What makes the perfect pitch deck for a Pakistani startup? It’s a delicate balance of statistics, and storytelling. On one hand, you have the impressive numbers – 220 million people, while on the other, there’s a young population bursting with potential, cheap mobile data, and high internet penetration. In a perfect world, all these features of our local market make for a highly persuasive pitch, causing investors to quake in their seats with uncontained excitement. But there’s a catch.

Underneath the shiny surface, there are challenges that come with being a developing country. What happens when the internet – the lifeblood of any tech startup – becomes a bargaining chip in political power plays?

Of course, a leaf from the perfect pitch tree withers and falls to the ground.

Navigating Pakistan’s tech landscape is no different than playing a game of Jenga – one wrong move and everything could come crashing down. Last week’s political drama just made the game even harder. Within just a day of former prime minister Imran Khan’s arrest, its resultant violent protests, and suspension of mobile internet; point-of-sale transactions fell by around 50%. When cash payments become the country’s only mode of transaction for over a week, it can hardly be considered an attractive region for venture capitalists (VC) to invest in.

Profit hit up local and foreign VCs, and startups to get their insights on how this new development is affecting their investment decisions.

How has the internet suspension impacted tech companies?

Profit has compiled a list of startups eager to share not only their thoughts on the recent mobile Internet blackout, but also the numerous challenges they faced while striving to keep their businesses running without the crucial tool they rely on.

These were their responses.

Kassim Shroff

Kassim Shroff

Co-Founder and CEO, Krave Mart

“During challenging times, one might have expected a surge in orders. However, our business and growth prospects were adversely impacted by the outage, causing disruptions to our operations. Our riders heavily rely on navigation services, and faced prolonged connectivity issues with support and customers.

To combat this, Krave Mart assigned additional rider support agents to enhance the delivery process. Meeting the increased demand without escalating costs proved to be quite challenging. We consistently sought ways to optimise operations, prioritise rider safety, and support our customers. A founders committee was also formed to strategise corrective measures for future crises.”

Representative from the ride-hailing industry

A spokesperson from the ride-hailing industry stated that, “The suspension of mobile internet services severely impacted ride-hailing businesses. We were saddened that we were unable to serve our customers and drivers who relied on us for their daily travel and to earn their livelihoods. We hoped we could return to serving them as soon as possible. A reliable, functioning internet service is vital to a functioning and prosperous economy.”

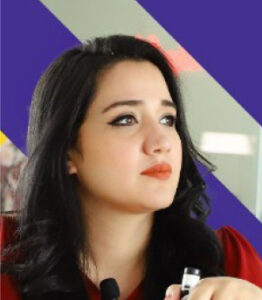

Halima Iqbal

Halima Iqbal

Founder & CEO, Oraan

“We are in the B2C business and were severely impacted by the internet blackout. On the operations side, our members struggled to pay their dues due to the inability to conduct digital transactions. On the growth side, new customers found it difficult to take up the product. Our numbers were down by 40%!”

“We received expressions of concern from both current and potential investors. Internet access is a fundamental requirement for conducting our business, and any disruptions to it are of great concern. However, we remain optimistic that common sense will prevail and that such incidents will be avoided in the future.”

Foodpanda Spokesperson

“The mobile broadband suspension significantly affected Foodpanda’s operations. The suspension caused disruptions in the delivery process, leading to significant inconvenience to our customers and degradation of the customer, rider and vendor experience due to failed orders, delays and cancellations.

We continued to work with our partners to improve access to internet connectivity and leverage our own infrastructure, but the resumption of mobile broadband was critical for a return to business as usual. If the suspension had persisted for an extended period, it could have resulted in continued financial losses for all stakeholders engaged on the platform.”

These comments are tell-tale of the fact that mobile broadband suspension has thrown the operations of several tech companies into disarray. Despite their efforts to proactively power through this crisis, it has been impossible to protect their revenues from taking a hit. There is only this much one can do, when the most essential paraphernalia for their business gets snatched away from them, without so much as a heads up.

Will the blackout spook investors?

Surviving tough times is one thing, but the internet blackout hit where it hurts. We’re talking about the gut-wrenching panic and uncertainty that comes when tech companies operate in a country like Pakistan, but are answerable to investors who are worlds apart from Pakistan and its never-ending political and economic chaos.

These were the sentiments of some tech startups Profit reached out to.

Muneeb Maayr

Muneeb Maayr

Founder, Bykea

“Even though no concerned investors inquired about the situation, everyone has been talking for a few months about the devaluation of the currency impacting their dollar investments. Pakistan is increasingly being looked at as a risky destination to invest in. Investors invested in USD, but with revenues in rupees, their dollar return on investments looks bleak with a rupee that has devalued almost 100% over the past year.”

Saud Rashid

Saud Rashid

COO, Cheetay

“Stability — political and economic — is something that investors are always concerned with, but that is weighed against potential. In our view, Pakistan has great potential and we share that vision with investors. However, it is much easier to engage with people who are familiar with Pakistan than those who have only heard negative news.

