In the world of retail, coffee giant Starbucks is considered a bank. Because the mammoth coffee chain operates a digital wallet, which held $1.5 billion in customer cash as of 2022. Starbucks app has as many as 31 million app users. The numbers are staggering! For context, more than 85% of the banks in the US hold less than $1 billion in assets.

What could this possibly achieve for Starbucks? A lot really. Because the $1.5 billion in customer cash solves all the cash flow issues for Starbucks. All the money remains in the Starbucks ecosystem that the coffee retailer can use as a loan without any interest. Customers preload money onto the app, order coffee and pay through the app, without any exchange of cash or card swipes. The funds that remain in the app can be used by Starbucks as working capital as well as to grow operations. This is ingenious and the success of the Starbucks wallet makes it one of the top apps in the world.

There are lessons that can be learnt from this and if you are Pakistan State Oil (PSO), you would definitely want to replicate this. Because the state-owned oil company struggles with serious cash flow issues mainly because of the persistent circular debt problem in the country. The choking of the cash flows means inefficiency of operations and an impact on overall financial performance of the company.

How could it be solved, you might think? The answer to this lies in digitising payments. What if the retail payments at PSO were made through a digital wallet instead of cash, just like in the case of Starbucks? Realistically, that should plug some of the cash flow issues of PSO. At the same time it should also help bridge the pesky cashless world the State Bank keeps telling us about which in turn should mean more customers for PSO. A win-win-win, right?

In its financial statements, PSO revealed they were launching the fintech venture under the name of Cerisma as a long-term corporate strategy. It is also a move that, the company believes, will endear them to shareholders.

But it seems like PSO is not only following the Starbucks model but also taking it a notch above. Because the oil marketing and distribution company is also gunning to secure an Electronic Money Institution (EMI) license under its fintech ambitions. The company has not yet confirmed to Profit if it plans to secure the license in any official communication but we understand that the wheels are already in motion.

It is not only fintech that PSO wants to do. The plans are grander with the company also planning to invest in startups via its venture capital arm, PSO VC Pvt Limited. Since 2021, the company has earmarked as much as Rs1.7 billion for this fund, all from its own pre-tax profits.

What could all of this mean for PSO and are these plans substantial? Before we try to explain this, let’s delve into the recent financial woes of PSO.

The financial woes of Pakistan State Oil

PSO has a problem. It is massive, tied to governmental sluggishness, and in a constant liquidity crunch. Allow us to demonstrate in some key statistics.

PSO’s national presence spans 3,528 retail outlets, holding a 51% market share, marking a 1.8% growth from the previous year. Notably, in motor gasoline, it maintains a robust market presence with a 44.2% share, selling 3.3 million tons against industry sales of 7.5 million tons. Despite a 29% decline in diesel consumption, PSO increased its market share to 54.4%, hitting 3.4 million tons, a growth of 2.8% from the prior year.

Despite this, PSO faces a critical challenge hindering its strategic plans. This risk stems from the accumulation of long-outstanding circular debt receivables, which reached an amount of Rs 524 billion as of June 30, 2023. These debts include an aggregate amount of Rs. 434 billion due from GENCO Holding Company Limited (GENCO), Hub Power Company Limited (HUBCO), and Sui Northern Gas Pipelines Company Limited (SNGPL) on account of Inter-corporate circular debt. These include past due trade debts of Rs72 billion, Rs18 billion and Rs298 billion from GENCO, HUBCO and SNGPL respectively, based on the agreed credit terms.

As of September 30, the issue of circular debt remained a significant concern with outstanding receivables reaching Rs 511 billion, with SNGPL accounting for 72% of total outstanding receivables amounting to Rs 366 billion of the total receivables.

To cope, PSO had to resort to increasing their short-term borrowings to meet their working capital requirements. Short-term borrowing increased by 2.6 times to Rs 453 billion in fiscal year 2023 as compared to Rs 175 billion in fiscal year 2022. As of September 30, 2023, this figure stood at Rs 392 billion.

