ISTANBUL: Turkey’s annual inflation soared to its highest in 19 years, data showed on Monday, laying bare the depths of a currency crisis engineered by policies that the country’s president has espoused.

Consumer prices rose 36.08%, outstripping a median forecast of 30.6%, with staples such as transportation and food and drink – which took increasing shares of Turkish households’ incomes during 2021 – rising even faster.

In December alone, CPI took a rare step into double-digits at 13.58%, the Turkish Statistical Institute data showed.

Turkey’s lira shed 44% of its value last year as the central bank slashed interest rates under a drive by President Tayyip Erdogan to prioritise credit and exports over currency stability. On Monday it fell a further 4% to 13.7 against the dollar.

One economist forecast that inflation could reach as high as 50% by spring unless the direction of monetary policy was immediately reversed.

“Rates should be immediately and aggressively hiked because this is urgent,” said Ozlem Derici Sengul, founding partner at Spinn Consulting in Istanbul.

The central bank was however unlikely to act, she added, and annual inflation “will probably reach 40-50% by March”, by when administered price rises would have been added into the mix, including a 50% minimum wage hike.

Last year was the worst for the lira in nearly two decades, while the annual CPI was the highest since the 37.0% reading of September of 2002, two months before Erdogan’s AK Party first took office.

ALARM BELLS FOR INVESTORS, CONSUMERS

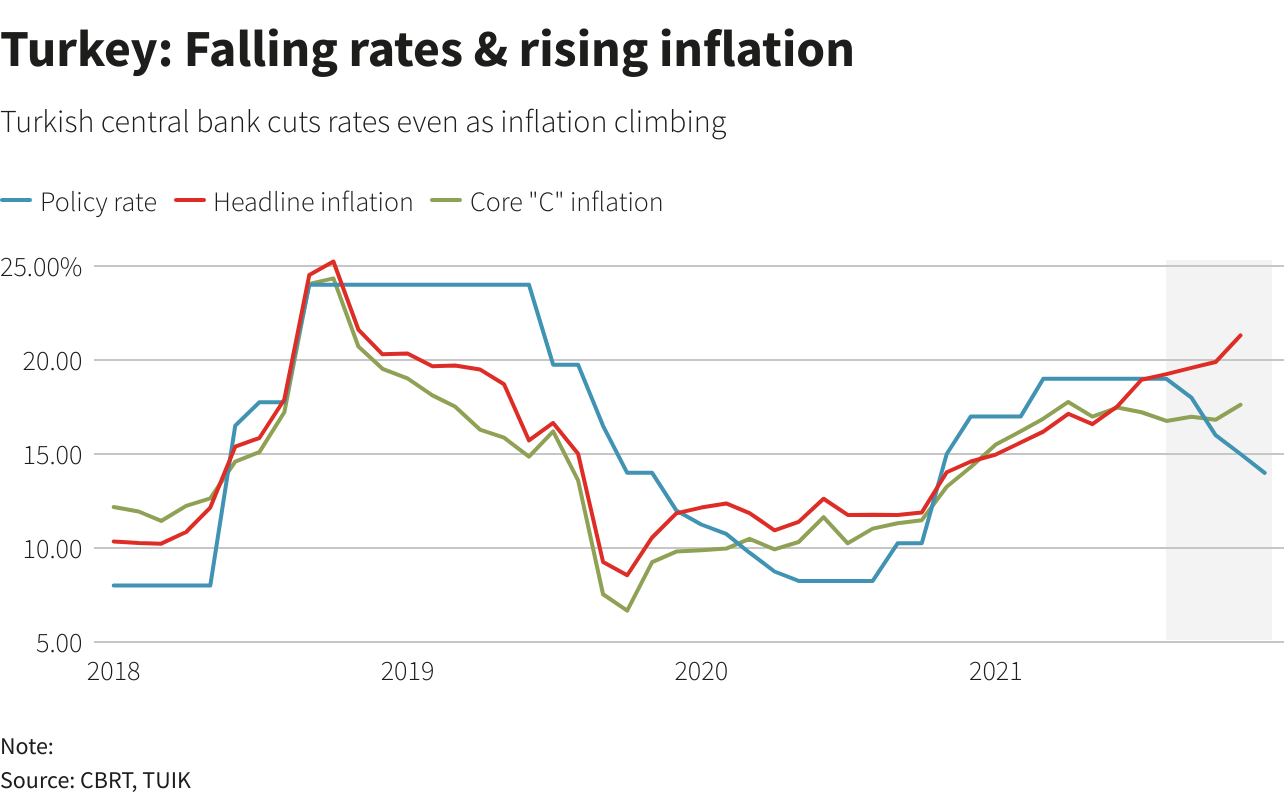

Erdogan, a self-declared enemy of interest rates, overhauled the central bank’s leadership last year. The bank has slashed the policy rate to 14% from 19% since September, leaving Turkey with deeply negative real yields that have spooked savers and investors.

The subsequent accelerating surge in prices and drop in the lira have also upended household and company budgets, scuttled travel plans and left many Turks scrambling to cut costs. Many queued last month for subsidised bread in Istanbul, where the municipality says the cost of living is up 50% in a year.

The central bank has argued that temporary factors had been driving prices and forecast a volatile course for inflation, which – having been around 20% in recent months and mostly double-digits over the last five years – it said in October would end the year at 18.4%. read more

Sengul suggested that, with Monday’s data, that argument had run its course.

“This reflects a vicious cycle of demand-pull inflation, which is very dangerous because the central bank had implied the price pressure was from cost-push (supply constraints), and that it couldn’t do anything about it,” she said.

Reflecting soaring import prices, December’s producer price index rose 19.08% month-on-month and 79.89% year on year.Annual transportation prices soared 53.66% while the food and drinks basket jumped 43.8%, the CPI data showed.

The economic turmoil has also hit Erdogan’s opinion polls ahead of a tough election scheduled for no later than mid-2023.

The lira touched a record low of 18.4 against the dollar in December before rebounding sharply two weeks ago after state-backed market interventions, and after Erdogan announced a scheme to protect lira deposits against currency volatility.