Our investors were aware of the situation in the country and were mindful of the hindrances it could have caused our business if it was not resolved soon.”

Qasif Shahid

Qasif Shahid

Co-Founder & CEO, Finja

“At present, we are not actively seeking capital and have not made any pitches to new investors. However, in light of the shutdown, we recognised that addressing this issue will be a significant challenge in any future pitches. We are also aware of our dependence on telecommunications companies and internet service providers in the country; thus, our reliance on their uptime and digital services will remain substantial.”

Sheryar Bawany

Sheryar Bawany

Co-Founder & CEO, Trukkr

“The current geopolitical situation presents challenges in promoting Pakistan’s startup potential. Two years ago, our story catalysed investment in frontier markets. We believe Pakistani startups have the potential to attract billions of dollars in investment, create jobs and advance the economy. However, we now face lower valuations and longer investment timelines. Despite this, Pakistan still offers attractive returns and its story will resurface once the political situation stabilises.”

What we gather, from the looks of it, Pakistan is like a child from a broken family — bursting at the seams, with undeniable potential but lacking the stability to actually do something with it. As it stands, Pakistan’s tech industry has come this far because it offers a promising future, nonetheless, it remains a highly risky market, which might deter risk-averse VCs from investing.

Do venture capitalists still want to venture in an unpredictable region like Pakistan?

To run a business in this market is one thing, to raise capital and piling it into startups knowing the risks is another. It’s not for the faint of heart to say the least. However, what goes on in the mind of someone who knows their capital could either strike them gold or go down the drain, if those they bet on fail to navigate the chaos?

Profit reached out to local, and international, VCs to ask just that.

Robin Butler

Robin Butler

Partner & Head of Impact, Sturgeon Capital

“Venture funding in Pakistan, like all emerging markets, is influenced by both domestic and international factors. Rising interest rates and global macroeconomic uncertainty have increased the cost of capital for startups and caused international investors to retreat to their home markets. This has been compounded by Pakistan’s domestic economic and political instability. However, we believe that now is an opportune time to develop transformative solutions, as both consumers and businesses face challenges that can be addressed through technology.

The long-term investment opportunity in such a large market that is rapidly transitioning from offline to online is attractive. We remain committed to supporting our existing portfolio companies and new investments through these short-term challenges.”

Mattias Martinsson

Mattias Martinsson

CIO & Founding Partner, Tundra Fonder AB

“The internet blackout raised concerns among local partners, but thankfully fixed lines remained mostly operational. The investment climate is dependent on the normalisation of the political situation and the holding of elections. The uncertain political climate has had a negative impact on investor interest, funding and valuations. Venture capital funding is diminishing due to the added uncertainty arising from political risks. Predictable economic management and the maintenance of democratic processes are necessary to attract more funding.

The macroeconomy and political climate play a significant role in investment decisions. Many Pakistani companies have weathered recent troubles well, but the current investment climate does not encourage new investments. Investors require predictability and are likely to adopt a wait-and-see approach until this is achieved.”

Meenah Tariq

Meenah Tariq

Partner, Karavan

“Uncertainty and a global economic squeeze harm the ecosystem. Money leaves emerging markets first, causing a slowdown. Socio-political cracks make even risk-taking investors apprehensive. However, venture capital is high-risk and our market can deliver outsized returns. Investors with dry powder and appetite can find deals with asymmetric risk profiles, but they are few. Founders report sharks offering bad terms due to tough times and scarce capital. Startups must cut costs, strategize smartly, and avoid painful bed-mates to survive and grow.”

“International emerging market investors know the risks and potential upside of markets like Pakistan. The internet is essential for growth and development.”

Kalsoom Lakhani

Kalsoom Lakhani

Co-Founder & General Partner, I2i Ventures

“We have experienced a significant decline in international venture capital funding. I anticipate that this will worsen due to Pakistan’s political and economic instability. Although funding rounds will still occur, they are likely to be smaller on average, with lower valuations. Additionally, the time it takes to close a funding round has increased.

These are all factors that founders should consider when deciding whether to raise funds in the coming year. They should allow for the time it will take to raise funds, be conservative in their pricing and broaden their pool of potential investors, knowing that many may decline.”

Shehryar Hydri

Shehryar Hydri

Managing Partner, Deosai Ventures

“Our local partners in Pakistan were concerned about the impact of the internet blackout on investment and operations. As a Pakistan-focused fund, this affected us significantly. 90% of foreign investors left due to the market slowdown and the change of government in 2022. They plan to return when conditions stabilise, but rash decisions such as this can damage our global reputation.

The investment climate is uncertain, with recent arrests and the targeting of the PTI causing investors to pause major investments. Some may exit or relocate operations outside Pakistan, while others will adopt a wait-and-see approach. Despite venture capital’s resilience to risks, funding in Pakistan is diminishing due to the global slowdown and political instability, indicating a pessimistic long-term outlook.