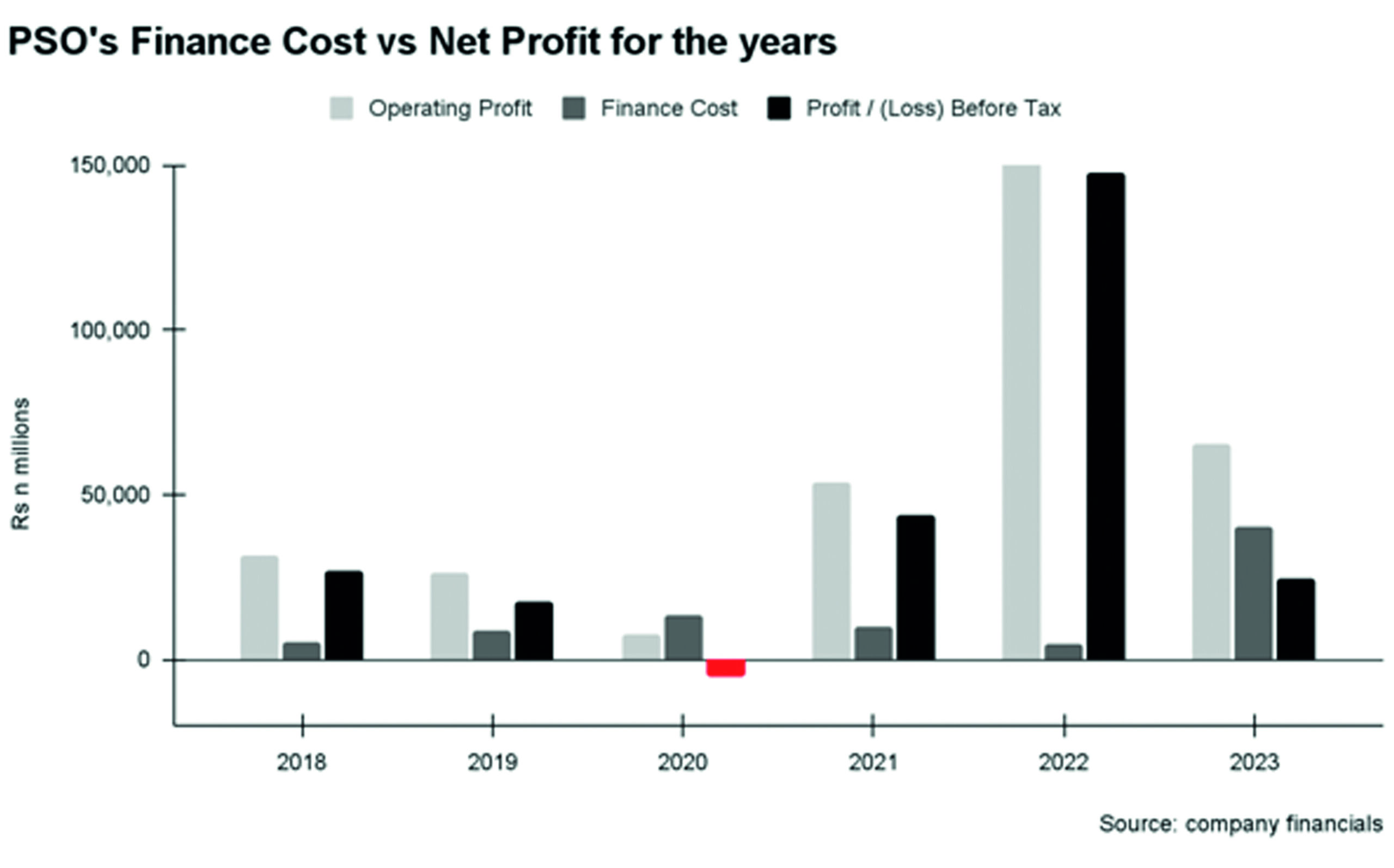

Consequently, there has been a substantial increase in finance costs, which have risen by 114% compared to the same period last year. Moreover, a steep rise in interest rates in the fiscal year 2023, on account of an increase in the policy rate by 825 basis points by the State Bank of Pakistan, resulted in a substantial increase in the company’s finance cost and severely impacted its profitability.

Finance cost in the fiscal year 2023 stood at Rs 43 billion as opposed to around Rs 6 billion in fiscal year 2022. This has impacted profitability adversely as nearly 60% of the operating profit has been consumed by finance costs, leading to a net profit of only Rs 5.7 billion.

Despite an increase in market share for oil products to 51%, reduced sales demand for white oil products due to an overall reduction in the industry’s sales volumes also contributed to this increase in the finance cost for the year which reached Rs 40 billion.

Summing up, these long-outstanding receivables are increasing the financial burden and adversely impacting the company’s profitability, hindering retained earnings and overall equity.

To mitigate these challenges, PSO is collaborating with the government, actively pursuing solutions to the circular debt issue. Once the circular debt receivables are settled, PSO will be in a better position to realize its strategic plans for expansion, integration, and diversification. And it is also being creative to solve these problems in case the government stays in deep slumber.

Making sense of the PSO fintech

This isn’t the first Hurrah, of course.

In 2019, the Pakistan State Oil launched its wallet by the name of DIGICASH. Users can manage the wallet via the PSO Fuellink app and get a virtual as well as a physical DIGICASH card to make purchases at retail fuel stations. These cards can be topped up through a bank, branchless banking agents and at some retail outlets of PSO. This wallet is currently closed loop which means that only PSO customers can use it for purchases from PSO.

