance on imports. And yet, a 5% drop in oil price translates into $700 million import savings, while moderating pressure on exchange rate, and a 60 basis points impact on monthly inflation. This would further allow the government to meet its petroleum development levy (PDL) target of Rs330 billion through higher upfront adjustments, and benefitting from compounding factors.

“From sectoral vantage, we believe EU restraining social activities is negative for textiles while intensification of the same might disrupt supply chains for pharma and surgical items while still far fetched, stringent measures by SA Govt. to curb Omicron’s transmission may potentially disrupt coal supply chain, sending prices upward/ negative for Cement plays,” explains Kamal.

This is buoyed by recent evidence from the stock market: fertilizers stood as the only sector yielding positive return of 2.3% given the defensive nature and increase in global prices improving earnings outlook while Cements were down 5.6% stood as the worst performer primarily. Meanwhile the jute sector turned out to be the best performer with 10.6% month-on-month gain while automobiles was down 7.2%.

Still Kamal is positive about the future: “With IMF-related uncertainty largely behind and MSCI-related re-

balancing near complete, the latest developments could act as a catalyst for the index gaining upward momentum with year-end phenomena carrying the Index forward. Also, ease-off in commodity prices could slow the pace of monetary adjustments in our view—another positive for the market.”

Instead he said that sectors to look out for include banks, due to the recent monetary tightening, cement, as coal prices declining will improve outlook, and oil marketing companies.

I have heard and read a couple of articles that there is a theory that Omicron is going to play an important role in ending the pandemic. If infected it is going to create natural antibodies that will drive away any future variants. Not sure though.

Thanks for sharing

Great work, Thanks for sharing

Guest posting is the practice of writing and publishing a blog post on another person or company’s website.

GuestPosting

Working Great work, Thanks for sharing

guest-posting-sites-list link din

Working!!!!!

devpost Working

Fine!!!!!!!

trustpilot working

pinterest Wokring

kuula now fine

glose is working

linktr nice comments

medium platform

any issuu availavle?

reverbnation new 2022

producthunt are buzy

great work

company is now

lice hd

twitter work