The curtains close on 2023, Pakistan concludes another year marked by economic misery, combined with uncertainty on the political front and a looming security threat that has the potential to exacerbate the suffering. While 2022 may be remembered as one of the worst years in the country’s history, its successor, though not as dire, failed to meet the expectations of an economic recovery.

The economic cohesion has been challenged by multiple factors. The inflation levels remained consistently high during the year while the fiscal deficit continued to pile up. The reserve position still remains challenging and interest rates are at a record high.

All of the aforementioned factors have resulted in an implementation of imposed austerity measures as the government grapples with a catch-22 situation. As a consequence, the general public endured hardship and resentment has heightened. In response to this situation, the establishment has adopted a heavy handed approach, and “Danda” remained the prevailing theme throughout the year.

The economy at a glance

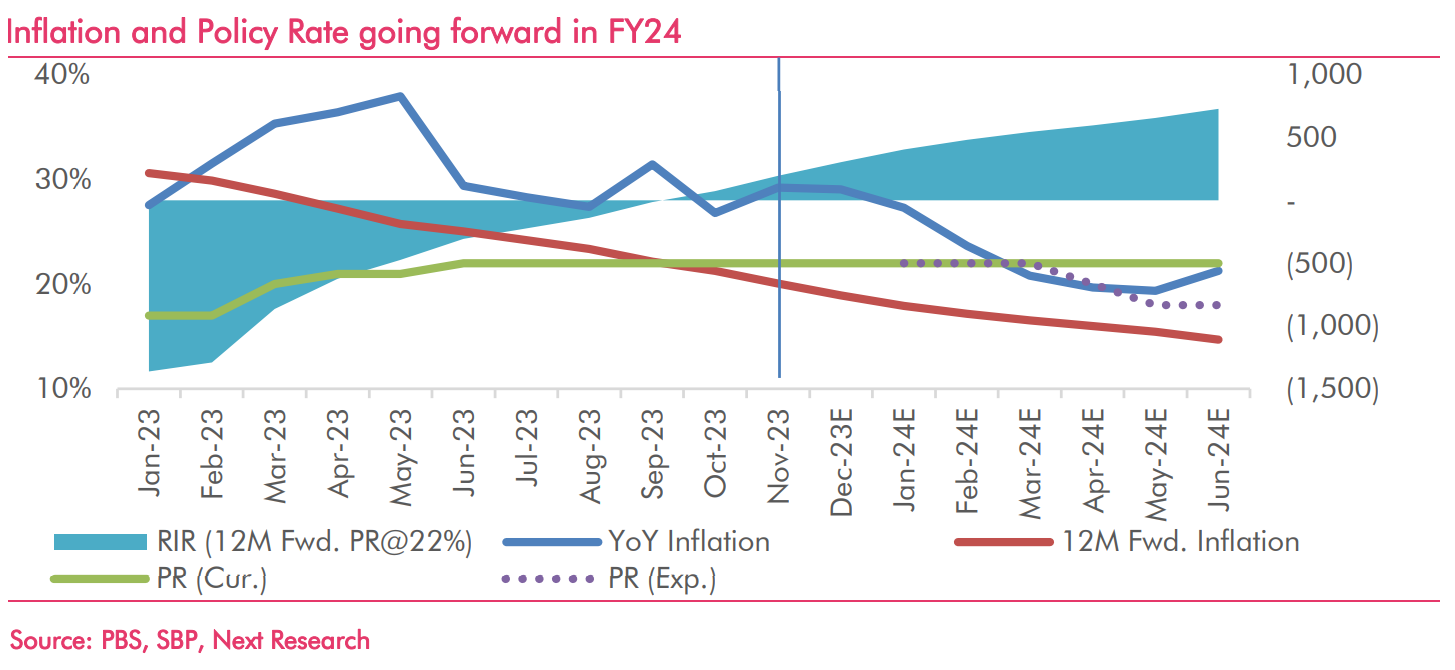

The year began with little to no respite for the people. The cost of living crisis persisted from 2022 as inflation remained close to 30% throughout the year. The combination of high commodity prices, rupee devaluation, and a significant correction in economic fundamentals resulted in elevated prices for 2023, even after factoring in the high base effect from the previous year.