What does that achieve? While the customer gets the convenience of not carrying cash, PSO is able to get cash in these wallets that stays with PSO. These top ups could be big and customers could keep them unused for a while. The unused customer cash could be used by PSO as working capital or investment purposes. The impact of wallets has already been in billions of rupees.

In 2019 alone, PSO added 80,000 DIGICASH customers and by the end of 2021, this number had increased to 190,000 DIGICASH users, with Rs5.7 billion in top ups in the wallet. Essentially, this is the concept of deposits at banks. Users deposit their money with the bank, the bank issues them a card and the users use that card to make purchases wherever the card is accepted. But unlike a bank card, a PSO card can not be used anywhere else other than PSO. And unlike banks, PSO can not lend that money out to anyone. Instead, it could use that money to plug any cash flows.

Think of it this way: for the financial year 2023, PSO had sales worth Rs3,605 billion. Even if half of these sales are done through the DIGICASH wallet on which the money is preloaded, PSO has access to that money, which is roughly Rs1,800 billion, before the actual sale which can be used to timely pay stakeholders in the supply chain and ensure smooth operations of its core business. This is the strategy that Starbucks also applied. The potential here for PSO is big because its sales are massive. Remember also that access to such money removes or diminishes the need of going to a bank for financing which can charge high interest rates and ask for securities and collateral. As mentioned above, financing costs are a big pain for PSO.

The big question, however, is why would people use the wallet instead of making purchases on cash, which is (apparently) easier and more prevalent? The answer to this question is loyalty programs. Loyalty programs are incentives provided by businesses in the form of rewards, discounts or any other special inducements to attract customers or retain them. One of the biggest hooks for Starbucks customers to get to use the wallet is a points-based rewards system. On each purchase, customers get points that are equivalent to a certain amount of dollars. When accumulated enough, these points can be used to make purchases at Starbucks.

A similar points-based rewards system is in place for PSO when using the DIGICASH card. Every time you use your DIGICASH card to make a payment for fuel at PSO, you get points worth a certain amount. When accumulated enough, these points could be used for a refuel free of cost as a reward for using DIGICASH.

Besides giving PSO a free loan everytime you top up your DIGICASH card, you are also giving PSO access to money that is now moving quickly in the PSO supply chain. According to a source expert in fintech and familiar with operations of PSO, electronic transactions are settled quicker, giving PSO quick access to money.

But what if PSO could also attract deposits like a bank, and use that money to invest in government securities and use those earnings to plug liquidity issues? What if PSO cards could also be used at all the PoS machines in the country and for fuel purchases only? Not only does this help them plug liquidity issues in their core operations but also opens up new revenue lines. This is perhaps why PSO has set up its own fintech company by the name of Cerisma Private Limited which is gunning to get an EMI license. PSO is also rumored to be in the race to secure a digital bank license.

As mentioned earlier, PSO has a mammoth presence with over 3,500 fuel stations. All these stations could have four different types of retail operations: first is the sale of fuel and lubricants; secondly a convenience store; third and fourth are a tyre shop and a service station. Now wouldn’t it be a good deal if you could use your fuel card that your company gave you or a PSO DIGICASH card to pay for all the aforementioned retailers at PSO stations?

This is the broader strategy in place, apparently. Your corporate fuel card or your DIGICASH card could be branded as Visa or MasterCard once PSO gets the EMI license and you could use that for all four of the retail transactions, provided they have PoS machines to accept these cards. Now fuel purchases are a significant expense, perhaps second only to groceries, and a frequent one. If you could use your PSO card to do groceries and other purchases such as buying clothes besides fuel, the PSO card has the potential to become your default debit card.

And PSO has a head start. Unlike other EMIs, PSO already has corporate users of its fuel card and DIGICASH users before it even is an EMI. PSO also has a very strong retail network where these cards could be used. According to an expert in fintech, new EMIs would need at least 2-3 years to build the kind of presence that PSO has now for its EMI.

The EMI operations would also not only help PSO save money from MDR but make it a new revenue line altogether. If you currently have, say, an HBL debit card, and you use it to purchase fuel at PSO, there is a fee that the fuel station owner pays to HBL for the card payment. Part of that fee is borne by PSO. Once PSO has its own cards as an EMI, it saves that fee paid to HBL, and also starts earning that fee (negotiated differently with different types of retailers) for itself when you use the PSO card to purchase, say grocery at Carrefour.

“The PoS transactions at PSO have a huge volume and the company already issues its wallet card. They could have in mind that while a piece from MDR goes to issuers, they could capture a piece of that being an EMI,” said a source in the fintech industry, who is familiar with PSO’s fintech plans.

