Pakistan’s poverty rate is expected to reach 37.2% this year, according to a recent report of the World Bank. This has of course been part and parcel of the last year where prices of essential commodities such as food and energy have risen dramatically.

And while this runaway inflation has been the result of a combination of international market determinants, bad policy making, and a debt repayment timeline that is finally catching up with Pakistan much of it has worsened since August 2022 when the recently concluded coalition government of Prime Minister Shehbaz Sharif first came into power.

The PDM government’s tenure has been eventful to say the least. From policy tightening, devastating floods, import restrictions, excessive borrowing, rising fuel costs and political uncertainty- we have seen it all. This has culminated in crippling foreign reserves and increasing inflation, which have led the country towards an economic disaster.

Even while the country’s state bank has tried to curb inflation by raising its benchmark interest rate to a record-high 22%, prices have continued to skyrocket leaving the purchasing power of most badly dented. As a result Pakistan has failed to meet any economic growth targets for the fiscal year 2022-23, with gross domestic product (GDP) growth at 0.3%. Foreign exchange reserves have dwindled to just $3.5bn, roughly enough for three weeks of imports.

At the end of his more than year-long run in office, Prime Minister Shehbaz Sharif seems to be regurgitating the same old lines he was taking back when he first came to power. In a long tweet the PM highlighted the challenges faced by his government, blaming the previous PTI government for having a legacy of economic turmoil and disruptions in global fuel and food supply lines. But just how bad of a picture does the PDM government leave on the inflation front?

The Inflation Picture — more than one reason

Several factors have contributed to inflation in Pakistan. To begin with, Pakistan had persistently been facing a balance of payment crisis, leading to a severe devaluation of the Pakistani rupee. Consequently, prices of imported goods increased drastically, leading to an increase in the general price level. As a country that is heavily reliant on oil imports, the situation became particularly detrimental.