As per an analyst note published by Insight Securities, “The inflation trajectory in 2QFY24 has surpassed the expectation of the analyst community. Despite expectations of decline in the headline CPI due to high base effect, the inflation remained high due to the adjustment in gas tariffs in Nov’23 and higher FCA in Dec’23, deviating from earlier forecast.”

In response to the crisis, SBP resorted to fire fighting measures as the policy rate was hiked by 6% during 2023. An inflation targeting regime was already in the works, but when inflation in March touched its peak, beyond SBP’s expectations, due to a freefall of the rupee value, the central bank announced an aggressive hike of 300 basis points in just one meeting.

According to the data compiled by Bloomberg, “Pakistan, which has raised rates by a cumulative 600 basis points since January, now ranks fourth on the list of world’s 50 central banks that have made the biggest rate changes this year.”

However, analysts over the past three years have reiterated the fact that the central bank has been completely off in terms of its medium term inflation expectation. Further, irresponsible fiscal behavior from the sovereign has led to a massive amount of money being pumped into the system.

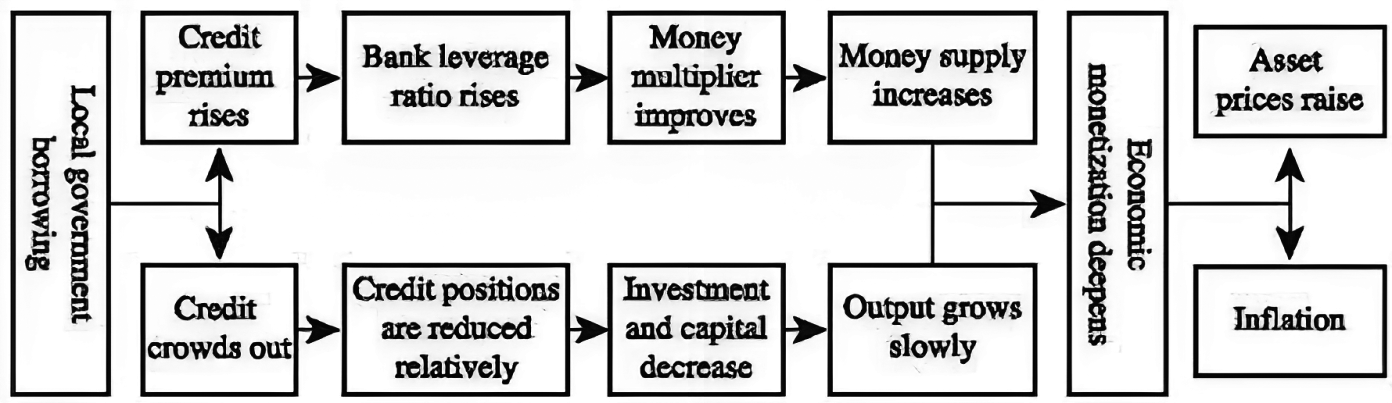

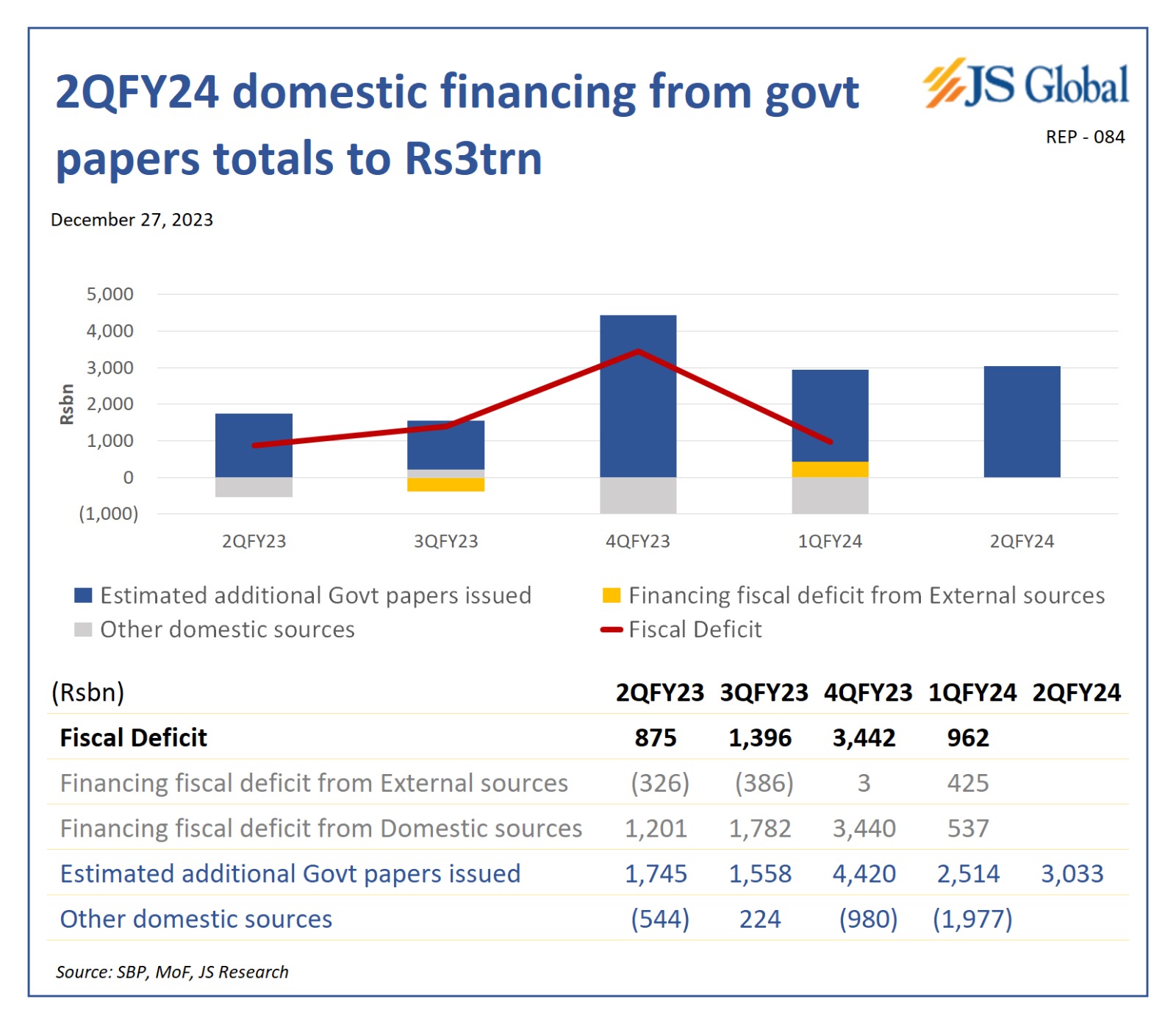

Adding to the fiscal conundrum was the debt servicing cost. The government borrowing has crossed the Rs 60 trillion mark and two-thirds of it pertains to domestic lending. In the last few years, the government has doubled down on borrowing by offering short-term securities in the domestic market. This has negatively impacted the maturity profile and resulted in exposure to high debt servicing costs.