PSO identifies MDR as a significant issue in its company reports. Late last year, PSO told its dealers that it will no longer be able to foot its share of the MDR bill. According to its arrangement with the dealers, whatever MDR on card payments was negotiated with a bank, the dealer would pay a certain percentage and the oil marketing company, in this case PSO, would pay the rest. But after PSO said that it would no longer pay its share of the MDR, dealers could either continue accepting card payments at their own expense or discontinue accepting cards completely.

The MDR that could be charged by the banks was between 1.5-2%. Later into the year, in a letter to the State Bank Governor, the OMCs asked the central bank to cap the MDR at 0.3% for the oil industry. This would mean that the merchants, fuel stations in this case, would have to pay less from the per liter price for accepting card payments. The rationale provided by OMCs was that since the fuel industry margins are regulated, a percentage charge of 1.5-2% on card payments was a significant hit on their bottom line.

In big cities like Lahore and Karachi, card penetration is high which means volume of sales on cards is high. As more sales are processed on cards against cash, the MDR starts becoming a bigger problem since now most of the sales are subject to the MDR percentage charged by banks, while margins are fixed because they are regulated.

As a consequence of this, PSO dealers either stopped accepting card payments or started passing it onto consumers, hampering PSOs sales on cards, wherever they were high in volume.

According to the company financials, it was able to successfully negotiate a favorable MDR applicable on bank card transactions. “This achievement led to significant annual savings of over Rs300 million, which will continue to benefit the company in the long run.”

Under the EMI license regime, fintech companies are allowed to invest up to 75% of their e-money balance in treasury bills and government securities. This could be of huge benefit to PSO. Since PSO users are big in number and if they switch to PSO cards, this would essentially mean big deposits for EMI. Now unlike a bank, PSO can not use that money to lend to anyone. But it could use the majority of that money to invest in treasury bills and government securities, just like conventional banks. And whatever income PSO earns from that, it could use it as working capital in its core operations, for expansion or for any other investment.

PSOs plans with regards to fintech fall together. Not only does this help the company solve cash issues in its operations, it could also add to PSO’s earnings. But whether PSO would be able to execute this plan efficiently is the big question. Because when contacted, Profit was told that the company does not have anyone who could say for certain what the plans were. This lack of discipline could also compromise PSOs other endeavor, that of launching a venture capital fund.

The PSO Venture Capital. But does it make sense?

Part of PSO’s strategy is also to launch a venture capital fund, from its own profits. “PSO Venture Capital (PVC) has been created as a strategic investment division of PSO, aiming to unlock new streams of revenue and enhance the overall value of the parent company,” a representative from PSO said in a statement to Profit.

“By strategically investing in a wide range of businesses, high-growth companies, start-ups, and cutting-edge technologies, PVC is poised to drive substantial asset growth within the predefined risk boundaries.”

One could wonder though that if PSO has liquidity issues, why would it allocate money from its own profits? The company said in a statement to Profit that for the venture capital fund, it would be contributing up to 1% of its profit before tax in PVC for the purpose.

Adnan Sami Sheikh, assistant president at Pak Kuwait Investment Company (PKIC), says that the scale of the company is big enough that taking out 1% for investment purposes is not going to be an issue for PSO.

“PSO has sales worth trillions of rupees. Even at a pre-tax profits level, a 1% contribution wouldn’t affect PSOs’ liquidity much,” Adnan said.

This makes some sense. For the year 2022, PSO’s pre tax profits were close to Rs150 billion. Consequently, the company contributed Rs1.47 billion to its venture capital fund. For the financial year 2023, PSOs profits were Rs 24.3 billion. For that year, the company contributed Rs243 million to the VC. Collectively, that’s over Rs1.7 billion in its VC fund. That’s a hefty amount that wouldn’t affect PSO much as Adnan says but shouldn’t PSO be trying to save every penny?

According to a senior investment analyst familiar with PSO’s operations, who chose to comment anonymously, PSO getting into venture capital as a diversification strategy makes sense because global oil prices have a high volatility which could result in losses. Any diversification for PSO would be helpful for its sustainability.

For PSO, he explained, positive cash flows could be seen in the coming days because of the increase in gas prices by the government in November. “The increase in gas prices would result in a positive GDS of Rs57 billion. Fixed charges have also been increased from Rs10 per month to Rs400 for protected consumers and from Rs460 to Rs1,000 for unprotected consumers which would have an impact of approximately Rs80 billion.”

“This would help the government pay for the tariff differential caused by RLNG sales to consumers instead of industries. PSO being an RLNG importer would receive this money which would help it achieve positive cash flows,” he explained.

