In an effort to limit the Kremlin’s capacity to continue funding the conflict in Ukraine, the Group of Seven (G7) price ceiling and the European Union’s complete ban on Russian seaborne oil went into effect on Monday.

The G7, EU, and Australia decided to establish a cap on the price of Russian oil at $60 per barrel on December 2. The EU announced a restriction on Russian crude oil transported by sea back in May. The 27-member group also announced that beginning on February 5, a prohibition on the imports of refined petroleum products will be in effect.

In tweets on social media on Saturday, Mikhail Ulyanov, Moscow’s envoy to international organisations in Vienna, reiterated Russia’s position that it will not supply oil to nations who adopt the cap.

Separate from this flurry of activity, Pakistan has been in talks with the Russian Federation to procure cheap oil from them. But as the details of the conversations between Pakistan and Russia have come to the fore, it has become increasingly clear that the hurdles in the way of Russian oil becoming a reality are far larger than any possible benefit from it. But with the federal government still using it as a political talking point, is there any possibility of Pakistan pulling it off despite the sanctions?

As Pakistan made its announcement of having productive discussions with Russia on importing oil and collaborating on energy infrastructure projects, this price cap has the potential to shatter all of these plans.

The G7 price cap will not prevent non-EU nations like Pakistan from continuing to buy Russian crude oil by ship, but it will prevent shipping, insurance, and re-insurance firms from transporting cargoes of Russian crude around the world unless it is sold for less than $60.

This might make it more difficult to transfer Russian oil priced above the cap, even to nations that are not signatories to the deal.

The effect of the price cap

The Wall Street Journal reports that numbers from two data suppliers on Russian crude both show a large reduction in exports since fresh sanctions and a price ceiling went into effect earlier in the week.

Russia’s seaborne exports decreased by about 500,000 barrels per day (bpd) on Tuesday, a 16% decrease from the 3.08 million bpd average for November, according to the commodity-analytics company, Kpler.

Russia’s crude shipments decreased by about 50%, according to TankerTrackers.com, a website that watches marine vessels using signals and satellite photos. With the majority of the decline in shipments coming from Baltic and Black Sea ports.

The US Treasury stated in a fact sheet that “the price cap’s operation depends on a vital element of the global oil trade: the maritime services industry, which includes insurance, trade finance and other key services that support the complex transport of oil around the globe.”

Who owns oil tankers ?

A ship constructed specifically for the bulk transportation of oil or its byproducts is an oil tanker, often referred to as a petroleum tanker. Crude tankers and product tankers are the two main categories of oil tankers.

Crude tankers transport massive amounts of crude oil from its extraction location to refineries. Product tankers, which are often much smaller, are made to transport refined products from refineries to locations close to markets for consumer goods.