In a podcast, journalist Khurram Husain pointed out that successive governments have pursued an aggressive growth strategy over the past three years, particularly in 2020 and 2021, through a substantial infusion of money into the system. This has led to an unchecked expansion of the money supply, and we are currently witnessing the consequences of this approach.

The sustained high policy rate has curbed the expansion in money supply to some extent. However, this came at the expense of the private sector, which has almost been cut-off from the credit market. Consequently, the large-scale manufacturing industry has suffered throughout the year, as the rising costs of financing, demand destruction measures and the crowding out of private credit have hindered the continuation and expansion of business operations.

“The broad money (M2) growth decelerated to 13.7 percent y/y as of November 24, 2023 from 14.2 percent as of end-June. This deceleration is attributed to net retirements in private sector credit and more than seasonal decline in commodity operations financing,” read the official statement of the monetary policy committee meeting held on 12th of December.

But, the economic pain was not limited to this. The Pakistani rupee also faced significant depreciation, falling approximately 20% against the US dollar during the year. Currency volatility was a recurring theme, as the then Finance Minister, Ishaq Dar, remained firm on maintaining the currency peg, adhering to his infamous principles of “Daronomics”.

Dar was also involved in a standoff with the International Monetary Fund (IMF) as he struggled to see through the ninth review of the Extended Fund Facility (EFF) that Pakistan had signed in 2019. However, thanks to direct intervention from the Prime Minister, Pakistan managed to secure a 9-month Stand-By Agreement with the Fund.

After returning to the IMF’s fold, some stability was achieved at the economic front. Almost a month later, the tenure of the PDM government concluded and a caretaker setup took charge.