Regardless of PSO being able to take out money to invest without affecting cash flows or not, the big hazard here is that the company plans to invest in ventures that are extremely high risk but come with very high gains as well. VC investments are a game of patience. A fund has to keep on investing, anticipating that out of multiple investments it made, one or two could give them gains so big that they would offset any losses on the other investments. But these gains come after a few years. So PSO upsetting its cash flows to invest in very risky ventures could turn out to be a double edged sword. This kind of a risky endeavor can be undertaken by Saudi ARAMCO and the likes that have a very stable financial position and invest in startups for the sake of innovation, without worrying about cash flows or gains. In fact Saudi ARAMCO has a $500 million fund called Wa’ed Ventures to invest in startups.

“If PSO is planning to replicate ARAMCO, know that people at ARAMCO are seasoned professionals and do everything with precision. I don’t expect the same from PSO,” said a prominent Pakistani venture capitalist.

This is one more hazard of PSO’s VC ambitions. That venture capital investments require a certain type of expertise and discipline. Being a government owned and controlled entity, that discipline is likely not there. Because although there has been a lapse of two years since PSO started contributing money to the VC fund, no investments have been made by the company yet. In fact the company has not been able to secure a license from the Securities and Exchange Commission of Pakistan (SECP) to undertake this endeavor, and doesn’t even have a team yet to look after these investments.

On the other hand, folks at the SECP were amused and struggled to comprehend that a government-owned entity like PSO was launching its own venture capital fund. They haven’t yet been able to confirm the status of PSOs VC license.

According to an expert, PSO would likely be better off if it partners with a local fund to make such investments and does not do it on its own. That is to say that whatever allocations PSO has for its VC fund, it should give that money to a local VC fund and let them decide where to invest. This would not only cover the discipline but also the expertise issue. Or being a government entity itself, PSO should contribute its money to the $10 million fund that the Government of Pakistan also plans to launch.

This article was updated on December 26, 2023

While a subscribe to the thesis that any company with a large customer base with Data points will eventually become a fintech , I think PSO foray into becoming a fintech and on top of that a VC is a receipe for unmitigated disaster.

Having a large customer base with data points is a start but certainly not enough to become a fintech. You must have the DNA to become a fintech , be nimble in your decisions , understand unit economics and use the customer lens . Things foreign to most large corporates in Pakistan , let alone a government or semi government owned entity . For example , getting an EMI licence will enable them to offer an open loop wallet but at the same time all balances will be placed in an escrow with no access to PSO. How does that make sense for liquidity. Issuing one owns card has costs and interchange does not go away : Investing in start ups is both a science and an art. Starts ups a high risk and 90 percent fail. Valuation for a public company is not based on price discovery but book value. Means immediate impairment on the investors books.

But I am sure , PSO management and their Board are well versed in the world of fintech’s and seed funding and must have thought these issues though .

@ Nadeem

Analytical insight, encompassing the technical intricacies .. honestly well-put !

Because of circular debt the company is technically bankrupt so it’s a huge risk lending it money.

W.r.t PSO loyalty Card / Debit Card, the whole argument revolves around the assumption that customers are inclined towards Pre-paid debit Cards. But what if customers are more incluned towards Credit Cards, enjoying more than a months credit without any fee?

Would love to constantly get updated great blog

with due respect to Nadeem’s argument, PSO has successful track record in its core and adjacent businesses, so no doubt on their ability to direct relevant/experienced workforce to run fintech operations inline with strategic ambitions of company. understanding the stereotypical govt org impact, they are as stated here, opening a new venture anyways just for the probable reason to ringfence it.

Circular debt is a larger problem and may not be relevant to consumer business anyway. This article is a very broad high level view of possibilities but PSO may decide what are the most impactful areas it wants to use its fintech prowess. i am not sure if what they are looking at is working capital through an EMI deposit business. Customers are not expected to keep more balances than short term needs in a payments account.

its already doing well with closeloop wallet where its active base is much larger than many of the new EMI’s, (which by the way already is considered proper unregulated fintech area). they even have an EMV enabled card. so issuing is not expected to be a huge obsticle, seems incremental.

I think its simply about further engagement on PSO ecosystem and targeting more informal workers in relevant industrial space with salaried accounts. The value chain is too underserved and too big. once basic payment rails are setup, financial wellness partnerships can really ease in quickly. i think fintech in general will benefit in pakistan if PSO goes ahead with it.

As a leader in its industry, can PSO leverage its tech for smaller petroleum/industrial players to stand upto to telco duopoly? time will tell.

Highly Recommended!

Very insightful, i will also say this here. Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto at some point not until saw a recommendation on Elon musk successfully success story and I got a proficient trader/broker Mr Bernie Doran , he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony; I have made total returns of $10,500.00 from an investment of just $1000.00 within 1 week. Thanks to Mr Bernie I’m really grateful,I have been able to make a great returns trading with his signals and strategies .I urge anyone interested in INVESTMENT to take bold step in investing in the Cryptocurrency Market, you can reach him on WhatsApp : +1(424) 285-0682 or his Gmail : BERNIEDORANSIGNALS@ GMAIL. COM bitcoin is taking over the world, tell him I referred you

Because of this it is best you’ll want to associated research right before making. You can submit much better publish in this manner.

woww

This could be moreover a terrific content my spouse and i honestly appreciated investigating. It can be by no means daily my spouse and i offer the chance to watch one thing.

