Road Prince has forged a deal with Yadea, a Chinese electric two-wheeler giant, to distribute their vehicles throughout Pakistan. The company has earmarked an investment of approximately $10 million, to be infused incrementally as they augment their existing manufacturing facility in Kasur. Interestingly, the vehicles will be retailed exclusively via Yadea’s dealership network, bypassing Road Prince’s well-established distribution channels. Six models are slated to be launched in the price bracket of Rs 1.5 lakh to Rs 10 lakh.

“It is the next big thing; we are at the cusp of a global paradigm shift towards electric vehicles, particularly in the two-wheeler segment.” declares Muhammad Salman, Director Sales and Marketing at Road Prince.

Yadea is a Shanghai-based Chinese manufacturer of electric bicycles, motorcycles, and scooters. The company operates in eighty different countries and has been on a worldwide expansion spree for the past two or three years. This venture marks Yadea’s second collaboration with a Pakistani two-wheeler manufacturer within a year.

The Chinese manufacturer inked a technical assistance agreement last December with Pak Star Automobile — the makers of Metro motorcycles. The company has since produced Yadea’s electric scooters in Pakistan as white label products. What will become of this relationship following the one with Road Prince? Well, we have no clue. Salman refused to comment on this particular issue. Profit also contacted Gulzar Ahmed Butt, Director of Pak Star Automobile. However, he remained silent as well.

The conspicuous absence of any comment or definitive stance from either party suggests that it might be business as usual. So, why has Road Prince acquired a new brand under its wing when it makes electric vehicles itself?

Solving a practical problem

To begin with, the move enables Road Prince to delegate a significant portion of innovation and product development to an external entity.

“Yadea is a brand that exclusively focuses on electric vehicles. In contrast, Road Prince only boasts a single model of lithium-ion based electric motorcycle in its portfolio,” elaborates Salman. Why strive to build your own product range in solitude when you can simultaneously bring an avant-garde player on board to seize market share on your behalf while you concentrate on refining your own indigenous products? Additionally, there’s the crucial aspect of market perception to consider.

“Upon its launch, Yadea is set to cater to a more upscale market segment compared to Road Prince, which has consistently prioritised serving customers with budget constraints,” Salman further elaborates.

However, does it make sense to introduce a premium product at a time when the two-wheeler industry is grappling with tumultuous demand? Whilst Salman champions the cost savings that customers stand to gain when opting for Yadea’s electric vehicle over comparable internal combustion engine alternatives, it’s undeniable that the industry has seen more prosperous days. The same can be said for the purchasing power of customers.

So, what exactly is happening here?

Hunting for opportunity amidst mayhem

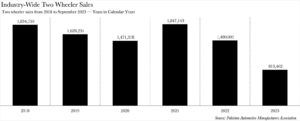

With a scant total of 700,000 two-wheelers sold and a mere three months remaining, Pakistan’s two-wheeler market finds itself in a precarious predicament. The industry, in conjunction with its four-wheeler counterpart and other manufacturing sectors, has capitulated to the plethora of challenges that have beleaguered Pakistan’s economy since 2022.

Road Prince, however, has borne the brunt of a particularly savage blow — a blow that the company has been weathering for approximately six years. The company is poised to register a six-year nadir, having sold a meagre 14,472 vehicles with just three months remaining before the curtain falls on 2023. Even if the company manages to double its total output in the remaining quarter, it will scarcely reach half of the sales it achieved in 2022. To provide some context, 2022 itself marked a five-year low for the company.

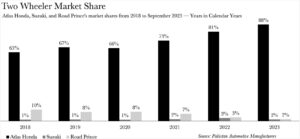

Furthermore, at 14,472, the company currently represents a mere fraction of its six-year average of 105,712 units per annum. This is also reflected in the company’s share of the two-wheeler market, which has dwindled to a paltry 2%. This represents a drop from last year’s 3%, and a precipitous decline from the 10% market share it commanded in 2018.