However, the currency markets continued to speculate with open market rates breaching the 330 mark. But this time around “the establishment” stepped up and a nationwide crackdown against money exchanges and speculators led to a sharp correction of the open market rate.

The heavy-handed approach set the scene for the rest of the year, during which the caretaker government’s primary aim was to comply with the requirements of the IMF agreement.

Additionally, the establishment took matters in its own hands and formed the Special Investment Facilitation Council (SIFC) to attract investments into the country and address the balance of payment issues. However, the forum is yet to yield the desired outcomes as the external account situation continues to be challenging. Despite the inflows of multilateral and bilateral funds, the burden of high debt payments has maintained the pressure on reserves.

According to an analysis note released by JS Global Capital in November, the Governor of the SBP conveyed, following the Monetary Policy Committee (MPC) meeting on 30th October, that the total external debt payment obligations for Fiscal Year (FY) 2024 stand at $21 billion. Out of this amount, $4.3 billion has already been disbursed during the first four months of the fiscal year, leaving an outstanding balance of approximately $17 billion. The SBP expects to roll over $12.3 billion, a slightly higher figure compared to the $11 billion discussed in the previous briefing held in September 2023. The remaining $4.4 billion is scheduled to be repaid to the respective lenders.

Therefore, the highlight for 2023 was the government being able to control the economic freefall and the country averting what looked as an imminent default.

2024: A year of miracles?