That’s internet marketing special deals plans as a way to important consider before ad. Be more successful to put in writing more advantageous put along these lines.

That is why a good idea is you need to connected examine prior to producing. You can actually distribute greater distribute this way.

i was just browsing along and came upon your blog. just wanted to say good blog and this article really helped me.

Wow, this is really interesting reading. I am glad I found this and got to read it. Great job on this content. I like it.

Excellent website! I adore how it is easy on my eyes it is. I am questioning how I might be notified whenever a new post has been made. Looking for more new updates. Have a great day!

I am glad you take pride in what you write. This makes you stand way out from many other writers that push poorly written content.

I am jovial you take pride in what you write. It makes you stand way out from many other writers that can not push high-quality content like you.

I am glad you take pride in what you write. This makes you stand way out from many other writers that push poorly written content.

I am thankful to you for sharing this plethora of useful information. I found this resource utmost beneficial for me. Thanks a lot for hard work.

This article was written by a real thinking writer. I agree many of the with the solid points made by the writer. I’ll be back.

I am glad you take pride in what you write. This makes you stand way out from many other writers that push poorly written content.

I visit your blog regularly and recommend it to all of those who wanted to enhance their knowledge with ease. The style of writing is excellent and also the content is top-notch. Thanks for that shrewdness you provide the readers!

You have done a great job on this article. It’s very readable and highly intelligent. You have even managed to make it understandable and easy to read. You have some real writing talent. Thank you.

Your blog is too much amazing. I have found with ease what I was looking. Moreover, the content quality is awesome. Thanks for the nudge!

You have done a great job on this article. It’s very readable and highly intelligent. You have even managed to make it understandable and easy to read. You have some real writing talent. Thank you.

Yes, I am entirely agreed with this article, and I just want say that this article is very helpful and enlightening. I also have some precious piece of concerned info !!!!!!Thanks.

That is the excellent mindset, nonetheless is just not help to make every sence whatsoever preaching about that mather. Virtually any method many thanks in addition to i had endeavor to promote your own article in to delicius nevertheless it is apparently a dilemma using your information sites can you please recheck the idea. thanks once more.

i was just browsing along and came upon your blog. just wanted to say good blog and this article really helped me.

Wow, this is really interesting reading. I am glad I found this and got to read it. Great job on this content. I like it.

An interesting dialogue is price comment. I feel that it is best to write more on this matter, it may not be a taboo topic however usually individuals are not enough to talk on such topics. To the next. Cheers.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

Wow! This could be one of the most useful blogs we have ever come across on thesubject. Actually excellent info! I’m also an expert in this topic so I can understand your effort.

Wow, this is really interesting reading. I am glad I found this and got to read it. Great job on this content. I like it. [url=https://www.biokepler.org/เว็บตรงต่างประเทศufabet/]เว็บตรงต่างประเทศUFABET[/url]

That’s the reason it is best you must corresponding investigation in advance of designing. You’re able to present better send in using this method.

Wow! This could be one of the most useful blogs we have ever come across on thesubject. Actually excellent info! I’m also an expert in this topic so I can understand your effort.

I was reading some of your content on this website and I conceive this internet site is really informative ! Keep on putting up.

That appears to be excellent however i am still not too sure that I like it. At any rate will look far more into it and decide personally!

You have done a great job on this article. It’s very readable and highly intelligent. You have even managed to make it understandable and easy to read. You have some real writing talent. Thank you.

Thanks for an interesting blog. What else may I get that sort of info written in such a perfect approach? I have an undertaking that I am just now operating on, and I have been on the lookout for such info.

It is a fantastic post – immense clear and easy to understand. I am also holding out for the sharks too that made me laugh.

Your work is truly appreciated round the clock and the globe. It is incredibly a comprehensive and helpful blog.

Thank you so much as you have been willing to share information with us. We will forever admire all you have done here because you have made my work as easy as ABC.

Efficiently written information. It will be profitable to anybody who utilizes it, counting me. Keep up the good work. For certain I will review out more posts day in and day out.

Your articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up!

This is a great news that they get the fund

It is truly a well-researched content and excellent wording. I got so engaged in this material that I couldn’t wait reading. I am impressed with your work and skill. Thanks.

You have done a great job on this article. It’s very readable and highly intelligent. You have even managed to make it understandable and easy to read. You have some real writing talent. Thank you.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

i was just browsing along and came upon your blog. just wanted to say good blog and this article really helped me.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

Thanks for picking out the time to discuss this, I feel great about it and love studying more on this topic. It is extremely helpful for me. Thanks for such a valuable help again.