Perhaps it is amidst this tumult that Road Prince may have chanced upon an opportunity. While Road Prince’s market share has contracted, Atlas Honda and Suzuki’s market shares have remained steadfast. The former has actually burgeoned from 63% to an impressive 88% over the past six years, whilst the latter has stood its ground despite having some of the most expensive two wheelers across the market.

The aforementioned price range enables Road Prince to offer a product to the market that is more on par with Atlas Honda and Suzuki in terms of pricing—both of whom command a premium over Road Prince. Distributing these new electric two-wheelers through its own exclusive delivery channel rather than the existing one also seems prudent in this case, if indeed it is a more upscale market that Road Prince has set its sights on.

Does it make sense to divert resources to an entirely different venture when the opportunity cost is potentially missing out on consolidating your core business? Perhaps. thing fact is that there has been a subtle shift in the two-wheeler market.

“The non-Honda motorcycle customer, predominantly from the lower-income stratum, has been disproportionately impacted by the macroeconomic turbulence. Their living expenses have skyrocketed, while their wages have seen a modest uptick,” elaborated Fahad Iqbal, Managing Director of Ravi Automobile, in an earlier conversation with Profit.

“Their eroded purchasing power currently precludes them from even contemplating such an acquisition. In my opinion non-Honda customers who had the financial wherewithal to acquire an Atlas Honda motorcycle have become more discerning over the past year or so,” Iqbal added further.

Evidently, Road Prince has also been vigilant and noticed the trends that Iqbal highlighted. The Yadea partnership does not preclude Road Prince from expanding its own indigenous footprint. In an ideal scenario, Road Prince could bolster its core audience through its existing brand while simultaneously capturing an entirely new market segment.

As to whether this new dual-pronged approach will prove successful remains to be seen. There’s also the example of Yamaha that provides a cautionary tale for companies looking at the upmarket category given the Japanese giant’s collapse, similar to Road Prince. However, in Road Prince’s defence, Yamaha doesn’t sell electric vehicles.

Pretty nice post. I just stumbled upon your weblog and wanted to say that I have really enjoyed browsing your blog posts. After all I’ll be subscribing to your feed and I hope you write again soon!

our disaster message board article is a lifesaver! Communication during crises is crucial, and your insights into the effectiveness of message boards in emergencies are invaluable. It’s impressive how this platform serves as a lifeline, connecting people and resources when they’re needed most. Thank you for highlighting the significance of such a vital tool in times of adversity! 🌐🆘 #EmergencyPreparedness #CommunitySupport

Road Prince’s collaboration with Yadea for electric vehicles is a smart move. They’re tapping into Yadea’s expertise to offer upscale options while continuing to serve their budget-conscious customers. It’s an adaptive strategy in a changing market, aiming to capture new segments while staying rooted in their core audience.”

Road Prince’s collaboration with Yadea for electric vehicles is a smart move. They’re tapping into Yadea’s expertise to offer

I recently came across your article and have been reading along. I want to express my admiration of your writing skill and ability to make readers read from the beginning to the end. I would like to read newer posts and to share my thoughts with you.

I am unquestionably making the most of your site. You unquestionably have some extraordinary knowledge and incredible stories.

I curious more interest in some of them hope you will give more information on this topics in your next articles.

Hi there, I found your blog via Google while searching for such kinda informative post and your post looks very interesting for me

You’ve got some interesting points in this article. I would have never considered any of these if I didn’t come across this. Thanks!.

All the contents you mentioned in post is too good and can be very useful. I will keep it in mind, thanks for sharing the information keep updating, looking forward for more posts.Thanks

After study many of the blogs on the website now, and i genuinely as if your strategy for blogging. I bookmarked it to my bookmark site list and you will be checking back soon. Pls take a look at my internet site as well and tell me if you agree.

We are really grateful for your blog post. You will find a lot of approaches after visiting your post. Great work