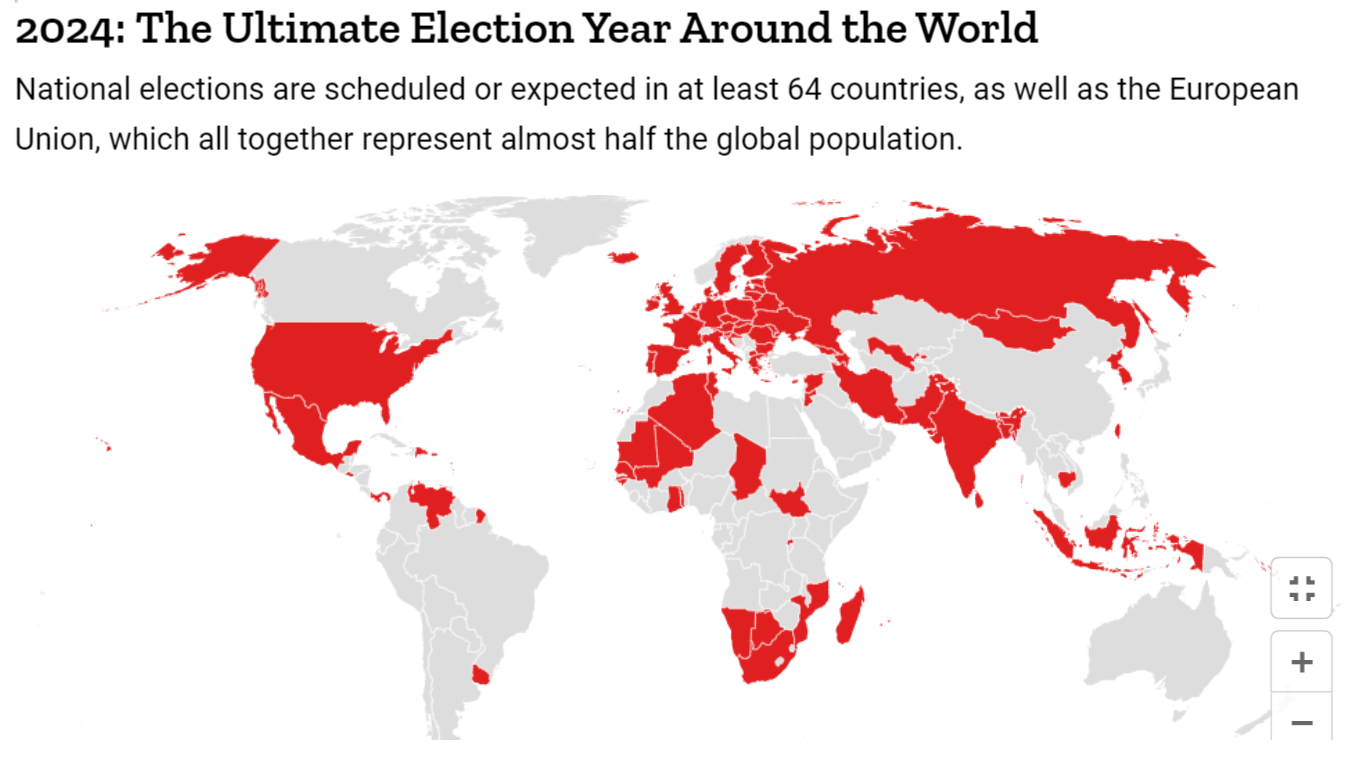

The year holds significant importance not just for Pakistan, but also for the world. Nearly half of the global population will be going into general polls, including the subcontinent nations: India, Pakistan, and Bangladesh.

Pakistan is scheduled to hold elections on 8th February 2024, yet it is expected to be a controversial affair, to say the least.

The Time magazine has assigned a comparatively low Freedom and Fairness score to Pakistan’s upcoming elections, positioning it below India and only above countries like Russia, Bangladesh, and Venezuela, which are governed by authoritarian regimes.

“The country’s most popular politician, former Prime Minister Imran Khan, sits in jail, while his party has been suppressed and his supporters arrested in the run-up to February’s election,” it remarked.

Source: Time Magazine

Additionally, the situation at the security front doesn’t inspire much confidence as well. The country faces an increasingly complex jihadist threat landscape, as the Tehreek-e-Taliban Pakistan (TTP) demonstrates greater tactical sophistication and political astuteness. The TTP’s effective use of social media for propaganda has contributed to its expansion in Khyber Pakhtunkhwa and Balochistan provinces. The emergence of new actors like the Islamic State of Khorasan Province (ISKP), which has absorbed other extremist groups, adds additional challenges.

The Baloch insurgency has also evolved, with educated, middle-class individuals leading a separatist movement that employs violent tactics. Political volatility, economic challenges, and a growing gap between the state and society hinder Pakistan’s efforts to address these threats effectively.

All of these factors contribute to the predicament of stability, which is crucial for facilitating an economic recovery.

As per Fitch’s December 2023 credit report for Pakistan,“We expect general elections to take place as scheduled in February, and to produce a coalition government along the lines of Shebhaz Sharif’s government. Former prime minister Imran Khan’s Pakistan Tehreek-e-Insaf party likely remains popular, but its electoral prospects may be limited by Mr Khan’s imprisonment and the departure of senior leaders. Space for political expression has shrunk since widespread protests in May 2023. Nevertheless, further delays to elections or renewed political volatility cannot be excluded and would jeopardise IMF negotiations and external funding,”

Additionally, exacerbating the situation is the pessimistic outlook on the external front in the near term.

Rating agencies like Fitch maintain a distressed rating for Pakistan which has shut the country off from the global credit market. Further, for private investors, the Country remains an unlikely investment destination and only hot money flows can be expected due to high interest rates and the recent uptick in the stock market.