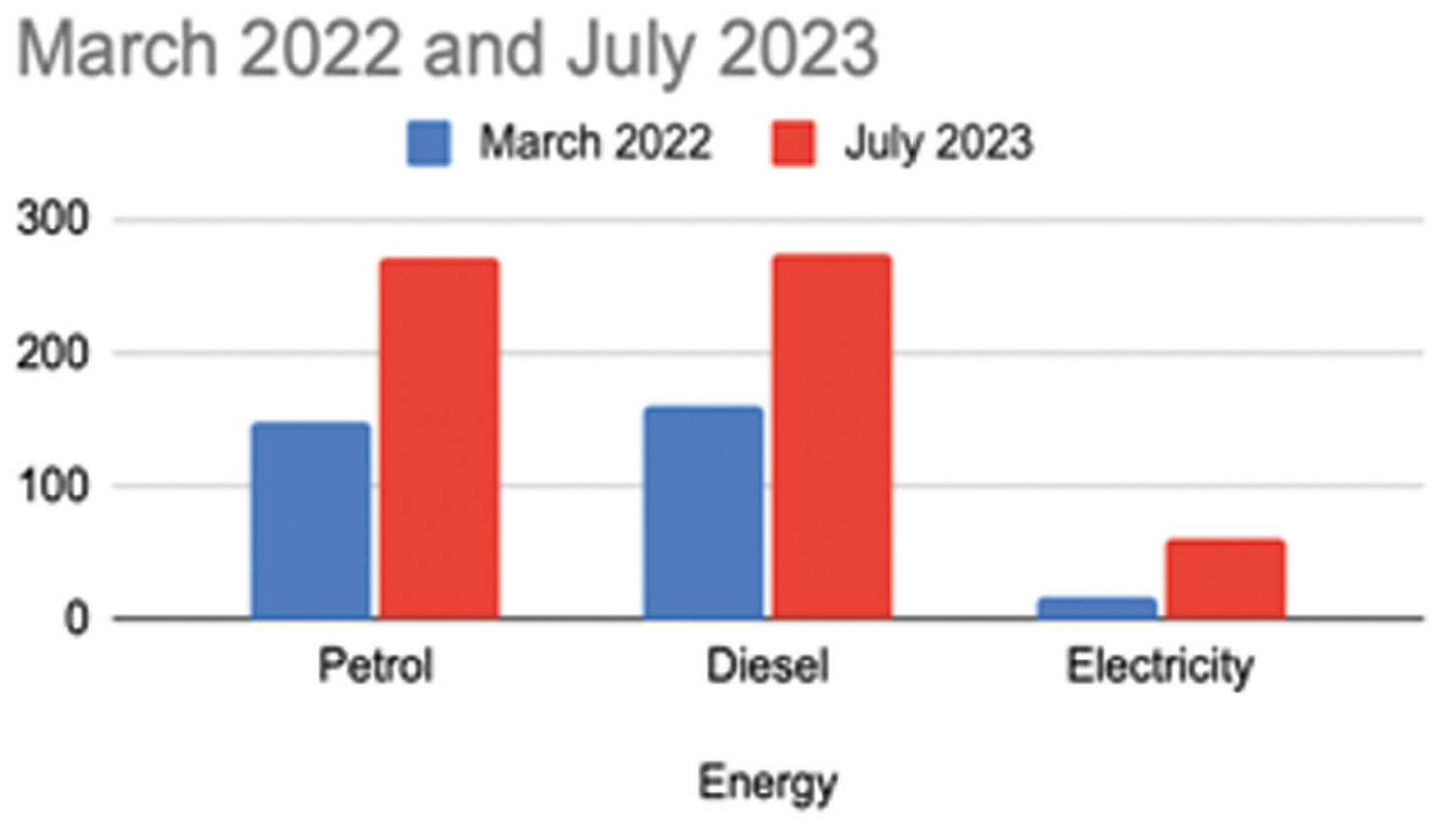

First and foremost, the PDM government increased petrol prices for up to Rs 84 per litre. Previously in March 2022, the former PTI government had given a Rs 38 billion subsidy on fuel, and planned to purchase oil from Russia at 30% less price as compared to that of the global market (similar to India that has already been purchasing cheap oil from Russia). This was however in violation of the IMF agreement which required Pakistan to raise energy prices.

When the PDM government came to power, Finance Minister, Miftah Ismail announced the fuel hike in attempts to reduce the fiscal deficit and resuscitate the IMF loan. The prices of high-speed diesel (HSD), petrol, kerosene, and light diesel oil (LDO) rose by a massive 83%, 56%, 73%, and 68.4% respectively in the subsequent months.

Inflation has been on an upward trend since early this year after the government took painful measures as part of fiscal adjustments demanded by the IMF to unlock stalled funding.Inflation clocked in at 35% in March, fuelled by a depreciating currency, a rollback in subsidies, and the imposition of higher tariffs to secure a bailout package of $1.1bn from the International Monetary Fund.

Inflation in Pakistan continued to rise. According to recent official figures, the consumer price index (CPI) was put at 35.4% year-on-year in March 2023, compared to the increase of 31.5% in the previous month and 12.7% in March 2022. A Dawn article reported that the multi-decade-high rate was primarily driven by soaring food and fuel prices.

Prices- Then and Now

By May 2023, the annual inflation rate had risen to 38% according to the Pakistan Bureau of Statistics (PBS), which set a national record the second month in a row. In the meanwhile, talks regarding a crucial bailout with the IMF stalled, raising the risk of defaulting on debts.

According to PBS, Pakistan’s CPI in April 2023 was at 36.5%- already the highest in the country as well as the South Asian region. An Al Jazeera article reported that Sri Lanka, which was gradually recovering from a two-year economic crisis, posted annual inflation at 25.2% in May. The month-on-month rise in May was 1.58%- food items such as vegetables, pulses, wheat, flour, rice, eggs, chickens as well as fuel and gas prices had caused the increase.

When the PDM government came to power, petrol and diesel were priced at Rs 150 per litre and Rs 160 per litre respectively, whereas the same are now being sold at Rs 273 and Rs 273.40 respectively. Likewise, the rate of per unit electricity has increased from Rs 16 to Rs 60 during the period- roughly an increase of 275%.

More specifically, the prices of vegetables, meat and other food items saw striking increases over preceding months. A plethora of factors have resulted in this, including a devalued rupee, higher production costs for farmers and disrupted supply-chains.