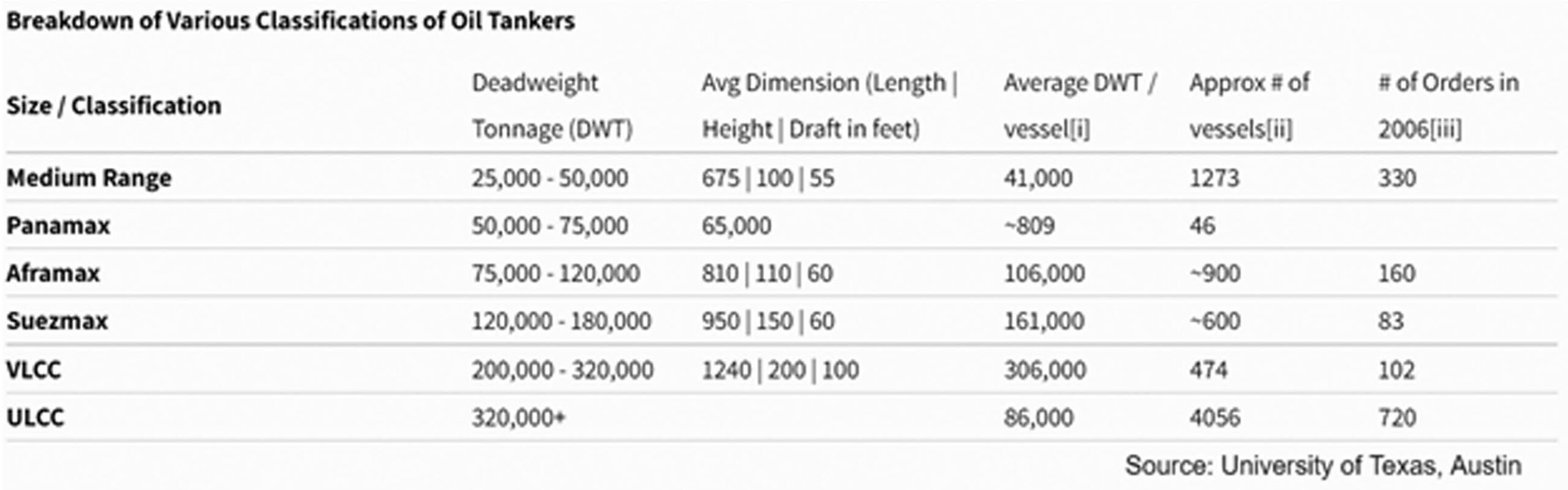

Oil tankers are broadly categorised according to their carrying capacity in deadweight tonnes (DWT), which is the sum of the ship’s weight including its crew, supplies, cargo, and other weights less the weight it would have if it were empty.

The 1960s saw the development of very large crude carriers (VLCC), which can transport two million barrels of oil and have a capacity of over 200,000 DWT. The capacity of ultra large crude carriers (ULCC) is greater than 320,000 DWT, or almost three million barrels of oil. Medium Range (MR), Panamax (the largest tankers that can fit through the Panama Canal), Aframax, and Suezmax (the largest tankers that can fit through the Suez Canal) are additional classifications of tankers .

Companies in Europe and the UK insure a large number of ships coming from China, India, and other nations. The EU, G7, and Australian price cap on Russian seaborne crude oil now apply to these ships.

About 90% of the market is controlled by businesses based in the G7, making it susceptible to the cap, according to the US Treasury, adding that “almost all ports and major canals require ships to carry protection and indemnity insurance.”

This essentially means that to procure oil from Russia has been made significantly more cumbersome especially with the fact that Pakistan has a fledgling economy. The issue now arises that even if we’re able to strike a deal with Russia how would it be transferred thousands of miles as oil tankers would be less likely to ship Russian oil that is being sold above the imposed price cap.

What are the alternatives?

Since the sanctions do not prevent the purchase of Russian oil, Pakistan still has the potential to import it. However procuring a tanker to transfer the oil from a Russian port to Karachi would be an issue that needs to be addressed.

However, according to some media reports, since its invasion of Ukraine, Russia has amassed a sizable “shadow” tanker fleet that it can utilise to transport the majority of the displaced volumes; nevertheless, some analysts point out that the insurance component is likely to provide serious problems.

Over 100 oil tankers have been gathered into a “shadow fleet” in an effort to evade Western sanctions put in place after Vladimir Putin’s invasion of Ukraine. According to shipping brokers and observers, Moscow has secretly accumulated additional tankers this year.

This clandestine fleet of oil tankers might be the only way Pakistan can oil from Russian port to Pakistani port, as far as insurance, financial and legal requirements are concerned it is still a question mark.

Profit reached out to Pakistan National Shipping Corporation the national shipping carrier for comment, however they did not wish to comment at this moment. Even though a deal with Russia seems like a much needed break for the country, it might just be another hollow promise.

I was looking for another article by chance and found your article related to the one I am writing on this topic, so I think it will help a lot. I leave my blog address below. Please visit once.

온라인 카지노

j9korea.com