One imagines many emergencies that might happen to them in their personal lives. A car crash, a roof collapse, a stampede, a wild tornado – anything could happen at any moment that could result in a person’s life or livelihood crashing down.

After all, how many of us could predict that the coronavirus would wreak havoc on the world as it did and cause colossal economic damage as well as the huge impact it had on global public health? The hospitality sector and the transport industry, two businesses considered ‘safe’ were suddenly humbled and brought to their knees by the force of the pandemic.

The disruption sent shockwaves into economies across the world and ours was no different. From large corporations to individual households – everyone was impacted. In Pakistan alone, more than 50% of working people reported that they were either fired or that their salaries were cut.

At times like these, when the unexpected happens, what comes in handy are emergency funds. The idea of an emergency fund elicits many kinds of responses. The first is an overly simplistic one. No, an emergency fund is not a piggy bank you’ve been putting money in or a drawer you’ve been setting aside a certain portion of your salary in each month. The second response to the idea of an emergency fund is intimidation – because there is very little understanding of what these funds are and what they do.

Profit brings you a detailed guide on how to create a personal emergency fund and where to place it.

What is an emergency fund?

An emergency fund is the money you set aside to meet unexpected expenses that result from financial emergencies. This fund is not to be used for leisure, like buying a new phone or a playstation rather it is there to meet expenses that are unavoidable. e.g. If you lose your job or there is a medical emergency then you can draw onto your emergency fund for help.

Getting health insurance or life insurance can serve as an emergency fund for a health scare. However, not everything can be insured and that is where one needs immediate cash to bail themselves out.

It is critical to understand that having an emergency fund is extremely important as it will help you float the downs in your life and save you from decisions made in desperation e.g. going to a loan shark for money as banks won’t lend you because you are jobless.

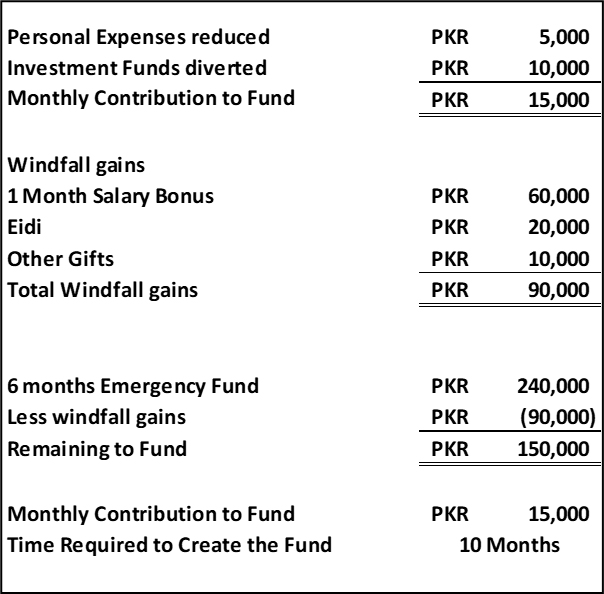

A fund should be equivalent to at least six months of your needs, and no, getting that pair of sneakers is not a need. To better understand the situation let’s take an example of my friend Talha who has a monthly salary of Rs 60,000.

The monthly expense of Talha is classified into 3 categories; Needs, Wants and Investments. As mentioned earlier, we will only be looking at needs to include in the emergency fund.

Rent, Utilities, Groceries and Insurance Premium all are categorized as needs as these payments are unavoidable, probably can be reduced a bit, but for sure cannot be eliminated.

Combining all these, we have an amount of Rs 240,000 that Talah needs to raise to create an emergency fund. But the next question is how? Like at the end of the month there is no spare money left, all of it is exhausted.

This is probably the reason why most people don’t create an emergency fund. They don’t see any utility in tightening their budget for something that is unforeseen, but you are not totally to blame for it. As per studies, When you think about your future self, your brain can not relate to that person and as a result couldn’t care less about it.

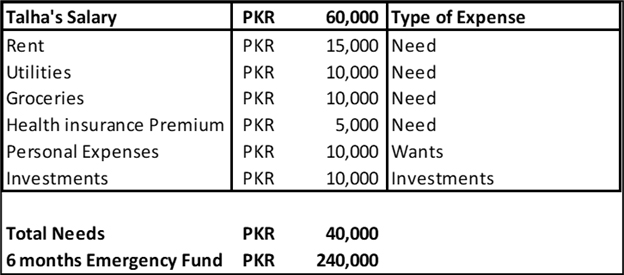

Coming back to Talha’s example, you can see that out of his total monthly salary, Talha expends around Rs 20,000 on personal expenses and investments. Now the dilemma here is that talha wants to invest and it is a good thing but the investments are of no use if you can’t use them to meet your emergency.

So the way to approach this is that one needs to prioritize the fund over everything else. Don’t invest in anything until you meet your personal financial security target (through the fund). Yes, you will have a fear of missing out (FOMO) but bear with it, your future well being is more important.

Furthermore, reduce your personal expenses, like don’t dine out as often as you do or manage your spending patterns, All this will help you to mitigate your future risk. Lastly, any windfall income like a bonus or Eidi should directly go into your emergency fund. This will add to the speed of creating the fund.

Coming back to Talha’s example, Congratulations!, He agreed on creating an emergency fund of Rs 240,000. His approach is explained through the illustration below.

So by cutting down on personal expenses, diverting investment funds and adding up the windfall gains, Talha will be able to create his emergency fund in 10 months. That is relatively a short time period compared to the peace of mind it will bring to Talha.

Where to keep the fund?

The first thing to remember is that your fund should be separated from your other finances. Don’t just keep the money in your salary account, you will likely be tempted to spend it. Instead, open another dedicated account for your fund.

Now that we have established how to create a fund, the logical next step is to decide where to keep your money.

Going back to Talha’s example, he is now saving Rs 15,000 a month. But now he is wondering where to keep that money, all in Cash or all in the Bank account he just opened for the fund?

What can be done with this is that the amount can be segregated into three components; Cash, savings account and open-end mutual funds.

Cash ideally should be around 10% of your fund. This will be the amount that will be the most liquid amongst your fund placements. However, if you are in close proximity to an ATM network, which most people living in urban centers are, then a debit card will serve the same purpose.

The second category is money deposited in the bank account which should comprise 20% of the fund. Here we are talking about normal savings accounts and not fixed deposits. Basically, what happens with Fixed Deposit is that when there is a premature withdrawal, you will be charged a fee from the bank and also the funds are not readily available as it would take some time to deposit the amount into your account.

The third and the bulk category is money market mutual funds. 70% of fund value should be kept as an investment in an open-ended mutual fund. Why an open-ended fund, because when you withdraw money from these funds, there are no fees or charges which in financial terminology is known as exit load.

Furthermore, the return on these money market funds, over the last 5 years have been around the inflation level which is a decent return given that the purpose here is not to create wealth rather create a basic money pool for financial security.

However, the catch with Mutual funds is that on redemption it takes around 1-3 days for the money to be deposited into your account. However, that is why 30% on the fund is made of highly liquid asset classes. Regardless, if you need more funds and the mutual fund money is taking time to come through, you can use a credit card in the meanwhile. Once the redemption money from the funds is received, the credit card bill, which comes at the end of the month can be paid off. If you need to know more about credit cards, read our article: https://profit.pakistantoday.com.pk/2022/02/07/so-you-want-to-have-a-credit-card-in-pakistan-heres-all-you-need-to-know/

Lastly, it cannot be emphasised enough that this fund is only to be used in an emergency. Don’t end up using the money for trading or any other type of investment, This is the money you owe your futureself.

👍

Great step by step explanation