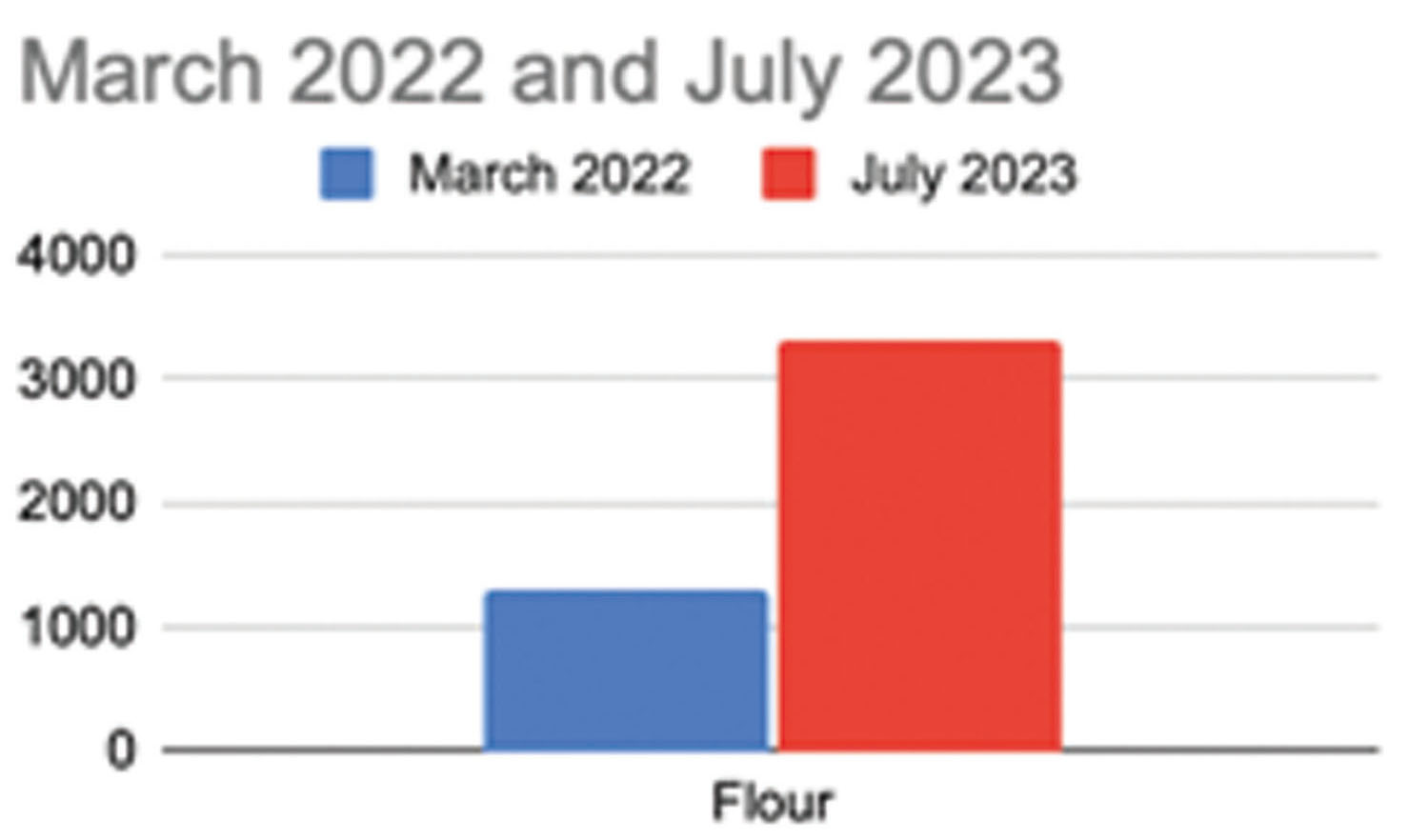

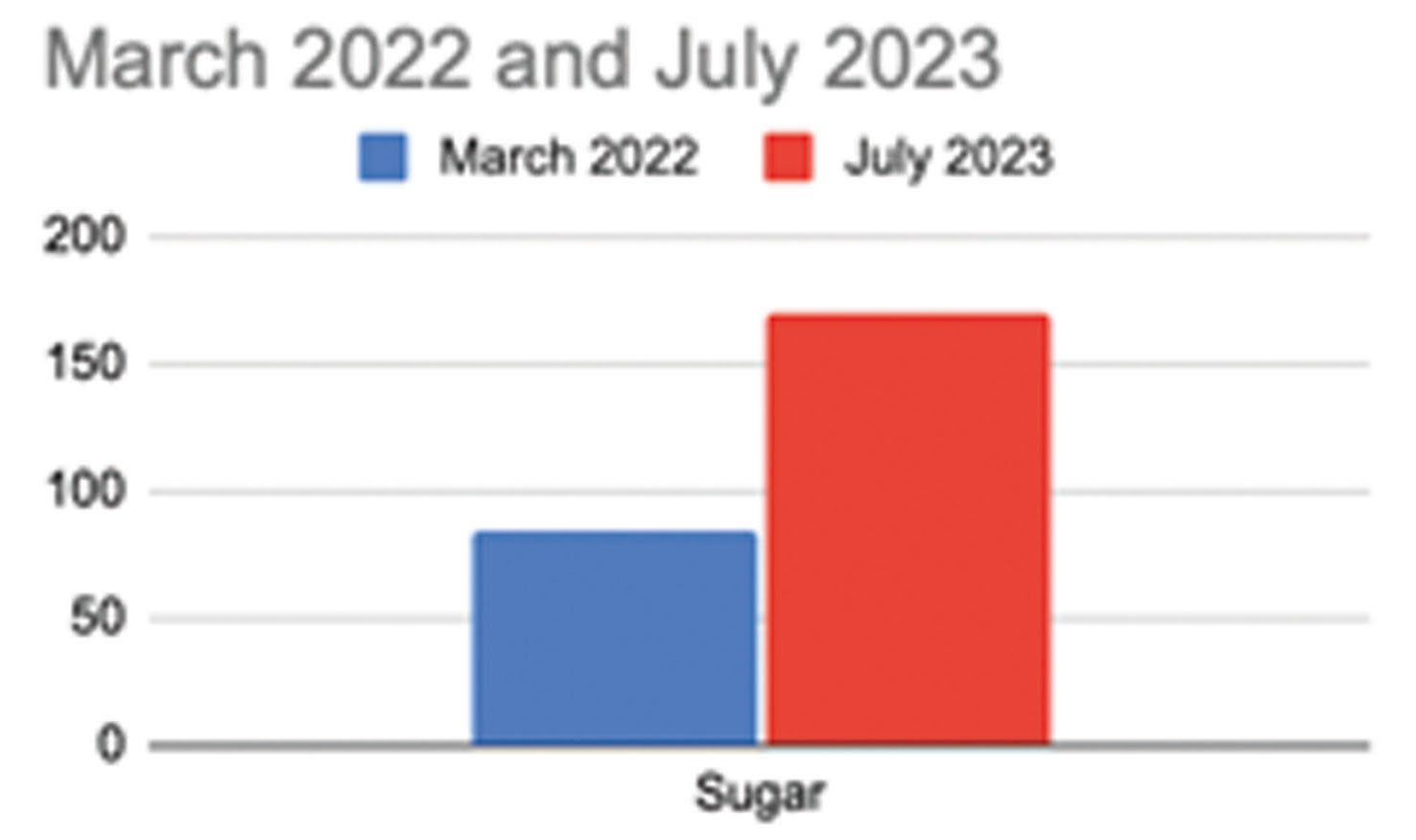

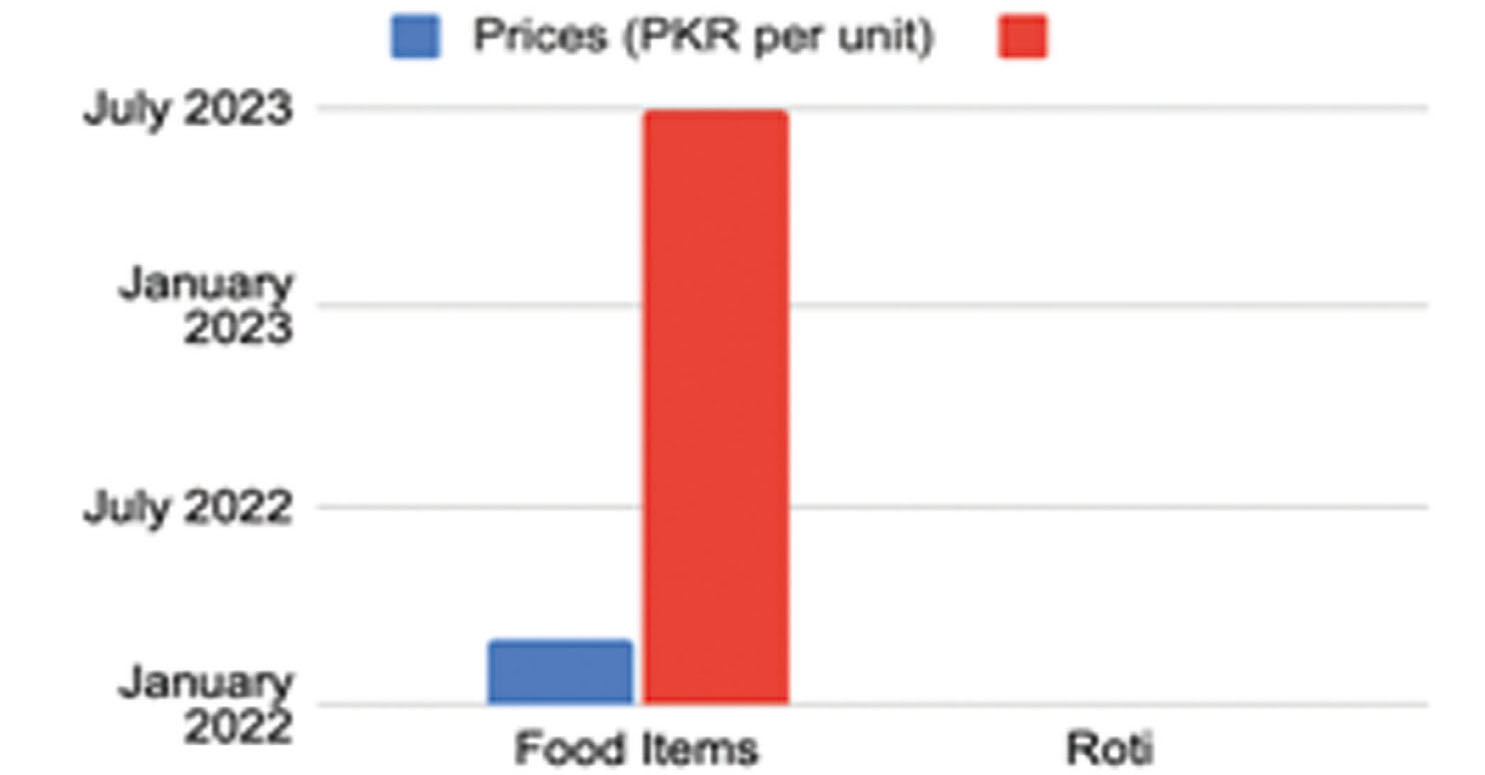

In the same vein, there has been a dramatic increase in the prices of food items such as flour and sugar. Previously sold at Rs 1300 per bag and Rs 85 per kg, flour is now being sold at Rs 3300 per bag while sugar at Rs 170 per kg. Furthermore, when the PDM government took control, the price of one roti was Rs 10, but is now Rs 30.

According to the Milkmen Union, the price of a buffalo in the open market, which was Rs 240,000 about 16 months ago, has gone up to Rs 600,000. “Fodder prices have also increased by 500 per cent,” he said, terming them the main reasons behind the milk price hike.

Nanbai Association President Shafiq Qureshi said: “In these 16 months, the price of flour has increased by 500 to 600 per cent and the price of electricity and gas for the oven has also increased by 1,000 per cent.” The situation is as bleak as it gets and the future government will be engrossed in an uphill battle in providing a lifeline to the sinking economy.