Source: Chase Research

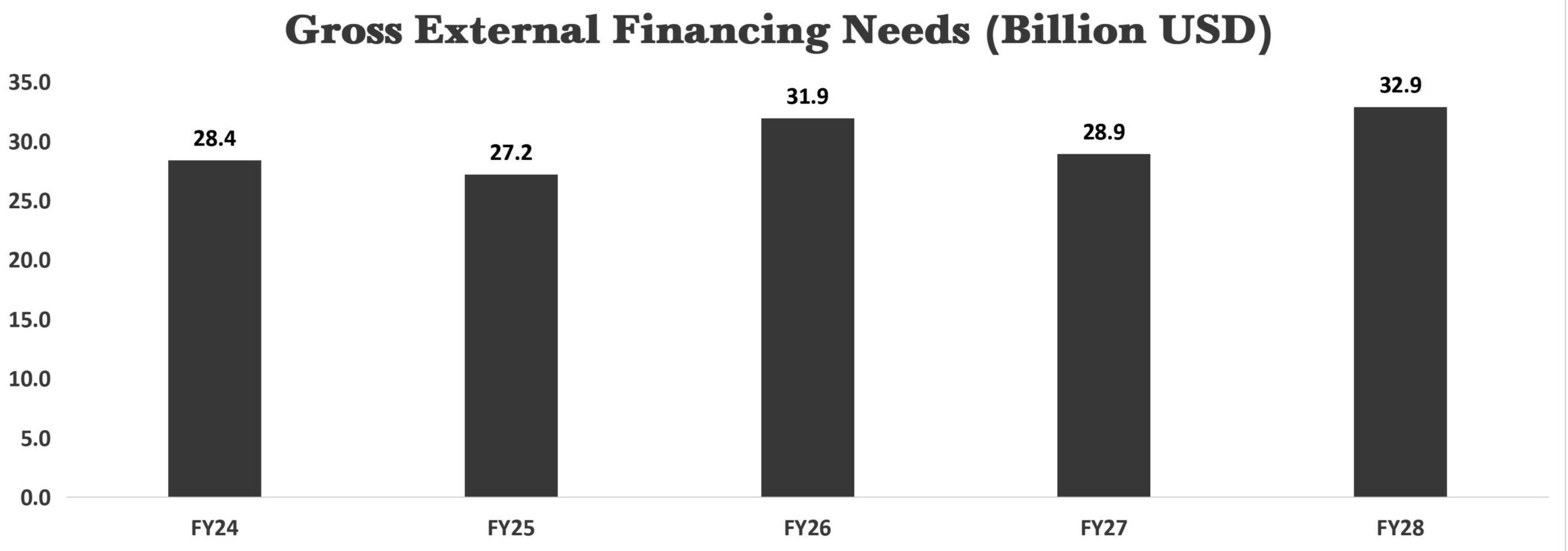

“Pakistan’s gross external financing needs stand at USD 55.5Bn over the next two years. Hence, Pakistan will need to enter another IMF program following completion of the SBA in Mar ’24, once a newly elected Government is in place. Wherein, the outcome of the negotiations for a new, long-term IMF program will depend entirely on Pakistan’s performance under the SBA. Future multilateral disbursements i.e. World Bank & ADB etc. along with support from friendly countries would also be tied to Pakistan remaining in the IMF program,” read a strategy note published by Taurus Securities Limited.

Graph Source: Taurus Securities Limited

“2024 is an election year for Pakistan. While faces matter, market is focused on continuation of reforms – irrespective of faces. Given importance of a new IMF program post completion of the current one in 1Q24, it is likely that any incoming government will abide by the discipline necessary to attract foreign flows which are adequate to fund the debt repayment and current

Account,” remarked Amreen Soorani, Head of Research at JS Global Capital.

Therefore, bilateral and multilateral flows become the sole source of hope for 2024. A new IMF program would involve additional reforms and heightened austerity measures, resulting in a reduction of the development spending capacity. The strategy of managing imports through demand control to maintain a modest and steady current account surplus is expected to continue, as the country is unlikely to pursue external debt relief.

“Debt relief is unlikely and should not be expected. The only way forward is doing small, consistent current account surpluses and keeping the currency at levels where exports grow,” remarked Yousuf Farooq, Director of Research at Chase Securities.

Unfortunately, the average Pakistani is expected to bear a disproportionate fallout from these measures, which is likely to be the reality in 2024. Unless there is a genuine effort to address these issues and distribute the burden equitably, the cycle is likely to persist.

Pretty! This has been a really wonderful post

Check our Real Estate site to buy any type of property in high standard societies.

Highly Recommended!

Very insightful, i will also say this here. Investment is one of the best ways to achieve financial freedom. For a beginner there are so many challenges you face. It’s hard to know how to get started. Trading on the Cryptocurrency market has really been a life changer for me. I almost gave up on crypto at some point not until saw a recommendation on Elon musk successfully success story and I got a proficient trader/broker Mr Bernie Doran , he gave me all the information required to succeed in trading. I made more profit than I could ever imagine. I’m not here to converse much but to share my testimony; I have made total returns of $10,500.00 from an investment of just $1000.00 within 1 week. Thanks to Mr Bernie I’m really grateful,I have been able to make a great returns trading with his signals and strategies .I urge anyone interested in INVESTMENT to take bold step in investing in the Cryptocurrency Market, you can reach him on WhatsApp : +1(424) 285-0682 or his Gmail : BERNIEDORANSIGNALS@ GMAIL. COM bitcoin is taking over the world, tell him I referred you

I was more than happy to search out this web-site. I wanted to thanks for your time for this excellent read!! I undoubtedly enjoying every little little bit of it and I have you bookmarked to take a look at new stuff you blog post.