We had hoped that we would only lose 1-2 years, but unfortunately it now appears that recovery will be a 3-5 year process.”

Rabeel Warraich

Rabeel Warraich

Founder & CEO, Sarmayacar

“The internet blackout had a negative impact on operations and will also have a negative impact on fundraising. Companies such as Bykea operated at reduced capacity due to the lack of mobile broadband, while other startups struggled to acquire customers due to blocked platforms. This hinders growth and jeopardises investment rounds. The investment climate in Pakistan will remain challenging until stability returns. If internet blockages persist, attracting new investors will be difficult.

Globally, venture capital funding has decreased. Pakistan’s elevated risk means it is losing out to safer destinations. However, we knew this would not be a permanent situation. Pakistan’s demographic dividend and low penetration of venture capital funding offer attractive investment opportunities. We must navigate the current environment with resilience and capital discipline in order to capitalise on future opportunities.”

Ahsan Jamil

Ahsan Jamil

Managing Partner, sAi Ventures

“It goes without saying that the impact was quite detrimental. It reinforced the negative perception that political uncertainty has an adverse effect on business, which is worse than the transactional disruption of the past few days. In the short term, both global macroeconomic factors and domestic political uncertainty are likely to affect investment inflows.

Rather than focusing solely on international and foreign investment, it would be more pertinent to examine why local investment is not supporting technology to a greater extent. When local capital oversubscribes to an opportunity despite local macroeconomic conditions, international capital is likely to follow suit.”

Salaal Hasan

Salaal Hasan

Director of Venture Capital, at JS Group

“Pakistan’s growing digital economy attracts venture capital and foreign investment due to its large population of cellular and internet users. The IT and IT export services industry can address economic issues such as inclusive growth, dollarised exports, investment attraction, and job creation. However, internet bans hinder innovation and contribute to brain drain.”

“The investment climate in Pakistan is fragile due to high interest rates, inflation, lower liquidity, and currency devaluation. Mixed signalling and lack of clarity on initiatives like the China Pakistan Economic Corridor (CPEC) impact investor confidence. As global markets correct in 2024, policy makers must support entrepreneurs and investors.”

VCs walk a tightrope, balancing risk and reward. Their concerns and anguish are on full display. They must have nerves of steel when their money’s on the line. The nerves may be a facade or false bravado, but they know they’re in it for the long haul to make a return on their investment. They’ve told us as much. Yet, they’re painfully aware that their lives have been made harder through no fault of their own.

Where do things stand now?

Saad Saleem, Co-Founder and Managing Director at Nayatel, divulged that “On May 9, mobile internet and specific social media sites were blocked. Mobile internet services were restored on Friday night, May 12; however, social media sites remained restricted. Access to blocked social media sites resumed on May 16.”

“Despite users lamenting the sluggish pace of the newly restored broadband,” Saleem continued, “sources revealed that there was no throttling when internet access was restored. The only disruption was in social media sites that remained blocked and could only be accessed through a VPN. However, there is an explanation for the subpar quality of internet connection across the country after its temporary suspension.”

Saleem further elaborated that “There can be side effects of this blocking because many sites embed content from different media sites. Ad insertions and video embeds from different media sites can cause issues. For example, if a site has a YouTube video inserted in its web page, it might cause the page to load slowly or timeout on the video links.”

Saleem shared additional reasons for the subpar service after restoration. “The Pakistan Telecommunication Authority (PTA) installed a web management solution (WMS) device to monitor traffic and surveil internet activity. The device crashed due to high traffic after restoration, causing sporadic connections and interruptions for users.”

It seems that the penny has finally dropped: the internet is kind of a big deal for keeping an economy afloat. So, when decision-makers get trigger-happy and sever mobile internet connections, the fallout can be a real doozy. One can hope our leaders have learned their lesson and won’t make the same blunder again.

“The internet is the backbone of most technological applications that startups rely on. Curtailing internet connectivity was not responsible, given the cost benefit to disruption of an already challenging economic landscape” Bawany tells Profit.

Pakistan does not come without baggage. With never-ending political challenges, outdated policies and several overarching macroeconomic challenges, we make for a market that proves to be a far riskier playground for investors. All of which is now aggravated by a trigger happy State that can’t decide whether it wants the startup, and VC space to triumph or tumble?

Whilst we don’t know whether the State ponders over this decision, founders and VCs alike will just have to fatten their deck with a slide on internet outages. [/restrict]

Read Pakistan News Updates in Urdu & English online. Today’s latest News Headlines in Pakistan in Urdu including breaking news, national news, top stories.

very nice article. I would like to draw attention of the readers to a more lucrative business which not only makes you dollar millionaires but even billionaires. You might wonder why I don’t make all the billions for myself. You see, I enjoy sharing wealth as well as knowledge. This trait is my boon as well Bane. So are you ready to be a dollar millionaire? If yes, please confirm in the comments with your mobile numbers and I would personally contact you with more details. Remember sharing is caring.