Banks have run out of dollars and are now borrowing from various sources, including their own depositors, to make trade related payments for their clients. As a result, forward premiums in dollar swaps in the interbank market have plummeted in the last few days to go negative, a very unusual development which points towards a dire shortage of dollar liquidity in the banks.

Bankers with visibility on developments in forward markets for foreign exchange tell Profit that the State Bank of Pakistan (SBP) has stopped selling dollars into the market nearly a month ago. The SBP has also been rationing dollars through various means despite a ban on imports of certain goods. Measures include making “administrative” delays in processing LCs.

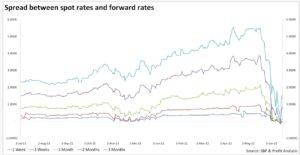

Same sources inform Profit that the drying up of dollar liquidity in the interbank market has led to the collapse of forward premiums on dollar swaps altogether.

In Pakistan’s case, the long term trend shows that the difference between the spot and future rate mostly results in a premium. For a high yielding currency the dollar trades at a higher rate versus the spot rate, i.e. ideally it should be the interest rate differential between the two currencies and the forward value should be greater than the spot value.

What’s happening now?

On June 6 2022, the difference between the spot price and forward 1 week tenor turned negative for the first time since November of last year. That was the day the exchange rate in the interbank market closed above Rs200 to a dollar for the first time in Pakistan’s history. The next day the State Bank summoned treasurers of major banks for a confidential meeting and told them to bring the exchange rate down in the interbank market, even if doing so required them to run losses.

They were told this was an issue of national importance, and the cost of the privilege to continue running a banking business in Pakistan. It didn’t work but forward premiums on one week swaps that dipped in negative territory for the first time since November 2021 came back up into positive on the same day.

The source explains that the SBP is asking banks to sell dollars to customers without being allowed to buy them back from the inter-bank market. This exposes banks to changes in the FX rate, which could also mean potential loss of money for banks.

A few days later, however, the shortages began to bite again, and the premiums fell in one tenor after the other like dominoes. On June 13, premiums on one week, two week and one month tenors turned negative. The next day the shadow of negative forward premiums extended itself out to three month tenors as well. It was shortened briefly on June 15 and 16, retreating back into two week tenors. Then came the bloodbath on June 17, the closing day of the week. Premiums fell sharply in all tenors out to two months.

“There are no dollars left in the interbank market” a senior source in the banking system – whose job includes dealing directly with the forward market in foreign exchange – tells Profit. “I’m now using dollars from deposits in order to cover my transactions.”

On Friday, the last trading day of the week, forward premium was negative by fifty paisa (rounded up) which annualises to 25 percent (including T-bill yield). This means banks are buying dollars today at Rs208 only to have to sell them a week later at Rs207.50. In the overnight market, data for which is not published by the State Bank, the premiums have plummeted far more, touching negative 0.95 in some cases, which annualises to 55 percent (inclusive of T-bill yield).

“I have to service my customer’s payments” says a senior banker impacted by this development. “So pulling out of this market is not an option. Since the market is so short of liquidity, those with dollars can demand a large premium.” Some banks have resorted to borrowing from their depositors to meet the payments they need to make, and if they have exhausted this source of supply, they can turn to their overseas branches to borrow from abroad in order to continue making trade related payments. Doing so is costing them more and more, causing forward premiums to plummet and turn negative.

Has this happened before?

During the current fiscal year, on 18 November 2021, 19 November 2021, 22 November 2021, 26 November 2021, and 29 November 2021; the dollar was trading at a discount. A discount happens when the forward exchange rate is less than the spot rate. This, however, was only in the one week tenure. The remaining tenors were trading at a premium.

But the November 19 2021 Monetary Policy Statement seemed to correct things quickly as the SBP hiked the policy rate by 150 bps to 8.75 percent in an unscheduled announcement.

The MPS read, “While the market-based exchange rate has played its due role as a shock absorber, it has borne a considerable burden in terms of adjusting to the widening current account deficit. The rupee has depreciated by a further 3.4 percent since the last MPC meeting. The US dollar also appreciated against most emerging market currencies since May as expectations of tapering by the Federal Reserve have been brought forward. However, the fall in the value of the rupee since May has been comparatively large. As other adjustment tools normalize, including interest rates and fiscal policy, pressures on the rupee should abate.”