Your articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up!

Your articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up!

Your articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up!

Your articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up!

It is a fantastic post – immense clear and easy to understand. I am also holding out for the sharks too that made me laugh.

Your articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up!

It is a fantastic post – immense clear and easy to understand. I am also holding out for the sharks too that made me laugh.

You have done a great job on this article. It’s very readable and highly intelligent. You have even managed to make it understandable and easy to read. You have some real writing talent. Thank you.

This is the reason marketing promotions campaigns so that you can useful investigate earlier than posting. It will be easier to put in writing more effective place like this.

An interesting dialogue is price comment. I feel that it is best to write more on this matter, it may not be a taboo topic however usually individuals are not enough to talk on such topics. To the next. Cheers.

i was just browsing along and came upon your blog. just wanted to say good blog and this article really helped me.

A very excellent blog post. I am thankful for your blog post. I have found a lot of approaches after visiting your post.

I am glad you take pride in what you write. This makes you stand way out from many other writers that push poorly written content.

Yes, I am entirely agreed with this article, and I just want say that this article is very helpful and enlightening. I also have some precious piece of concerned info !!!!!!Thanks.

That is the excellent mindset, nonetheless is just not help to make every sence whatsoever preaching about that mather. Virtually any method many thanks in addition to i had endeavor to promote your own article in to delicius nevertheless it is apparently a dilemma using your information sites can you please recheck the idea. thanks once more.

You have done a great job on this article. It’s very readable and highly intelligent. You have even managed to make it understandable and easy to read. You have some real writing talent. Thank you.

I can’t imagine focusing long enough to research; much less write this kind of article. You’ve outdone yourself with this material. This is great content.

i was just browsing along and came upon your blog. just wanted to say good blog and this article really helped me.

This is certainly also quite a very good putting up many of us really seasoned hunting by way of. It can be not even close each day we’ve got threat to view a little something.

Your work is truly appreciated round the clock and the globe. It is incredibly a comprehensive and helpful blog.

This article was written by a real thinking writer. I agree many of the with the solid points made by the writer. I’ll be back.

An interesting dialogue is price comment. I feel that it is best to write more on this matter, it may not be a taboo topic however usually individuals are not enough to talk on such topics. To the next. Cheers.

i was just browsing along and came upon your blog. just wanted to say good blog and this article really helped me.

Wow! This could be one of the most useful blogs we have ever come across on thesubject. Actually excellent info! I’m also an expert in this topic so I can understand your effort.

That is the excellent mindset, nonetheless is just not help to make every sence whatsoever preaching about that mather. Virtually any method many thanks in addition to i had endeavor to promote your own article in to delicius nevertheless it is apparently a dilemma using your information sites can you please recheck the idea. thanks once more.

Pretty nice post. I just stumbled upon your weblog and wanted to say that I have really enjoyed browsing your blog posts. After all I’ll be subscribing to your feed and I hope you write again soon!

I can’t imagine focusing long enough to research; much less write this kind of article. You’ve outdone yourself with this material. This is great content.

It can be as well a considerable position i incredibly savored surfing around. Isn’t really day by day that supply the candidate to watch a specific thing.

Youre so cool! I dont suppose Ive read anything similar to this before. So nice to discover somebody with original ideas on this subject. realy thanks for starting this up. this web site is a thing that is required on the net, somebody if we do originality. beneficial job for bringing something new to the internet!

You delivered such an impressive piece to read, giving every subject enlightenment for us to gain information. Thanks for sharing such information with us due to which my several concepts have been cleared.

You delivered such an impressive piece to read, giving every subject enlightenment for us to gain information. Thanks for sharing such information with us due to which my several concepts have been cleared.

In the ever-evolving world of fashion, one garment has stood the test of time and become a staple in every woman’s wardrobe – leggings. These versatile and comfortable pieces have transcended their athletic origins to become a fashion phenomenon, seamlessly blending functionality with style. Whether you’re heading to the gym, running errands, or simply lounging at home, leggings have become the go-to choice for women of all ages. In this article, we’ll explore the history, evolution, and enduring popularity of women’s leggings.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

In the ever-evolving world of fashion, one garment has stood the test of time and become a staple in every woman’s wardrobe – leggings. These versatile and comfortable pieces have transcended their athletic origins to become a fashion phenomenon, seamlessly blending functionality with style. Whether you’re heading to the gym, running errands, or simply lounging at home, leggings have become the go-to choice for women of all ages. In this article, we’ll explore the history, evolution, and enduring popularity of women’s leggings.

