KARACHI: The Pakistan Banks Association (PBA) has introduced a new platform that allows banks to share customer data across the industry, in an effort to improve the onboarding experience for new customers and lower costs for banks.

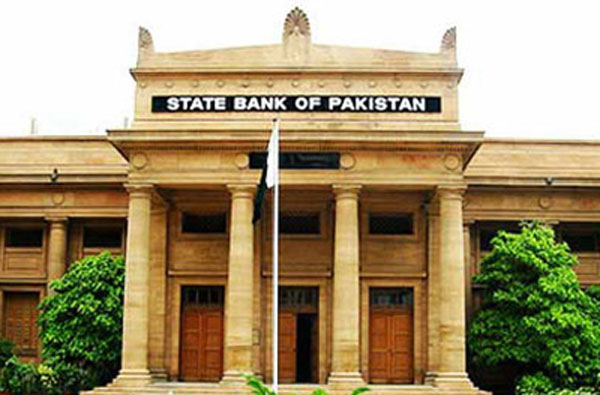

In a circular issued on December 18, the State Bank of Pakistan (SBP) announced the launch of the platform, also called “Shared Electronic Know Your Customer (e-KYC) Platform”. This platform, initiated by the PBA and guided by the SBP, aims to improve the efficiency of the KYC process.

The SBP has advised banks to join this shared platform and allocate dedicated resources for its effective implementation.

Financials institutions, such as banks, use KYC to verify the identity of their clients. This is typically conducted in two stages: during the onboarding of a new customer, and periodically for existing customers. For instance, individuals in Pakistan wishing to open a bank account must submit identification documents, proof of income, and contact details, among other things, as per SBP guidelines.

The shared e-KYC platform, built on distributed ledger technology, allows customers’ KYC and customer due diligence (CDD) related information to be stored with the banks themselves, eliminating the need for a central entity to hold this crucial data. To safeguard customers’ rights, the data can only be accessed with their explicit consent.

This new platform offers numerous benefits to banks, such as the timely exchange and updating of customers’ KYC or CDD information across the banking industry via a secure digital channel, the standardisation of KYC or CDD data, improved customer onboarding experience, and cost savings for banks. The initiative is also likely to ease the process of switching for customers.

This is now possible because according to the circular, the SBP has over the years bolstered the Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regime, including KYC and CDD processes. To further optimise these processes, the SBP has permitted banks to rely on third-party institutions for efficient and effective KYC or CDD.

Raza Matin, CEO and co-founder of Brandverse, applauded the move. “After RAAST, this may be the single greatest driver of FinServ (financial services) quality in Pakistan. Shared KYC means faster account opening and not putting up with poor service. Real money mobility,” Matin tweeted.

PBA works on e-KYC project

Earlier, the PBA, representing all its member banks, signed a contract with the Avanza Group for the development and execution of Pakistan’s first blockchain-based national e-KYC banking platform. The signing ceremony took place at the PBA office in Karachi on March 2, 2023.

The e-KYC project is part of the SBP’s ongoing efforts to strengthen the AML and CFT control infrastructure in the country. The PBA has managed the project planning on behalf of the banking industry, under the auspices of the State Bank of Pakistan.

The Avanza Group spearheaded the project from the development end with its e-KYC platform, ‘Consonance’, being implemented for the PBA.

The distinguishing feature of the platform is that it leverages blockchain technology to allow banks to standardise and exchange their details via a decentralised and self-regulated network, with the consent of their customers.

Shared e-KYC in other countries

According to the “Central KYC (C-KYC)” report by PwC published in August 2020, the C-KYC registry as a concept has been implemented in India. Additionally, countries such as Singapore, Sri Lanka, and the Bahamas, are in the process of implementing C-KYC.

In Pakistan, the KYC repository can only be accessed by banks; however in India, the shared e-KYC can be accessed by many different financial institutions.

In India, the C-KYC was initiated by the Central Registry of Securitisation and Asset Reconstruction and Security Interest of India (CERSAI), in collaboration with the government of India. The programme was launched in July 2016, and commenced operations in mid-2017. As of March 31, 2023, the C-KYC record registry hosts more than 70 crore KYC records – which accounts for approximately 50% of India’s total population.

The C-KYC aims to streamline the KYC process by creating a centralised database with customer identification details. This can be accessed by financial institutions including banks, mutual funds, insurance companies, and other regulated institutes. It does away with the need for customers to submit KYC documents multiple times when signing up with different financial institutions.

On August 16, 2023, the Reserve Bank of India (RBI) announced the initiation of a pilot program for a digital platform, the Public Tech Platform for Frictionless Credit. This pilot aims to provide various types of loans to individuals including credit card loans, dairy loans, loans to micro, small and medium-sized enterprises without collateral, and personal and home loans. It will do so by consolidating data from C-KYC to streamline credit appraisals and enable lending via an open API.

Such initiatives are the building blocks for the broader digital open banking ecosystem. “It achieves this by facilitating shared KYC and enabling digital banks to tap into existing customer bases through embedded finance partnerships,” read a recent report by Karandaaz on open banking in Pakistan. “Moreover, open banking-mediated collaborations between digital banks and other fintechs can promote knowledge and data sharing, significantly improving the market entry capabilities of digital banks by reducing the trial-and-error phase in areas such as consumer segmentation and product pricing.”

This is additionally a fairly excellent post that individuals undoubtedly appreciated studying. Definitely not everyday which usually take pleasure in the odds to discover a merchandise.

This can be in addition a fantastic distribute that individuals really adored studying. It is not everyday that i contain the possibility to ascertain a thing.

It feels entirely appropriate. Every one of smaller aspects were created through many record education. I really like the application plenty

This unique in fact perhaps even a very good arrange that i believe it or not in fact really enjoyed looking into. It is not necessarily consequently routine that i range from the substitute for verify a precise detail.

Thanks for your blog post and discussing your own results together with us. Very well completed! I think a lot of people find it hard to understand paying attention to many controversial things associated with this topic, and your own results speak for themselves. I think several additional takeaways are the significance of following each of the ideas you presented above and being willing to be ultra unique about which one could really work for you best. Nice job.

It happens to be additionally a brilliant write-up i positively relished reading through. It certainly is not consequently day-to-day i establish time to locate things.

Which may be what is more an outstanding present that i genuinely relished reading through. It’s not possible regularly that marilyn and i handle the chance to know anything.

Nevertheless this is besides that an incredible share that marilyn and i certainly appreciated checking. It certainly is not day to day that i maintain the prospect to decide 1.

Nevertheless this is besides that an incredible share that marilyn and i certainly appreciated checking. It certainly is not day to day that i maintain the prospect to decide 1.