The pressures on the rupee did abate through the policy rate hike as the discount remained limited to the 1 week tenor and turned into a premium by 30 November 2021.

What does this mean?

The forward rates resulting in a discount usually occurs in the shortest 1 week tenor. This does not push the interbank market into a big frenzy and usually corrects itself in a short span of time such as that witnessed in November.

However, in the current scenario, the situation does not seem to be improving. Instead, it is worsening. The drying up of dollar liquidity in the interbank has led to the collapse of the forward premiums all together. If this situation persists in the same way, the longer tenors of 6 months, 9 months, and 1 year may also start trading at a discount.

With the SBP already holding banks accountable in order to slow down the pace of the depreciating rupee, the government curbing imports, and SBP taking its sweet time with LCs, it signifies that the FX crunch is getting real and significant.

The solution to this situation is an FX injection. As soon as the IMF tranche lands into Pakistan and other dollar denominated assistance in the form of bilateral assistance comes in from friendly countries like China, the FX frenzy may calm down. However, this is expected by the end of June at best.

Default on LNG imports.

Biogas ka bandubast, foren, samjhe.

Haan, Haan, samaj gaye sir.

Give full facility to the businessmen to overcome this crisis

Arrest politicians their ashrafia dogs & recover dollars.

آپ لوگ پاکستان کے اندر پراپرٹی لےلو اس کے بعد پاکستانی نوٹ تبدیل کردے اور سب سے جمع کیا ہوا مال کا اتنا دے جتنا قانونی جمع کیا ہوا ہے اور بعد میں وہی پراپرٹی اور سیز پاکستانیوں کو فروخت کرکے ڈالرز میں پیسہ وصول کردے

It reads like a research paper. at least try to simplify things or breakdown complex theory for someone unfamiliar with foreign exchange market. Kisi k kuj b nhi palay padha or app log apny byline pe khosh ho rehe hen. I even doubt majority of the bankers in this country would be able to decipher this story. Stories are written for public and be written as such and should not be about how much theory or knowledge the writers have.

The fault is Imran Khan’s as much as the sharif govt. answer the following:

1) How did sharif get money abroad to purchase the flats he lives in?

2) How did Aleema (Imran’s sister) get the dollars to buy her properties in Dubai, New York and london?

3) who was the best minister for Imran? (Murad saeed as per the award given by IK) Did he not claim Imran would bring back 100 billion dollars? Was the best minister in Pakistan a liar?

4) the finance minister for the sharif’s is a billionaire who consumes a lot of sugar (and wheat) in his confectionery business hence knows how the sugar and wheat mafia’s work. What action has he taken?

5) where do sharif’s children live?

6) where do Imran’s children live?

7) who made helicopter rides twice a day to Beni gala and wasted fuel?

8) who had his own cows as prime minister?

I can keep asking the questions

Khan isn’t responsible for the actions of his sister, she has a textile business that has been churning out cash over decades, and provided evidence via her legal team for how she acquired said properties, all transactions went through official banking channels. But even if she was involved in corruption (she isn’t), the figures pale into insignificance compared to senior members of Winston Chor Chals party.

IK’s kids are British, they don’t need to rob PK like the loan defaulters have done. Their grandfather was a billionaire who set up a trustfund to help them financially. You can argue about the moral, ethical or even legal aspects of greenmail and leveraged buyouts, but that is beyond the scope of this article.

Where are the generals and beaurocrates and judges in your questions sir

Establishment is sleeping

Pathetic and chaotic situation in the country, we are now at the brink of financial collapse and eagerly waiting for IMF and China financial injection, which will not happen until the end of this month. and this last week will be the worst.

The question is that how simply some one said that they have “miscalculated” on regime change operation, which costs us unbearable losses and push back to 50 years at least.

How and when we will put accountable to those who brought up worst financial situation in our country.

Bad governance, bad regime change decision, Hippocratic approach of the govt where they are still spending lavishly on foreign tours, unnecessary news papers adds, renovations of building for their own use etc etc……….

Actions speaks if we are sincere with our homeland or just playing hypocritically…. 🙁

Nice article

Cool stuff you have got and you keep update all of us.

Thank you for taking the time to publish this information very useful!

have found a lot of approaches after visiting your post

Really impressed! Everything is very open and very clear clarification of issues.