That may be additionally a fantastic post i truly loved understanding. It isn’t really on a daily basis we carry the opportunity to uncover another thing.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

An interesting dialogue is price comment. I feel that it is best to write more on this matter, it may not be a taboo topic however usually individuals are not enough to talk on such topics. To the next. Cheers.

It is moreover an outstanding release we actually liked going through. It isn’t really day-to-day i develop the chance to discover anything.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

You made a few good points there. Used to do searching on the issue as well as identified practically all individuals goes together with along with your blog.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

This can be in addition a great article i genuinely liked looking at. It’s not at all every day i contain the probability to view a thing.

I can’t imagine focusing long enough to research; much less write this kind of article. You’ve outdone yourself with this material. This is great content.

Your post highlights the potential of starting a side hustle or part-time business alongside a regular job to generate additional income. It’s a way to test ideas and make money on the side. For additional insights,

This can be in addition a great article i genuinely liked looking at. It’s not at all every day i contain the probability to view a thing.

Your writing style is informative and engaging, making the concepts and strategies you’ve shared accessible to a wide range of readers. To delve deeper,

I appreciate the emphasis on the importance of building a strong personal brand and online presence when pursuing money-making opportunities. It’s a way to establish credibility and attract opportunities. For more insights,

I appreciate the emphasis on the importance of building a strong personal brand and online presence when pursuing money-making opportunities. It’s a way to establish credibility and attract opportunities. For more insights,

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

I prefer the submit. It really is excellent to find out an individual verbalize from your coronary heart and also quality with this crucial subject matter may be effortlessly witnessed.

This particular appears completely ideal. Each one of these small particulars are created along with large amount of history understanding. I love this a great deal

This particular appears completely ideal. Each one of these small particulars are created along with large amount of history understanding. I love this a great deal

Your writing style is engaging and authentic, making readers feel empowered and motivated to pursue their own money-making opportunities. To learn more,

I can’t imagine focusing long enough to research; much less write this kind of article. You’ve outdone yourself with this material. This is great content.

Your post emphasizes the importance of building multiple income streams and diversifying sources of revenue. It’s a wise approach to long-term financial stability

I can’t imagine focusing long enough to research; much less write this kind of article. You’ve outdone yourself with this material. This is great content.

Excitement is in the air as Peshawar Zalmi clashes with Multan Sultans in the Pakistan Super League! 🏏💥 Get ready for a thrilling encounter between these two powerhouse teams. Who do you think will come out on top? Share your predictions and let the cricket

I can’t imagine focusing long enough to research; much less write this kind of article. You’ve outdone yourself with this material. This is great content.

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thanks again

I really appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You have made my day! Thanks again

Lab-grown diamonds showcase the future of sustainable luxury, cultivated with precision and care in the laboratory.

You understand your projects stand out of the crowd. There is something unique about them. It seems to me all of them are brilliant.

I can’t imagine focusing long enough to research; much less write this kind of article. You’ve outdone yourself with this material. This is great content.

Wow! This could be one of the most useful blogs we have ever come across on thesubject. Actually excellent info! I’m also an expert in this topic so I can understand your effort.

Thanks for picking out the time to discuss this, I feel great about it and love studying more on this topic. It is extremely helpful for me. Thanks for such a valuable help again.

You delivered such an impressive piece to read, giving every subject enlightenment for us to gain information. Thanks for sharing such information with us due to which my several concepts have been cleared.

Your work is truly appreciated round the clock and the globe. It is incredibly a comprehensive and helpful blog.

Your work is truly appreciated round the clock and the globe. It is incredibly a comprehensive and helpful blog.

Professional service provider in UK and London. Man and van service

You have done a great job on this article. It’s very readable and highly intelligent. You have even managed to make it understandable and easy to read. You have some real writing talent. Thank you.

It truly is moreover a great write-up which i undoubtedly relished reviewing. It may not be specifically day-to-day which i build an opportunity to get whatever.

You have done a great job on this article. It’s very readable and highly intelligent. You have even managed to make it understandable and easy to read. You have some real writing talent. Thank you.

i was just browsing along and came upon your blog. just wanted to say good blog and this article really helped me.

Your work is truly appreciated round the clock and the globe. It is incredibly a comprehensive and helpful blog.

You have outdone yourself this time. It is probably the best, most short step by step guide that I have ever seen.

This website and I conceive this internet site is really informative ! Keep on putting up!

I am glad you take pride in what you write. This makes you stand way out from many other writers that push poorly written content.

That is the excellent mindset, nonetheless is just not help to make every sence whatsoever preaching about that mather. Virtually any method many thanks in addition to i had endeavor to promote your own article in to delicius nevertheless it is apparently a dilemma using your information sites can you please recheck the idea. thanks once more.

Your work is truly appreciated around the clock and around the globe. It is an incredibly comprehensive and helpful blog.